Closing Bell: Zip abandons Sezzle at altar as ‘sell now, maybe come back later’ trade hits small caps

It's not me, it's you. Via Getty

- The ASX 200 ends flat, XEC sheds 1.6%

- Gains in healthcare and supermarkets offsets losses for miners, materials, tech and gold

- ANZ: Consumer confidence is broke; is Belararox IPO of ’22?

The benchmark has given up wee gains to end flat. But that risk sentiment is way off if the Emerging Companies (XEC) Index and its more than 1.5% losses are any measure.

In Meta-land, the Nasdaq Composite shrank circa 2.5%. Meta Platform (down 4.7%) and an Elon Musk-less Twitter (down 11%) led a souring in sentiment which has re-emerged in Asian trade today with the whole neighbourhood throwing its hands in the air.

The Nikkei 225 is down 2%, the Hang Seng short 1.3% and the Shanghai Composite 1%.

At home, tech sector losses have been eclipsed by the mining, materials and metals sector. Iron ore pulled back heavily overnight and that’s seen losses escalate across the base metals and pretty metals. The All Ords Gold Index (XGD) is down about 0.7%.

Offsetting these small calamities are health stocks and the don’t-need-but-want-retail sector. In fact the Consumer Discretionary and the Healthcare sectors are both up 1.4%.

As a fan of pop-psychology – with which I successfully undermine my growing children’s confidence in themselves, their parents and the world around them – my take is that self-doubting investors have sought the safety of supermarkets and the comforts of COVID in a conveniently alliterative Tuesday pivot.

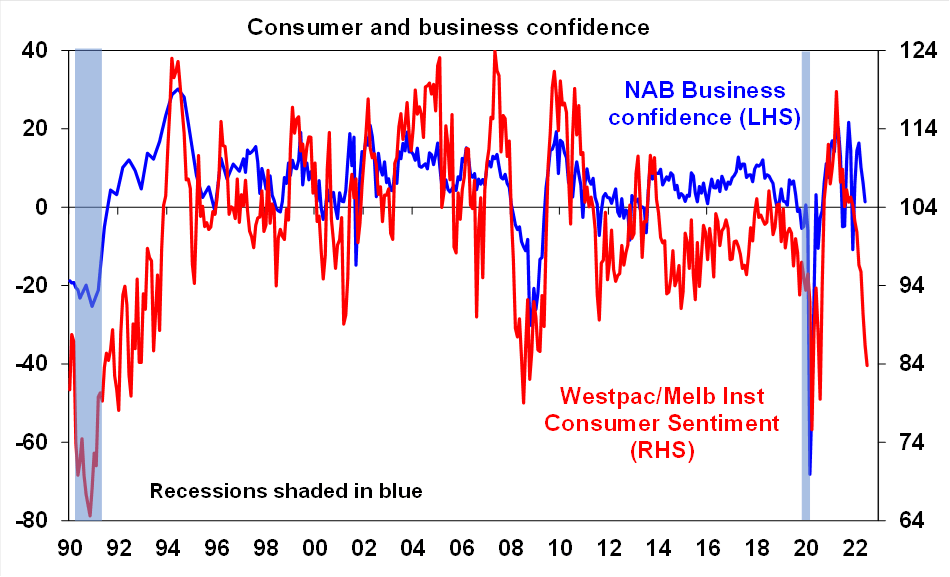

Meanwhile consumer confidence, according to the Westpac/Melbourne Institute data division, continues to track our burgeoning doubts in ourselves, the economy and those around us.

It was down by 3% in July, the eigth consecutive straight nosedive placing our confidence at its lowest ebb since the pandemic swallowed our former lives back in early 2020. As well as a beat on the lowest levels of confidence since the GFC.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 12 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| RMY | RMA Global | 0.16 | 52% | 199,713 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | 182,525 |

| ATU | Atrum Coal Ltd | 0.008 | 33% | 465,582 |

| ZLD | Zelira Therapeutics | 1.98 | 29% | 47,735 |

| AD1 | AD1 Holdings Limited | 0.015 | 25% | 598,385 |

| SBR | Sabre Resources | 0.005 | 25% | 333,500 |

| HMG | Hamelin Gold | 0.12 | 20% | 36,000 |

| 1ST | 1St Group Ltd | 0.006 | 20% | 507,857 |

| LNU | Linius Tech Limited | 0.006 | 20% | 4,090,797 |

| DLM | Dominion Minerals | 0.049 | 20% | 170,506 |

| TAR | Taruga Minerals | 0.026 | 18% | 598,235 |

| RTH | Ras Tech | 0.59 | 18% | 31,612 |

| DUN | Dundas Minerals | 0.14 | 17% | 64,388 |

| PEC | Perpetual Res Ltd | 0.042 | 17% | 9,930 |

| VKA | Viking Mines Ltd | 0.007 | 17% | 20,000 |

| RNO | Rhinomed Ltd | 0.15 | 15% | 141,478 |

| FGL | Frugl Group Limited | 0.015 | 15% | 100,000 |

| TTI | Traffic Technologies | 0.015 | 15% | 1,600,800 |

| 88E | 88 Energy Ltd | 0.0115 | 15% | 39,791,783 |

| RCW | Rightcrowd | 0.046 | 15% | 11,000 |

| PFE | Pantera Minerals | 0.155 | 15% | 3,850 |

| CXU | Cauldron Energy Ltd | 0.008 | 14% | 781,797 |

| ROO | Roots Sustainable | 0.004 | 14% | 30,000 |

| JNO | Juno | 0.125 | 14% | 2,457 |

| OSL | Oncosil Medical | 0.06 | 13% | 2,539,616 |

Belararox (ASX:BRX)is hands down one of the best performing ASX IPOs for 2022, says the notoriously difficult to impress Jessica Cummins.

After IPOing in January with $6m at $0.20, the BRX share price has inched ahead by slightly over 270%.

It’s now trading at over $0.50.

This makes it one of the best performing ASX IPOs for 2022.

The stock is up some 20% this morning after confirming high-grade massive sulphide in its third hole from phase-one reverse circulation drilling at the Belara Mine in the Lachlan Fold Belt of New South Wales.

Hits include 7m at 2.2% zinc, 2.54% copper, 0.63% lead, 36.87g/t silver and 0.67g/t gold from 78m, including 3m at 4.72% zinc, 5.85% copper, 1.30% lead, 82.60g/t silver and 1.5g/t gold.

BRX managing director Arvind Misra says the assays have higher grades for all metals than in the historic model.

“We are now fast-tracking work on our maiden resource, which we hope to announce in this current quarter, and significant results like these bode well for it.”

We’re big fans of Shekel Brainweigh (ASX: SBW), the Israeli-based leader in artificial intelligence-based (AI) electronic weighing systems here at Small Stocks R US.

And by we, I mean me.

And by big fan, I mean I really like it’s crazy business niche, and the crazy tech and the crazy name which so suits it.

What do they do at Shekel Brainweigh?

For over four decades, Shekel Brainweigh has disrupted the retail, healthcare and manufacturing markets with its innovative advanced weighing technology solutions.

Using highly advanced Deep Learning and Artificial Intelligence, Shekel’s suite of automation products aim to transform the retail industry and revolutionise the consumer experience.

Anyhoo. SBW reports first half revenue is up by almost a full quarter (23% to $19.5m) on the back of strong growth in its Retail Innovation segment.

“All sectors of our business have reported growth compared to the same period in FY2021, with our Healthcare and Retail sectors posting strong double-digit revenue growth – underlining the innovation and technology that we provide and the depth and resilience of our business,” chair Arik Schor says.

Also doing well, the Shekel Healthcare segment which saw a full-third (33%) jump in H1 revenue, while the weighing-stuff-really-well retail division jumped a further 27% on the previous corresponding period.

Up well over 5% at the close after hitting intraday highs which were bolder and fuller, Arafura Resources (ASX:ARU) remains a happy resources firm on news GE Renewables’ non-binding memorandum of understanding aims to establish a sustainable supply chain for Neodymium and Praseodymium (NdPr) for the manufacture of offshore wind turbines and energy transition.

It’s a big deal for Arafura, considering the size and scope of GE Renewables and the projects that the latter has been talking up internationally in recent years. Had we bothered to ask GE for comment about wind turbines, the company would no doubt have said “big fans”.

ASX SMALL CAP LOSERS

Here are the best performing ASX small cap stocks for July 12 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Security | Description | Last | % | Volume |

|---|---|---|---|---|

| CLZDB | Classic Min Ltd | 0.055 | -63% | 3,121,006 |

| SZL | Sezzle Inc. | 0.255 | -39% | 9,651,888 |

| CVV | Caravel Minerals Ltd | 0.135 | -27% | 414,251 |

| WFL | Wellfully Limited | 0.044 | -21% | 754,301 |

| MKL | Mighty Kingdom Ltd | 0.03 | -21% | 1,025,599 |

| IOU | Ioupay Limited | 0.072 | -20% | 13,460,517 |

| DAL | Dalaroo Metals | 0.115 | -18% | 65,557 |

| FIN | FIN Resources Ltd | 0.014 | -18% | 187,026 |

| IMR | Imricor Med Sys | 0.3 | -17% | 509,786 |

| LSA | Lachlan Star Ltd | 0.015 | -17% | 1,626,833 |

| PFT | Pure Foods Tas Ltd | 0.2 | -17% | 117,295 |

| SRZ | Stellar Resources | 0.015 | -17% | 913,300 |

| ARE | Argonaut Resources | 0.0025 | -17% | 1,833,846 |

| AUH | Austchina Holdings | 0.005 | -17% | 17,614,430 |

| GMN | Gold Mountain Ltd | 0.005 | -17% | 4,611 |

| TSC | Twenty Seven Co. Ltd | 0.0025 | -17% | 37,713 |

| CYM | Cyprium Metals Ltd | 0.092 | -16% | 16,315,902 |

| C6C | Copper Mountain | 1.97 | -16% | 27,501 |

| E2M | E2 Metals | 0.105 | -16% | 434,013 |

| ENX | Enegex Limited | 0.032 | -16% | 16,667 |

| TPW | Temple & Webster Ltd | 3 | -16% | 1,583,871 |

| LLL | Leolithiumlimited | 0.38 | -16% | 13,746,973 |

| AOU | Auroch Minerals Ltd | 0.062 | -15% | 581,060 |

| MOH | Moho Resources | 0.023 | -15% | 430,766 |

| GTI | Gratifii | 0.018 | -14% | 943,972 |

Looking anxious and perhaps making decisions without much confidence in themselves, the economy and those around them is Mother of the Other buy now, pay later companies, Zip Co (ASX:ZIP), who’ll be paying Sezzle (ASX:SZL) a sorry I left you at the altar fee after suddenly scuppering their long ago promised merger.

In a statement to the exchange, Zip said the deal is off because the economy went sideways yada yada and now market conditions suck yada yada.

Unimpressed analysts who’ve long talked up the wedding and even invited a bunch of clients have been quick to put sword to paper:

“Less than three weeks ago (June 22), Zip provided an update to the market noting that the acquisition of Sezzle remained on track, hence we are somewhat surprised at the timing and reasoning contained in today’s announcement,” UBS analyst Tom Beadle wrote in blood this morning.

“The termination of the proposed merger has the potential to slow Zip’s near-term cash burn given Sezzle is loss-making, but it also slows the scaling of Zip’s US business, where we continue to have concerns around transaction frequency.”

Zip will pay Sezzle US$11m to cover legal, accounting, pop-psychological and other damage-related costs.

WHAT YOU’VE MISSED BECAUSE THE DAY CAN CREEP UP ON YOU LIKE THAT

It looks like one of today’s small caps bolters has been issued a speeding ticket by the ASX. Zelira Therapeutics (ASX:ZLD) had torn up the charts by more than 26% over the course of the day, for no apparent reason, but was grounded by the regulators minutes before 3pm, most likely with a ‘Please Explain’ attached.

And speaking of Please Explains, there’s been a bit of back and forth between CFOAM (ASX:CFO) and the ASX over who knew what and when about its proposed sale to CONSOL Energy.

The current state of play is that CFOAM is maintaining that the negotiations of the sale were all above board and in confidence, as per the rules, noting that the conditional agreement was only confirmed and signed on 7 July 2022, two days after the 5 July trading halt was called.

However, that still leaves everyone short of an explanation for why the company’s price nearly tripled leading up to the 5 July halt, so there could be further furious faxes to come.

TRADING HALTS

Lake Resources (ASX:LKE) – Lake is preparing a response to an online report. Stay tuned.

Okapi Resources (ASX:OKR) – Capital Raising.

Falcon Metals (ASX:FAL) – There’s an announcement in relation to exploration results at Falcon’s Pyramid Hill Gold Project on its way.

AML3D (ASX:AL3) – Aaaaand it’s a capital raise. Happy days.

Zelira Therapeutics (ASX:ZLD) – Speeding ticket.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.