Confessions of a Day Trader: Can’t fight this feeling! All aboard the RIO speedwagon!

News

News

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Commodity stocks again go through the roof today, with things like RIOs hitting $108.00, which is $4.00 above CBA. It was only a few weeks ago and they were struggling to hold $89.00. Amazing.

I have to wait around twiddling me thumbs until 11.30ish, when CBA have a bit of a sell off. Put in a limit buy at $103.80 and buy 1000 at $104.14 as a bit of an each way bet.

Miss out on the limit by 10c and then they go on a nice run, which gets me running out of the door at $104.37. They don’t look back and finish the day at $105.10.

RIO’s range for the day was $108.40 to $105.56 and I did have a look at them around the $106.00 level after getting out of CBA, but chickened out.

Up $230 on a Monday and let’s hope the rest of the week remains the same.

Recap

Bought 1,000 CBA @ 104.14

Sold 1,000 CBA @ 104.37 ($230 profit)

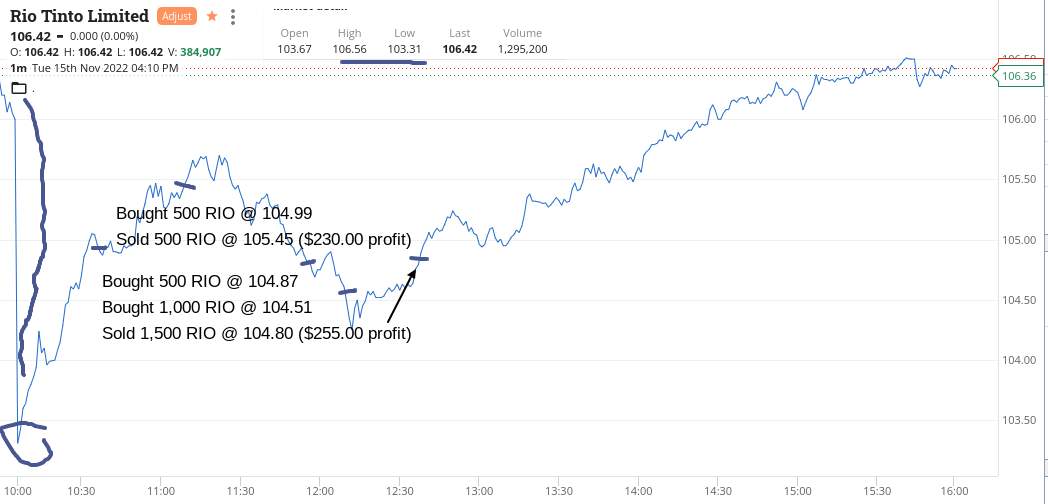

Start the day off in RIO. The stock, that is, not the place, sadly. Make a nice little $230 and think to myself that that is the same as yesterday, as happy to walk away.

$230 everyday, after 10 days comes to $2,300 and times by three makes a nice monthly. A Goldilocks return!

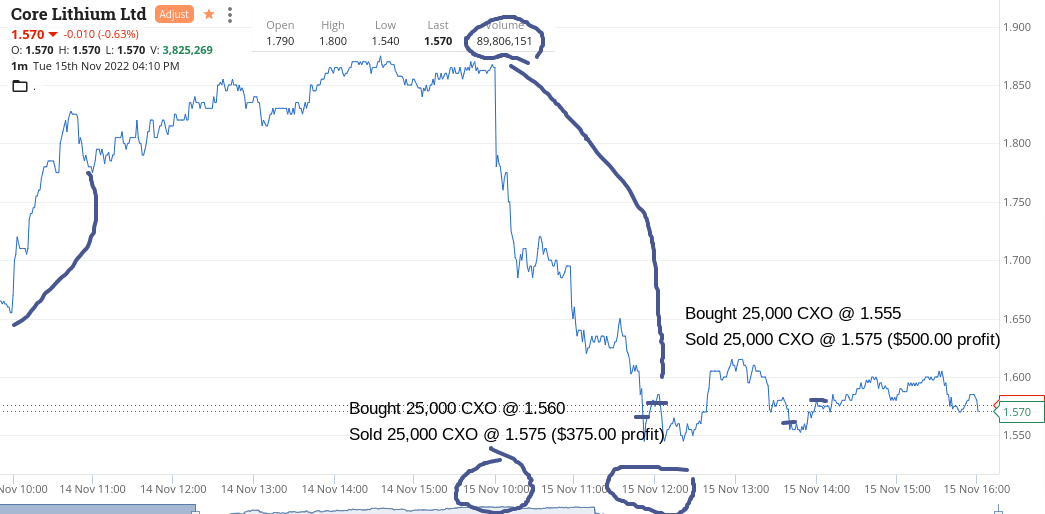

Then it all kicks off with a fall in CBA and RIOs going below my last purchase price. Double down and then CXO come onto the radar.

Down from $1.80 and on good volume. They seemed to level out at around the $1.55 level. Just above their day’s low, so load up in 25,000 and watch and wait. Sell them at $1.575 and then the RIOs at $104.80. Been eyeing off FMG and they have fallen towards the $19.00 level.

Flick them out and then the CBA as they are boring me as I keep missing selling them for 2c so just sell them.

Back in after they fall to the $106.16/15 level. In and out like Flynn and then CXO are back down again. I go again for the same amount of 25,000. In for a penny in for a pound.

Bingo, out they go 2c higher and up $1,515 for the day. I think now every 10 days that could be 15 grand! Been there before and got too greedy, so happy with $230 a day and the occasional have it off day, as I know I can always give it back faster than I make it.

Stay humble as my trading mentor would say to me. You can only smoke one cigar at a time.

Recap

Bought 500 RIO @ 104.99

Sold 500 RIO @ 105.45 ($230 profit)

Bought 500 CBA @ 106.39

Bought 500 RIO @ 104.87

Bought 1,000 RIO @ 104.51

Bought 25,000 CXO @ 1.560

Sold 25,000 CXO @ 1.575 ($375 profit)

Sold 1,500 RIO @ 104.80 ($255 profit)

Bought 1,500 FMG @ 19.09

Sold 1,500 FMG @ 19.14 ($75 profit)

Sold 500 CBA @ 106.42 ($15 profit)

Bought 500 CBA @ 106.16

Sold 500 CBA @ 106.29 ($65 profit)

Bought 25,000 CXO @ 1.555

Sold 25,000 CXO @ 1.575 ($500 profit)

A day of madness in CBA. I counted 15 times it went through the $104.00 level. Got a bit caught out early on as they had been up to $105.47 and had an intra day low of $103.42. So an almost a $2.00 swing on 2.9m share turnover.

Even towards the end of the day, they dip again, so I get one last go, having thought my day was complete, as I was about to knuckle down with a nana nap. NAB was the only other one to swing me around and just like CBA, they gave me a hard time before coming good.

Up $1,375 and RIO’s now higher than CBA, for the second day in a row.

Recap

Bought 500 CBA @ 104.36

Bought 500 CBA @ 104.07

Bought 1,000 CBA @ 103.97

Sold 2,000 CBA @ 104.23 ($275 profit)

Bought 1,000 NAB @ 30.23

Bought 1,000 CBA @ 104.19

Bought 1,000 NAB @ 30.13

Sold 1,000 CBA @ 104.39 ($200 profit)

Bought 2,000 CBA @ 103.80

Bought 2,000 CBA @ 103.50

Bought 1,000 NAB @ 30.06

Sold 4,000 CBA @ 103.77 ($480 profit)

Sold 3,000 NAB @ 30.22 ($240 profit)

Bought 2,000 CBA @ 103.96

Sold 2,000 CBA @ 104.05 ($180 profit)

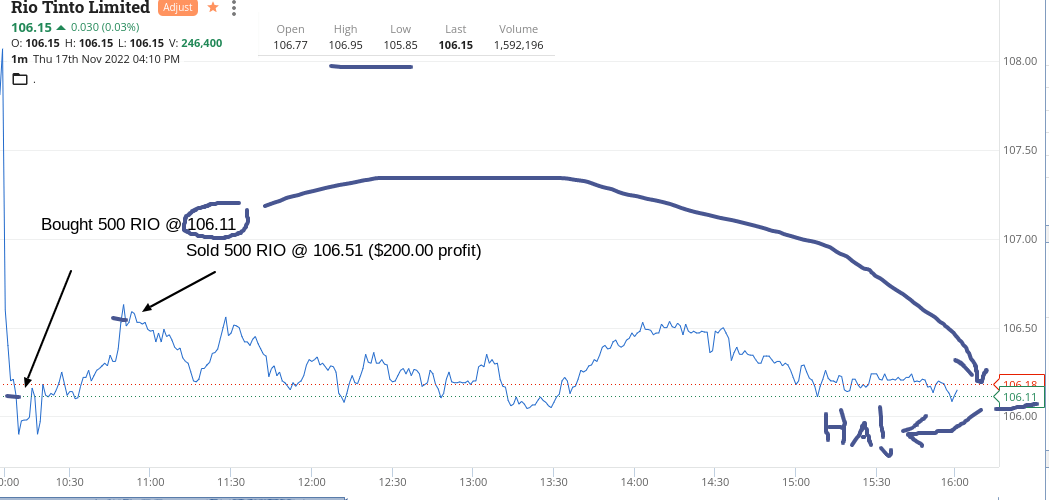

A quieter day for me today than the last two trading days. Really wanted to have another go at CBA today but really couldn’t find any doors to open!

Had a small nibble on 500 RIOs and was expecting to do more in them but the 500 went up by 40c or so and closed them out and that was it.

Up $200 on a restful and pleasant sunny day. Expecting to lose tomorrow.

Recap

Bought 500 RIO @ 106.11

Sold 500 RIO @ 106.51 ($200.00 profit)

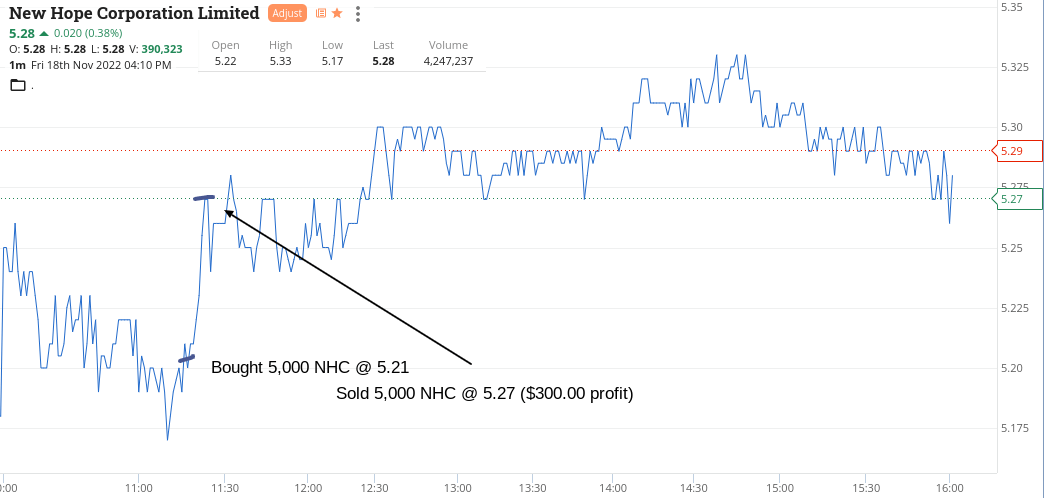

Looking forward to the weekend. NHC can now buy back some shares so when I saw them down at $5.21 just thought I had to have a go and just 4c off their low.

That worked out OK and with the buy back they can stay on my watch list. Then the only faller on the list was WDS and thought it was a good idea to have a nibble as they were hovering around that $38.00 level. Wrong!

Had to wait around as they swung around in and out of a small profit and loss and then just after 3.30pm, they had a bit of an English cricket team collapse.

Had to double down to get the average down and then stuck them on a limit to sell at $38.10. That was a bit ambitious, so kept adjusting it down as they started to edge up and finally they took me out at $38.00.

Up $480 for the day and up $3800 gross or $3210 net and mainly thanks to CXO and CBA. CXO volume started to drop after that one big fall and that’s always a sign of loss of interest and hence now off the old watch list.

Time for a beer.

Recap

Bought 5,000 NHC @ 5.21

Sold 5,000 NHC @ 5.27 ($300 profit)

Bought 1,000 WDS @ 38.04

Bought 2,000 WDS @ 37.89

Sold 3,000 WDS @ 38.00 ($180 profit)