Closing Bell: WiseTech crumbles 20pc, but APA saves the day with big gas plans

APA saves the day with big gas plans. Picture via Getty Images

- Banks lead ASX200 comeback

- Tech sinks after Wisetech crashes on boardroom drama

- Reece, Iress slump, NIB and NextDC rise

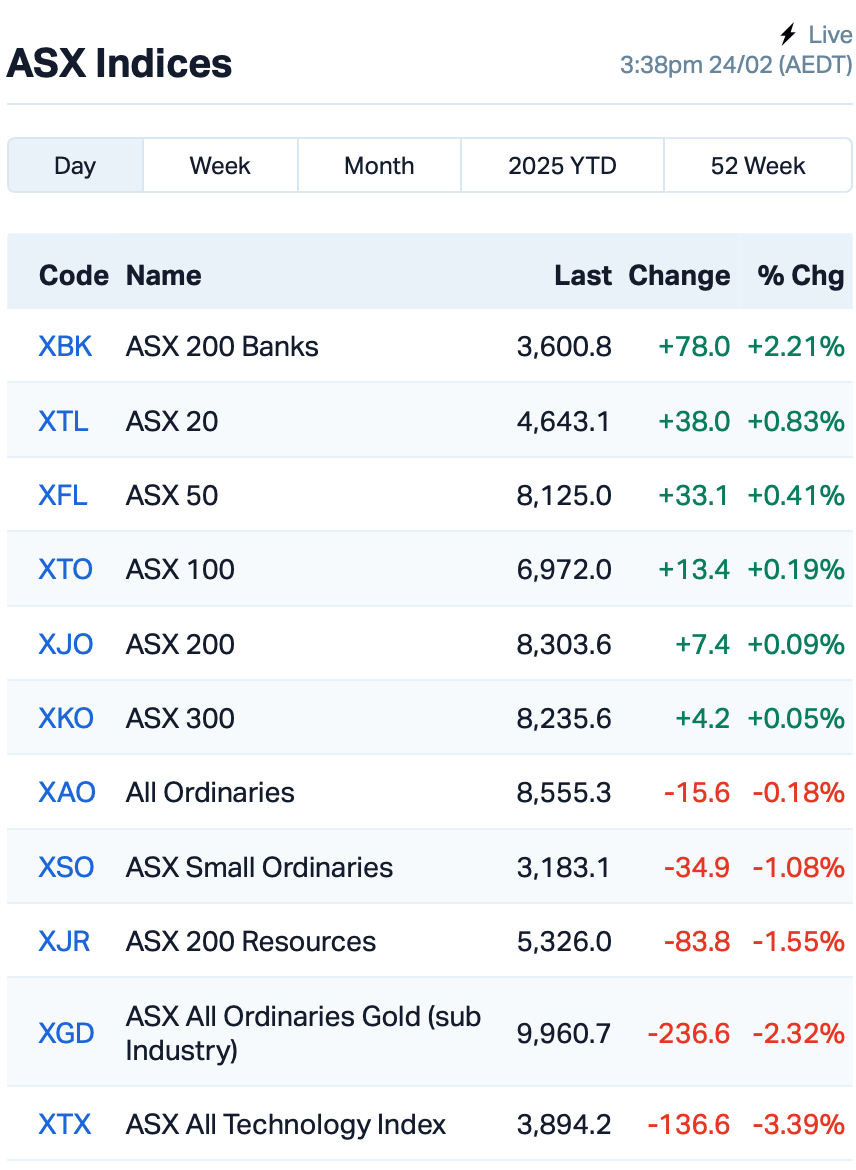

The ASX had a rollercoaster Monday, with some wild swings, but by session close the benchmark ASX200 index was pretty much flat.

The big banks led the afternoon comeback, with the Commonwealth Bank (ASX:CBA), Australia and New Zealand Banking Group (ASX:ANZ) and National Australia Bank (ASX:NAB) all jumping by more than 2% on no specific news.

But while the banks were flying, the fallout from WiseTech Global’s (ASX:WTC) boardroom drama continues to weigh on the index.

The tech sector sold off around 7% after WiseTech Global’s stunning 20% crash as shares hit a one-year low.

The massive drop came after the chairman and three directors tendered their resignations earlier today.

Word is, the board is in turmoil over founder and former CEO Richard White’s future role. Some directors reckon he shouldn’t even be involved any more after coming under fire with allegations from three women.

Late last year, WiseTech said White would step down as CEO and take on a full-time consulting gig in the company, focusing on product and business development while still pocketing his $1 million salary.

However, that agreement hasn’t been signed yet, and the board is still ironing out the details. Adding fuel to the fire, new allegations of inappropriate conduct have surfaced this year.

“We don’t see the board resignations as a material loss,” said Morningstar’s Dr Roy Van Keulen.

“But it could signal a shift in power toward the founder. Following the changes to the board, the average tenure on WiseTech’s board has more than doubled to over 20 years, from under 10 years previously.”

Elsewhere in the large caps space, NIB Holdings (ASX:NHF) jumped by 14% despite reporting a dip in profit in 1H25. The company’s growth in its Australian health insurance business helped offset losses in New Zealand.

NextDC (ASX:NXT), the $9bn data centre operator, dropped 2% after it posted a deeper net loss for the six months to December.

NEXTDC also announced a $150 million Growth Incentive Plan (GIP) to keep its top execs locked in.

To stay competitive, NEXTDC’s offering a one-off reward for its MD/CEO and senior leaders, linking their pay to shareholder value over the next five years.

Software group Iress (ASX:IRE) tumbled by 13% despite swinging to a profit for the full year; and fast-fashion jewellery retailer Lovisa fell by 5% after its store network growth led to only a modest sales increase in the half.

And, the utilities sector outperformed today after APA Group (ASX:APA) rose 8% on announcing a five-year plan to boost gas transport capacity by 24% across the East Coast Gas Grid, with upgrades to pipelines and storage to meet growing demand. The $75 million initial investment will focus on two key projects: converting the Moomba to Sydney pipeline and expanding off-peak capacity.

This is how things looked leading up to Monday’s close of day:

Meanwhile, Trump is pushing for a series of moves that could ramp up tensions, including curbing Chinese investments in key US sectors like energy.

On Friday, he also targeted Chinese shipping dominance and pushing Mexico to slap tariffs on Chinese goods to counter evasion tactics.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap CT1 Constellation Tech 0.002 100% 264,713 $1,474,734 SLZ Sultan Resources Ltd 0.011 38% 3,121,877 $1,851,759 ECT Env Clean Tech Ltd. 0.004 33% 10,443,221 $9,515,431 NES Nelson Resources. 0.004 33% 25,000 $6,515,783 C1X Cosmosexploration 0.140 33% 3,702,918 $10,863,993 ARN Aldoro Resources 0.440 26% 3,093,607 $60,603,810 CZR CZR Resources Ltd 0.245 26% 794,456 $46,163,256 HCD Hydrocarbon Dynamics 0.003 25% 829,629 $2,156,219 QXR Qx Resources Limited 0.005 25% 289,156 $5,240,311 SFX Sheffield Res Ltd 0.240 23% 284,849 $76,986,965 PLC Premier1 Lithium Ltd 0.011 22% 44,020,724 $3,312,545 PFT Pure Foods Tas Ltd 0.034 21% 602,873 $3,791,917 FRS Forrestaniaresources 0.018 20% 1,948,041 $3,936,817 ALM Alma Metals Ltd 0.006 20% 280,000 $7,931,727 AUR Auris Minerals Ltd 0.006 20% 181,977 $2,383,130 BPP Babylon Pump & Power 0.006 20% 150,014 $12,497,745 GES Genesis Resources 0.006 20% 281,333 $3,914,206 ROG Red Sky Energy. 0.006 20% 4,711,149 $27,111,136 YAR Yari Minerals Ltd 0.006 20% 2,768,168 $2,411,789 NRX Noronex Limited 0.019 19% 29,205,432 $7,994,998 SPX Spenda Limited 0.010 19% 10,036,513 $36,921,724 VLS Vita Life Sciences.. 1.920 19% 25,431 $90,133,149 NH3 Nh3Cleanenergyltd 0.020 18% 1,747,236 $9,343,281 JGH Jade Gas Holdings 0.034 17% 168,907 $48,918,191

Vulcan Energy Resources (ASX:VUL) has kicked off synthetic brine testing at its German facility, marking its move towards fine-tuning lithium extraction processes. The testing aims to optimise extraction methods before analysing bulk brine samples from Bolivia’s top lithium salars. Vulcan’s proprietary Vulsorb tech will be used to maximise lithium recovery while minimising water use, with the results guiding the processing of the brine samples. This, the company said, is a major step towards large-scale commercial lithium production.

Premier1 Lithium (ASX:PLC) has wrapped up the heritage survey at its Yalgoo project with no issues, giving the green light for the first drill program. Site works for access and drill pad prep are underway, with drilling set to kick off in early March. The drilling will target high-grade gold areas, including Crescent East, Olive Queen, and Carlisle, which showed promising results in previous rock chip samples. The Wadgingarra area hasn’t been explored much since the 1980s.

Noronex (ASX:NRX) said it has just hit a major copper-silver find at the Fiesta Project in Namibia, with a 500m step-out revealing solid mineralisation. Drilling results show strong intercepts, including 5m at 1.4% copper and 58g/t silver, and the mineralisation is still open, heading deeper. A diamond rig is coming in to keep testing this hot zone and see if the mineralisation keeps going. This step-out is a big win for Noronex, the company said, as it proves the potential of this system.

And, Alcidion (ASX:ALC) has scored a £19.5m ($39m) deal with North Cumbria Integrated Care NHS Trust in the UK, using its Aussie-made Miya Precision platform to manage patient records. This is the company’s biggest-ever contract, marking a major milestone after a successful run during the COVID-19 pandemic. Miya’s cloud-based tech helps hospitals manage patient flow, decision-making, and real-time access to records.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNR | Lanthanein Resources | 0.002 | -33% | 230,000 | $7,330,908 |

| TX3 | Trinex Minerals Ltd | 0.001 | -33% | 9,092 | $2,817,978 |

| BNL | Blue Star Helium Ltd | 0.005 | -29% | 3,924,008 | $18,864,197 |

| OZM | Ozaurum Resources | 0.080 | -27% | 15,742,982 | $21,722,456 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 4,092,823 | $57,867,624 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 23,044 | $2,507,203 |

| HLX | Helix Resources | 0.003 | -25% | 5,216,427 | $13,456,775 |

| OB1 | Orbminco Limited | 0.002 | -25% | 6 | $4,333,180 |

| VRC | Volt Resources Ltd | 0.003 | -25% | 176,951 | $18,117,573 |

| WTC | Wisetech Global Ltd | 97.110 | -20% | 3,366,460 | $40,704,950,320 |

| CDT | Castle Minerals | 0.002 | -20% | 4,729,253 | $4,742,035 |

| EMT | Emetals Limited | 0.004 | -20% | 200,000 | $4,250,000 |

| CMO | Cosmometalslimited | 0.021 | -19% | 135,650 | $3,405,815 |

| KRR | King River Resources | 0.009 | -18% | 1,904,231 | $16,810,428 |

| BDG | Black Dragon Gold | 0.042 | -18% | 1,889,096 | $15,489,519 |

| AMS | Atomos | 0.005 | -17% | 83,907 | $7,290,111 |

| ASR | Asra Minerals Ltd | 0.003 | -17% | 1,741,872 | $6,937,890 |

| EVR | Ev Resources Ltd | 0.005 | -17% | 7,286,882 | $11,595,020 |

| GLL | Galilee Energy Ltd | 0.005 | -17% | 30,000 | $3,343,157 |

| FCT | Firstwave Cloud Tech | 0.021 | -16% | 720,472 | $42,837,967 |

| RFA | Rare Foods Australia | 0.016 | -16% | 60,182 | $5,167,682 |

| PRN | Perenti Limited | 1.163 | -16% | 7,124,484 | $1,289,421,351 |

| RGT | Argent Biopharma Ltd | 0.145 | -15% | 20,048 | $10,076,286 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 100,000 | $5,665,530 |

IN CASE YOU MISSED IT

Sun Silver (ASX:SS1) is aiming to streamline development at its Nevada-based Mavericks Springs asset by kicking off a series of baseline environmental surveys. The surveys will run until August, with a final report expected in November. For now, the company remains focused on resource expansion and feasibility studies.

Arizona Lithium (ASX:AZL) is moving ever closer to production, securing the final water rights license and associated approvals for its Prairie lithium brine project in Saskatchewan, Canada. The company has now submitted its project application to the Ministry of Energy and Resources, paving the way for Phase 1 of the Prairie development.

Goldfields explorer OzAurum Resources (ASX:OZM) has seen success in a short round of aircore drilling, confirming consistent mineralisation over a 400-metre strike length. The drilling aimed to identify targets for RC drilling, with both RC and further AC drilling planned as soon as rigs become available.

QMines (ASX:QML) is launching a 10,000-metre drilling campaign at its Scorpion and Window deposits in Queensland, with resource updates at both potentially to come. Following this effort, rigs will shift to enhance the Sulphide City resource. The company anticipates resource updates soon, with a PFS expected in the second half of 2025.

New World Resources (ASX:NWC) has appointed highly experienced US-based mining executive Gil Clausen as a non-executive director. Clausen brings a strong track record in project development, having previously served as President and CEO of Copper Mountain Mining Corporation, Brio Gold Inc., and Augusta Resource Corporation.

Green Critical Minerals (ASX:GCM) has appointed Chris Whiteley as head of sales and marketing to support customer engagement and revenue growth as it advances the commercialisation of its VHD Graphite technology. Whiteley brings 28 years of experience in technical sales and business development across the graphite and carbon sectors.

At Stockhead, we tell it like it is. While Sun Silver, Arizona Lithium, OzAurum Resources, QMines, New World Resources and Green Critical Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.