Closing Bell: We’re living in a material world and this is a flat materials stockmarket

Via Getty

- The ASX benchmark has ended the day a cat’s whisker lower

- Rising iron ore prices defy forecasts, Utilities lead sector gains

- Small caps led by Westar Resources

Israel and Hamas have agreed to a temporary cease-fire on humanitarian grounds in a long-awaited move, which reportedly includes a hostage swap.

“The Israeli government is committed to the return of all hostages home. Tonight, the government approved the outline for the first stage of achieving this goal, according to which at least 50 hostages – women and children – will be released for four days, during which there will be a lull in the fighting,” the Israeli Prime Minister’s Office said in a statement.

With trading holidays ahead in New York and in Tokyo, the Aussie sharemarket has ended just so slightly lower on so light volumes.

The big miners lifted on surprisingly strong iron ore prices as local IT stocks were sold off following the rare decline in the Nasdaq.

Already analysts are rewriting their projections for the country’s most valuable export.

At match-out on Wednesday November 22, the S&P/ASX 200 (XJO) index was down about 5 points, or -0.068% at 7,073:

This morning, Sydenham time, analysts at Citi decided that the iron ore price rally could just keep on creeping ahead of the invisible starters gun on expectations of a looming stimulus push from China.

Citi subsequently upgraded its three-month iron ore forecast to US$140 from US$120.

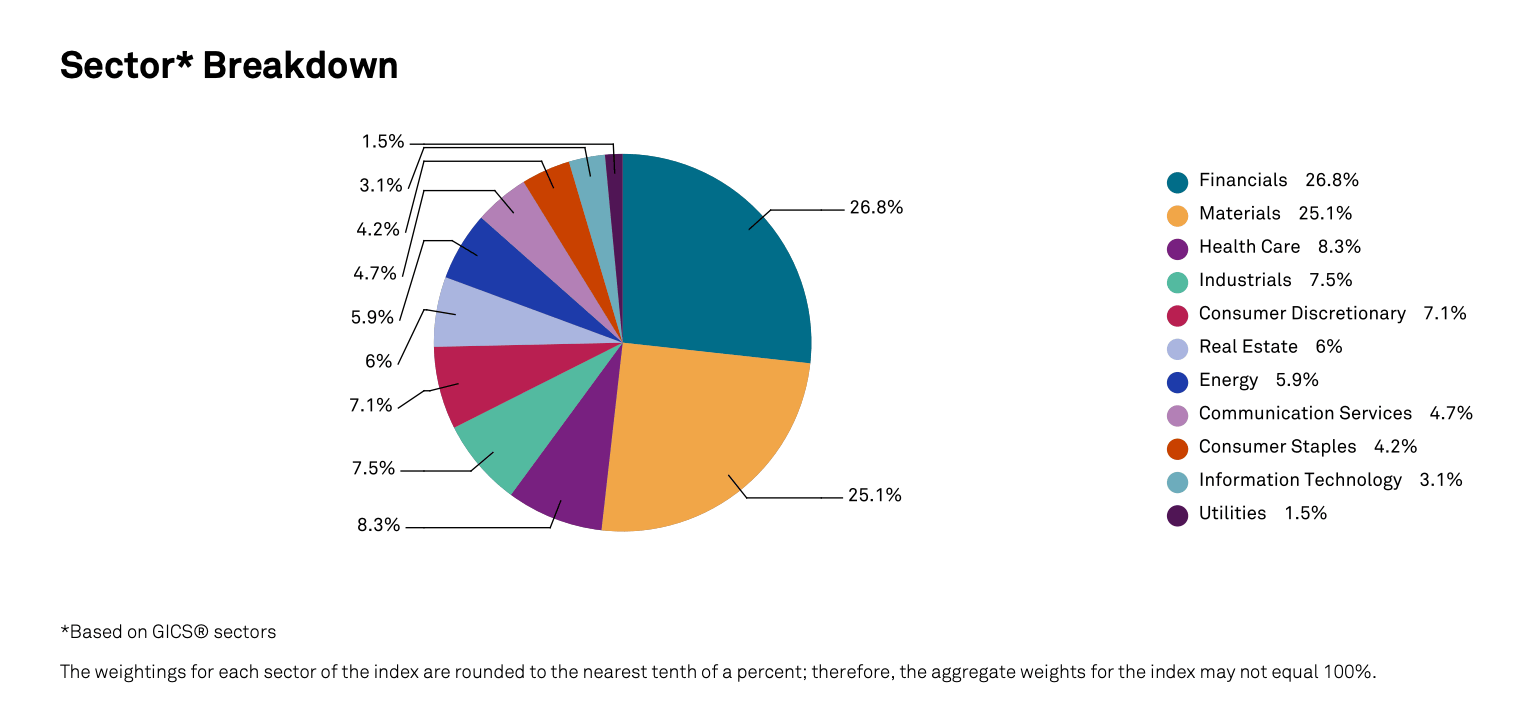

That’s good news on the whole for the local (All Ords ASX: XAO) bourse, where over one quarter of market weight is made up entirely of diggers:

This week, iron ore prices have rallied to levels not seen since June last year as Chinese inventories wallow at six-year lows.

Prices for 63.5 fe iron ore for delivery in Tianjin have lifted beyond US$134 a tonne in November, the highest in over eight months on dream-like expectations of ongoing demand and nightmarish-like fears of supply risks as BHP faces industrial action for some 400 train drivers effectively capping production out of the Pilbara.

China – the world’s biggest consumer of iron ore and our largest customer – has plans for a bond issuance binge supposedly good for some one trillion RMB worth of debt to lift old school infrastructure and building projects. On the whole the feeling is a tidal wave might be coming, one that far outstrips recent attempts by Beijing to spark its lacklustre economy.

And Singapore iron ore futures moved higher again on Wednesday, as punters bet that China will go hard on a bumper stimulus to firestart its ailing property sector and long-stalled economic recovery.

Singapore iron ore futures inched higher on Wednesday, up 0.3% to US$134 a tonne.

The November iron ore contract in Singers is about 0.4% higher at US$135, making it 18 rises from the previous 23 sessions.

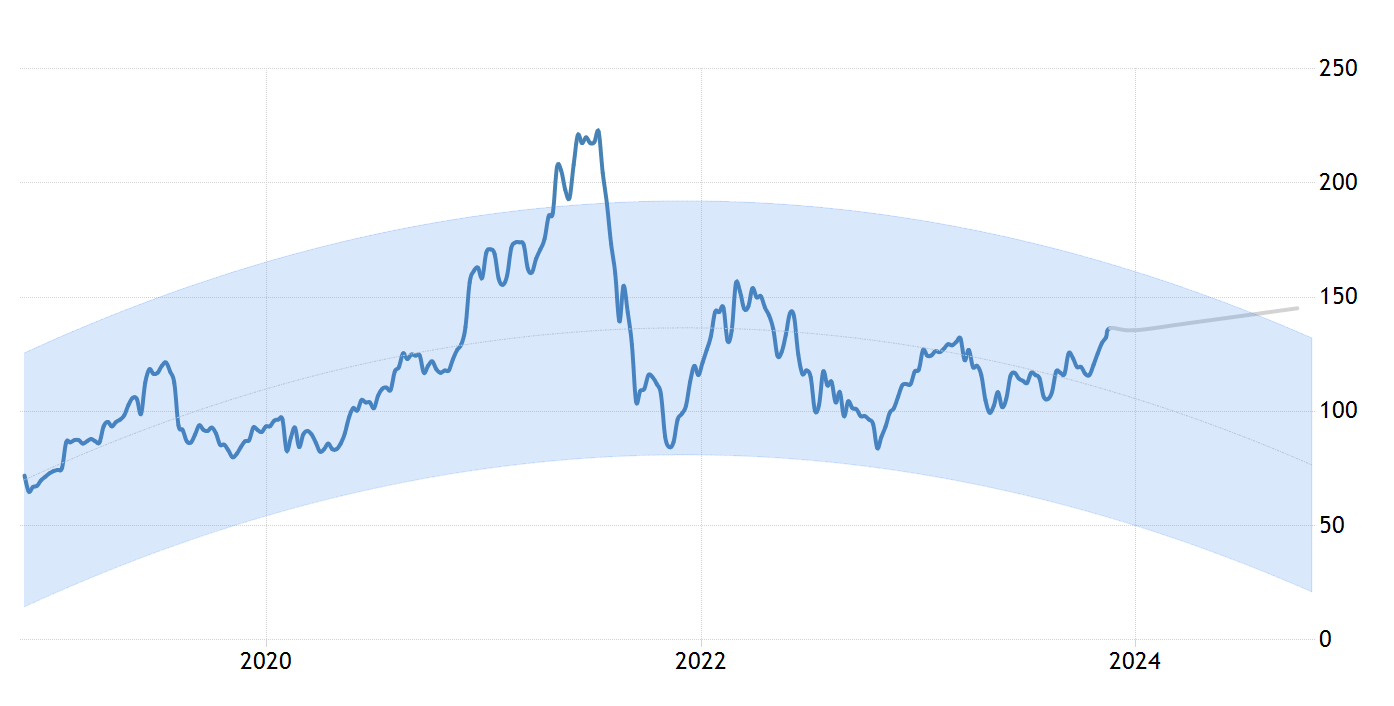

Prices have now lifted by around 16% since the beginning of the year, as per trading on a contract for difference (CFD), which tracks the commodity benchmark.

According to global macro models and analyst expectations at Trading Economics, iron ore prices are expected to trade at US$145.23 in 12 months time.

Trading Economics: 12-month iron ore price outlook (USD)

Meanwhile, at the world’s most valuable chipmaker, Nvidia has left Wall St underwhelmed despite smashing its quarterly results, pretty much just blaming US President Joe Biden’s semiconductor embargo of China.

Among the big local names to suffer: WiseTech Global (ASX:WTC) , Xero (ASX:XRO) and Altium (ASX:ALU).

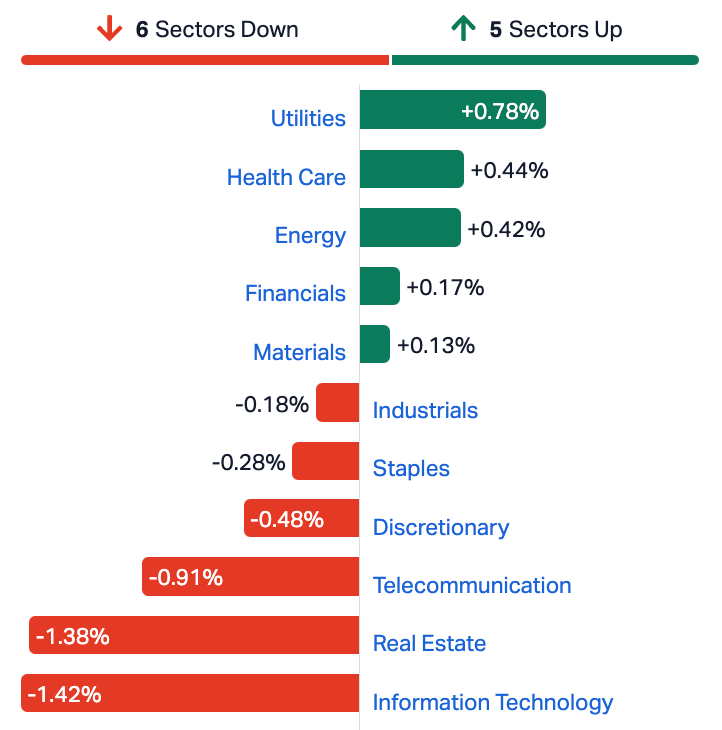

Gains in the Utilities, Energy and Healthcare stocks have been offset by weakness across IT, Property and consumer stocks.

The +0.8% win for Utilities comes off the back of a rising Origin Energy share price. The takeover target’s been a Wednesday favourite, up about +1% as shareholders await the outcome of the stand-off between a conglomerate led by Brookfield and major shareholder AustralianSuper.

ASX Sectors On Wednesday

As the takeover bid for Origin Energy (ASX:ORG) heats up, so too does passionate stockpicker Emanuel Datt of Datt Capital.

The Datt Cap CIO told Stockhead it’s worth cheering on the minds currently driving AustralianSuper – Origin’s largest investor – which is breaking the Aussie Super Fund code and standing up against what Datt says is a lowball bid from ORG’s out-of-town raiders made up of US giant Brookfield, Singapore’s Temasek and GIC.

“The new offer for Origin still materially undervalues the sum of parts valuation of Origin, which is a high quality portfolio of energy assets including a fast growing global business in Octopus Energy.

“AustralianSuper, one of Australia’s largest superfunds with a $300 billion portfolio, continues to reject the bid. This is a welcome change as typically public superfunds have been passive onlookers on key M&A activities despite their outsized influence on local equity markets.

“For far too long superfunds have meekly stood on the sidelines,” Emanuel reckons.

Why so resilient?

UBS says that despite 13 rate increases and a 425bps increase in the cash rate, the Aussie economy’s resilience is a bit of a double-edged sword – ‘cos the market is now largely priced for the peak in the cash rate to top ourt around this level, but it comes with the rider that, by about May 2025, the market has just one rate cut priced (a genuine higher-for-longer environment).

In large part it comes down to the “twin peaks”, as UBS phrase it, of migration and “big spending Boomers”.

Migration to Australia is tracking at 600k annualised, which would see Australia’s population surge by a booming 2.5% this year.

At the same time senior Australians have emerged as a spending force, with A$29bn of superannuation benefits paid in Q3-2023, which is equal to an astounding 10% share of total household disposable income.

Although this suppression of the economic and profits cycle is “smoothing” the economic landscape, it is also creating a sideways and rangebound equity market.

UBS identified the range as starting this year but we would argue it has been in motion for much longer than this – The ASX200 has been rangebound between ~6,400 and 7,600 for three years now (~ +/-10%).

The sticky local inflation compared to most other advanced economies has weighed on the $AUD over the last two years but UBS says this could now swing over to a strengthening bias.

“Historically, the most direct sector view for a rising AUD has been long Mining over Healthcare.”

Without any ‘imminent turning point’ in the economic cycle evident, the bank says playing EPS momentum trends is the handiest way to eke out some shorter term gains.

Currently, UBS likes construction related stocks as the best illustration of this dark matter momentum in the real Aussie economy – with upward revisions for Boral (ASX:BLD) , James Hardie (ASX:JHX) , CSR (ASX:CSR) , Worley (ASX:WOR) ,Seven Group Holdings (ASX:SVW) and Reece (ASX:REH) .

Wall Street takes a knee

US stock markets eased overnight, pausing for a well-earned break after a blistering November rally where the Nasdaq has closed in positive territory in 15 of the past 18 sessions.

The three major indices also lost momentum after the Federal Reserve’s latest FOMC notes showed the team agreeing to take a cautious approach to raising US rates further.

According to the minutes from the late October, early November US central bank meet, members said they’d only raise interest rates if ‘progress in controlling inflation’ went awry.

The FOMC minutes confirmed the Fed is well-positioned to proceed carefully (read on hold). US stocks went back a little into their shells on Tuesday, with the S&P 500 and Nasdaq Composite snapping their respective five-session winning streaks, as retailers and technology names fell on some disappointing profit updates and forward guidance.

In the US overnight, both the S&P 500 and the Dow Jones Industrial Average gave away -0.2%, respectively. But for the S&P 500, it was only its 3rd negative session in the previous 17 days.

The Nasdaq fell -0.6%.

That’s a well deserved rest to be honest. For November thus far the tech heavy Nasdaq has ended higher for 15 of the past 18 sessions.

Meanwhile, earnings season on Silly Street is pretty much done for a few brief days and I thought it ended on a wonderfully high note that is Nvidia in full flight, beating expectations and making people rich ensuring it is front and centre amid the boom in demand for the artificial intelligence semiconductor chips it’s so good at producing.

The newest member of the Magnificent 7 and Wall Street’s emperor of AI saw its revenue rise by +206% year-over-year and +34% from the prior quarter to more than $18 billion, beating estimates of $16 billion.

Q3 of NVDA’s fiscal 2024 also saw income up +49% on the prior quarter and (ahem) +1,259% year-over-year to US$9.2bn, although its stock dipped in after-hours trading on belated concerns about US trade restrictions into China.

“Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI,” said Jensen Huang, NVDA’s founder and CEO.

“Large language model startups, consumer internet companies and global cloud service providers were the first movers, and the next waves are starting to build.”

Drops mic, mic gets up, calls Uber, goes home, writes novella called My Revenge on Humanity.

US Futures ahead of the shortened Wednesday session in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WSR | Westar Resources | 0.0265 | 39% | 5,832,420 | $3,521,793 |

| MOH | Moho Resources | 0.011 | 38% | 34,135,907 | $2,931,153 |

| EPN | Epsilon Healthcare | 0.027 | 35% | 367,657 | $6,007,080 |

| BP8 | Bph Global Ltd | 0.002 | 33% | 1,500,000 | $2,423,345 |

| DXN | DXN Limited | 0.002 | 33% | 23,589,813 | $2,585,010 |

| NME | Nex Metals Explorat | 0.022 | 29% | 413,561 | $5,993,053 |

| BMR | Ballymore Resources | 0.125 | 25% | 50,000 | $14,619,726 |

| ALM | Alma Metals Ltd | 0.01 | 25% | 6,014,623 | $8,912,006 |

| ASP | Aspermont Limited | 0.01 | 25% | 46,236 | $19,510,110 |

| LSR | Lodestar Minerals | 0.005 | 25% | 1,000 | $8,093,589 |

| RNX | Renegade Exploration | 0.01 | 25% | 2,873,855 | $7,624,990 |

| IRX | Inhalerx Limited | 0.037 | 23% | 254,682 | $5,693,009 |

| GGE | Grand Gulf Energy | 0.008 | 23% | 18,890,215 | $13,619,106 |

| IPB | IPB Petroleum Ltd | 0.011 | 22% | 1,161,820 | $5,086,102 |

| CXU | Cauldron Energy Ltd | 0.017 | 21% | 5,301,458 | $15,850,288 |

| CC9 | Chariot Corporation | 0.63 | 21% | 987,347 | $38,132,415 |

| M2M | Mtmalcolmminesnl | 0.03 | 20% | 200,366 | $2,558,588 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 134,174 | $8,795,359 |

| FME | Future Metals NL | 0.048 | 20% | 1,553,391 | $16,528,161 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 1,237,333 | $24,182,996 |

| VSR | Voltaic Strategic | 0.024 | 20% | 6,419,291 | $9,662,078 |

| BCB | Bowen Coal Limited | 0.13 | 18% | 8,743,704 | $284,716,594 |

| TTM | Titan Minerals | 0.035 | 17% | 14,107 | $45,748,598 |

| STK | Strickland Metals | 0.1925 | 17% | 11,780,474 | $268,743,770 |

| 4DX | 4Dmedical Limited | 0.78 | 16% | 4,429,974 | $232,132,682 |

Top of the pops on hump day is Westar Resources (ASX:WSR) which says that drilling is on at its Olga Rocks Project out in Western Australia somewhere isolated and desperate, to ‘test the reinterpretation for potential pegmatite-hosted lithium and also target a prospective horizon for high grade gold mineralisation that is largely underexplored.’

Takes breath.

This is what an excited Westar Executive Director Lindsay Franker said:

“We are excited to test the reinterpretation for the discovery of lithium-bearing pegmatites in such close proximity to Zenith Mineral’s recently announced Rio lithium Mineral Resource, and at the same time drill for potential high grade gold over a similar prospective horizon in which Zenith recently announced their maiden Mineral Resource for the Dulcie Far North gold project, just 1.5km along strike from our Project.”

It certainly is true that Olga Rocks is located just 2km from Zenith Minerals (ASX:ZNC), which recently announced ‘Rio’ Inferred Mineral Resource (11.9Mt at 0.72% Li2O) 1 and 40km from Wesfarmers (ASX:WES) -SQM JV’s operating Earl Grey lithium Mine (Mt Holland Project: 189Mt at 1.5% Li2O) 2a2b which has a 50 year mine life.

Handy.

Coming in a close second on nothing fresh Rob Badman could locate – Ballymore Resources (ASX:BMR) … despite the gold/copper/silver explorer clocking an easy 30% gain.

Earlier this month, the junior Queensland explorer noted that it had conducted soil sampling at the Ruddygore copper project/system, targeting a ‘significant magnetic anomaly’ and extending the system by another 2km, to create a 5km long target zone.

The project is an extension of the historic Ruddygore high-grade mine that was operated until 1909, yielding 1,450 tons of copper at a grade of 3.9% Cu & 56g/t Ag.

Ballymore also had good news in late October, announcing “extremely high-grade gold results” with individual assays up to 2206ppb Au (2.2g/t) returned from soil sampling program over its Dittmer prospect, some 30-odd kilometres southwest of Prosperine in central Qld.

That prospect includes the historic Dittmer mine and numerous unexplored, historic workings in local area and the company believes the find confirms Dittmer as a major mineralised system defined by broad anomalies.

Also.

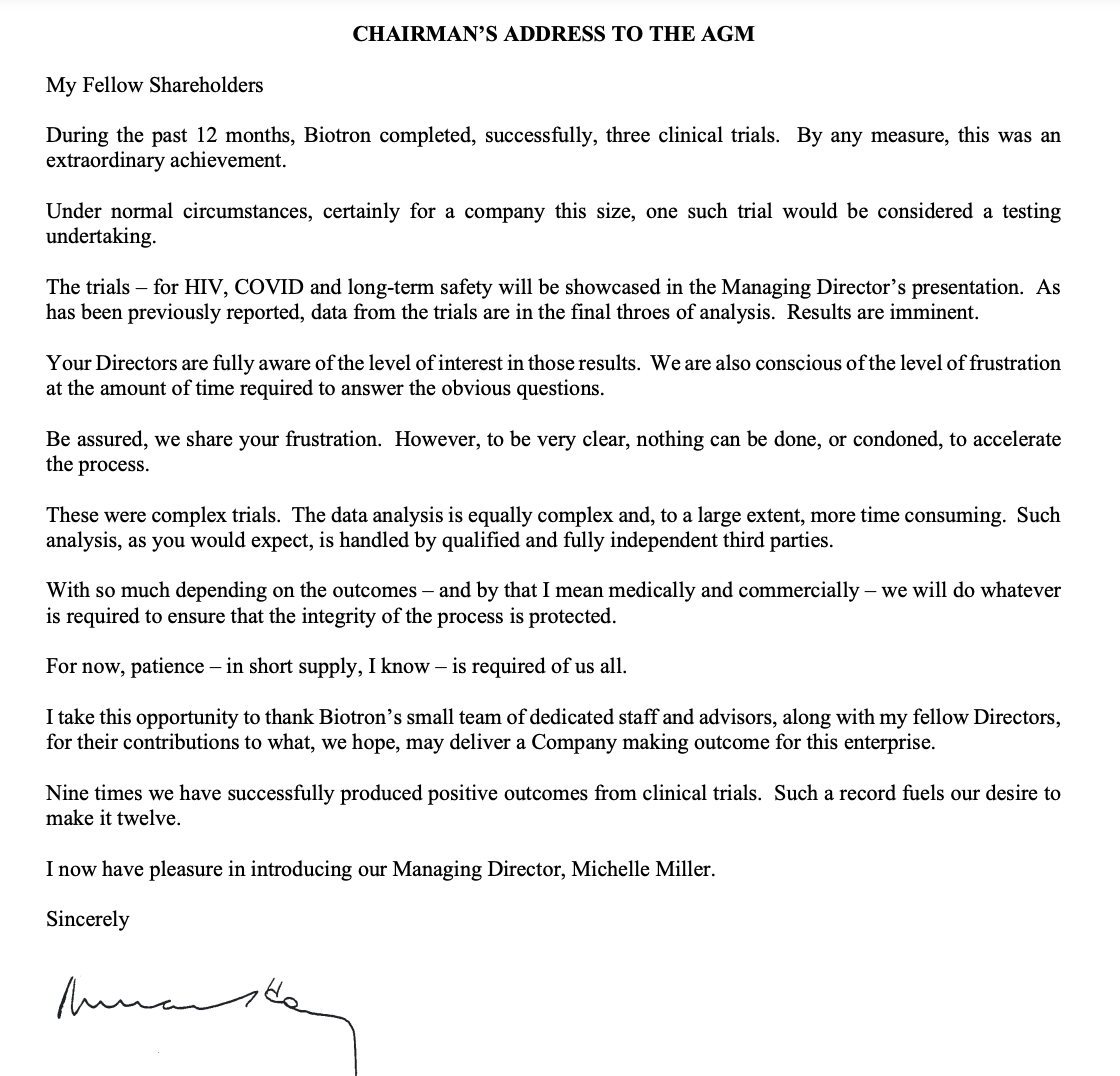

Biotron is higher again.

There’s a big AGM on for the biotech/pharma today.

Everything you need without the entrance fee is right here: (although I bet the CEO killed it too, she’s fab)

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ATH | Alterity Therap Ltd | 0.0045 | -36% | 26,548,741 | $17,079,283 |

| ME1 | Melodiol Glb Health | 0.002 | -33% | 10,204,363 | $12,575,830 |

| PPS | Praemium Limited | 0.39 | -33% | 19,706,256 | $289,479,501 |

| HLS | Healius | 1.2275 | -28% | 15,169,364 | $967,993,686 |

| KNM | Kneomedia Limited | 0.003 | -25% | 450,000 | $6,019,141 |

| MCT | Metalicity Limited | 0.0015 | -25% | 262,400 | $8,502,172 |

| RVT | Richmond Vanadium | 0.285 | -21% | 58,423 | $31,034,810 |

| XGL | Xamble Group Limited | 0.056 | -20% | 15,000 | $20,690,937 |

| IEC | Intra Energy Corp | 0.004 | -20% | 3,587,457 | $8,303,908 |

| KP2 | Kore Potash PLC | 0.008 | -20% | 19,836 | $6,690,575 |

| RGS | Regeneus Ltd | 0.004 | -20% | 2,298,110 | $1,532,185 |

| SP8 | Streamplay Studio | 0.008 | -20% | 460,930 | $11,506,238 |

| TMG | Trigg Minerals Ltd | 0.008 | -20% | 8,000 | $3,747,562 |

| UCM | Uscom Limited | 0.04 | -18% | 75,000 | $9,336,144 |

| SLM | Solismineralsltd | 0.165 | -18% | 775,577 | $15,569,741 |

| OAK | Oakridge | 0.062 | -17% | 8,037 | $1,319,956 |

| TEE | Topendenergylimited | 0.125 | -17% | 6,400 | $6,680,625 |

| ADV | Ardiden Ltd | 0.005 | -17% | 33,000 | $16,130,012 |

| FGH | Foresta Group | 0.01 | -17% | 99,671 | $26,874,033 |

| LVT | Livetiles Limited | 0.005 | -17% | 80,000 | $7,062,664 |

| ADX | ADX Energy Ltd | 0.096 | -17% | 2,755,557 | $41,761,021 |

| DCL | Domacom Limited | 0.026 | -16% | 66,528 | $13,500,555 |

| BML | Boab Metals Ltd | 0.14 | -15% | 180,019 | $28,786,357 |

| 1TT | Thrive Tribe Tech | 0.017 | -15% | 59,303 | $5,932,430 |

| NXS | Next Science Limited | 0.26 | -15% | 240,499 | $88,967,006 |

Trading Halts

Roots Sustainable Agricultural Technologies (ASX:ROO) – Pending “it releasing an announcement”

Clean Seas Seafood (ASX:CSS) – In connection with a proposed non-underwritten placement

Equinox Resources (ASX:EQN) – Pending a strategic announcement in connection with the Company’s proposed capital raising and project staking initiatives

Sunshine Metals (ASX:SHN) – Pending the release of an announcement to the market regarding material exploration results

Metal Hawk (ASX:MHK) – Pending the Company making an announcement regarding the outcome of a proposed capital raising

Bubs Australia (ASX:BUB) – Pending an announcement by the Company in relation to a potential capital raising for the purposes of providing funds for its US expansion

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.