Confessions of a Day Trader: Throw another margherita on the barbie!

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Well today, CBA hit a high of $114.85 and closed 5c lower than there. Amazing stuff.

As soon as they opened at bang on $114, you could feel that they were going to rally higher but mentally, I just couldn’t get into the sandpit with them to play, so I had to take my bucket and spade elsewhere.

So, Liontown and Chalice became my friends today, after both had pre market announcements which did not go down too well.

Liontown took two goes even though they opened up at $1.07, down from a close of $1.20, they still managed to nose dive and hit a low of 88c.

I caught them at 98c and at 91.5c and held on with both hands for the bounce, having set a limit sell order.

Chalice did fall as much % wise as Liontown and I had them on a higher limit, which I adjusted down, when they looked like they were struggling to rally.

Smaller amounts than usual being staked today but the gearing volume was still there.

In both cases, every 1c movement meant +/- $100 so you still have to be nimble and on your toes.

I feel for the long term holders but to make $475 out of both of them day trading sort of brings home what it is all about.

Recap

Bought 5,000 LTR @ 0.980

Bought 10,000 CHN @ 1.025

Bought 5,000 LTR @ 0.915

Sold 10,000 LTR @ 0.980 ($325 profit)

Sold 10,000 CHN @ 1.040 ($150 profit)

Ah McCain, you’ve done it again! CBA hit another all time high of $115.98.

Just couldn’t make it by 2c.

Their day’s low was $114.71, so a bit of a range and only solid buying most of the day, which meant I really could not come out to play today.

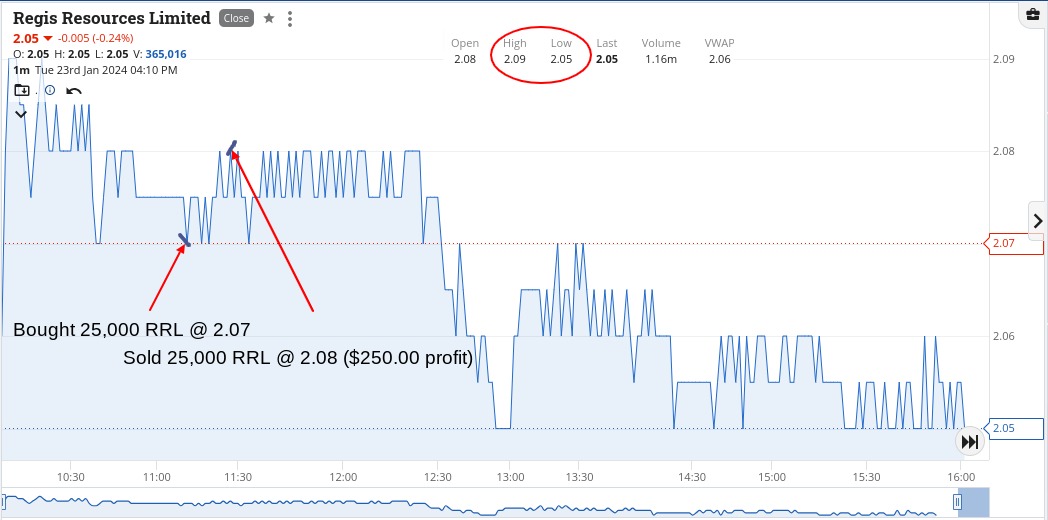

Had a quickish ‘wham bam thank you ma’am’ in RRL but that was all.

Many screen looks and many thumb hovering action but just couldn’t do it today, with any conviction.

Up $250 and can’t wait to get Australia Day out of the way and a kinder market back for me.

Recap

Bought 25,000 RRL @ 2.07

Sold 25,000 RRL @ 2.08 ($250 profit)

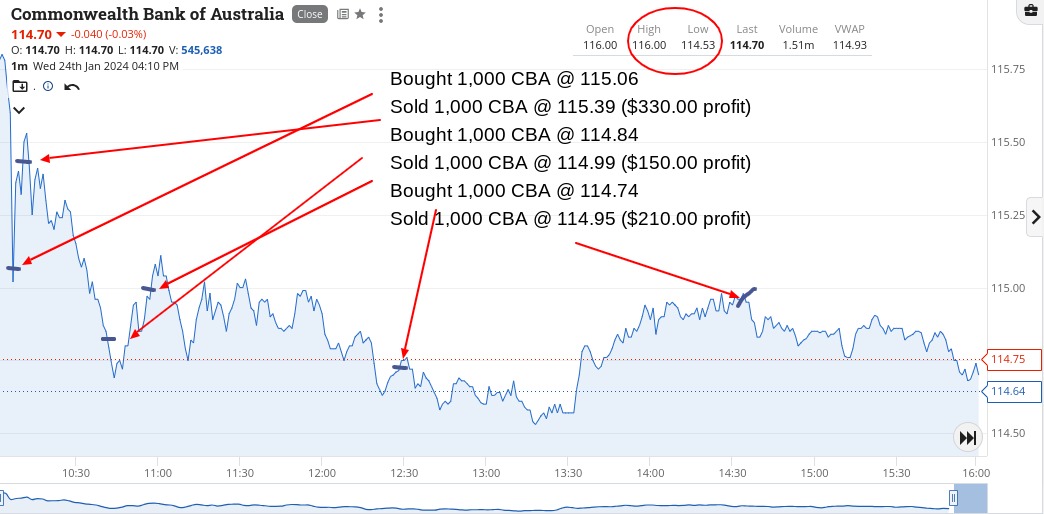

Up $2,625. A complete opposite of the last few days. Finally, we got some profit taking which was a relief for me.

It was like the Fremantle Doctor blowing through my watch list, plus we had the benefit of Nanosonics falling 33% after a pre market announcement. They gave me three goes and CSL and CBA gave me two goes each.

After all my moaning yesterday, something finally cracked and I was in like Flynn.

CBA opened at their day’s high of $116 and then their low was $114.53. CSL’s range was $290.26 to $294.50.

My first two trades were completed by about 10.20am and I thought that was it.

See charts. They are quite amazing.

Recap

Bought 1,000 CBA @ 115.06

Sold 1,000 CBA @ 115.39 ($330 profit)

Bought 500 CSL @ 291.79

Sold 500 CSL @ 292.53 ($370 profit)

Bought 1,000 CBA @ 114.84

Bought 5,000 NAN @ 2.97

Sold 5,000 NAN @ 3.01 ($225 profit)

Sold 1,000 CBA @ 114.99 ($150 profit)

Bought 500 CSL @ 290.64

Bought 1,000 CBA @ 114.74

Bought 5,000 NAN @ 2.90

Sold 5,000 NAN @ 2.96 ($300 profit)

Bought 500 CSL @ 290.38

Bought 5,000 NAN @ 2.89

Sold 5,000 NAN @ 2.93 ($200 profit)

Sold 1,000 CBA @ 114.95 ($210 profit)

Sold 500 CSL @ 291.32 ($405 profit)

Sold 500 CSL @ 291.38 ($435 profit)

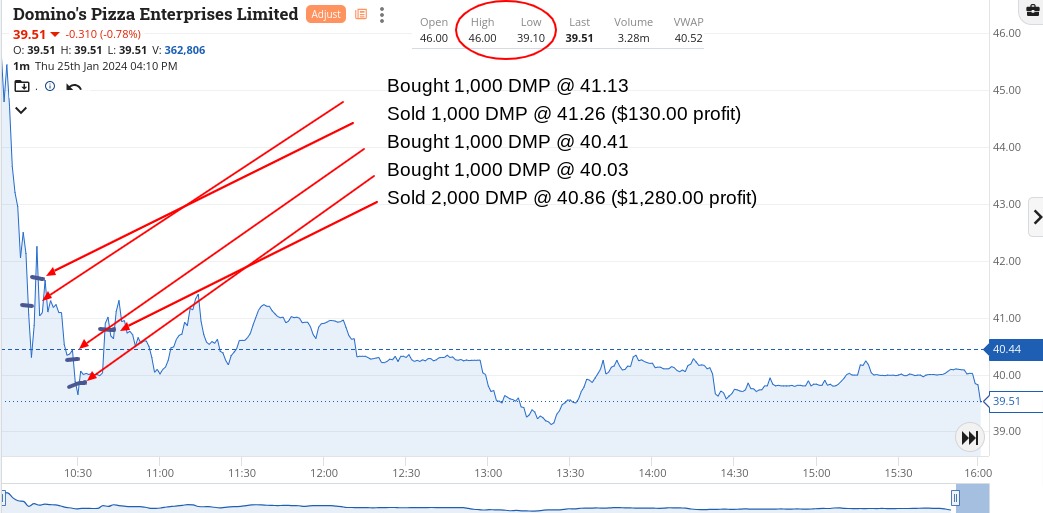

‘Anyone for pizza for breakfast?’ I asked the coffee group today, after Domino’s had a shocker pre market.

They went from a close of $58 to an opening of $46 and then the cheese just kept on melting down and at one point they touched a low of $39.10.

I, for my unhealthy sins, got in and out twice though I did have to double down on the topping as a bit of stock market indigestion hit me the second time around.

Again, all the news was out, so what more damage could be done around the $40 level, which would be down $18.

Got a takeaway profit of $1410 today, less the coffees, and my day was over. Could have gone a few times more in hindsight but was a happy chappie.

Up $4,760 for the (four-day) week gross ($4,405 net) and that’s after whinging like a Pom on Tuesday, which maybe I should do a bit more of. Seemed to work.

Recap

Bought 1,000 DMP @ 41.13

Sold 1,000 DMP @ 41.26 ($130 profit)

Bought 1,000 DMP @ 40.41

Bought 1,000 DMP @ 40.03

Sold 2,000 DMP @ 40.86 ($1,280 profit)