Closing Bell: Tough going for the ASX on Friday ahead of US jobs report; Bitcoin cools off

News

News

After hitting fresh record highs earlier this week, the ASX dipped as investors pulled profits off the table ahead of a key US jobs report.

At the close of Friday, the benchmark S&P/ASX 200 was down by 0.64%, and around 0.15% lower for the week.

The jobs data tonight is expected to give clues on whether the Federal Reserve will continue easing its policy in the coming months.

“A 25-basis point cut is also priced in by markets by the Federal Open Market Committee on December 18, with a near 75% probability…” said a note from S&P Global Market Intelligence.

Meanwhile, Bitcoin pulled back from its record high, trading at US$97,878 (as of 4.15pm AEDT on Friday), after briefly surpassing US$102,000 on Thursday, following the nomination by Donald Trump of crypto-supportive Paul Atkins to lead the SEC.

“With such a dramatic rise in a short period, it’s natural that some investors will lock in profits,” said deVere Group’s Nigel Green.

“This likely sell-off will be a temporary pause before Bitcoin builds on its momentum, surging to US$120,000 as early as the first quarter of next year.”

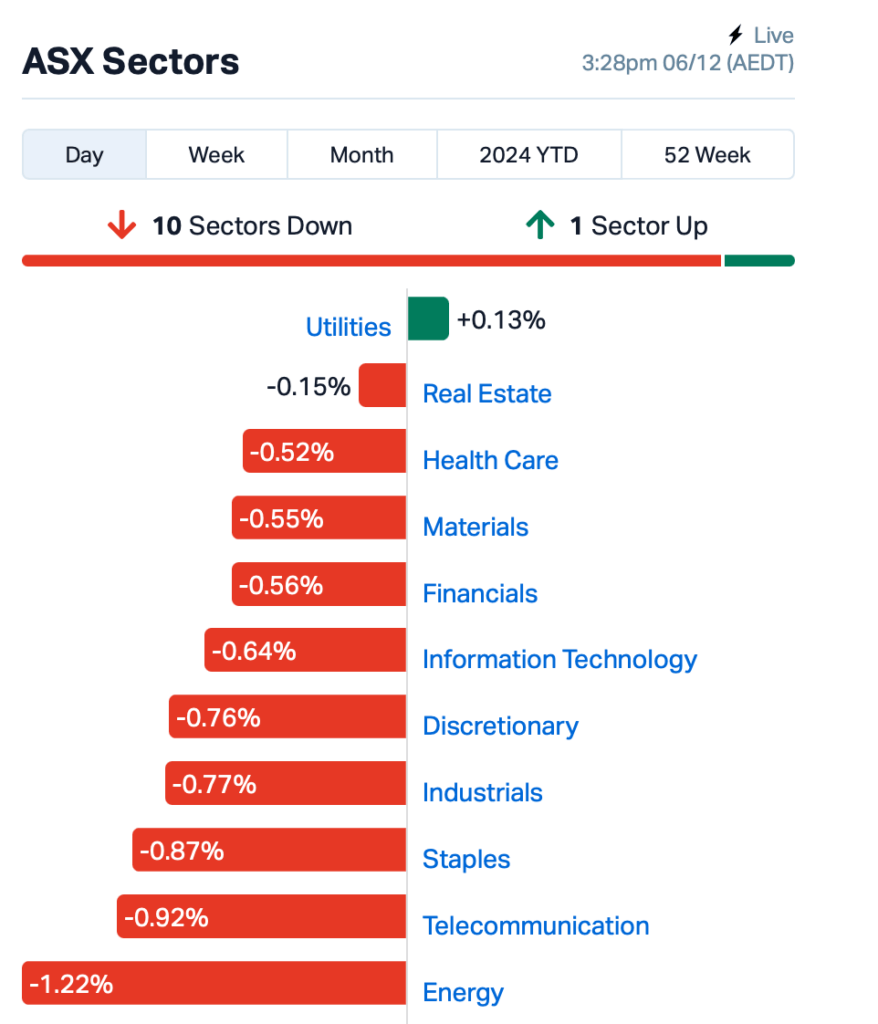

On the ASX, 10 out of 11 sectors saw losses today, with tech and energy hit the hardest. Energy stocks tracked oil price declines after OPEC+ delayed a planned output increase until April.

In the large caps space, a notable announcement today came from natural gas transmitter APA Group (ASX:APA), which gained 2% after the energy regulator confirmed it wouldn’t apply full price regulation to its South West Queensland gas pipeline.

Iluka Resources (ASX:ILU) slumped by over 10% after announcing that it has secured an additional $400 million loan from the Australian government for its Eneabba rare earths refinery to cover cost overruns at its domestic rare earths refinery. As part of the agreement, Iluka will also contribute an additional $214 million cash equity, on top of an initial $200 million.

Now watch: Stockhead TV’s Break it Down: Iluka’s rare earths refinery gets $400M lifeline

Today’s best performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EFE | Eastern Resources | 0.040 | 43% | 759,550 | $3,530,519 |

| ARN | Aldoro Resources | 0.225 | 41% | 5,431,373 | $21,539,799 |

| VRC | Volt Resources Ltd | 0.004 | 33% | 1,000,000 | $12,476,034 |

| BWN | Bhagwan Marine | 0.710 | 28% | 1,570,377 | $152,736,132 |

| AAU | Antilles Gold Ltd | 0.005 | 25% | 2,394,720 | $7,422,971 |

| EPM | Eclipse Metals | 0.005 | 25% | 200,000 | $9,111,422 |

| TMK | TMK Energy Limited | 0.003 | 25% | 8,720,309 | $18,651,130 |

| PUA | Peak Minerals Ltd | 0.008 | 23% | 25,307,190 | $16,231,217 |

| TMS | Tennant Minerals Ltd | 0.011 | 22% | 1,316,768 | $8,603,014 |

| GBZ | GBM Rsources Ltd | 0.009 | 20% | 7,211,041 | $8,675,167 |

| LDR | Lode Resources | 0.120 | 20% | 888,948 | $11,748,018 |

| CR9 | Corellares | 0.006 | 20% | 778,333 | $2,325,462 |

| DUB | Dubber Corp Ltd | 0.024 | 20% | 3,624,769 | $51,901,864 |

| GCM | Green Critical Min | 0.006 | 20% | 7,465,714 | $9,537,766 |

| GGE | Grand Gulf Energy | 0.003 | 20% | 500,500 | $6,125,968 |

| TIG | Tigers Realm Coal | 0.003 | 20% | 1,361,523 | $32,666,756 |

| TFL | Tasfoods Ltd | 0.013 | 18% | 218,417 | $4,808,051 |

| COY | Coppermoly Limited | 0.014 | 17% | 54,712 | $8,491,889 |

| KGD | Kula Gold Limited | 0.007 | 17% | 1,342,612 | $3,859,272 |

| PEB | Pacific Edge | 0.145 | 16% | 6,960 | $101,489,497 |

| C1X | Cosmosexploration | 0.038 | 15% | 62,266 | $2,754,398 |

| D3E | D3 Energy Limited | 0.115 | 15% | 67,629 | $7,947,501 |

| BP8 | Bph Global Ltd | 0.004 | 14% | 12,000 | $1,388,245 |

Australian Rare Earths (ASX:AR3) has secured a $5 million grant from the Australian federal government for its Koppamurra project. The funding will support metallurgical testwork, a pre-feasibility study, and the construction of a demonstration plant, with AR3 matching the grant for a total $10 million investment over 2025 and 2026. The project, backed by strategic partner Neo Performance Materials, aims to strengthen rare earth supply chains for the clean energy transition.

GBM Resources (ASX:GBZ) said it has sold approximately 466 ounces of gold in the December quarter, generating around $1.9 million in revenue. The increase in production and sales is attributed to new heap leach material, mineralised material recovered from the gold room and elution circuits, and the rising AUD gold price. The company said further higher production is expected next quarter as maintenance continues, with additional gold set for assay and sale.

Bhagwan Marine (ASX:BWN) expects strong earnings growth for the first half of FY25, with pro-forma EBITDA projected to be between $26 million and $28 million, a 26% to 36% increase compared to the previous period. This follows the successful completion of a large-scale oil and gas decommissioning project in Q1, marking the company’s largest project of its kind. The project, involving 180 offshore personnel, delivered over 800,000 working hours without any lost-time injuries.

And, Cleanspace (ASX:CSX) has appointed Gabrielle O’Carroll as CEO, effective January 1 2025. O’Carroll, formerly of 3M, brings extensive experience in marketing, sales, and business leadership, including managing 3M’s Personal Safety division in Australia and New Zealand. The appointment comes as CleanSpace prepares for its next phase of growth.

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 1,692,228 | $3,704,796 |

| ERA | Energy Resources | 0.002 | -33% | 262,042 | $1,216,188,722 |

| TKL | Traka Resources | 0.001 | -33% | 409,285 | $2,918,488 |

| VML | Vital Metals Limited | 0.002 | -33% | 618,564 | $17,685,201 |

| MCO | Myeco Group Ltd | 0.022 | -27% | 485,091 | $17,898,301 |

| WEC | White Energy | 0.028 | -26% | 21 | $7,561,402 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 3,129,400 | $57,867,624 |

| CRB | Carbine Resources | 0.003 | -25% | 300,000 | $2,206,951 |

| GCR | Golden Cross | 0.003 | -25% | 83,620 | $4,389,024 |

| GTR | Gti Energy Ltd | 0.003 | -25% | 380,000 | $11,851,799 |

| WNR | Wingara Ag Ltd | 0.007 | -22% | 30,000 | $1,579,883 |

| NVO | Novo Resources Corp | 0.091 | -21% | 410,975 | $12,864,673 |

| BGE | Bridgesaaslimited | 0.019 | -21% | 206,615 | $4,796,621 |

| S66 | Star Combo | 0.115 | -21% | 6,001 | $19,587,032 |

| AD1 | AD1 Holdings Limited | 0.051 | -20% | 288,790 | $9,058,230 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 2,122,400 | $6,620,957 |

| CZN | Corazon Ltd | 0.002 | -20% | 33,896 | $1,919,764 |

| M2R | Miramar | 0.004 | -20% | 362,583 | $1,984,116 |

| BPM | BPM Minerals | 0.055 | -19% | 1,522,591 | $5,703,311 |

| HMI | Hiremii | 0.048 | -17% | 75,000 | $8,532,693 |

| CTN | Catalina Resources | 0.003 | -17% | 50,000 | $3,731,286 |

| RNX | Renegade Exploration | 0.005 | -17% | 825,176 | $7,704,021 |

| AQN | Aquirianlimited | 0.170 | -15% | 29,756 | $16,150,794 |

Worth a mention here, Micro-X (ASX:MX1) fell 2% despite announcing that it has achieved a milestone with the successful production of full 3D CT images using its proprietary miniature X-ray technology. The images, which show detailed brain anatomy, were produced with one-third of the radiation dose of conventional CT scans. This has triggered a $0.5m payment under the Medical Research Future Fund program. The company is now preparing hospital test benches for ethics approval and plans to begin human clinical trials in early 2025.

Race Oncology (ASX:RAC) has submitted the ethics and regulatory package for its phase I clinical trial of RC220 bisantrene in solid tumour patients. Patient recruitment is expected to begin in Q1 2025, with plans to expand to up to 10 additional trial sites.

James Bay Minerals (ASX:JBY) is raising $6 million to drive exploration at its recently acquired Independence gold project in Nevada. The company secured commitments at 65 cents per share from institutional and sophisticated investors.

In Arizona, New World Resources (ASX:NWC) has reported an exceptionally thick, high-grade assay result from the final reserve definition hole at its Antler project. The result exceeded expectations from the resource model, with an updated resource expected to be finalised in Q1 2025.

Trigg Minerals (ASX:TMG) is advancing its antimony project in Australia, securing $5 million through a placement supported by new strategic investors. The company holds the country’s highest-grade undeveloped resource, well-placed amid surging antimony prices.

EBR Systems (ASX: EBR) has scheduled its Day-100 Meeting with the US Food and Drug Administration (FDA) for December 20. The meeting is an important step in reviewing the company’s pre-market approval application, giving the FDA a chance to assess its progress and request any additional information or documentation.

Sunshine Metals (ASX:SHN) will receive $950,000 in cash and around 83 million fully-paid ordinary shares in Dart Mining (ASX:DTM) as part of the sale of its Triumph gold project.

The deal enables Sunshine to concentrate on the growth of its Ravenswood Consolidated project while maintaining a significant interest in Triumph as a 13.93% shareholder in Dart.

Raiden Resources (ASX:RDN) is making strong progress at its Andover South project in WA, expanding the current drill program from 5000 metres to up to 15,000 metres, including drilling Target Area 7, with over 7000 metres already completed. Some core samples have been sent to a Perth lab, with assay results expected early in the new year.

At Stockhead, we tell it like it is. While Race Oncology, James Bay Minerals, EBR Systems, Sunshine Metals and Raiden Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.