Confessions of a Day Trader: If you pick it, it will never heal

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Ah,

Monday, Monday, so good to me;

Monday morning, it was

all I hoped it would be!

Yay for today, though I had to go a bit off piste today, to kick off my first trade of the week.

All the way to PNG in fact, as BOC was the first one of the day. As mentioned at the end of last week’s diary entry, they were up 128% on Friday and closed at 80c.

Well today they opened at 85c and then they fell and hit a low of 60c and then went back up to 80c and closed at 70c on 1.1m shares.

On one of those rare occasions, I manage a hole in one by getting some on their day’s low of 60c and this set me up for the day.

I had decided that I wasn’t going to do anything till around midday and BOC helped set me up for this strategy.

Opted to go for ANZ again today, as it gives me better gearing on the quantity I can buy and below $27.00, I just had to have a go. Same for FMG below $29.00 and as for RIOs, well they were down $3 at that time.

All up, plus $1,190 which is almost as hot as NSW at the moment. So humid.

Recap

Bought 10,000 BOC @ 0.600

Sold 10,000 BOC @ 0.640 ($400 profit)

Bought 5,000 ANZ @ 26.98

Bought 1,000 RIO @ 129.17

Bought 2,500 FMG @ 28.99

Sold 2,500 FMG @ 29.07 ($200 profit)

Sold 1,000 RIO @ 129.36 ($190 profit)

Sold 5,000 ANZ @ 27.06 ($400 profit)

RBA rate decision out today at 2.30pm, so I’m happy to get in early and take advantage of a few nervous nellies.

Then do nothing as blind Freddie can see what today’s RBA announcement would be.

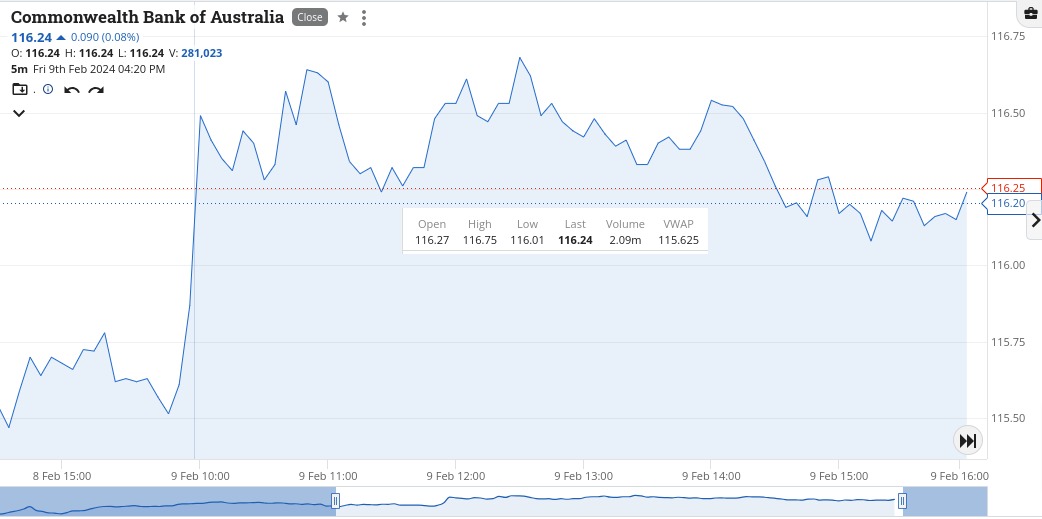

CBA are all over the place as you will see from their chart, which doesn’t help the market sentiment.

Then out of boredom, I have a go in AGL, as we were coming around the final corner but alas, it had a stumble and never recovered, so I just cut them.

Not a good market today and a bit miffed as to why we have to wait around till 2.30pm for their announcement. Why not 9.30am, pre market?

Up $385 and the rest of the week should now be a bit clearer for each day ahead.

Recap

Bought 2,500 FMG @ 28.14

Sold 2,500 FMG @ 28.24 ($250 profit)

Bought 1,000 CBA @ 114.23

Sold 1,000 CBA @ 114.44 ($210 profit)

Bought 5,000 AGL @ 7.85

Sold 5,000 AGL @ 7.835 ($75 loss)

Markets and bonds rally overnight, so come into a bit of a strong market.

However, WBC crashed and burned heading into 11.00am, so hoovered some up as not all the banks were doing the same.

That worked out OK and then Santos did the same thing at 11.50am but I was a bit slower to react. Finally decided what I should be doing but it was too late and I missed them at $7.31, so that was $500 or so that slipped through my hip pocket.

My manic child just kept on trucking today and opened at $305 and touched $306.42, so someone was short and hurting!

Up $400.

Recap

Bought 5,000 WBC @ 24.06

Sold 5,000 WBC @ 24.14 ($400 profit)

We had some weird movements today early on, so had to go a bit harder on the size earlier on as had a longer fuse to get myself out of trouble or into trouble.

Bloody AGL, who I was moaning about on Tuesday, came out with their results and jumped $1.00.

So much for the know it alls selling them down.

How wrong were they and how right was I? I thought they were due a rebound and just when I had my back turned they became naughty against me!

Anyway, enough of my whinging, as CBA came in good, not once but twice as for some reason they keep doing a swan dive and then a bungy jump recovery and all around that $115.00 level.

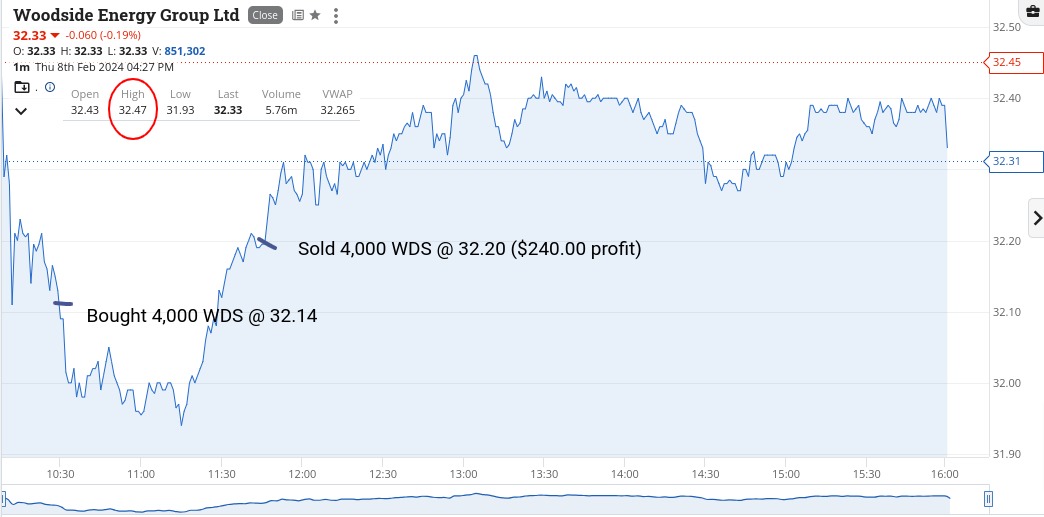

As for Woodside, I don’t know what was happening with them but they were a tad oversold.

Finally, I was up a good result and then just like a little scab on your knee, I just had to pick it to see if it would bleed and it did – with the blood of RIOs oozing out onto my P/L!

As my mother used to say, you should have left it alone and of course I wish I had. My picking away cost me $320, plus brokerage and a Band-Aid and a couple of sorrow beers.

Anyway, up $920 and learning how to sit on my hands.

Recap

Bought 2,000 CBA @ 114.82

Bought 4,000 WDS @ 32.14

Sold 4,000 WDS @ 32.20 ($240 profit)

Sold 2,000 CBA @ 115.00 ($360 profit)

Bought 2,000 CBA @ 114.76

Sold 2,000 CBA @ 115.08 ($640 profit)

Bought 1,000 RIO @ 129.60

Sold 1,000 RIO @ 129.28 ($320 loss)

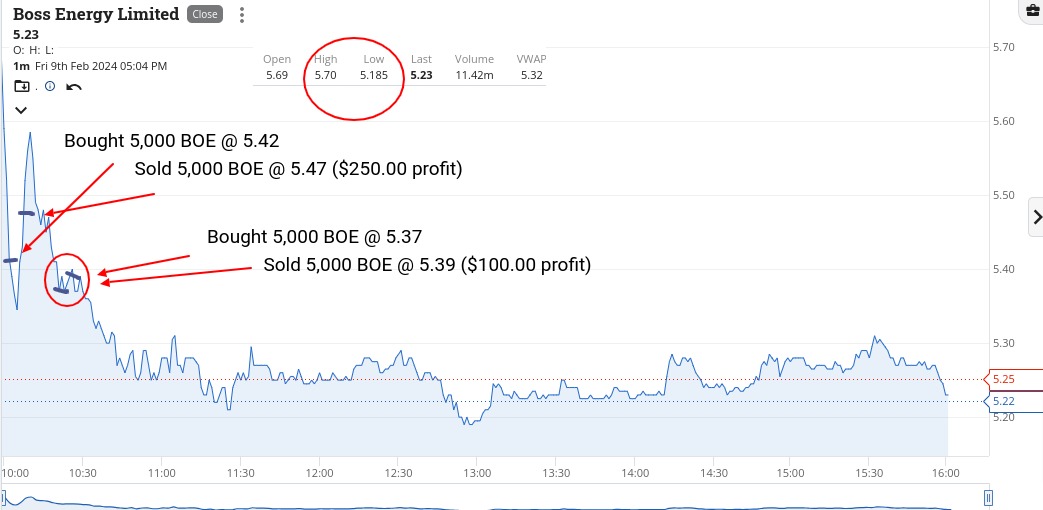

Managed to scrape back my loss yesterday in RIOs, via Boss Energy, who crashed and burned on their opening, along with all the other uranium hopefuls.

At one point they were the biggest faller on my list of large cap movers, along with Deep Yellow though at the end of the day, they were the biggest faller with a big fat red -12.69%.

And that was that.

Up $350, but you had to be quick. Total for the week came in at $3,245 gross or $2,701 net, so not a bad week, even with a rate announcement.

Recap

Bought 5,000 BOE @ 5.42

Sold 5,000 BOE @ 5.47 ($250 profit)

Bought 5,000 BOE @ 5.37

Sold 5,000 BOE @ 5.39 ($100 profit)