Closing Bell: Uranium stocks go full turbo after Putin threat; Lithium’s theme still intact, says IGO

Uranium stocks surge as Putin hints at possible export limits. Picture Getty

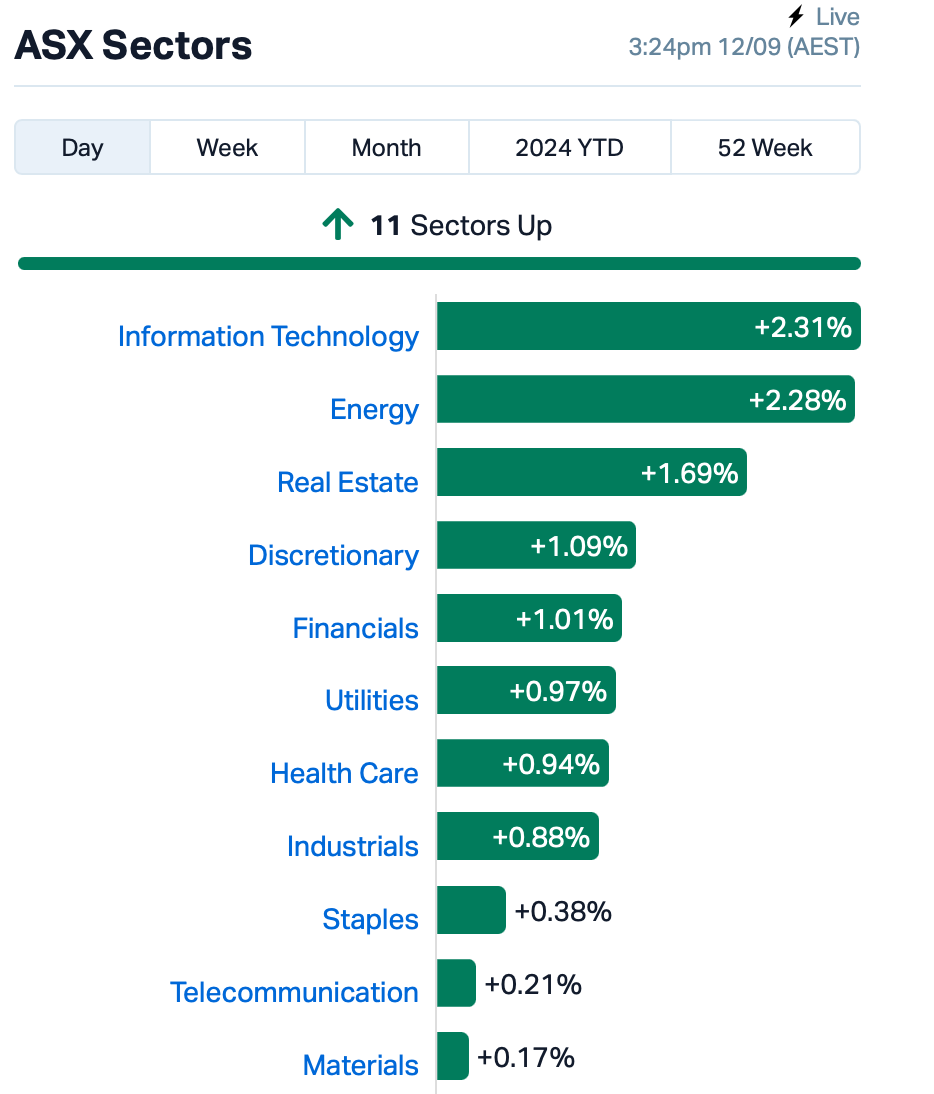

- ASX climbs with tech, energy, and uranium stocks driving gains

- Uranium stocks surge as Putin hints at possible export limits

- Lithium miners rise on growing demand, while WiseTech hits a new record high

The ASX took a leap on Thursday, riding on the Wall Street rally with tech and energy stocks leading the charge. At the close of day, the S&P/ASX 200 index was up 1.10%.

Overnight, US inflation eased to a three-year low, while Nvidia surged 8% on strong demand and bullish comments from its CEO.

On the ASX today, energy shone with uranium stocks having a cracker of a day after news of Vladimir Putin’s threat to cut uranium exports in response to Western sanctions.

Putin suggested that Russia might limit exports of uranium, titanium, and nickel as a countermeasure against Western bans.

Russia is a major player in the supplies of those commodities. The country, for example, is home to Nornickel, the largest producer of refined nickel globally.

Analysts believe that if the export limit is put into action, it could create chaos in the market.

“It will be really hard to replace, especially in the short term, the next two to three years,” said Arkady Gevorkyan at Citi.

Deep Yellow (ASX:DYL) surged by 14% on the news, Boss Energy (ASX:BOE) 10%, and Paladin Energy (ASX:PDN) by 8.5%.

Lithium miners also caught more bids today on the back of a rise in lithium carbonate futures.

Mineral Resources (ASX:MIN), which was up 17% yesterday, saw another 8% jump, while Pilbara Minerals (ASX:PLS) leapt up 6%.

Oil stocks also enjoyed a lift from rising Brent crude prices, which jumped overnight on concerns about Hurricane Francine in the US.

Elsewhere, WiseTech (ASX:WTC), the giant shipping software company, drove the Tech sector higher after rising almost 3% and hitting a new record high, bringing its year-to-date gains to around 75%.

And Nine Entertainment (ASX:NEC)’s share price stayed flat after the company said CEO Mike Sneesby was stepping down at the end of the month after a 3½-year run.

His resignation follows a loss of confidence from Nine’s chairwoman and dissatisfaction from major shareholders.

IGO says lithium’s long term theme is intact

Meanwhile, lithium producer IGO (ASX:IGO) gave a presentation at its investor day today.

The company said the current market conditions are creating a great opportunity as global demand for lithium grows, but getting the cost positioning right is crucial.

Lithium is a unique commodity that’s essential for all major EV battery chemistries, IGO added, and with heaps of R&D and capital already invested, it’s not likely to be replaced anytime soon.

The lithium industry will need to triple its size by 2035, which means around 80 new projects are needed—a massive challenge.

While the long-term outlook for lithium remains strong with continued demand growth, the market is still quite immature, so expect a lot of volatility for the time being, said IGO.

The current downturn might even make the next boom more pronounced, with high volatility likely until demand growth steadies.

What else is happening?

Across the region, most Asian stock markets rose on Thursday, marking their first gain of the week, thanks to the tech-driven rally on Wall Street.

Investor confidence also improved after US inflation data for August bolstered hopes for a Fed Reserve rate cut next week.

While a 25 basis point cut is expected next week, traders are split on whether that cut is enough to guide the US economy smoothly into a soft landing.

Benchmarks in Japan, South Korea, and Taiwan all advanced, with the MSCI Asia-Pacific Index posting its biggest gain in nearly a month.

Looking ahead to tonight’s session, two crucial reports will be released : the European Central Bank rate decision, and the US initial jobless claims.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.002 | 100% | 425,310 | $5,546,741 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 466,666 | $793,283 |

| SFG | Seafarms Group Ltd | 0.003 | 50% | 729,739 | $9,673,198 |

| BCB | Bowen Coal Limited | 0.013 | 44% | 23,423,871 | $25,642,612 |

| TON | Triton Min Ltd | 0.011 | 38% | 2,706,763 | $12,547,110 |

| M2R | Miramar | 0.010 | 36% | 8,017,616 | $2,763,457 |

| ALR | Altairminerals | 0.004 | 33% | 250,000 | $12,889,733 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 3,292,429 | $7,649,841 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 398,347 | $3,052,209 |

| TG6 | Tgmetalslimited | 0.160 | 33% | 148,855 | $8,532,905 |

| CXM | Centrex Limited | 0.043 | 30% | 1,748,005 | $28,586,780 |

| GTE | Great Western Exp. | 0.037 | 28% | 5,889,222 | $12,615,385 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 216,085 | $2,013,147 |

| NAE | New Age Exploration | 0.005 | 25% | 912,955 | $7,175,596 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 313,356 | $3,220,998 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 109,600 | $8,846,989 |

| C1X | Cosmosexploration | 0.026 | 24% | 42,460 | $1,619,387 |

| CRR | Critical Resources | 0.013 | 24% | 22,103,921 | $18,693,678 |

| SNS | Sensen Networks Ltd | 0.042 | 24% | 838,205 | $26,448,897 |

| GBE | Globe Metals &Mining | 0.046 | 21% | 131,529 | $26,274,929 |

| LKY | Locksleyresources | 0.029 | 21% | 49,209,682 | $3,520,000 |

| OSM | Osmondresources | 0.180 | 20% | 49,646 | $11,004,406 |

| ADD | Adavale Resource Ltd | 0.003 | 20% | 303,334 | $3,059,413 |

| ICG | Inca Minerals Ltd | 0.006 | 20% | 500,000 | $4,052,682 |

| LNR | Lanthanein Resources | 0.003 | 20% | 10,665,185 | $6,109,090 |

SenSen Tech (ASX:SNS) was winning on news that the company has secured a tender to provide mobile and fixed camera technology in The City of Calgary, Canada. The deal will see Sensen provide mobile and fixed lane enforcement systems with a first-year value of $1.9 million, with the entire contract worth a reported $4.6 million over five years, with two additional two-year extension options for a total potential length of nine years.

GTI Energy (ASX:GTR) was up on news that it has completed 66 of the proposed 76 drill hole exploration program at its Lo Herma ISR uranium project, located in Wyoming’s prolific Powder River Basin which the company says “confirms that uranium mineralisation continues north from the current mineral resource area with strong mineralised intercepts over good thicknesses encountered stretching at least 2km north along projected trends”.

Locksley Resources (ASX:LKY) has reported results of a holistic review of antimony potential outside of the known high-grade REE mineralisation within the Mojave Project, California which the company says has uncovered six rock chip samples grading >0.5% Sb, including two samples grading 11.2% Sb and 8.3% Sb.

AML3D (ASX:AL3) reports the signing of a new Manufacturing License Agreement, which allows the company to work with key suppliers and internal teams within the US Navy submarine industrial base through the exchange of technical assistance and data, facilitating an expansion of AML3D’s activities to support the US Navy.

Earlier, Belararox (ASX:BRX) was rising on news that the company has bought the rights to 4,286km2 of prospective tenure across 14 prospecting licenses on Botswana’s highly prospective Kalahari Copper Belt, through the acquisition of 100% of KCB Resources, including its subsidiaries Blackrock Resources and NI MG Northern Nickel.

The acquisition secures BRX a second significant copper-prospective project in a highly prospective and mining-friendly jurisdiction, close to Sandfire Resources’ (ASX:SFR) Motheo Copper Mine, MMG Limited’s Khoemacau Mine and Cobre’s (ASX:CBE) flagship Ngami Copper project.

Great Western Exploration (ASX:GTE) was moving well after announcing that it has identified a “large, robust and coherent niobium lag soil anomaly”, which it has named the Sumo Niobium Target, 70km south-east of Sandfire Resources’ DeGrussa Copper-Gold Project and within Great Western’s 100% owned Yerrida North Project.

MTM Critical Metals (ASX:MTM) has announced promising results from its new Flash Joule Heating (FJH) technology, which recovers gold from electronic waste with high efficiency. Initial tests have achieved up to 70% gold recovery without using toxic acids, by rapidly heating e-waste in a chlorine gas atmosphere to separate and collect the metals. This eco-friendly method is scalable and offers a more sustainable alternative to traditional, energy-intensive recycling processes. Given the large volume of e-waste produced globally, which contains valuable metals, MTM believes FJH could significantly improve recycling efficiency and reduce environmental impact.

Critical Resources (ASX:CRR) has confirmed its antimony credentials at tenure that abuts the southern boundaries of August’s best-performing ressie stock – Larvotto Resources’ (ASX:LRV) Hillgrove project, which contains 93,000t Sb.

The junior’s Halls Peak project is a 884,000t zinc, copper and base metals deposit with some silver and gold trimmings, yet it’s the nearology to Hillgrove that has the explorer excited at the moment.

CRR non exec director Nigel Broomham says the Mayview Homestead prospect, just 2.7km east of Larvotto’s Hillgrove, stands out as particularly promising.

And, radiopharmacy developer Clarity Pharmaceuticals (ASX:CU6) says its prostate cancer trial has produced further evidence that its proposed therapy is safe to use, with “strong preliminary safety data” in the first multi dose cohort enrolled in the phase 1/2a safety study.

The trial, called Secure, uses the copper isotope 64Cu/67Cu-SAR-bis to image – and possibly treat – metastatic castrate-resistant prostate cancer patients expressing the prostate-specific membrane antigen (PSMA).

The company says the fourth cohort was the first to assess two cycles of the treatment at the highest of the allowable doses being appraised. Three patients completed the dose-limiting toxicity period (DLT) and another one will complete the DLT by the end of September.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Voltgroupltd | 0.001 | -50% | 700,000 | $21,432,416 |

| EDU | EDU Holdings Limited | 0.065 | -28% | 375,810 | $14,869,300 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 13,766,016 | $57,867,624 |

| IBG | Ironbark Zinc Ltd | 0.003 | -25% | 4,844,731 | $7,334,591 |

| SI6 | SI6 Metals Limited | 0.002 | -25% | 236,343 | $4,737,719 |

| MGU | Magnum Mining & Exp | 0.011 | -21% | 4,883,140 | $11,331,060 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 11,112 | $5,589,945 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 1,961,188 | $9,724,426 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 2,554,393 | $6,981,357 |

| WML | Woomera Mining Ltd | 0.002 | -20% | 35 | $3,795,347 |

| ZMI | Zinc of Ireland NL | 0.008 | -20% | 213,135 | $2,656,554 |

| KLI | Killiresources | 0.130 | -19% | 4,488,840 | $22,435,799 |

| CC9 | Chariot Corporation | 0.110 | -19% | 42,716 | $12,099,761 |

| GEN | Genmin | 0.058 | -18% | 2,924,901 | $48,722,763 |

| LGM | Legacy Minerals | 0.165 | -18% | 107,424 | $21,090,999 |

| CTN | Catalina Resources | 0.003 | -17% | 257,513 | $3,715,461 |

| CUL | Cullen Resources | 0.005 | -17% | 22,727 | $4,160,411 |

| ACM | Aus Critical Mineral | 0.074 | -15% | 447,048 | $3,073,384 |

| FGL | Frugl Group Limited | 0.018 | -14% | 223,749 | $2,203,081 |

| BLZ | Blaze Minerals Ltd | 0.003 | -14% | 28,571 | $2,199,954 |

| EPM | Eclipse Metals | 0.006 | -14% | 4,006,543 | $15,755,989 |

| TMK | TMK Energy Limited | 0.003 | -14% | 105,293 | $24,225,642 |

| FRE | Firebrickpharma | 0.056 | -14% | 1,177,057 | $12,718,338 |

IN CASE YOU MISSED IT

Belararox (ASX:BRX) has signed a deal to acquire a second significant copper-prospective play. The Kalahari copper project in Botswana is close to several world-class copper-silver ore bodies in a mining friendly jurisdiction.

BlinkLab (ASX:BB1) has formed a partnership with Netherlands company INTER-PSY to run a clinical trial that will determine if its smartphone-based AI app can aid in the diagnosis of autism in children between 2-6 years.

Dimerix (ASX:DXB) has achieved a key milestone with the opening of the first paediatric site for its ACTION3 Phase 3 clinical trial of lead drug DMX-200 to treat rare kidney disease focal segmental glomerulosclerosis (FSGS).

Equinox Resources (ASX:EQN) has started a 50-hole reverse circulation drill program totalling 4000m at its Campo Grande rare earths project in Brazil. This drilling at the Rio Negro prospect targets monazite sand and host hard rock beneath high-grade intercepts from earlier Phase I scout auger drilling.

GTI Energy’s (ASX:GTR) drilling has extended uranium mineralisation at its Lo Herma ISR uranium project in Wyoming northwards from the current resource area. The latest results maintain the 80% success rate for intersecting on-trend mineralisation.

Data-tech company IXUP (ASX:IXU) has secured a major multi-year deal to integrate its cutting-edge data technology with Microsoft Azure, opening up potential opportunities for the company.

New World Resources (ASX:NWC) has submitted the Air Quality Control permit application that address air quality and emissions relating to construction, mining and mineral processing at its high-grade, high-margin Antler copper project. This is a key state permit required to start construction.

Sun Silver (ASX:SS1) has proved its theory that thick, high-grade mineralisation at its Maverick Springs project extends to the northwest after drilling returned an 88m intersection grading 79.6g/t silver equivalent. It notes that laboratory assays are returning results with stronger silver grade and width compared to pXRF scans.

Killi Resources (ASX:KLI) has started maiden drilling at the Kaa gold-copper prospect within its Mt Rawdon West project in Queensland to test a large chargeable anomaly that was identified from an induced polarisation survey below the historical Wonbah copper mine.

While laboratory analysis is essential to determining what is present at the prospect, visual observations of the diamond drilling core has granted “confidence” in the targets. The company has also started an IP survey at Baloo, which is adjacent to Kaa, to cover the 2.5km by 1.8km gold-copper-molybdenum anomaly in a bid to define drill targets.

TRADING HALTS

Antilles Gold (ASX:AAU) – pending an announcement in relation to completed metallurgical testwork for the proposed La Demajagua gold-silver-antimony mine in Cuba.

RemSense Technologies (ASX:REM) – pending an announcement to the market in relation to the awarding of a service contract.

Northern Minerals (ASX:NTU) – pending the release of an announcement in relation to a capital raise.

Pengana Global Private Credit Trust (ASX:PCX) – pending an announcement in relation to a proposed capital raising.

At Stockhead, we tell it like it is. While Killi Resources, Belararox, BlinkLab, Dimerix, Equinox Resources, GTI Energy, IXUP, New World Resources and Sun Silver are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.