Confessions of a Day Trader: Work is for sucke-… people who like work

Don't forget to stretch after every $1000 you make. Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

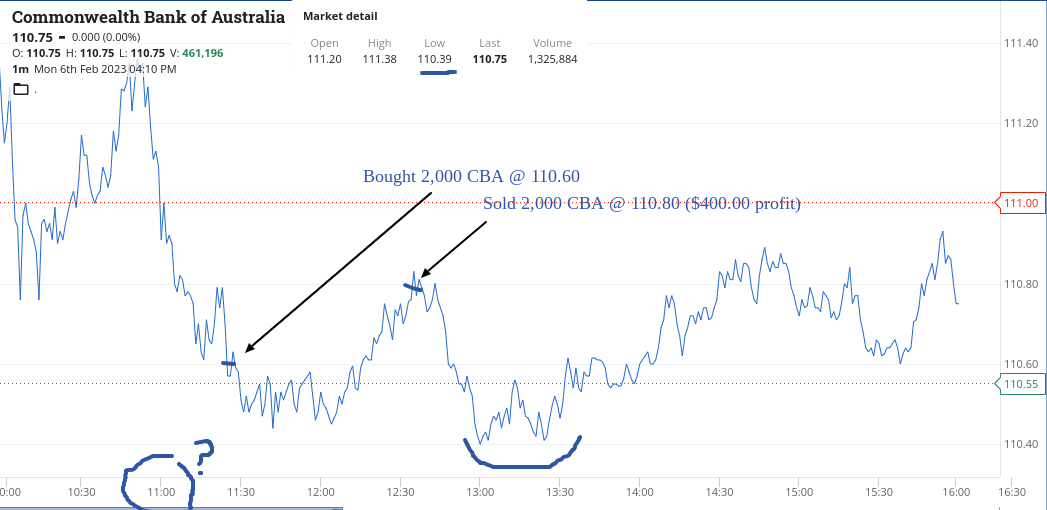

Monday Feb 6

Bit of a cruisy day today but both positions gave me some pain before the gain.

Could have gone a few times more in CBA, with some hindsight but in the back of my mind, I am expecting them to have a down day soon. Just wasn’t today.

NCM have been bid for, so scrambled to get some on their opening, had to double down but knew that the arbitrators would lift them at some point. When they hit $25.20, I said ‘I am out of here’ but had to chase them down to $25.13, as they were moving very fast. That speed cost me $210!

Anyway, up $620 and happy Monday.

Recap

Bought 1,000 NCM @ 25.57

Bought 2,000 NCM @ 24.80

Bought 2,000 CBA @ 110.60

Sold 2,000 CBA @ 110.80 ($400 profit)

Sold 3,000 NCM @ 25.13 ($220 profit)

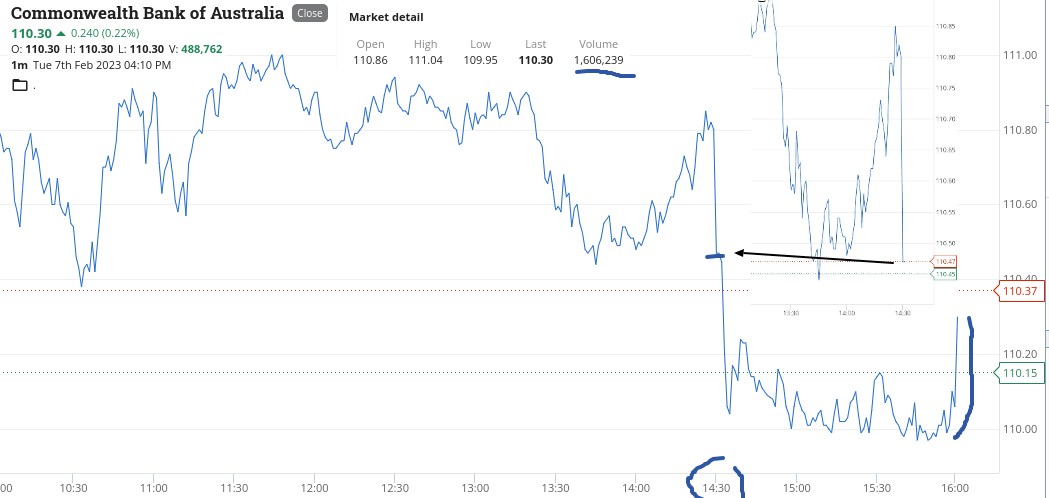

Tuesday Feb 7

CPI day today and had to wait till 2.30pm for them to come out. The market reacted and I just couldn’t get into the groove.

CBA got marked down from $110.85 to $110.45 in one minute and then headed towards the $110.00 level.

I went to lunch awaiting for the CPI figs to come out and really wanted to see CBA get down to something like $109.50, but they never did.

Expecting that tomorrow, we could see them get there.

Recap

Went to Fishing Club for lunch @ $96 (loss)

Wednesday Feb 8

A good day at the office today, though CBA never got to trade in the $109 zone. In fact its low was $110.15. However Elders (ASX:ELD) did yield us a $250 profit after they were marked down on a pre market announcement.

They had a high of $9.30 and a low of $8.69, after reaching a high of $9.70 on Tuesday.

So they are the ones we like. Bad news out and digested, knee jerk reaction and then get in and wait for a bit of short covering to come in.

All up, plus $770 today and that was after each trade showing red on my P/L. FMG was the slowest one to come good.

Recap

Bought 2,000 FMG @ 22.37

Bought 1,500 NCM @ 25.25

Bought 5,000 ELD @ 8.84

Sold 1,500 NCM @ 25.37 ($180 profit)

Bought 2,000 BHP @ 48.03

Sold 5,000 ELD @ 8.89 ($250 profit)

Sold 2,000 BHP @ 48.15 ($240 profit)

Sold 2,000 FMG @ 22.42 ($100 profit)

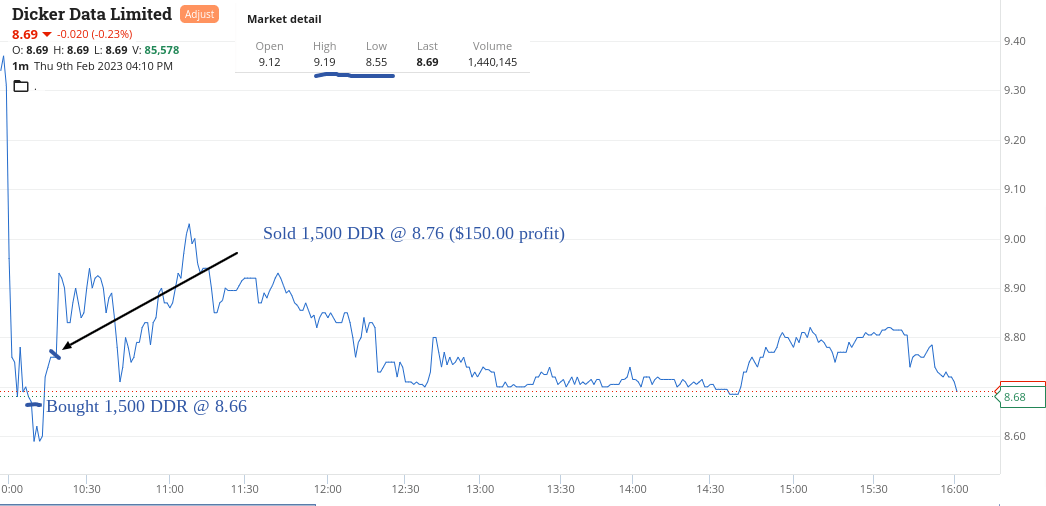

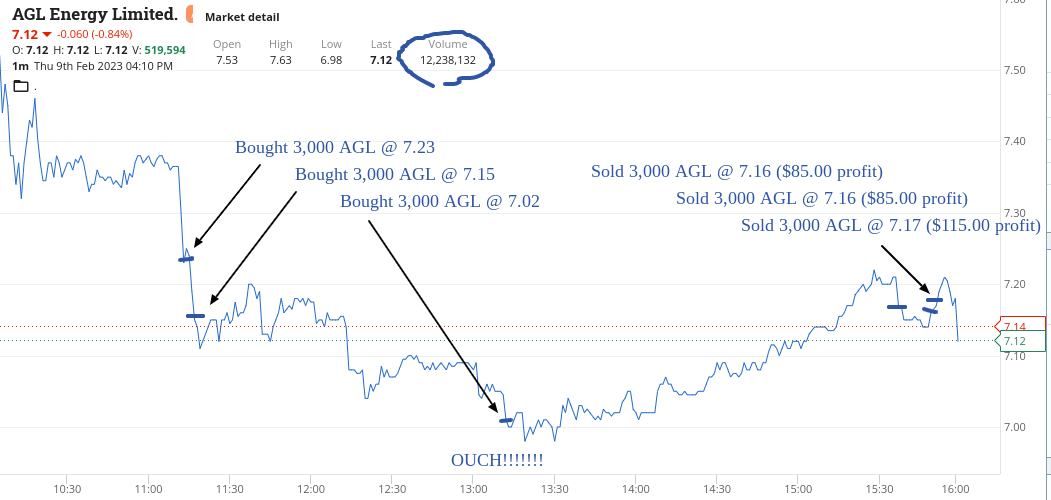

Thursday Feb 9

Started off the day in Dicker Data (ASX:DDR) which went okay. Left a bit on the table but that’s also okay, as I have no idea how they are going to behave.

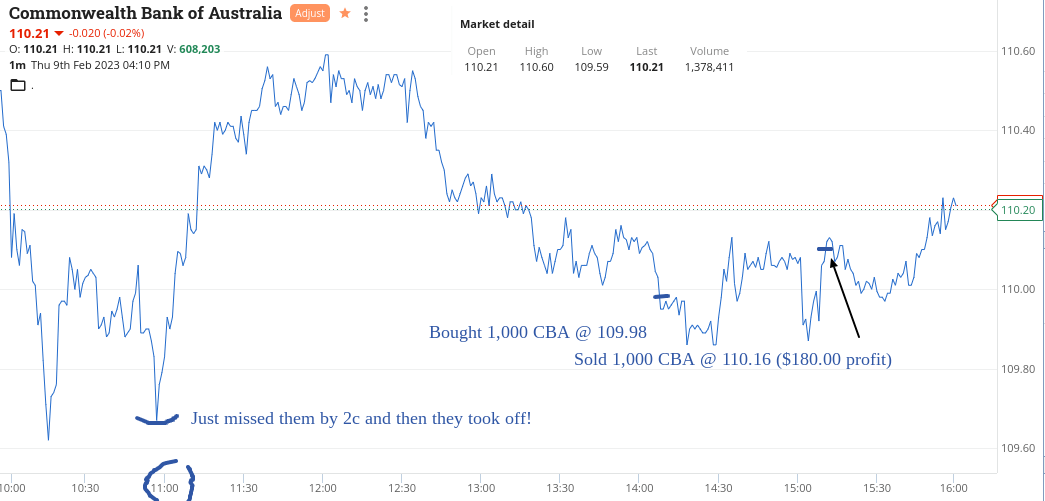

Mucked up in CBA. They fell into the late $109s and I missed them by a couple of cents as I had it in my mind that they should get down to $109.50.

At $109.62, I missed out and chose not to chase them up and off they went to $110.50. Couldn’t believe it.

When they came back again, I just had to buy them with a $109 in the front.

Had to wait all bloody day before they came good and covered more than brokerage and in between all of this I’d been having an arm wrestle with AGL, who had pre market results and were the day’s biggest market cap faller.

Three goes and down a grand at one point but hung in there and had three separate sell orders in so as not to miss out and have all 9000 in all at once.

Up $615 and could have done a bit better in AGL which was my own fault as I got distracted in the afternoon sun and fell asleep.

Recap

Bought 1,500 DDR @ 8.66

Sold 1,500 DDR @ 8.76 ($150 profit)

Bought 3,000 AGL @ 7.23

Bought 3,000 AGL @ 7.15

Bought 3,000 AGL @ 7.02

Bought 1,000 CBA @ 109.98

Sold 3,000 AGL @ 7.16 ($85 profit)

Sold 1,000 CBA @ 110.16 ($180 profit)

Sold 3,000 AGL @ 7.16 ($85 profit)

Sold 3,000 AGL @ 7.17 ($115 profit)

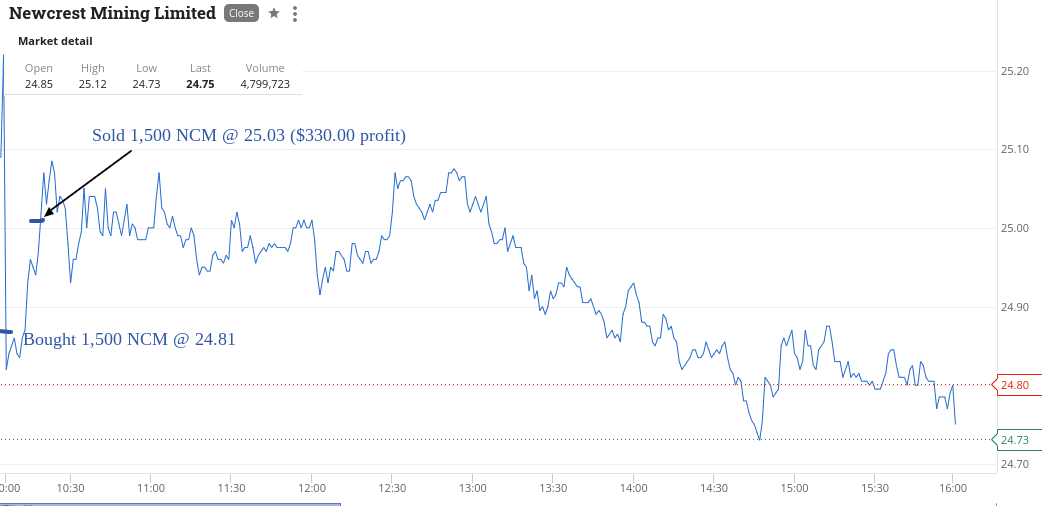

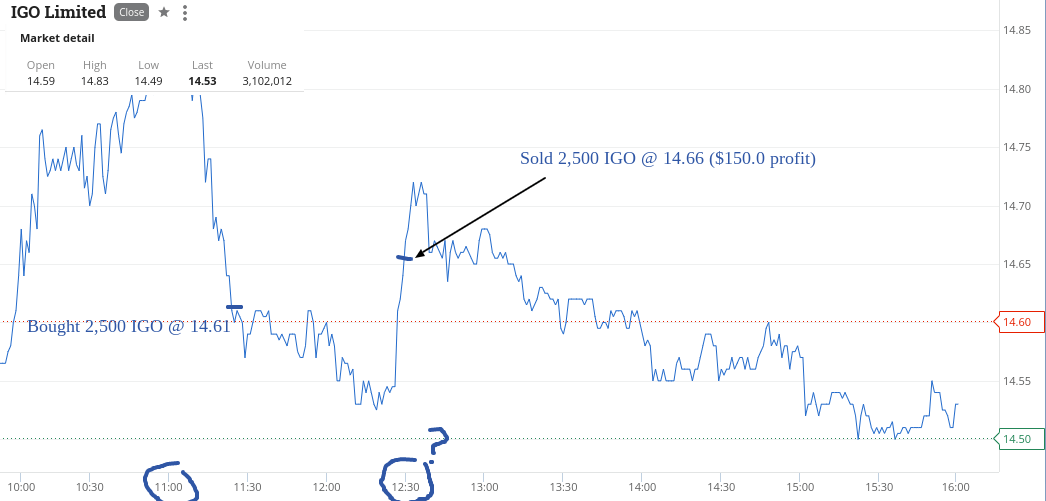

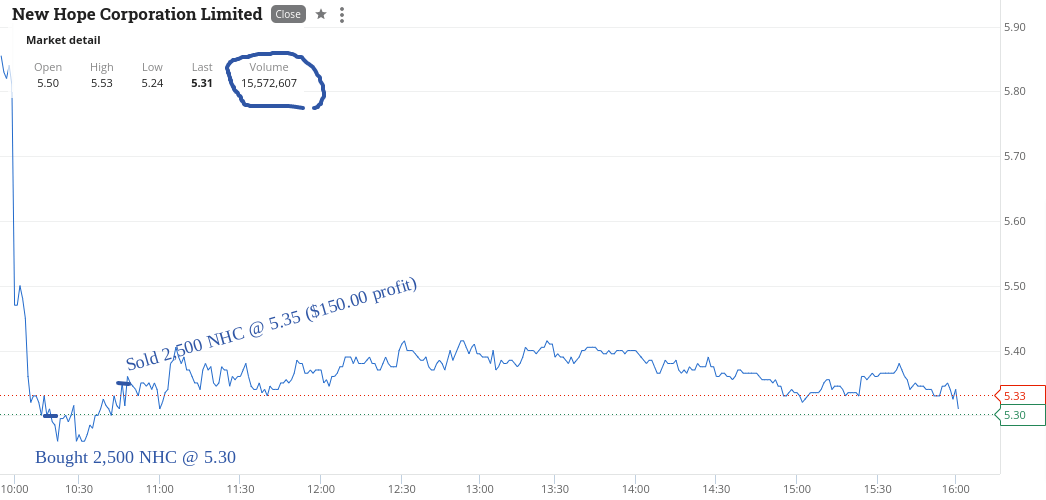

Friday Feb 10

NCM get marked down early and I can only put it down to some overnight option activity as the reason why.

Jump in early at below $25.00 and wait for them to recover, which they do and I tickle them out at $25.03.

Then NHC are marked down with a few other coal stocks and looked to have levelled out at $5.30 and they gave me a 5c turn, as did IGO.

A cruisy day today and one that didn’t cause me too much stress. Out of the three trades only NCM are on my watch list and the other two only came on my radar as being in the top 10 large cap fallers.

So, it’s good to see some other names appear and give us some profits. Up $630 today and $2539 gross for the week or $2,123 net and that includes a doughnut CPI day on Tuesday.

Recap

Bought 1,500 NCM @ 24.81

Sold 1,500 NCM @ 25.03 ($330 profit)

Bought 2,500 NHC @ 5.30

Sold 2,500 NHC @ 5.35 ($150 profit)

Bought 2,500 IGO @ 14.61

Sold 2,500 IGO @ 14.66 ($150 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.