Closing Bell: The local bourse giveth and the local bourse wrencheth away and calleth the cops

Via Getty

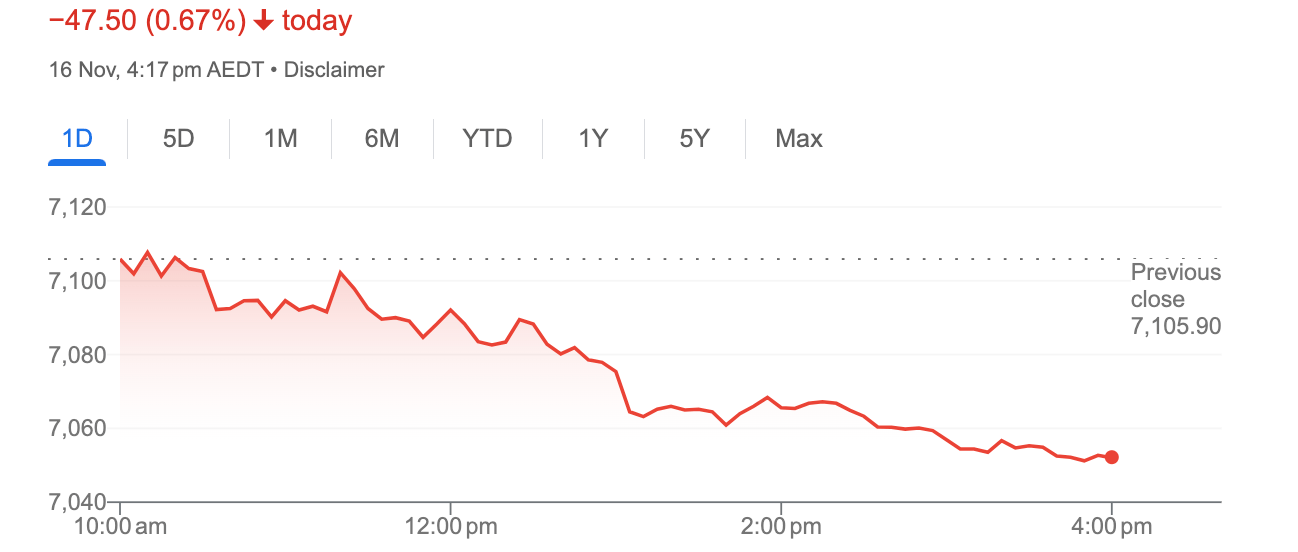

- The ASX benchmark has ended Thursday in a circa -0.8% hole

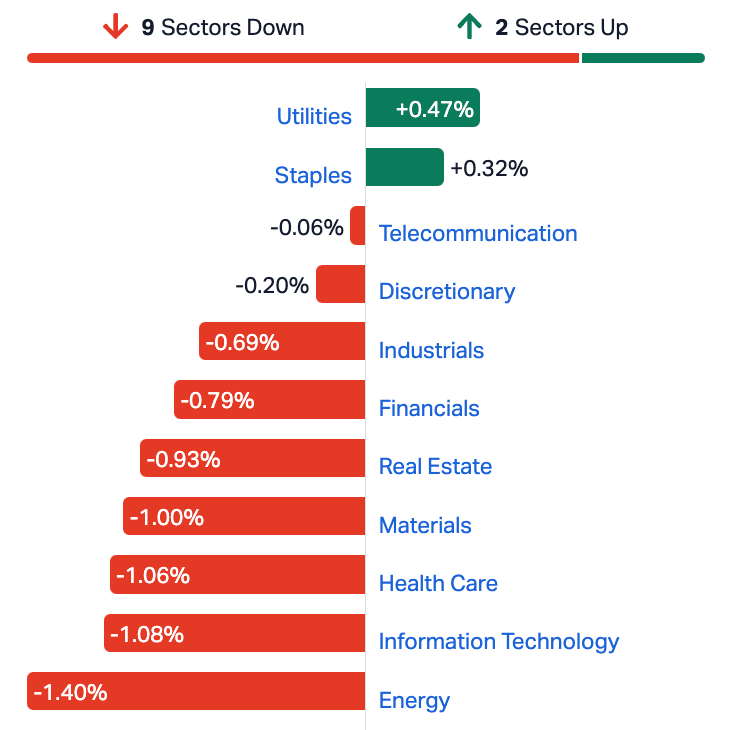

- Energy Sector, down -1.4% leads losses

- Small caps led by RWD

The Australian sharemarket has been trimming gains from the open on Thursday, steadily digging a hole in the red as investors sell what they bought during Wednesday’s bumper session.

At match-out on Thursday November 16, the S&P/ASX 200 (XJO) index was down about 47 points, or -0.67% at 7,058

A strong session overnight in New York hasn’t hit the right buttons here, as traders juggle easing US inflation and the uncertain signals coming out of regional economies.

Stocks in the US finished higher on Wednesday, as the Dow Jones advanced 163 points to close at mid-August high, while the S&P 500 added 0.1% and the Nasdaq ended just above parity, but in the green. On Wall Street, the Financials and Materials sectors were the heroes of the dish, while in company news, shares in Target lurched almost +18% after the retailer smashed profit and revenue expectations.

Regional equity markets have fallen as one during Thursday trade, with high Aussie wage growth, mixed local unemployment data, a weak Yen presaging weak Japanese trade data and retreating Chinese new home prices ensuring we’ve all got more on our plate than just revelling in the death of the US rate cycle.

After walking away from Wednesday’s session with a 100 point gain, up some 1.42%, the benchmark ASX200 has closed significantly lower with only Consumer Staples and Utilities higher after October’s jobless rate dropped in at 3.7%.

There were a stronger than expected 55K new jobs in October (consensus was looking for +24K) but despite the strength in jobs growth, the unemployment rate ticked up by +0.1% (from 3.6% last month) which was in line with expectations.

Diana Mousina at AMP Capital says the unemployment rate increased because the participation rate rose back up to its record high of 67%.

“The RBA expect the unemployment rate to average at 3.8% in the December quarter, so today’s figures are still in line with that if the unemployment rate increases again in November and December, which we think is likely.

So, today’s figures don’t provide enough of a “smoking gun” for a follow-up rate hike at the December board meeting and that seems to also be the market reaction as the $A fell after the data was released, Diana adds.

“Yesterday’s wage figures were also more or less in line with expectations (of wages growth running at around 4% year on year to September).

“Another rate hike is still a possibility for February 2024 after the next round of quarterly inflation data, but we think the macroeconomic environment will be weaker by February and allow the central bank to keep interest rates on hold, until the start of rate hikes around mid-2024.”

In any case, there were big problems up front in the engine room for the ASX.

The Financials Sector is flopping thanks to ANZ going very ex-dividend – the stock is down about -3.5%, while most of the other banks are sliding. AMP has given up another -15% after disappointing on forward guidance. Westpac bucked the trend to gain +0.3%.

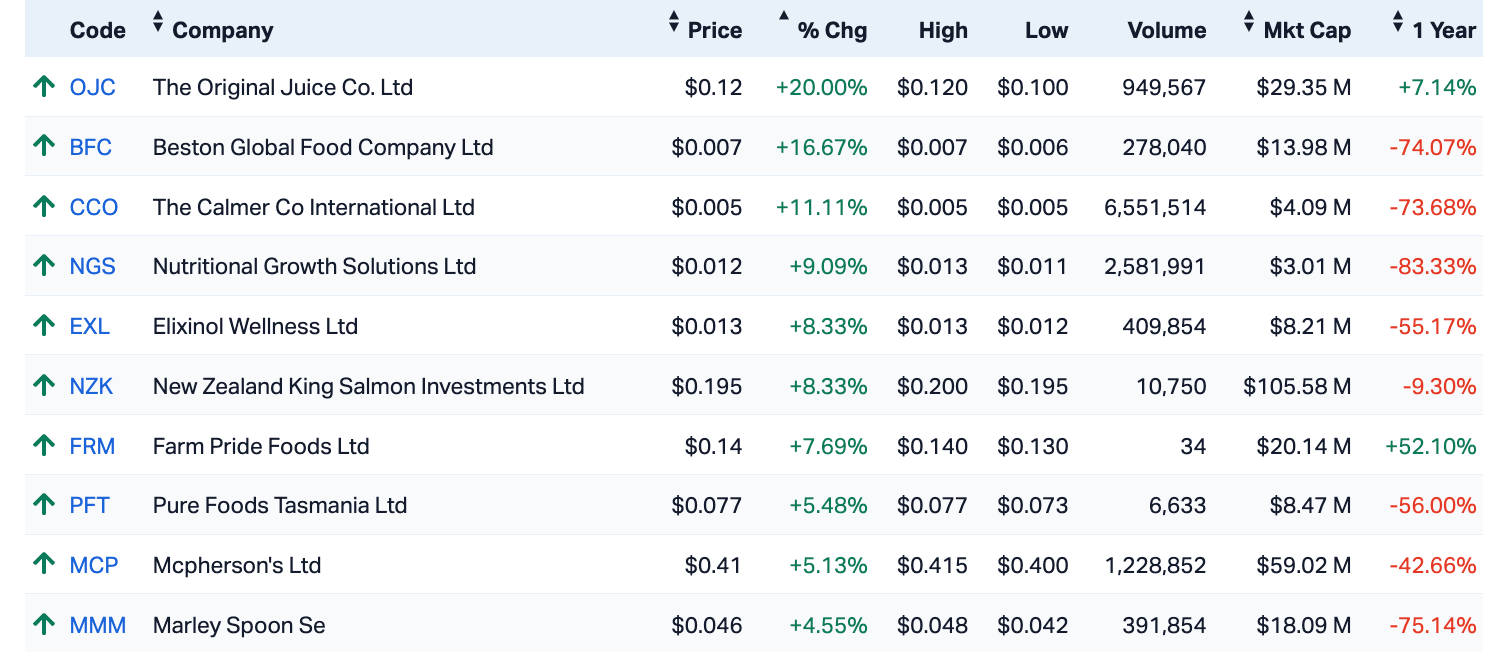

On the plus side of the register, hats off to these plucky Consumer Staples names:

Other problem children on the local bourse were led by perennial brat pack 2023 member Qantas (ASX:QAN), which has shed more weight after being found guilty of illegally standing down a health and safety rep back in early pandemic days.

ASX SECTORS ON THURSDAY

Ripped from the headlines

We’re watching crypto, again

Hmm. Yummy Bitcoin (BTC) spasmed higher last night, up about 6%, and taking its 2023 gains to around +120%

It’s not nuts by crypto standards, but the rally’s been turning heads of late as traders try to forget the trials of crypto’s fraudsters’ various trials (SBF et al) and turn to the riches that come with the potential end of The Fed’s rate rising cycle.

Of course, BTC et al now appear to be in something of a small retreat – down -1%, since the open this morning.

We’re watching iron ore

Reuters reports that in Dalian, iron ore futures fare down more than 2% on Thursday afternoon as Chinese authorities stepped in to control soaring prices and newly concerning property data fuelled fears of a hole in the key steel-consuming sector.

The most-traded January iron ore on China’s Dalian Commodity Exchange fell 2.6% to its lowest mark in a week. On the Singapore Exchange, the benchmark December iron ore was down 1.1% at $US128.65.

We’re watching US Futures

Which were universally lower on Wednesday night at 9.30pm in New York.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RWD | Reward Minerals Ltd | 0.082 | 82% | 2,803,658 | $10,253,391 |

| AMD | Arrow Minerals | 0.0015 | 50% | 1,666,666 | $3,023,765 |

| GCR | Golden Cross | 0.003 | 50% | 9,325 | $2,194,512 |

| KGD | Kula Gold Limited | 0.031 | 48% | 61,939,136 | $7,837,450 |

| MSG | Mcs Services Limited | 0.02 | 43% | 220,023 | $2,773,395 |

| OZM | Ozaurum Resources | 0.175 | 35% | 5,590,739 | $20,637,500 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | 4,332,952 | $8,094,876 |

| IEC | Intra Energy Corp | 0.004 | 33% | 3,898,333 | $4,982,345 |

| TWE | Treasury Wine Estate | 0.08 | 33% | 588,872 | $4,583,163 |

| OCN | Oceanalithiumlimited | 0.165 | 32% | 3,735,309 | $6,634,563 |

| MXC | Mgc Pharmaceuticals | 1.16 | 32% | 33,855 | $31,178,832 |

| IVX | Invion Ltd | 0.0065 | 30% | 1,856,656 | $32,108,161 |

| CVB | Curvebeam Ai Limited | 0.4 | 29% | 132,304 | $56,687,838 |

| CC9 | Chariot Corporation | 0.46 | 26% | 510,368 | $26,766,022 |

| SCT | Scout Security Ltd | 0.015 | 25% | 133,488 | $2,771,129 |

| ASV | Assetvisonco | 0.01 | 25% | 1,570,293 | $5,766,693 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 1,997,498 | $6,727,274 |

| OZZ | OZZ Resources | 0.086 | 23% | 700,935 | $6,477,108 |

| EMP | Emperor Energy Ltd | 0.011 | 22% | 5,871,715 | $2,757,262 |

| MKL | Mighty Kingdom Ltd | 0.022 | 22% | 641,544 | $7,566,653 |

| MHK | Metalhawk. | 0.22 | 22% | 1,675,952 | $14,260,600 |

| LYN | Lycaonresources | 0.2 | 21% | 34,632 | $6,611,344 |

| SLB | Stelarmetalslimited | 0.445 | 20% | 446,212 | $19,205,932 |

| OJC | The Original Juice | 0.12 | 20% | 949,567 | $24,459,079 |

| CHK | Cohiba Min Ltd | 0.003 | 20% | 86,833 | $5,533,110 |

The advanced-stage sulphate of potash (SOP) explorer and developer Reward Minerals (ASX:RWD) has some cracking news on the SOP front – telling the ASX it has entered into an exclusivity deed with the Receivers of Kalium Lakes Limited regarding the potential acquisition of the Beyondie SOP Project, located circa 160 km SE of Newman, WA (Beyondie Project).

The exclusivity deal has a few caveats, but essentially Kalium’s people will provide a period of exclusivity for RWD to sit down and “in good faith to seek to agree the terms of a sale agreement and any associated documents required to give effect to the sale of the Beyondie Project, in line with key terms set out in a non-binding term sheet.”

The total upfront consideration of $14.75mn cash (plus a final payment of $5mn by 30 June 2025 and an exclusivity payment of $250,000).

The previous owners of the Beyondie Project are estimated to have spent in excess of $400 million on Mineral Resource/Reserve definition, development, construction and operations of the only producing SOP mine in Australia.

There’s also apparently a stack of infrastructure out there – including:

• A fully constructed and permitted SOP trench and brine field, fresh water bore field, evaporation ponds and processing operations.

• Numerous granted Mining, Miscellaneous Licences and Exploration Tenements covering an area of approximately 1,800 square kilometres.

• A great big fuck off power station.

RWD, which runs its flagship 100%-owned Kumpupintil Lake Potash Project east of Newman in north-western WA, reckons it hosts Australia’s largest high-grade brine SOP deposit in a region with the highest evaporation rate.

On Thursday RWD was up over +73%.

Kula Gold (ASX:KGD), has added another circa +55% to yesterday’s solid results, off the back of yesterday’s two-banger announcement bundle that told the market that drilling is about to commence at the company’s “substantial” Cobra Lithium Prospect approximately 20km west of the world’s largest hard rock lithium mine, Greenbushes in Western Australia.

Here’s the low down in bullet form:

- Drilling to start next week at Kula Gold’s 3km long, 500m wide Cobra lithium prospect

- $650,000 to be raised for a maiden drill program

- Company also optioned more ground to expand wider Kirup lithium project by 48km2

- Kirup tenements are adjacent to Greenbushes, the world’s biggest lithium mine

We’re back in Canada’s James Bay on Thursday – Oceana Lithium (ASX:OCN) – says it has identified a fresh suite of high priority targets at its Monaro lithium project, following successful fieldwork at the James Bay site.

Some 175 rock samples have been submitted to ALS Laboratories in Val-d’Or, Québec for whole-rock analysis, with results due sometime in December – but in the meantime, the company says that the fieldwork revealed “Elevated levels of Rubidium (Rb) and low Potassium (K) to Rubidium ratios coincident with favourable geology and magnetic signatures”, which have helped pinpoint where Oceana is going to point the drills next time around.

Meanwhile, something exciting has happened over at one of Twiggy Forrest’s new toys – CurveBeam AI (ASX:CVB), which has climbed almost 25%.

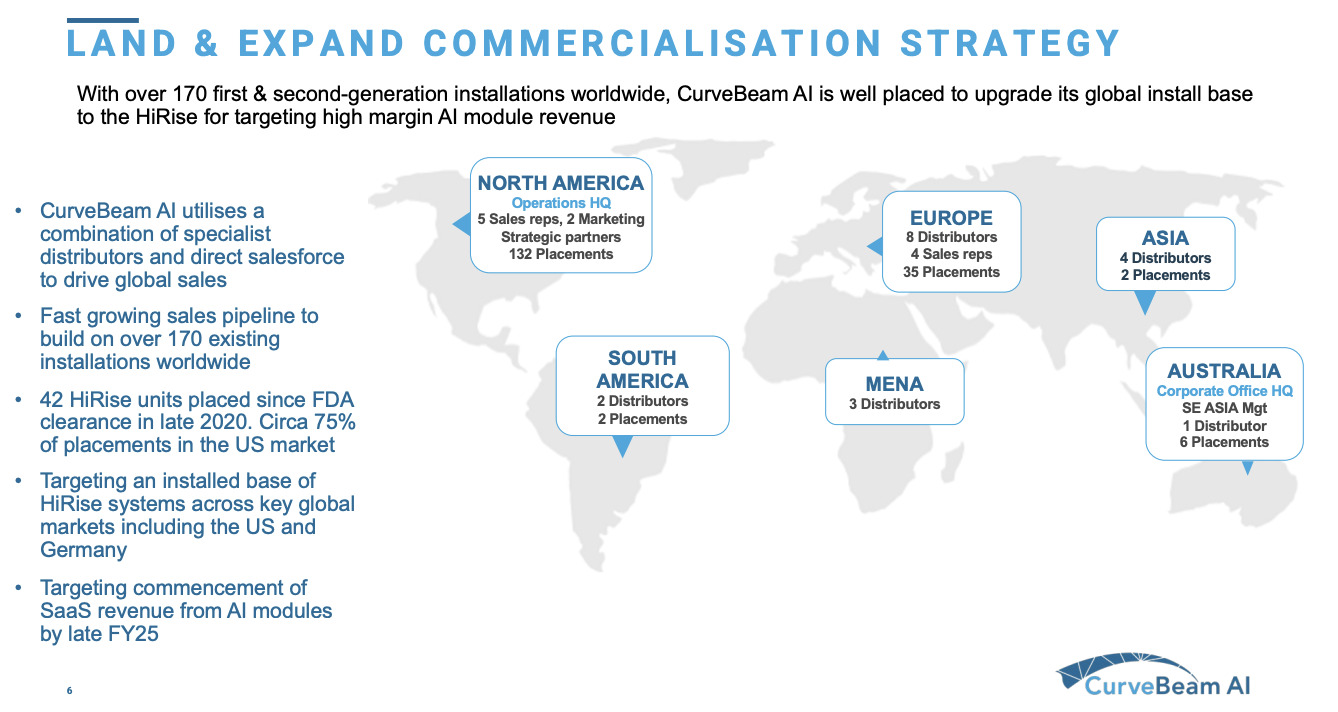

CEO Greg Brown gave a big presso on the company this week at the Bell Potter Healthcare Conference. There were some snazzy slides, for sure:

So it’s entirely possible someone was convinced.

The Medical imaging business listed back in August at 48c after raising $25m at the IPO round.

Based in Melbourne, the company develops and manufactures a range of specialised medical imaging (CT) scanners and the supporting clinical assessment software.

It’s known as a leader in cone beam CT imaging, paving new frontiers in artificial intelligence (AI)-based bone and joint analysis, while its flagship product, called theHiRise, allows medical people to assess bone health (mainly of elderly patients) from foot to hip in a standing position.

At the time of listing, CVB could count its existing investors include Andrew Forrest’s Tenmile and fundies Firetrail, Frazis Capital, Karst Peak Capital and Acorn among the early backers.

Most excitingly CVB combines CT imaging with artificial intelligence to ‘target improved assessments for orthopaedics and bone health.’ In this regard it already has 170+ devices used around the world right now, including the US hospital giant Mayo Clinic.

It is cleared by the Food and Drug Administration in the United States, has 37 granted patents internationally (27 applied) and has a co-marketing and distribution agreement with NYSE-listed Stryker Corp – the bad guys in Hugh Jackman’s X2.

On Tuesday, Kingfisher Mining (ASX:KFM) shares went nuts after it lobbed an update from its ongoing exploration at Mick Well within the highly prospective Gascoyne Province.

It’s doing the same today, likely on the same theme.

KFM Exec Dir. and CEO James Farrell says they’re seeing some significant additional carbonatites and REE mineralisation

Farrell says there’s significant new strike lengths of REE mineralisation discovered from reconnaissance mapping close to the recently identified gravity targets as well as a substantial REE system confirmed, with more than 13.5km of mineralisation mapped so far within a very large 7km by 4km carbonatite complex.

“The latest discoveries confirm Mick Well is a very large and exciting REE system that extends over an area of more than 7km by 4km.

Our ongoing fieldwork has also identified outcropping ferrocarbonatites together with monazite veining proximal to the recently identified carbonatite plug targets. These are the main ingredients for the World’s largest REE resources”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.065 | -35% | 806,738 | $31,285,147 |

| BP8 | Bph Global Ltd | 0.001 | -33% | 24,193 | $2,423,345 |

| HTG | Harvest Tech Grp Ltd | 0.018 | -22% | 1,683,696 | $16,237,157 |

| TTA | TTA Holdings Ltd | 0.011 | -21% | 247,678 | $1,923,928 |

| ASP | Aspermont Limited | 0.008 | -20% | 401,777 | $24,387,637 |

| FAU | First Au Ltd | 0.002 | -20% | 22,418,902 | $3,629,983 |

| IHL | Incannex Healthcare | 0.0465 | -20% | 17,578,365 | $92,046,686 |

| FBM | Future Battery | 0.0725 | -19% | 8,492,506 | $45,891,539 |

| CUS | Coppersearchlimited | 0.125 | -19% | 257,020 | $13,887,442 |

| IBX | Imagion Biosys Ltd | 0.355 | -19% | 126,695 | $14,363,432 |

| BTH | Bigtincan Hldgs Ltd | 0.2 | -18% | 4,969,221 | $148,777,007 |

| WNR | Wingara Ag Ltd | 0.02 | -17% | 8,310 | $4,213,020 |

| NTD | National Tyre&Wheel | 0.755 | -16% | 309,106 | $120,302,907 |

| ACM | Aus Critical Mineral | 0.43 | -16% | 1,164,629 | $15,162,938 |

| AMP | AMP Limited | 0.8575 | -16% | 70,468,105 | $2,792,046,603 |

| MCL | Mighty Craft Ltd | 0.011 | -15% | 133,734 | $4,737,753 |

| SIX | Sprintex Ltd | 0.011 | -15% | 5,995,983 | $4,437,635 |

| JGH | Jade Gas Holdings | 0.034 | -15% | 63,387 | $63,073,367 |

| SRX | Sierra Rutile | 0.115 | -15% | 2,079,720 | $57,271,920 |

| ACP | Audalia Res Ltd | 0.012 | -14% | 86,285 | $9,689,907 |

| AR9 | Archtis Limited | 0.12 | -14% | 663,995 | $39,981,246 |

| MTL | Mantle Minerals Ltd | 0.003 | -14% | 995,371 | $21,516,060 |

| RHK | Red Hawk Mining Ltd | 0.49 | -14% | 28,365 | $96,243,689 |

| OKJ | Oakajee Corp Ltd | 0.019 | -14% | 25,000 | $2,011,813 |

| FG1 | Flynngold | 0.064 | -14% | 264,911 | $10,092,311 |

TRADING HALTS

ABx Group (ASX:ABX) – Pending an announcement to the market regarding a material increase in the Company’s REE Resource.

Ionic Rare Earths (ASX:IXR) – Pending an announcement by the Company regarding the finalisation of a capital raising

Nagambie Resources (ASX:NAG) – Requests the immediate implementation of a trading halt in its ordinary shares (NAG) and quoted 10 cent options (NAGO) pending release of an announcement regarding a capital raising

Spartan Resources (ASX:SPR) – For the purpose of considering, planning and executing a capital raising

Peninsula Energy (ASX:PEN) – Pending an announcement from the Company regarding a proposed capital raising

Verbrec (ASX:VBC) – Pending the release of an announcement regarding a proposed capital raise

Xanadu Mines (ASX:XAM) – Pending the release of an announcement regarding a proposed capital raise

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.