Confessions of a Day Trader: Size doesn’t matter!

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

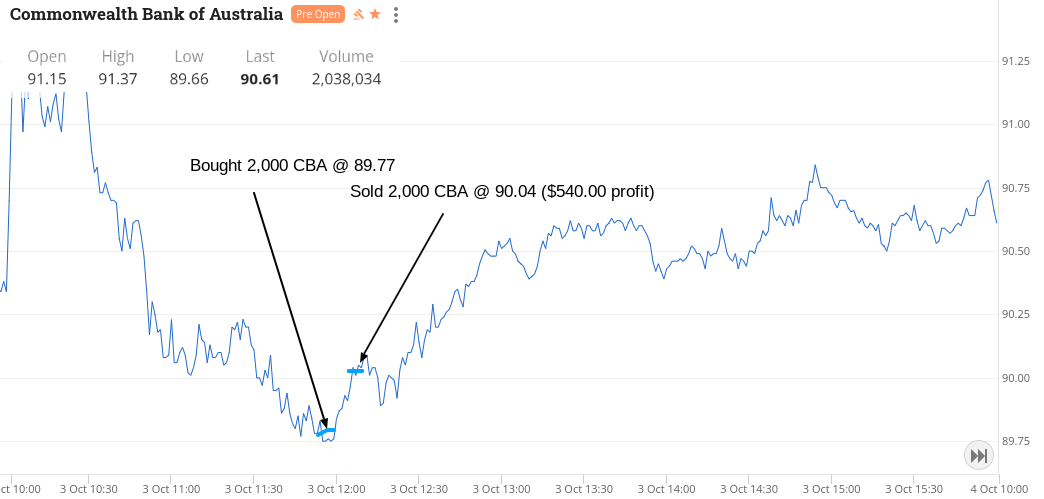

A slow holiday day today and market is still open. Was planning not to do anything but just like a drug, I can’t help myself.

Pick up some NAB and also some CBA below $90.00.

Put them both on limit sells and walk away and try and enjoy the day with family and friends.

CBA rallied first and then NAB caught up and I adjusted my limit order down to meet the market.

After last week’s effort, was happy to book a $660 profit.

Recap

Bought 2,000 NAB @ 28.53

Bought 2,000 CBA @ 89.77

Sold 2,000 CBA @ 90.04 ($540.00 profit)

Sold 2,000 NAB @ 28.59 ($120.00 profit)

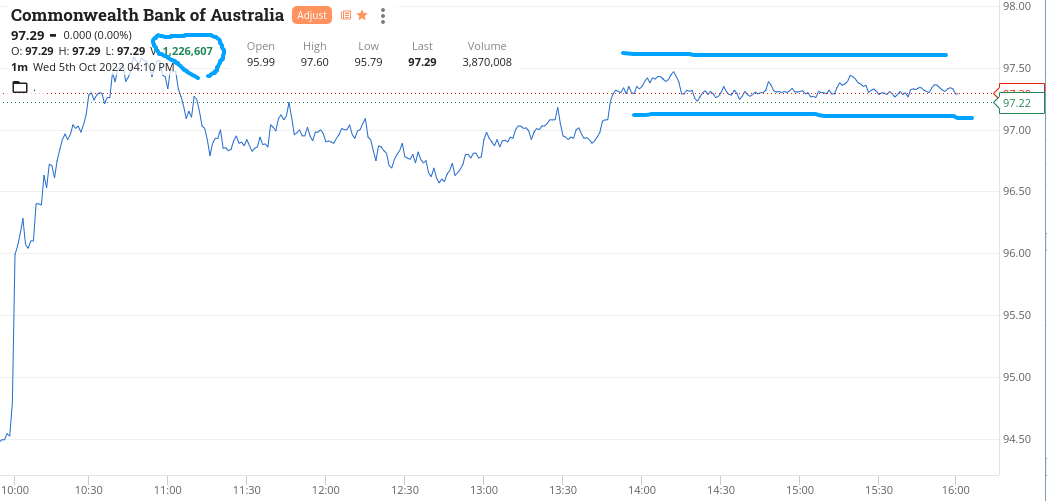

I can’t do anything today, as all the moves don’t help my trading style.

Everything up from overnight levels and then we had the rate rise at 2.30pm, which added to the rally.

Attached charts on CBA and RIO and you will see a $3.00 range in CBA.

Recap

SFA!

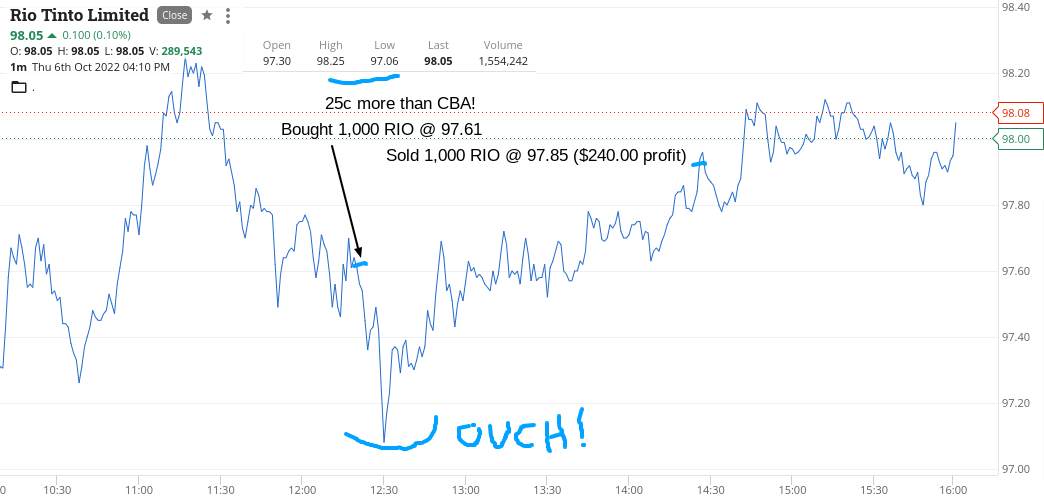

Again everything shoots out of the traps higher. Things like RIOs finally settle down a bit and at $97 they are down from their opening high by $1.86, and they keep falling and then as they turn I have to have a go at $96.80, which is almost $2 off their high.

Leave them on a limit and away they go above $97 and keep going.

Again, days like this really have me sitting on the side as all the dancing goes on and all I can do is tap my foot and not the keyboard.

Up $200.

Recap

Bought 1,000 RIO @ 96.80

Sold 1,000 RIO @ 97.00 ($200 profit)

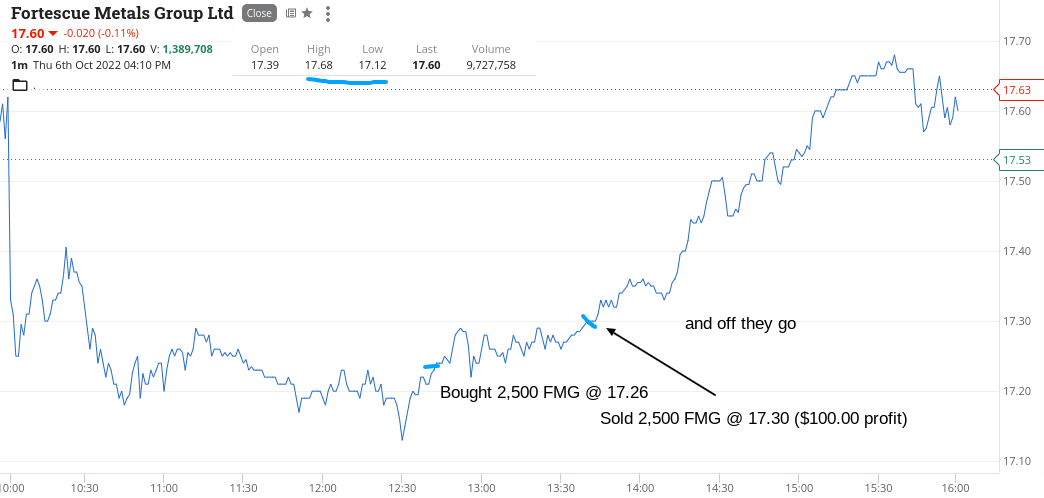

Another day and it feels like another dollar keeps slipping through my hands. Volumes and day ranges are getting low.

For example CBA had a range $97.08 to $96.07 on 2m shares of which 665,000 of volume went through at 4.10pm.

The fishing rod is out but I can’t find many takers.

Only managed two trades today and on each one I was down by a combined $500 at one point.

Held my feet firmly in the sand and finally reeled in two profits.

Not big ones but I will take them all the same.

Plus $340.

Recap

Bought 2,500 FMG @ 17.26

Bought 1,000 RIO @ 97.61

Sold 2,500 FMG @ 17.30 ($100 profit)

Sold 1,000 RIO @ 97.85 ($240 profit)

Very hard at the moment, so just trying to keep my head down.

Snag a couple of trades but very hard and boring. Like waiting around in a doctor’s waiting room before being called to action.

Up $1640 gross and $1452 net and awaiting next week’s wave of market up and market down. I reckon CBA wil touch $91 next week and also $98. Let’s see.

Recap

Bought 1,000 RIO @ 96.94

Sold 1,000 RIO @ 97.20 ($260 profit)

Bought 1,000 CBA @ 96.11

Sold 1,000 CBA @ 96.29 ($180 profit)