Closing Bell Xmas Hits! Oh Kairos REE; Culpeo the visible copper nosed miner; And It’s starting to look a lot like a Xmas rally

Having decked the halls with bowels of Holly, Reginald went on to kill four more times before he was eventually trapped by police in a Chicago frozen custard shop. Pic via Getty Images.

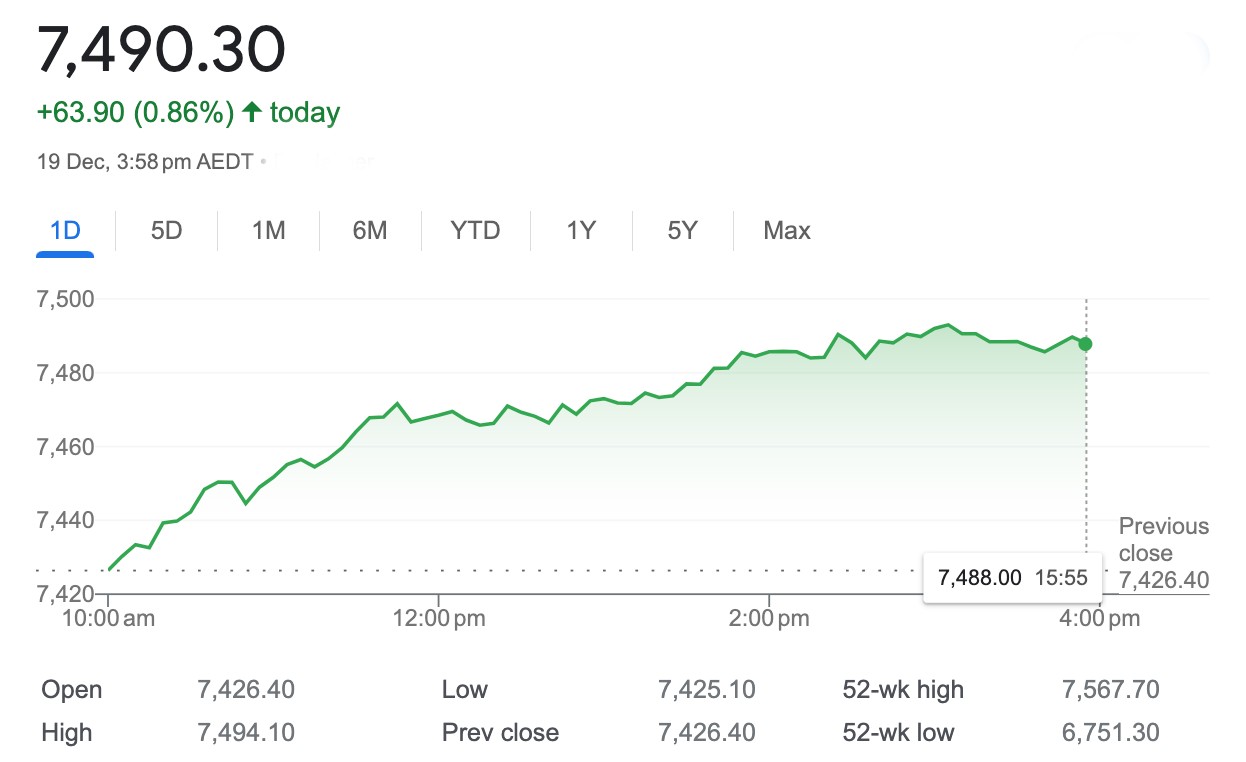

It’s green across the board on Tuesday as the ASX finds air on the lunchtime release of the Reserve Bank’s December minutes, which conceded there’s a lot less inflation than the governor’s been fearing.

Aussie stocks were also buoyed by the Bank of Japan (BoJ) choosing to leaves rates and guidance where they’ve been, ensuring its zero-interest rate policy was safe for the time being.

The benchmark is now sitting comfy at near 10-month highs.

At 3.55pm on Monday December 19, the S&P/ASX200 was up 42 points, or 0.6 per cent, to 7490.

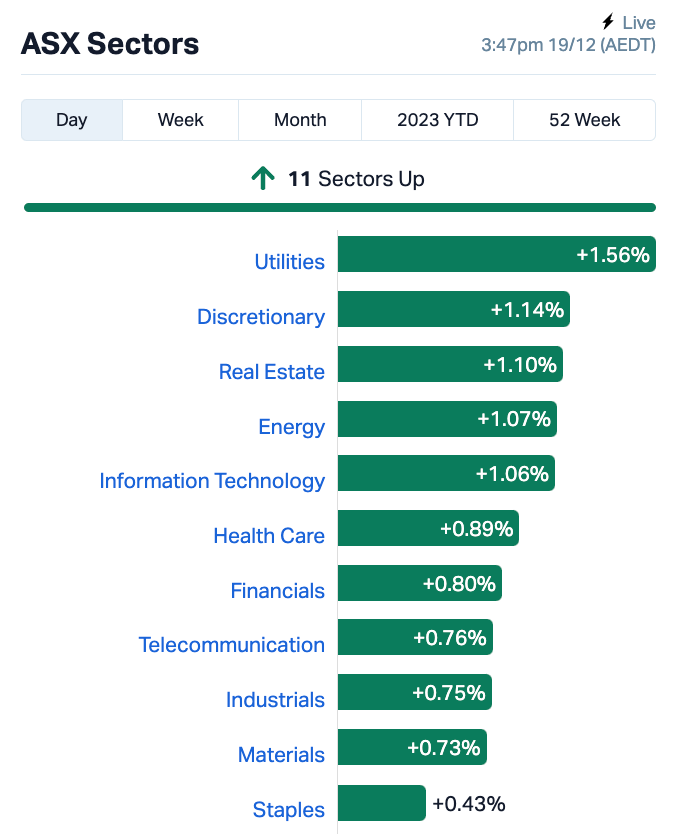

The Property, Utilities and Energy Sectors were all putting in some decent Tuesday performances ahead of Christmas.

Energy names look particularly likely after oil prices jumped +2% overnight.

It’s taken a while for someone with a penchant for petrol to notice, but it’d seem these increasing attacks on merchant shipping by Iran-allied Houthi militants out of Yemen in the Red Sea have finally raised a few eyebrows about what that might do to the smooth supply of oil, through the key global shipping lane.

And the RBA Minutes gave stocks a further blast of warm air at 11.30am, the bank dismissing a rate rise – noting some rather encouraging inflation data and holding again at 4.35%

Rate sensitive stocks did well.

The real estate investment trusts (REITs) did the easiest work – Lendlease Group (ASX:LLC) , Goodman Group (ASX:GMG) (up +2%) and Scentre Group (ASX:SCG) rising on the bets that the central bank is done with tightening for the short-term at least.

Inside the final 30 minutes of trade in Sydney, all 11 ASX sectors were in the green.

ASX Sectors on Tuesday

Overnight, BP decided the route was too dicey to send it’s cargo through after other key shipping firms began avoiding the area over the weekend. Meantime, marine insurers plumped up premiums for any ships transiting the Red Sea, adding to price pressures.

At home, almost all the major energy stocks found keen buying.

Origin Energy (ASX:ORG) also found favour, after announcing another $530mn out of UK energy retailer and tech platform Octopus Energy.

Meridian (ASX:MEZ) has enjoyed Tuesday, while the other oil names on the ASX200 like Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) also rose.

In company news on Tuesday, the learning stocks came out to play. IDP Education (ASX:IEL) and G8 Education (ASX:GEM) were richer, the latter by about 12% after the childcare operator’s upbeat earnings update, forecasting EBITDA between $99-$102mn, aa well as operating NPAT of $62 to $64mn.

On the M&A front, lithium lovers will be excited that Allkem (ASX:AKE) proposed merger with US-listed Livent got the shareholder vote of approval, (89% of votes), paving the way fora new mega lithium monster with the American venture.

Allkem however fell about 0.1% after a long buildup to take off.

In the US…

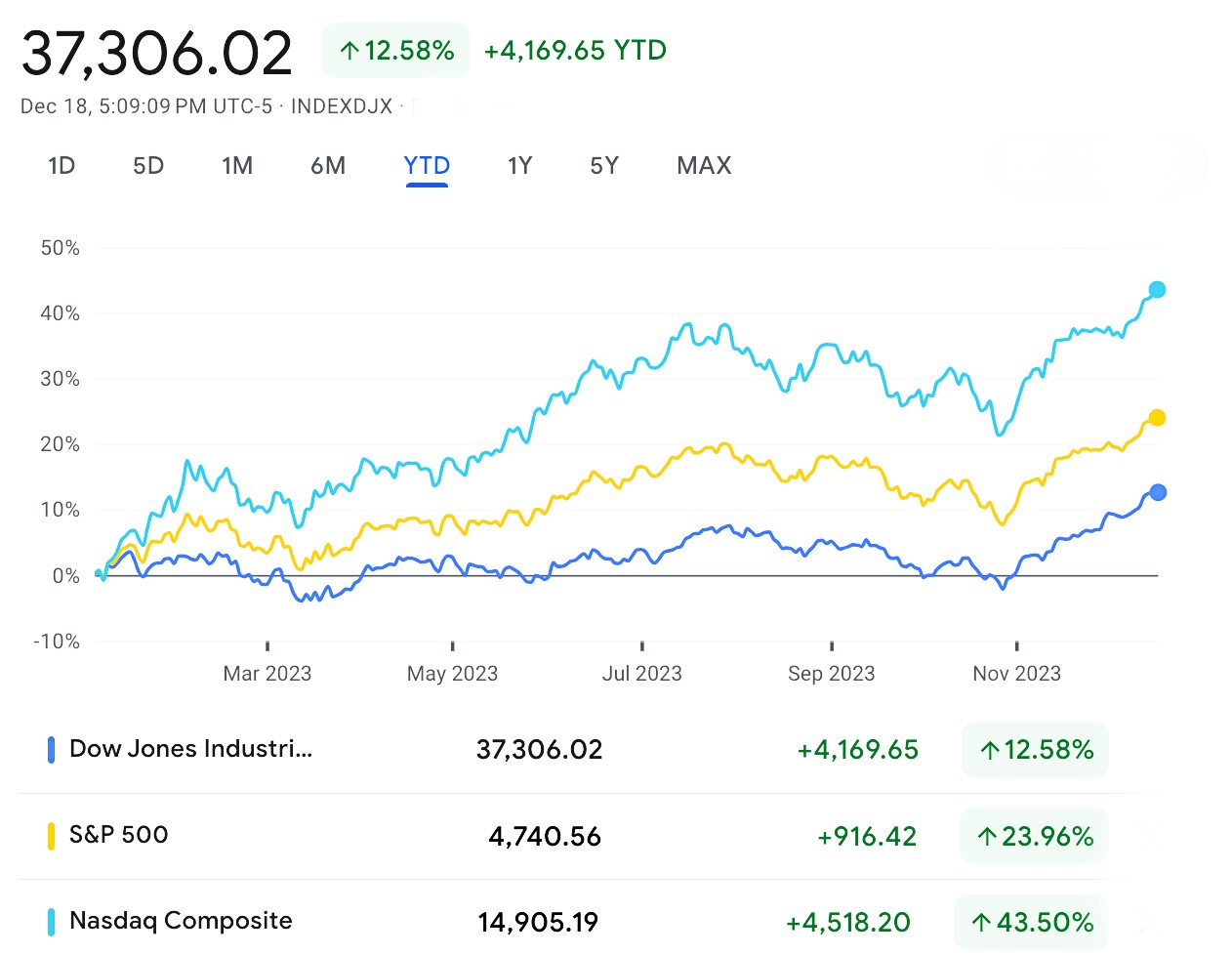

US stock futures have crept lower during our Tuesday session.

Overnight the 3 major indices extended gains, the S&P 500 and Nasdaq Composite up around +0.5%, while the Dow finished flat, although still at record highs, for a flat market.

The Dow Jones vs Mates Year-to-date:

9 out of the 11 S&P sectors ended higher on Monday in the US, led by Comms, and consumer stocks.

In corporate news, US Steel surged 26.1% on news that it would be acquired by Japan’s Nippon Steel for $14.9 billion, while Apple fell 0.85% after announcing a halt in Apple Watch sales in the US due to patent rights violations.

Wall St, one must say, remains Minotaur-esque in its anticipation of lower interest rates next year.

The PCE inflation, will put those fears to bed, the Fed’s preferred measure of price pressures drops on Friday.

At 4pm in Sydney, Futures tied to the 3 major US indices were mixed of the Tuesday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTM | MTM Critical Metals | 0.043 | 105% | 36,971,186 | $2,088,179 |

| AMD | Arrow Minerals | 0.0045 | 50% | 91,486,667 | $9,071,295 |

| AVW | Avira Resources Ltd | 0.0015 | 50% | 200,010 | $2,133,790 |

| OLH | Oldfields Holdings | 0.055 | 38% | 600,000 | $7,990,238 |

| 1TT | Thrive Tribe Tech | 0.019 | 36% | 1,184,615 | $4,152,701 |

| NVO | Novo Resources Corp | 0.2025 | 35% | 2,363,821 | $6,740,720 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | 1,304,749 | $9,507,891 |

| RGS | Regeneus Ltd | 0.004 | 33% | 603,007 | $919,311 |

| TKL | Traka Resources | 0.004 | 33% | 127,000 | $2,625,988 |

| ADR | Adherium Ltd | 0.045 | 32% | 161,478 | $11,336,959 |

| SGA | Sarytogan | 0.25 | 28% | 2,735,611 | $15,005,232 |

| DVL | Dorsavi Ltd | 0.014 | 27% | 632,068 | $6,563,278 |

| 1AE | Auroraenergymetals | 0.093 | 24% | 2,642,640 | $11,940,520 |

| KAI | Kairos Minerals Ltd | 0.017 | 21% | 15,027,806 | $36,692,771 |

| CPO | Culpeominerals | 0.036 | 20% | 35,805,905 | $3,496,871 |

| KCC | Kincora Copper | 0.036 | 20% | 825,655 | $5,995,052 |

| HT8 | Harris Technology Gl | 0.012 | 20% | 133,116 | $2,991,355 |

| LBT | LBT Innovations | 0.012 | 20% | 53,667 | $12,564,543 |

| 3DA | Amaero International | 0.25 | 19% | 1,580,466 | $91,970,964 |

| AR9 | Archtis Limited | 0.125 | 19% | 430,265 | $29,997,127 |

| DEL | Delorean Corporation | 0.032 | 19% | 828,668 | $5,824,465 |

| KP2 | Kore Potash PLC | 0.013 | 18% | 62,500 | $7,370,066 |

| NGS | NGS Ltd | 0.013 | 18% | 523,438 | $2,763,501 |

| GLA | Gladiator Resources | 0.02 | 18% | 500,000 | $10,043,546 |

| PVT | Pivotal Metals Ltd | 0.02 | 18% | 2,978,781 | $11,560,948 |

A late charge on Tuesday saw MTM Critical Metals (ASX:MTM) launch into low orbit, up better than 160% mid-afternoon on news that the company has entered into a binding agreement to acquire 100% of Flash Metals.

Flash, for those not in the know, currently holds three granted exploration licences in Western Australia’s West Arunta region, immediately adjacent to ground held by WA1 Resources (ASX:WA1) and Encounter Resources (ASX:ENR) … it is, as MTM’s new neighbours suggest, a pretty ritzy neighbourhood.

Additionally, the deal also hands over Flash’s Mukinbudin Niobium-REE Project, comprising 2 granted exploration licences located 250km northeast of Perth in the South West Mineral Field of Western Australia.

But wait, there’s more… Flash also has an option to exclusively negotiate the licensing rights to an early-stage processing technology for REE and precious metals known as Flash Joule Heating, which has been developed by researchers at Rice University in the USA.

The deal wasn’t cheap – Provided all of Flash’s shareholders agree to the deal, MTM is on the hook for:

- 100m fully paid ordinary shares in MTM.

- 50m quoted options with an exercise price of $0.25 and expiring 26 November 2024.

- 37.5m performance rights.

- 15m unquoted options to acquire Shares with an exercise price of $0.25 and an expiry date of 30 December 2026.

The big winner earlier in the day was Novo Resources (ASX:NVO), which slammed a 53.3% homer on news that SQM Australia has agreed to pay A$10 million for a 75% interest in five of Novo’s prospective lithium-nickel tenements in the West Pilbara. It’s since retreated to a still-respectable +36% gain.

SQM Australia, in case you missed all the other memos this year, is a wholly-owned subsidiary of Chilean giant Sociedad Química y Minera de Chile, which is 49% owned by China’s Tianqi Lithium Corporation, helmed by CEO Ricardo Ramos, and busily buying up everything it can get its lithium-stained hands on.

That deal will see the formation of the Harding Battery Metals Joint Venture, and also allows for an option over additional Novo Pilbara tenements down the track.

The Harding Battery Metals JV tenements are within neurological spitting distance of Azure Minerals (ASX:AZS) Andover lithium–nickel project, so everyone’s pretty excited about what the new collab is going to produce.

Meanwhile, Culpeo Minerals (ASX:CPO) has revealed that it has hit “significant widths of visible copper mineralisation” at shallow depth during drilling at its El Quillay Prospect, Fortuna Project in Chile.

Culpeo’s not kidding when it says that the copper is visible, either… the company has posted several images along with the announcement that are quite striking, and – dare I say it – fittingly colourful for this festive time of year.

The company says the images are indicative of a 40m intercept from a depth of just 15m from drillhole CMEQD002, where the near surface mineralisation was dominated by malachite and chrysocolla while in the primary zone the main copper mineralisation was in the form of chalcopyrite and to a lesser extent bornite.

(That last bit’s just a little sumthin’ sumthin’ for all you hardcore rock nerds out there… Happy Xmas, rockhounds…)

Sarytogan Graphite (ASX:SGA) is busting out the Christmas bubbly this morning, with news that the first spheroidised graphite from the Sarytogan Graphite Deposit in Central Kazakhstan has been produced.

The company says that a high combined spheroidisation yield of 54% achieved ideal D50 sphere sizes of 32, 18, and 12μm after classification, with high tap densities ranging from 0.91 to 0.99g/cm.

“What a way to end the year!” said an obviously very happy Sarytogan managing director, Sean Gregory.

“This result allays all doubts of the giant and exceptionally high-grade Sarytogan Graphite deposit’s suitability to vie for a share of the rapidly growing lithium-ion battery market for electric vehicles and other uses, subject to customer qualification.”

Thrive Tribe Technologies (ASX:1TT) has jagged an out-of-nowhere, but probably very welcome 35% jump this afternoon on no fresh news, moving it to a healthy +171% for 2023 YTD.

Kairos Minerals (ASX:KAI) is up this afternoon as well, on the back of news that final assays from recent Roe Hills North drilling reveal very high-grade rare earth element (REE) intersections over a large area at the company’s Black Cat prospect at its 100% owned Roe Hills project, 110km east of Kalgoorlie in WA.

The company reports that more than 90% of holes tested for REEs have returned significant intersections of REE (>500ppm TREO), and include a standout intersection of 28m @ 3854ppm TREO from 32m which includes 4m @ 2.31% TREO (23,182ppm) in drillhole RHRC253.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -33% | 2,568,878 | $15,706,757 |

| ADY | Admiralty Resources. | 0.005 | -29% | 2,282,234 | $9,125,054 |

| RML | Resolution Minerals | 0.003 | -25% | 100,000 | $5,029,167 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | 187,569 | $24,408,512 |

| PRM | Prominence Energy | 0.01 | -23% | 20,000 | $2,032,893 |

| IXU | Ixup Limited | 0.039 | -22% | 398,390 | $54,080,433 |

| HAV | Havilah Resources | 0.21 | -21% | 686,072 | $83,909,391 |

| CTN | Catalina Resources | 0.004 | -20% | 1,785,525 | $6,192,434 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 3,073,322 | $19,462,207 |

| AML | Aeon Metals Ltd. | 0.009 | -18% | 132,000 | $12,060,407 |

| EQN | Equinoxresources | 0.255 | -18% | 86,900 | $31,364,251 |

| BTE | Botalaenergyltd | 0.075 | -17% | 443,136 | $6,528,500 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 40,112 | $2,070,870 |

| WEL | Winchester Energy | 0.0025 | -17% | 100,000 | $3,061,266 |

| KKO | Kinetiko Energy Ltd | 0.071 | -16% | 480,665 | $114,602,808 |

| PHO | Phosco Ltd | 0.062 | -16% | 50,000 | $20,306,588 |

| MRZ | Mont Royal Resources | 0.13 | -16% | 33,139 | $13,179,618 |

| CR9 | Corellares | 0.022 | -15% | 306,804 | $12,092,363 |

| TOY | Toys R Us | 0.011 | -15% | 2,528,133 | $12,772,026 |

| ID8 | Identitii Limited | 0.017 | -15% | 2,190,936 | $8,604,760 |

| BUY | Bounty Oil & Gas NL | 0.009 | -14% | 298,900 | $14,390,260 |

| CVR | Cavalierresources | 0.12 | -14% | 32,198 | $4,456,048 |

| H2G | Greenhy2 Limited | 0.006 | -14% | 146,303 | $2,931,291 |

| OPN | Oppenneg | 0.006 | -14% | 23,872 | $7,904,257 |

| VML | Vital Metals Limited | 0.006 | -14% | 53,939,245 | $41,265,469 |

TRADING HALTS

Latrobe Magnesium (ASX:LMG) – pending an announcement to the market regarding a proposed capital raising.

Fatfish Group (ASX:FFG) ) – pending the release of an announcement concerning a capital raise.

Genetic Signatures (ASX:GSS) – pending an announcement to the market regarding a proposed capital raising.

Argonaut Resources (ASX:ARE) – pending the release of an announcement regarding a capital raising.

Hiremii (ASX:HMI) – pending release of an announcement regarding a capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.