Confessions of a Day Trader: Bears and rollercoasters don’t mix. Time to hibernate

News

News

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

No Wall Street tonight and headlines stating that the USA debt ceiling negotiations have been resolved means that I am walking into an up-market start.

The day kicks off and I look around for something to trade but even though everything has been marked higher, the volumes in some of them are very low.

This worries me, as it means there is a lack of real conviction and if there are some fallers, the lack of interest may not give them the chance to bounce back up.

CBA for example had a range of $98.85 to $99.69 and their volume up to 4.00pm was 1.2m. At 11.00am, there had only been about 300,000 turned over.

RIOs were far worse. Their range was $108.89 to $110.50 and their total volume, including the 4.10pm matchup, was only 590,000.

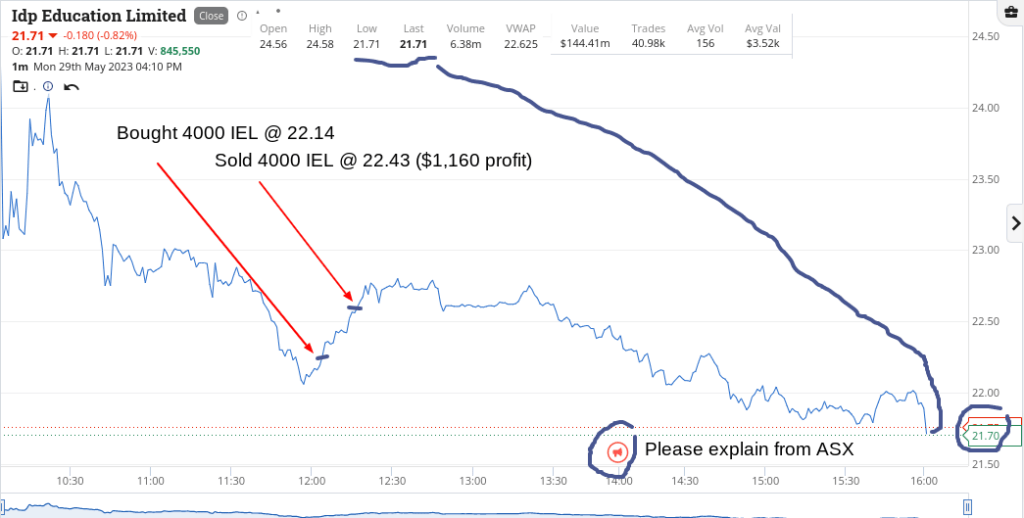

Having said all of that, there was a $6bn company that was down 13%, having opened on their day’s high of $24.58, their low and last trade for the day was $21.71. Volume was 6.38m.

Their selling was brutal and as I watched them, they just kept falling until they got to a point where I dived in and grabbed 4000 at $22.14 on their first real rebound, since I started to watch them.

They produced a very nice 29c turn at $22.43 and went on to $22.65, before being sold down again. Thank you, IDP Education.

Up $1,160 and it’s my first trade of the week and I was not expecting to really do anything today. Tomorrow should be interesting but not expecting much volume wise.

Recap

Bought 4000 IEL @ 22.14

Sold 4000 IEL @ 22.43 ($1,160 profit)

No lead from overseas, so we are in the hands of the local trading God today. Volumes are very low again today, which is starting to concern me.

A buyers’ strike is not something that helps me squeeze the pips of other traders as it becomes more of a ‘should I double down or just cut my losses’?

Luckily for me I had another good result out of IEL. They opened at $21.95 and hit a high of $22.32 and a low of $21.53 before closing at $22.21 on a volume of 2.4m during the normal trading day and 594,000 in the 4.10pm matchup.

Had them on a limit in and a limit out and all based around the $22.00 mark. Just below and a tad higher up.

Everything else was left alone. CBA had a day range of 97c, 1.1m over the whole day and another 563,000 in the match up. They jumped a massive 40c in their match up, compared to RIOs who fell 7c in theirs.

In fact, RIOs only traded just under 500,000 over the whole proper trading session, which is just woeful.

Up $780 but not looking forward to tomorrow, as my gut tells me the only direction will be down. Volumes are the key to any bounces.

Recap

Bought 6,000 IEL @ 21.97

Sold 6,000 IEL @ 22.10 ($780 profit)

Last day of the month as we head into June and tax time trading. I wrote an extra article for Stockhead regarding the market, which were my thoughts on where the market is heading, short term.

On the back of that, I did absolutely nothing today but watch. I became a voyeur of stocks and their movements and especially their volumes and today and boy, today was amazing.

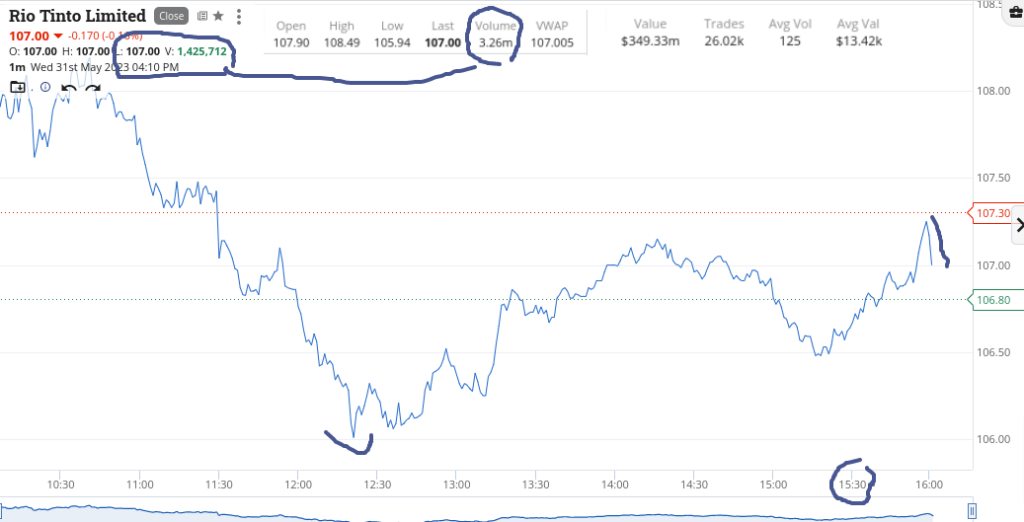

RIOs finished down $2.30 at $107.00. Volume was 3.2m of which 1.4m was in their 4.10pm matchup. Their range was $105.94 to $108.49.

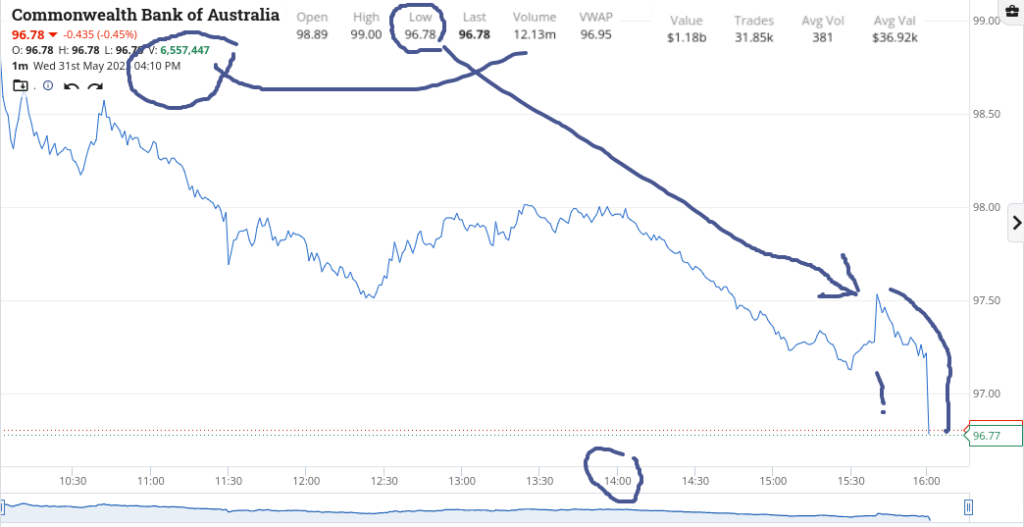

CBA finished down $2.40 and finished on their day’s low of $96.78. Their range was $99.00 to $96.78 and their volume was a massive 12m, with 6.5m coming from their 4.10pm matchup.

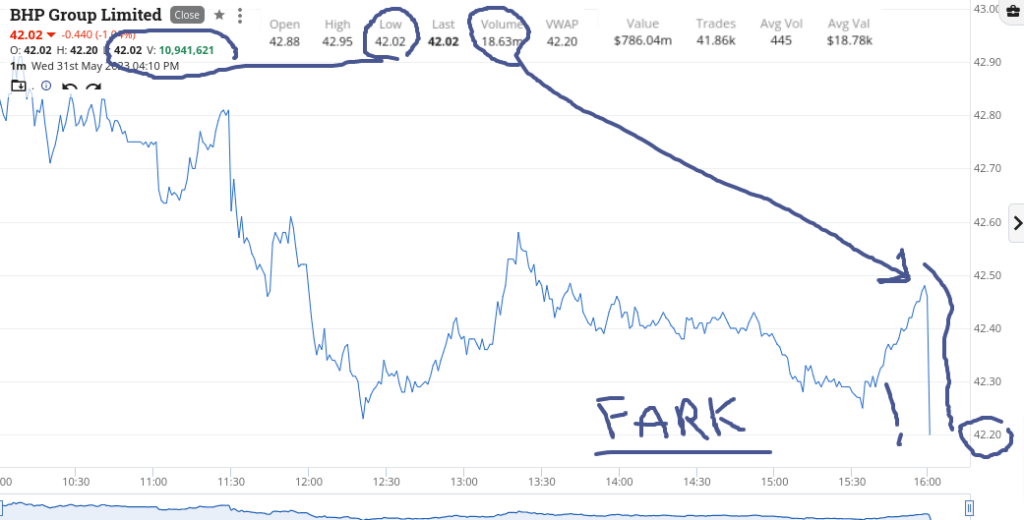

BHP finished down $1.47 at $42.02, which also was their day’s low. Their high was $42.95 and 18m of which 10m went through at 4.10pm.

Amazing stuff!

I am presuming that it’s a bit of option expiry and a bit of fund liquidation. However, even second tier blue chips had massive volumes going through.

FMG: 15m (7.4m at 4.10pm)

WBC: 15m (6.9m at 4.10pm)

NCM: 10.6m (6.5m at 4.10pm)

So, a big day for the market. I just want to see what happens overnight, to see if I want to get involved tomorrow. Hopefully for me and my trading style we have some quick sharp falls and not slow sell downs.

See today’s charts. They will make you sit up and lean in!

Recap

A doughnut day!

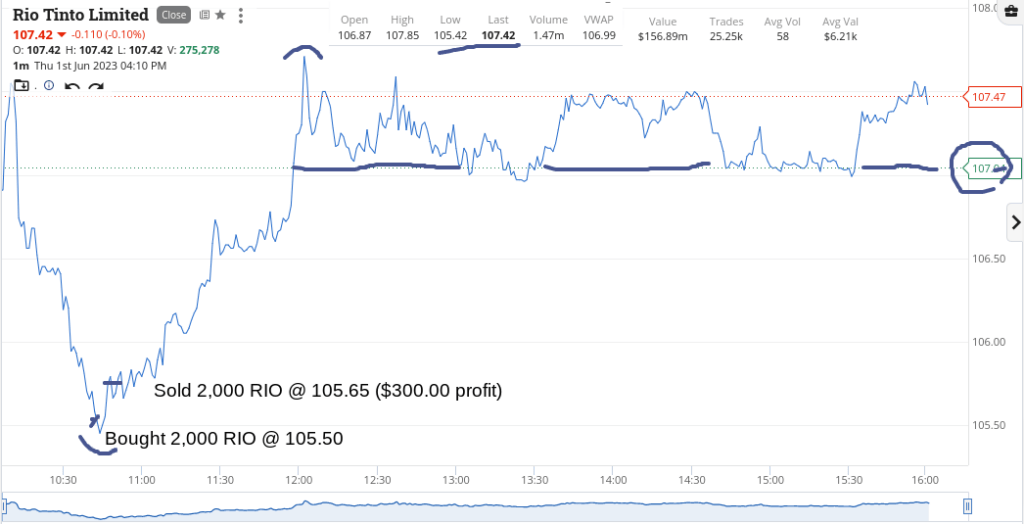

Start off the day in RIOs at, as it turns out, 8c off their day’s low. Went in double for a quick grab and run and left a lot on the table for the next guy!

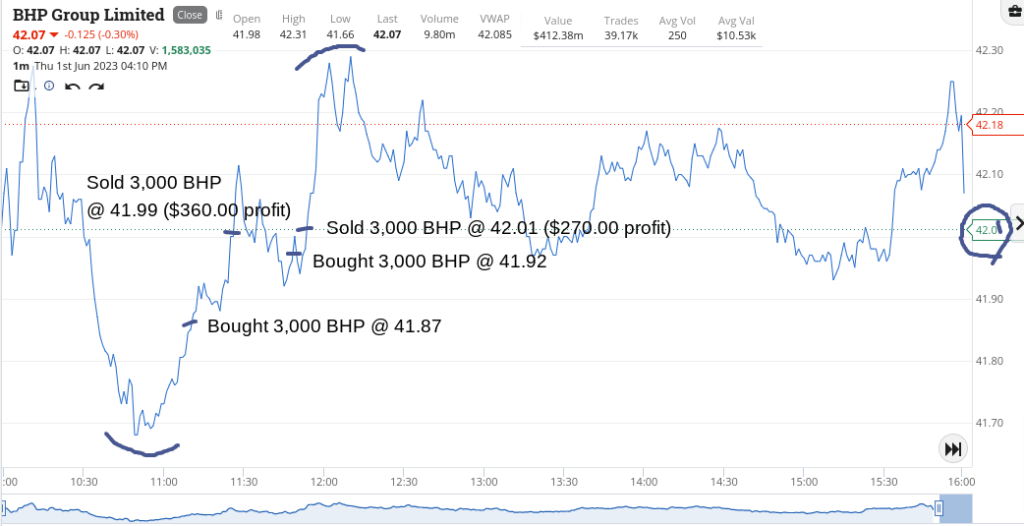

Then the same in BHP at below $42.00 and out on a limit of $41.99.

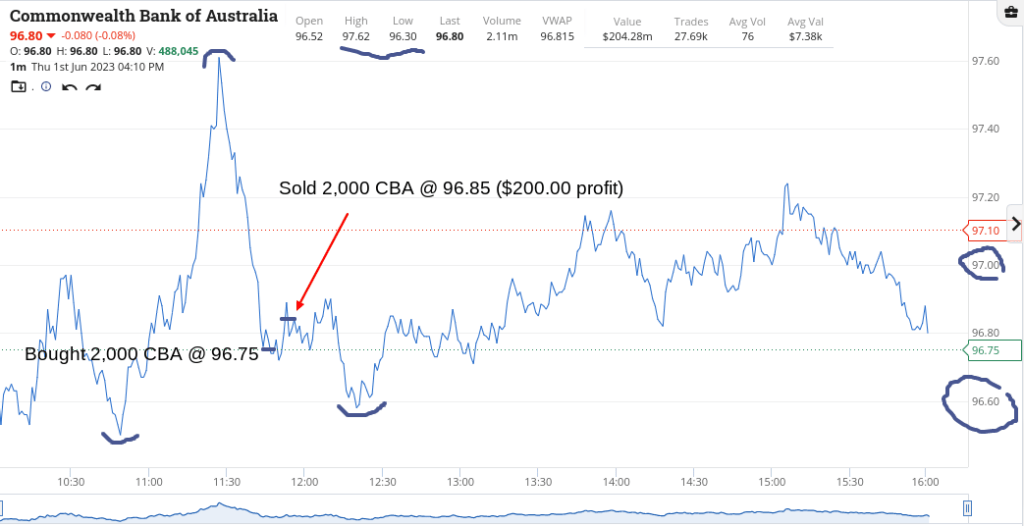

Then CBA, who basically fell 85c in 15 mins, so put them on for a 10c turn and after RIOs took off, decided to have another go in BHP, with the idea that they would get dragged up with them.

Could have done the same in FMG, but today I only wanted to play around in the bluest of blue chips.

This time I had BHP on a limit just above $42.00 and it reached $42.00 and bounced back below it about five times before they finally broke out.

Vols a bit more back to normal but watching RIOs was like going on a rollercoaster ride at Wet ‘n Wild. Their range was exactly $2.00 today. It’s a full moon somewhere in the world is all I can say.

Up $1,130.

Recap

Bought 2,000 RIO @ 105.50

Sold 2,000 RIO @ 105.65 ($300 profit)

Bought 3,000 BHP @ 41.87

Sold 3,000 BHP @ 41.99 ($360 profit)

Bought 2,000 CBA @ 96.75

Bought 3,000 BHP @ 41.92

Sold 2,000 CBA @ 96.85 ($200 profit)

Sold 3,000 BHP @ 42.01 ($270 profit)

Almost the opposite of yesterday. All the miners take off and the banks start out higher, drop down, recover, drop down again and then take another two hours before they eventually recover.

NAB below $26.00 and CBA below $97.00 seemed the way to go today. Some dramatic ups and downs before lunch, as you will see from the charts.

Doubled up in size, so as to take full advantage of the volatility.

Been a fun week. Up $1,770 today and $4,840 gross ($4,243 net) for the week and that includes having a doughnut trading day on Wednesday after Tuesday’s dramatic moves and volumes.

Tuesday is a day I won’t forget for a long time. Can’t see this debt ceiling rally lasting very long and next week being a ‘right, what happens now’ kinda market.

Still bearish Tuesday onwards next week.

Recap

Bought 2,000 CBA @ 96.88

Bought 5,000 NAB @ 25.82

Sold 2,000 CBA @ 97.09 ($420 profit)

Sold 5,000 NAB @ 25.96 ($700 profit)

Bought 2,000 CBA @ 96.51

Bought 5,000 NAB @ 25.73

Sold 2,000 CBA @ 96.66 ($300 profit)

Sold 5,000 NAB @ 25.80 ($350 profit)