Closing Bell: Trump’s tariff threat rattles markets, but these ASX stocks buck the trend

The ASX dropped as Trump’s tariff threat rattled markets. Picture via Getty Images

- ASX drops as Trump’s tariff threat rattles markets

- Bluescope and Reece rise amid energy and bank sell-off

- EML Payments jumps after strong earnings report

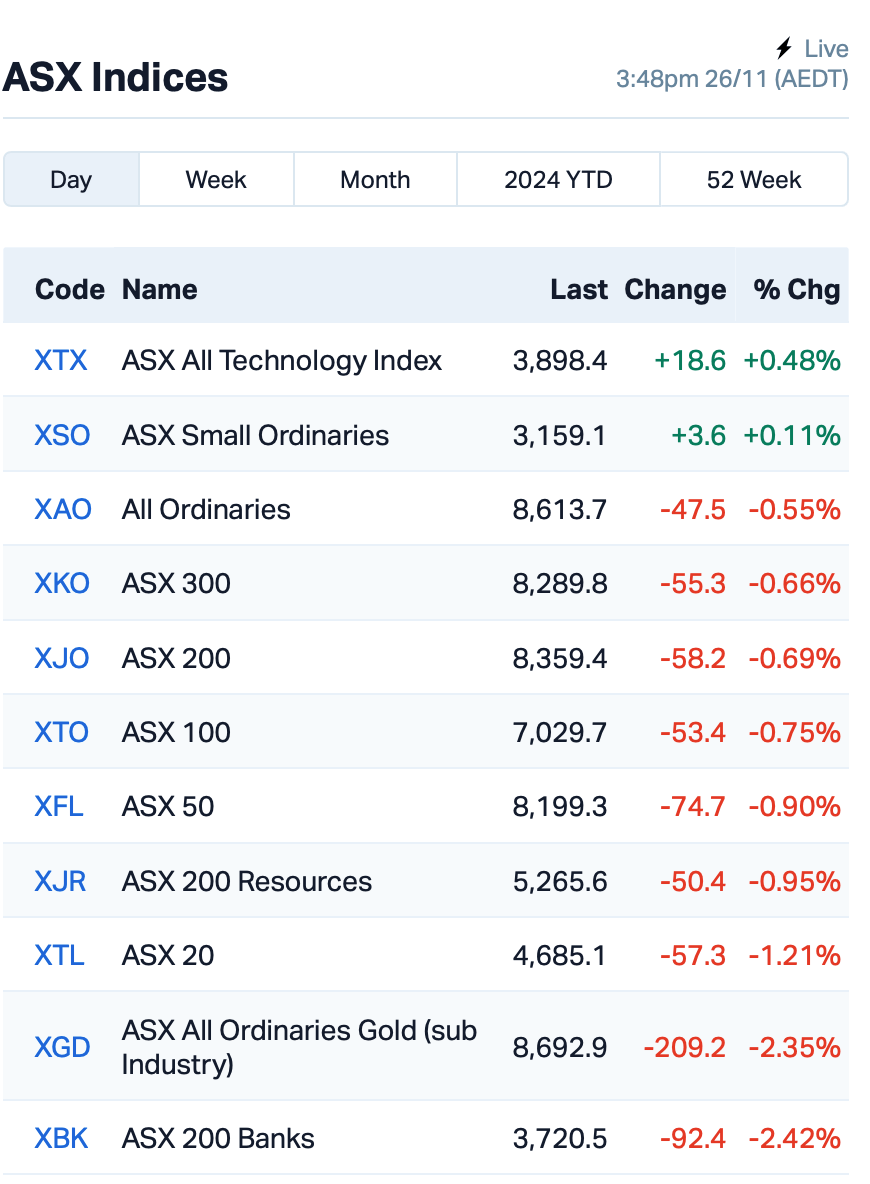

The ASX closed in the red on Tuesday, down by 0.45% after being dragged down by a sell-off in energy stocks and banks.

The drop followed Donald Trump’s announcement on Truth Social, where he revealed plans to impose additional tariffs on goods from China, Mexico and Canada, citing concerns over illegal drugs finding their way into the US.

Trump’s tariff threat, which would add 10% on Chinese imports and 25% on goods from Mexico and Canada, sparked concern in the markets.

Oil prices fell sharply after the comments and gold continued to slump, following a brief period of relief in the Middle East.

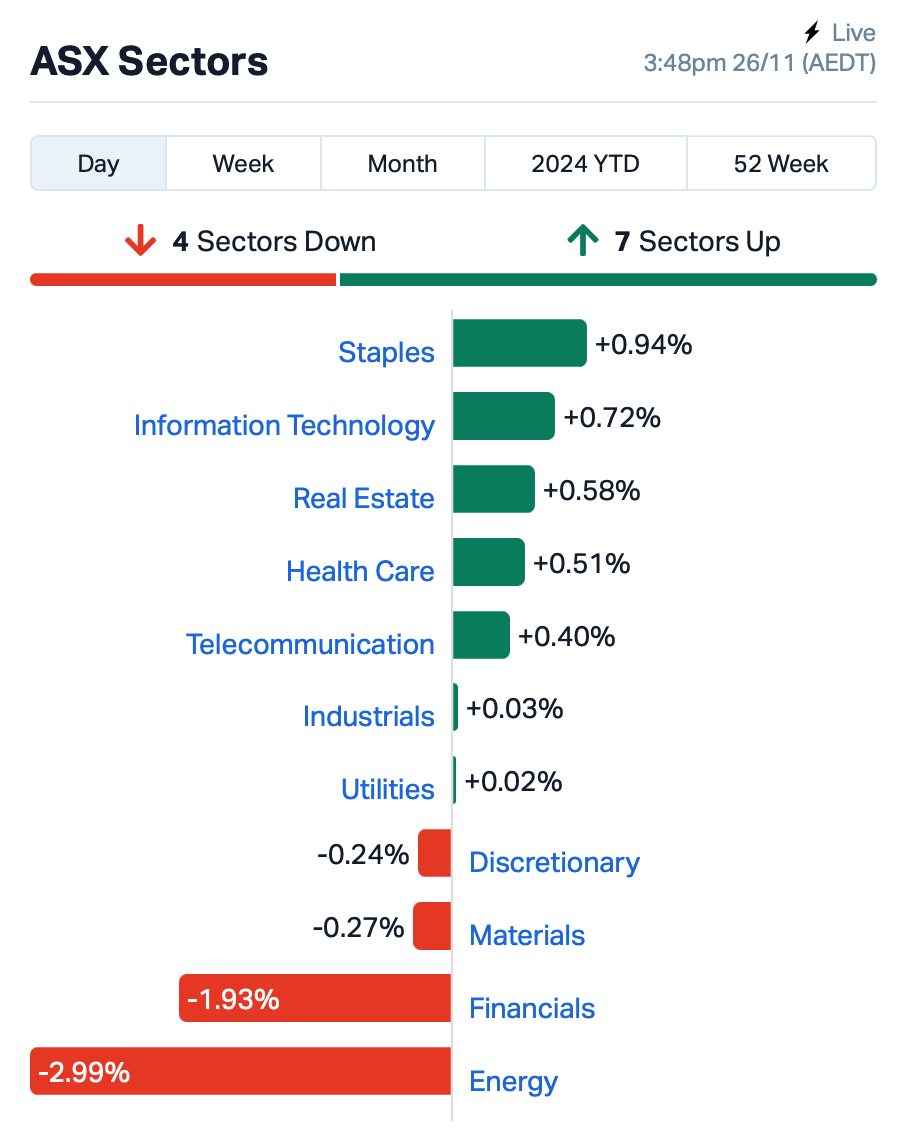

Here’s how the ASX sectors were performing at around 15.50pm AEST:

At least some ASX companies managed to find silver linings today…

EML Payments (ASX:EML) soared 26% after reporting a 46% increase in underlying earnings for the first quarter of FY25.

Bluescope Steel (ASX:BSL), which has significant operations in the US, surged by 7%, while another US-exposed company, plumbing supplier Reece (ASX:REH), also rose by 3%.

And giant miner Newmont Corporation (ASX:NEM) is selling its Éléonore gold mine in Quebec to Dhilmar for $795 million, part of its broader effort to raise over $3.6 billion by selling non-essential assets. Shares were up 0.4%.

Meanwhile, market operator ASX (ASX:ASX) fell 4% after announcing its plan to implement the second phase of the CHESS project by 2029, with projected costs of up to $320 million.

Regionally, Asian markets, including Japan, South Korea, dropped sharply today after Trump’s announcement.

However, Chinese stocks surprisingly bucked the trend, with the CSI 300 Index rising by around 0.5%, likely driven by dip-buying after a recent decline.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.002 | 100% | 1,350,000 | $4,497,970 |

| PHO | Phosco Ltd | 0.065 | 63% | 165,218 | $11,269,927 |

| MTB | Mount Burgess Mining | 0.002 | 50% | 16,560,263 | $1,298,147 |

| TKL | Traka Resources | 0.002 | 50% | 28,926,420 | $1,945,659 |

| VPR | Voltgroupltd | 0.002 | 50% | 57,500 | $10,716,208 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 375,000 | $5,567,228 |

| AOK | Australian Oil. | 0.004 | 33% | 112,344 | $3,005,349 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 1,521,897 | $8,737,021 |

| BP8 | Bph Global Ltd | 0.004 | 33% | 44,903,497 | $1,189,924 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 763,361 | $7,254,899 |

| KNI | Kunikolimited | 0.225 | 29% | 118,256 | $15,184,622 |

| EML | EML Payments Ltd | 0.875 | 28% | 10,233,410 | $259,146,111 |

| NSM | Northstaw | 0.014 | 27% | 110,799 | $2,999,442 |

| 8IH | 8I Holdings Ltd | 0.010 | 25% | 222,441 | $2,785,287 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 31,057,397 | $6,338,594 |

| ERA | Energy Resources | 0.003 | 25% | 8,722,458 | $810,792,482 |

| IS3 | I Synergy Group Ltd | 0.005 | 25% | 319,918 | $1,424,871 |

| TMK | TMK Energy Limited | 0.003 | 25% | 6,763,422 | $18,651,130 |

| GTK | Gentrack Group Ltd | 11.650 | 24% | 349,112 | $974,612,464 |

| IFG | Infocusgroup Hldltd | 0.033 | 22% | 22,888,310 | $3,453,103 |

| LVE | Love Group Global | 0.140 | 22% | 50,078 | $4,661,429 |

| MGU | Magnum Mining & Exp | 0.012 | 20% | 1,415,600 | $8,093,614 |

| SMM | Somerset Minerals | 0.003 | 20% | 1,796,111 | $2,577,497 |

| VAR | Variscan Mines Ltd | 0.013 | 18% | 3,737,667 | $8,121,673 |

PhosCo (ASX:PHO) has received approval for its Gassaat Phosphate Exploration Permit in Tunisia, which is a key step in developing the Northern Phosphate Basin. The company has also signed a non-binding Memorandum of Understanding with the Tunisian Ministry of Industry, Mines and Energy and the European Bank for Reconstruction and Development. The MoU aims to collaborate on the development of phosphate processing facilities and support regional growth.

North Stawell Minerals (ASX:NSM) said it will begin diamond drilling in January 2025, focusing on two priority targets, Wildwood and Darlington, along the Stawell Gold Corridor in Victoria. The program, fully funded after a recent $1.3 million capital raise, will include approximately 1500 metres of drilling. The company said the targets, which share similarities with the multimillion-ounce Stawell Gold Mine deposit, offer significant exploration potential.

Gentrack Group (ASX:GTK) a software provider for utilities and airports, has reported strong growth in its full-year results for FY24, with a 25.5% revenue increase to $213.2 million. The utilities division saw a 23% rise in revenue. The airports division, Veovo, posted a 45.5% revenue increase, benefiting from new contracts in the UK and Middle East.

Noronex (ASX:NRX) has identified new drilling targets at its Damara Copper Project in Namibia, following a recent gravity survey. The survey uncovered several gravity-magnetic anomalies in the Damara Basement, on the edge of the Kalahari Copper Belt, which are similar to major copper deposits in Zambia and Congo. The drilling is funded through an earn-in agreement with South32.

Frontier Energy (ASX:FHE) … see below in ‘In Case You Missed It’.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 2,275,166 | $9,296,169 |

| RDN | Raiden Resources Ltd | 0.017 | -26% | 83,588,740 | $75,027,492 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 11,541,273 | $57,867,624 |

| CDE | Codeifai Limited | 0.002 | -25% | 35,573 | $5,842,590 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 476,214 | $8,216,419 |

| ASE | Astute Metals NL | 0.020 | -23% | 773,914 | $13,780,979 |

| IXR | Ionic Rare Earths | 0.007 | -22% | 29,144,144 | $43,827,864 |

| UNT | Unith Ltd | 0.011 | -21% | 9,476,130 | $17,202,996 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 826,709 | $7,937,639 |

| ARV | Artemis Resources | 0.009 | -18% | 4,972,060 | $21,085,707 |

| GML | Gateway Mining | 0.023 | -18% | 33,600 | $11,072,864 |

| SCP | Scalare Partners | 0.170 | -17% | 5,523 | $7,150,974 |

| TMB | Tambourahmetals | 0.025 | -17% | 1,006,754 | $3,317,701 |

| AUK | Aumake Limited | 0.005 | -17% | 850,230 | $16,879,446 |

| CZN | Corazon Ltd | 0.003 | -17% | 900,000 | $1,919,764 |

| LML | Lincoln Minerals | 0.005 | -17% | 76,857 | $12,337,557 |

| MEM | Memphasys Ltd | 0.005 | -17% | 830,841 | $10,578,489 |

| SP8 | Streamplay Studio | 0.010 | -17% | 36,077,112 | $13,807,485 |

| BUS | Bubalusresources | 0.110 | -15% | 52,377 | $4,727,353 |

| DTM | Dart Mining NL | 0.011 | -15% | 1,907,561 | $6,691,389 |

| 1AI | Algorae Pharma | 0.006 | -14% | 139,901 | $11,811,763 |

| HHR | Hartshead Resources | 0.006 | -14% | 2,263,718 | $19,660,775 |

| VTI | Vision Tech Inc | 0.120 | -14% | 1,597 | $7,705,105 |

| FUL | Fulcrum Lithium | 0.155 | -14% | 34,851 | $13,590,000 |

IN CASE YOU MISSED IT

Eagle Mountain Mining (ASX:EM2) has shifted focus to exploration at its Silver Mountain and Wedgetail projects in Arizona, reducing holding costs at Oracle Ridge while retaining key infrastructure and securing drill permits to target high-grade veins and porphyry systems.

European Lithium (ASX:EUR) has acquired the Leinster project in Ireland to expand its lithium portfolio and also appointed prominent executive George Karageorge to drive operational advancements.

Frontier Energy (ASX:FHE) is welcoming upcoming changes to WA’s energy policy and framework, expected to deliver marked improvements to the economics of its Waroona renewable energy project.

The changes will be included in an updated DFS for Waroona due for release in early December.

Marmota (ASX:MEU) has reported new high-grade assays close to surface – up to 50g/t gold – at its Aurora Tank gold deposit in South Australia.

Recce Pharmaceuticals (ASX:RCE) has secured patent protection for its new class of synthetic anti-infectives in all major pharmaceutical markets globally, with the Australian Patent Office granting the latest approval.

The Australian patent expires in 2037 and covers Recce 327 (R327) and Recce 529 (R529), their manufacturing processes, use in treating infections, and methods of administration via oral, injection, inhalation and transdermal applications.

RCE CEO James Graham said the company was thrilled by the formal recognition of its synthetic anti-infectives.

“This milestone underscores our commitment to addressing critical viral threats with innovative therapies and ensures we are well positioned to deliver meaningful solutions for patients worldwide,” he said.

And an 11-hole Phase 1 RC drilling program is complete, testing the historic high-grade silver-polymetallic Endowment Mine within Sierra Nevada Gold’s (ASX:SNX) Blackhawk epithermal project in Nevada.

Drilling intersected argillic alteration with sulphides in a number of holes, while historic workings were also intersected in three holes. Assays are due in around a month’s time. Follow-up drilling is being planned to begin in Q2, 2025.

At Stockhead, we tell it like it is. While Eagle Mountain Mining, European Lithium, Frontier Energy, Marmota, Recce Pharmaceuticals and Sierra Nevada Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.