Confessions of a Day Trader: It’s Christmas in August!

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

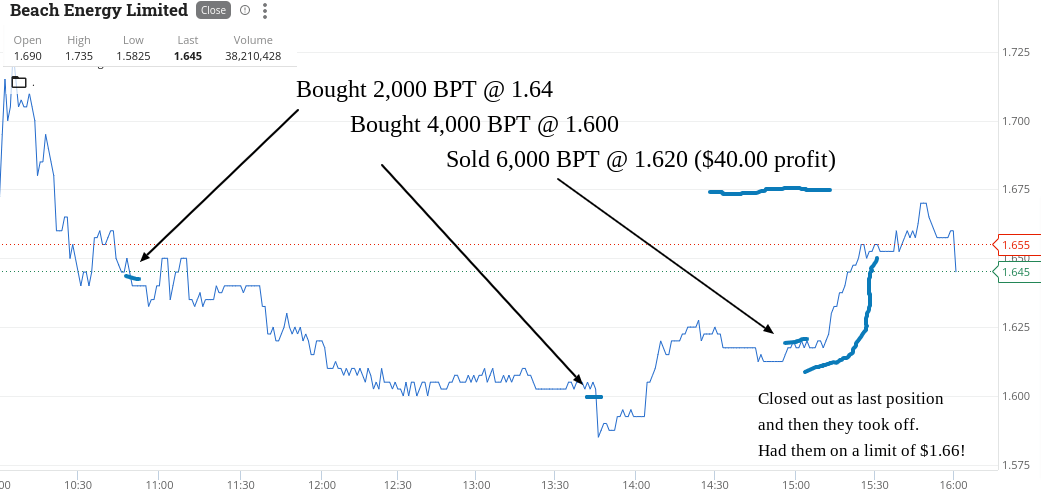

Had to go a bit off piste today. Well, to start with anyway. Beach Petroleum were the biggest faller and the second was Bendigo Bank.

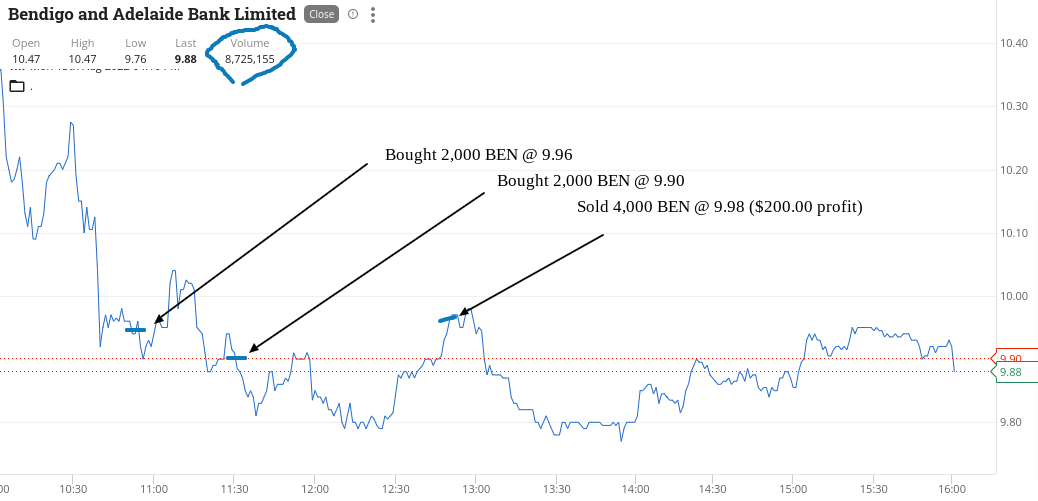

Both had some news out, so was in the market. Beach were down from their highs and Bendigo were below $10.00, so had a go in both.

Had to double down in both.

Bendigo were first to yield a profit and Beach were sold out as they were the last position left and I adjusted down from a limit order of $1.66 to $1.62, only to watch them promptly take off and reach that level.

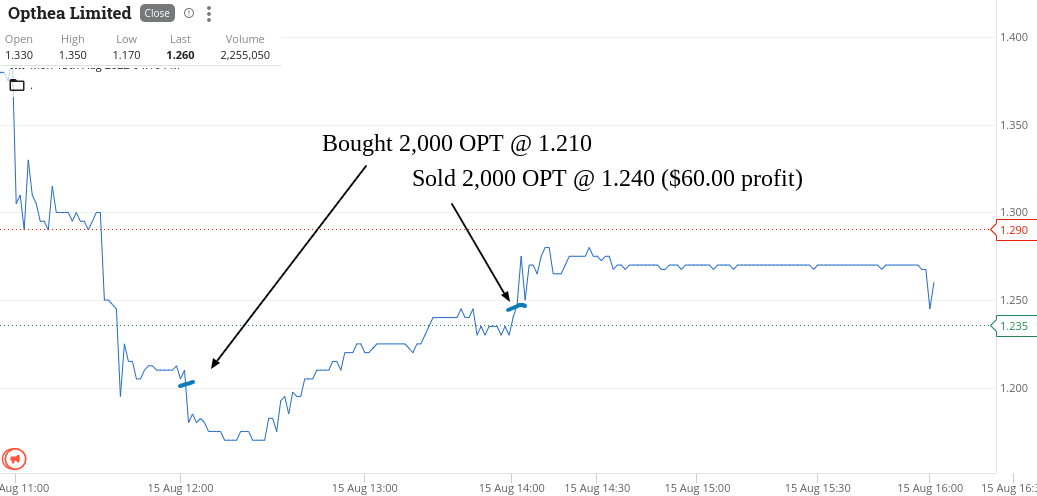

Snuck in a bread and butter trade in CBA and also had a trade in OPT for a $60 profit.

Total profit was $520. Happy Monday!

Recap

Bought 2,000 BPT @ 1.64

Bought 2,000 BEN @ 9.96

Bought 2,000 BEN @ 9.90

Sold 4,000 BEN @ 9.98 ($200 profit)

Bought 1,000 CBA @ 100.37

Bought 2,000 OPT @ 1.210

Sold 1,000 CBA @ 100.59 ($220 profit)

Sold 2,000 OPT @ 1.240 ($60 profit)

Bought 4,000 BPT @ 1.600

Sold 6,000 BPT @ 1.620 ($40 profit)

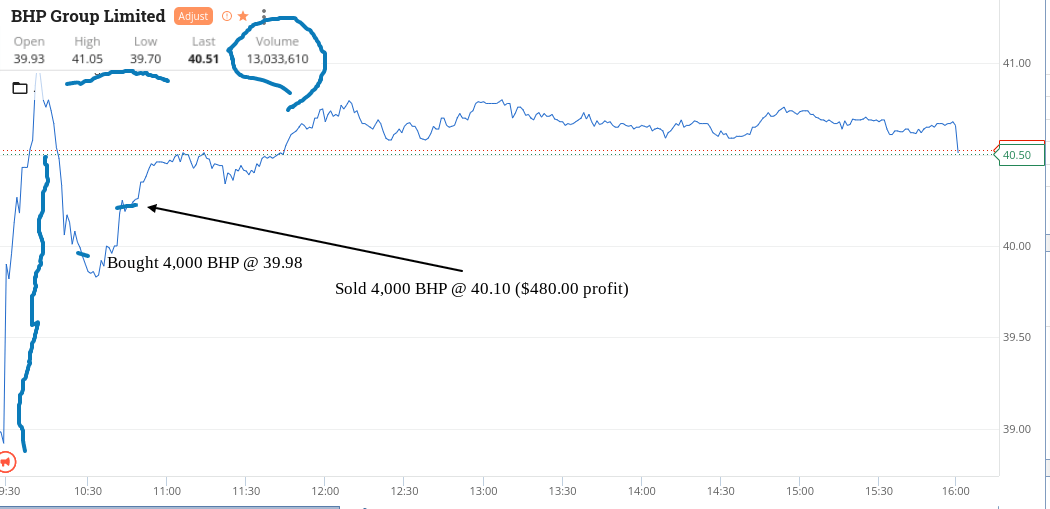

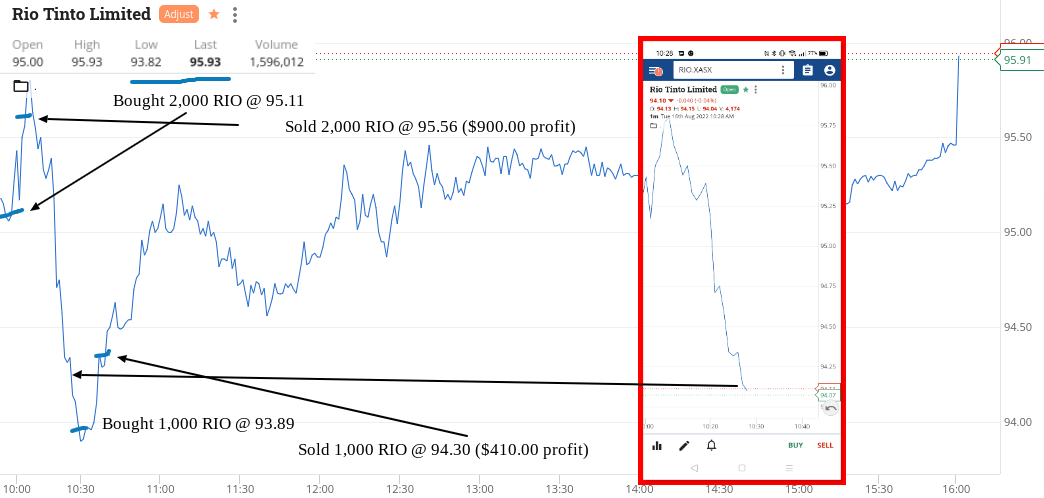

BHP come out with a cracker of a result. They come out of the traps like a rocket.

So, waiting till RIO open. Thinking they will get caught up in BHP’s up draft.

BHP reach towards $41.00 having closed at $38.90 yesterday. RIOs open at $95.00 and then rally and crash which is a mystery to me.

BHP still up, RIOs crash down and I buy 2000 at $95.11, as I think that they should not be down. Gone XD and sold down. This is a punt that I love. Odds are in my favour.

They bounce very quickly and I lock in a $900 profit on their way up!

Very nice. They come back down as do BHP and I walk away. Then RIOs really get sold down.

They go below $94.00 FFS. Why they do this I still don’t know. Have $900 profit up my sleeve, so if I buy 1000, I can lose 90c and breakeven.

Buy 1000 at $93.89 and out on a limit of $94.30.

Now over to BHP and they are $1.00 or so off their high of $41.00.

Hovering around the $40 level and pick up 4000 at $39.98. Not mucking around here but the stars have aligned. Right price for me so up the size and put them on a limit. Takes forever (a boiling pot never boils, etc etc) but am on a roll and then they spike and out we go.

Thank you very much. All done and dusted and now have CBA tomorrow, going XD. Can’t wait. Like Xmas morning!

Up $1790 and that was before lunch!!!

Recap

Bought 2,000 RIO @ 95.11

Sold 2,000 RIO @ 95.56 ($900 profit)

Bought 1,000 RIO @ 93.89

Sold 1,000 RIO @ 94.30 ($410 profit)

Bought 4,000 BHP @ 39.98

Sold 4,000 BHP @ 40.10 ($480 profit)

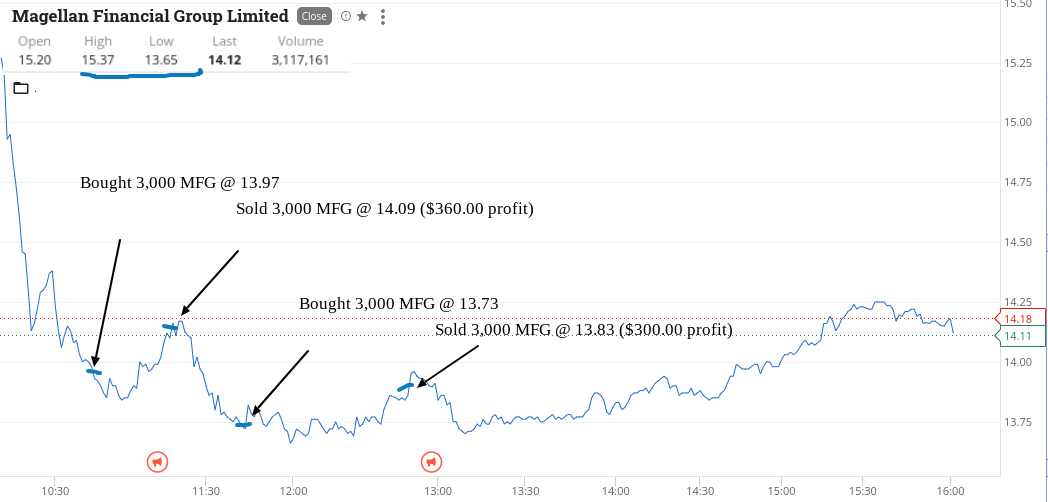

What a day. Let’s start with the outcome, then walk through it:

Bought 3,000 MFG @ 13.97

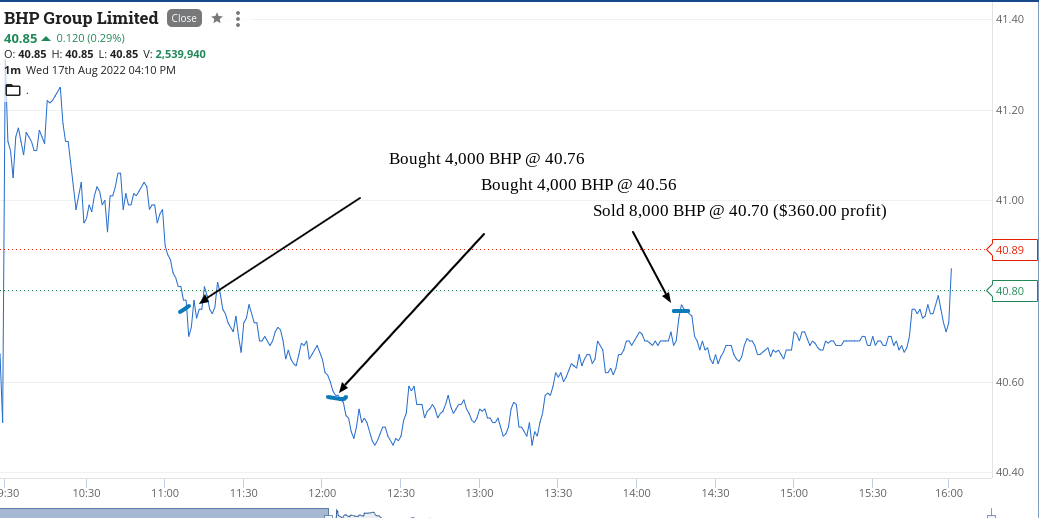

Bought 4,000 BHP @ 40.76

Sold 3,000 MFG @ 14.09 ($360 profit)

Bought 4,000 BHP @ 40.56

Bought 3,000 MFG @ 13.73

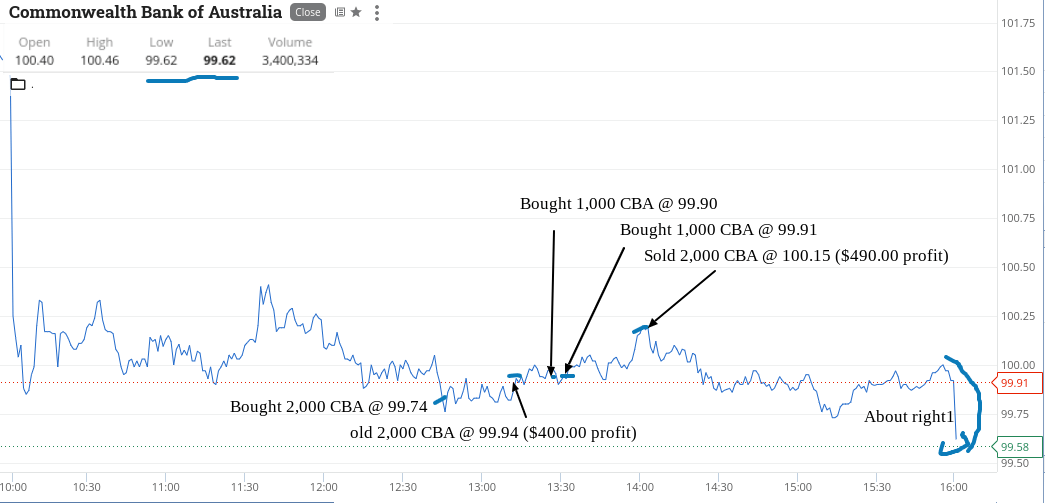

Bought 1,000 CBA @ 99.90

Sold 3,000 MFG @ 13.83 ($300 profit)

Bought 1,000 CBA @ 99.91

Bought 2,000 RIO @ 95.73

Sold 2,000 CBA @ 100.15 ($490 profit)

Sold 2,000 RIO @ 96.13 ($800 profit)

Sold 8,000 BHP @ 40.70 ($360 profit)

Bought 2,000 CBA @ 99.74

Sold 2,000 CBA @ 99.94 ($400 profit)

Big day with CBA going XD and I had cancelled all coffees and appointments, ready to go at 10am.

They open at $100.40 which is $1.06 below their price yesterday having gone ex and $2.17 fully franked div.

I have a limit order to buy 2000 at $99.68 from the start and after my last trade in them I cancelled it.

It was only on their 4.10pm close that they reached it.

By then I was long gone and in the pub reflecting on the day, with a beer in my hand.

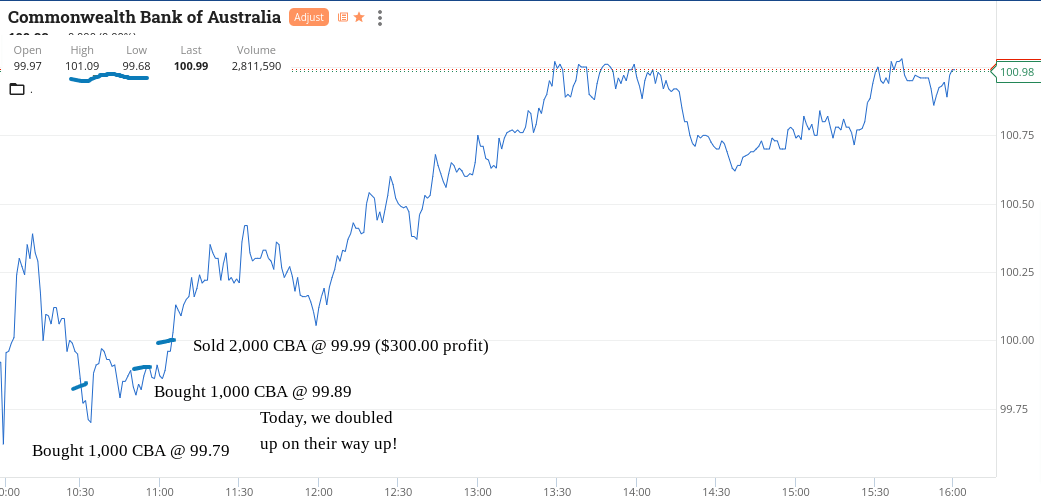

So anyway, CBA didn’t come into play till later in the day, as on my back of envelope calculations, they were at the wrong price.

Start out in MFG and they have done this before. Bad news, marked down and then pounce. Then get into BHP as below $41.00.

Double down in them and then back into MFG.

Finally get into CBA at $99.90 and then think I need to go again at $99.91 and put them on a limit and wait.

RIOs went above $97.00 and I get a go at $95.73 and hang on to them as too cheap.

Up $2710 and I thought CBA would be my main star but not so!

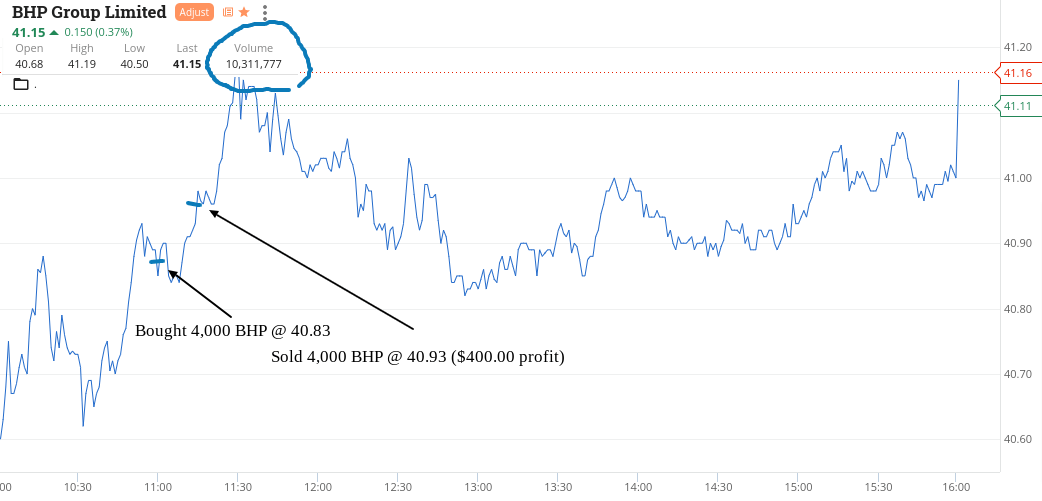

CBA open up above $100.00 and finally fall coming into 11.00am. Pick up 1000 and then another 1000 as they head back up. Put them on a limit of 1c below $100.00 and out they go.

Then BHP are below $41.00 and pick up 4000 on a limit and put them on to sell 10c higher.

Have gone up in size as have more confidence and profit cushion, in case anything weird happens outside of my control.

Plus $700. Now bring on Friday!

Recap

Bought 1,000 CBA @ 99.79

Bought 1,000 CBA @ 99.89

Sold 2,000 CBA @ 99.99 ($300 profit)

Bought 4,000 BHP @ 40.83

Sold 4,000 BHP @ 40.93 ($400 profit)

Don’t know what’s going on in ANZ, bar a bit of fun and games over their new issue pricing.

A few days ago they were up above the $24.00 level and today they are just above $23.00.

So, thought I should join in. Went a bit early and then doubled down at below $23.00. Happy to up the size, as a) having a good week and b) the selling looks way overdone.

The last trade saved me and off they went above $23.00. Had them on a limit of $23.15 to sell but had to keep adjusting it down in 1c increments, till they finally went out. Their volume in the first 30 mins of trading was over 5m, so happy to have played my part.

Then it became CBA’s turn. They were sold down after 3.00pm and having seen them at above $101.00 and only an hour of trading to go, I put on what I thought was a cheeky limit and low and behold I get hit. Size and price in my favour and I watch them like a hawk.

3.30pm comes and they take off. Up then down a couple of cents then up by 10c, down by 2c and so on. Stick them on a limit and wait. The excitement is building as they head towards it. I adjust it down by 5c and out they go.

Far out. Couldn’t have hoped for a better ending for the week and of course, being in CBA was the icing on the cake.

So a big week and up $6860 gross or $5913 net and because of the volatility and the opportunities coming from it, was happy to keep going hard whilst the profits were being locked in.

BHP don’t go XD till September 1, so have that in my diary, ready to roll up my sleeves again!

Recap

Bought 5,000 ANZ @ 23.11

Bought 5,000 ANZ @ 22.93

Sold 10,000 ANZ @ 23.10 ($800 profit)

Bought 4,000 CBA @ 99.59

Sold 4,000 CBA @ 99.80 ($860 profit)