Closing Bell: The ASX is slightly higher, but not much cooler on Monday

Not that cool, ASX. Via Getty

- The ASX benchmark has closed slightly higher on Monday

- Energy Sector gains after oil prices rose over the weekend

- Small caps led Killi Resources, Nyrada and Viridis Mining

The Aussie sharemarket has ended the opening salvo of the week slightly higher, despite ho-hum leads and thanks largely to a strong performance from the Energy Sector.

At match-out on Monday November 17, the S&P/ASX 200 (XJO) index was up about nine points, or +0.13% at 7,049:

There were some decent rises right across the bourse this morning when the index opened with SPI Futures up almost 0.4% and pointing to a strong day, despite a mixed session to end the week on Friday in New York.

In local company news, the ASX (ASX:ASX) has lifted almost +2% after making at least some good progress in replacing its legacy-looking CHESS clearance system.

The energy sector rose by 1.2% after Brent crude lifted more than 4% over the weekend following concerns over inventories and some OPEC+ bluster. The only local set up to miss out on that appears to be Origin Energy, which is down -0.7%, ahead pf this week’s shareholder showdown vote on Brookfield and EIG’s flawed $20bn takeover play.

Oil’s been falling for four weeks and while the recovery will be welcomed by oil traders, Brent is still well below the $US93.00 of late September when we had no idea what Hamas was planning.

Sector leaders include Allkem (ASX:AKE) , Altium (ASX:ALU) and Whitehaven Coal (ASX:WHC) .

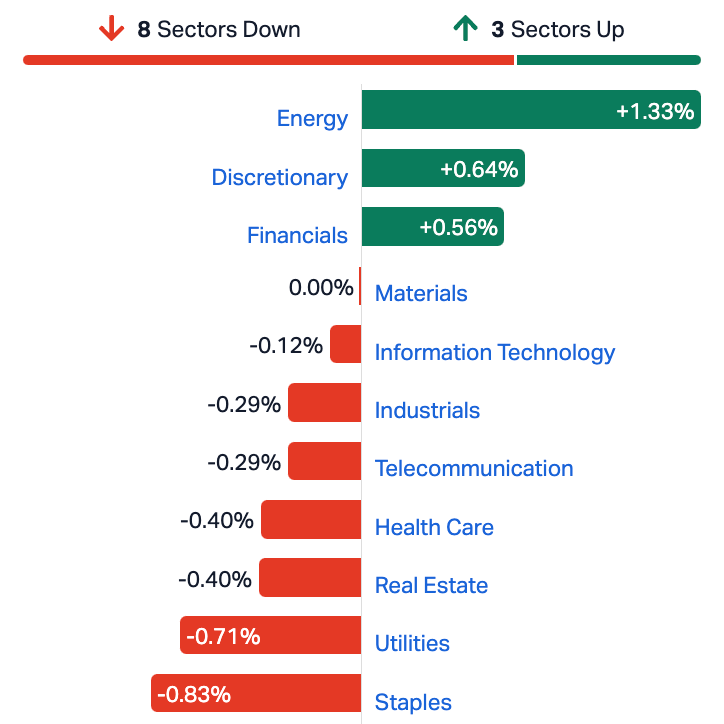

ASX Sectors On Monday

Materials have ended the day flat after iron ore walked back some of its recent booty, down almost 2% on the Dalian exchange.

Elsewhere, Staples, Utilities and Health care stocks draaaaged.

Speaking of a drag – life for right now for Optus chief executive officer Kelly Bayer Rosmarin. But it’s about to get much better.

KBR resigned earlier today in the wake of the telco’s nationwide outage which caused such nationwide ourtage.

Her Turkey was cooked the moment Singtel started saying things like trust needs to be rebuilt. Under her watch Optus was the target of a major cyber attack last year as well as the total system failure on November 8.

Ms Bayer Rosmarin has in fact been a handy lightning rod for the intense criticism following the black out which left some 10 million customers without the internet.

Bayer Rosmarin said while it “had been an honour to serve” she thought it good to get out now after “some personal reflection”.

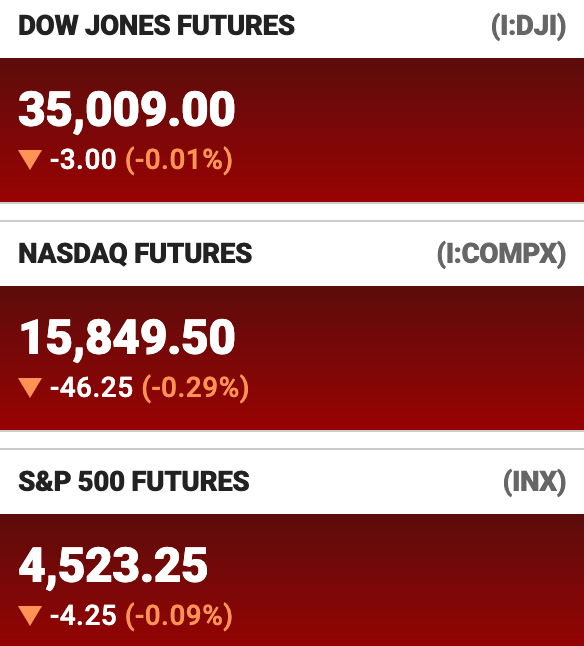

Looking overseas, and last week all 3 major US averages clocked a third straight weekly gain – the Nasdaq surged again, up +2.4% for the week. The S&P 500 added +2.2%, while the the Dow ended the week with a +1.9% rise.

For now, US Futures look pretty undecided on Sunday night in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VMM | Viridismining | 2.13 | 68% | 4,841,744 | $56,778,158 |

| RNX | Renegade Exploration | 0.008 | 60% | 1,096,801 | $4,765,619 |

| AVM | Advance Metals Ltd | 0.004 | 33% | 250,000 | $2,167,040 |

| KNM | Kneomedia Limited | 0.004 | 33% | 1,283,899 | $4,514,356 |

| MCT | Metalicity Limited | 0.002 | 33% | 1,500,140 | $6,376,629 |

| NYR | Nyrada Inc. | 0.026 | 30% | 338,232 | $3,120,174 |

| GTI | Gratifii | 0.009 | 29% | 1,291,402 | $9,266,300 |

| KLI | Killiresources | 0.071 | 27% | 1,003,897 | $3,336,203 |

| AD1 | AD1 Holdings Limited | 0.005 | 25% | 26,090 | $3,290,276 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 233,333 | $4,426,488 |

| ERL | Empire Resources | 0.005 | 25% | 848,075 | $4,451,740 |

| ME1 | Melodiol Glb Health | 0.0025 | 25% | 4,804,520 | $7,776,127 |

| RGS | Regeneus Ltd | 0.005 | 25% | 215,566 | $1,225,748 |

| TG6 | Tgmetalslimited | 0.91 | 23% | 2,734,874 | $29,823,140 |

| NIS | Nickelsearch | 0.1225 | 23% | 19,485,948 | $17,894,539 |

| AMT | Allegra Medical | 0.05 | 22% | 61,061 | $4,904,052 |

| YRL | Yandal Resources | 0.084 | 20% | 140,180 | $13,153,402 |

| GSR | Greenstone Resources | 0.006 | 20% | 2,405,115 | $6,827,082 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 5,896,501 | $24,182,996 |

| SQX | SQX Resources Ltd | 0.13 | 18% | 175,576 | $2,750,000 |

| SSH | Sshgroupltd | 0.165 | 18% | 5,000 | $9,225,979 |

| ADR | Adherium Ltd | 0.0035 | 17% | 30,000,000 | $15,004,781 |

| AYT | Austin Metals Ltd | 0.007 | 17% | 600,000 | $6,095,248 |

| AZL | Arizona Lithium Ltd | 0.056 | 17% | 90,574,373 | $159,301,729 |

| CCZ | Castillo Copper Ltd | 0.007 | 17% | 118,000 | $7,797,032 |

Viridis Mining and Minerals (ASX:VMM)

Diverse minerals hunter Viridis is coming out of a trading halt with some big assay-result news from its newly acquired Colossus rare earths (REE) project in Minas Gerais, Brazil.

The company recently entered into a binding agreement to acquire 100% of the rights to the REEs comprising the Colossus project, consisting of 41 Licenses (including 2 Mining Licenses) covering 56km2 “within South America’s largest known alkaline complex”.

Today, the company has announced ‘major ionic clay rare earth discoveries’ at Colossus, with 46.0m at 3,285 ppm Total Rare Earth Oxide (TREO) from surface making the headline.

The VMM share price has subsequently shot up more than 69% at the time of writing.

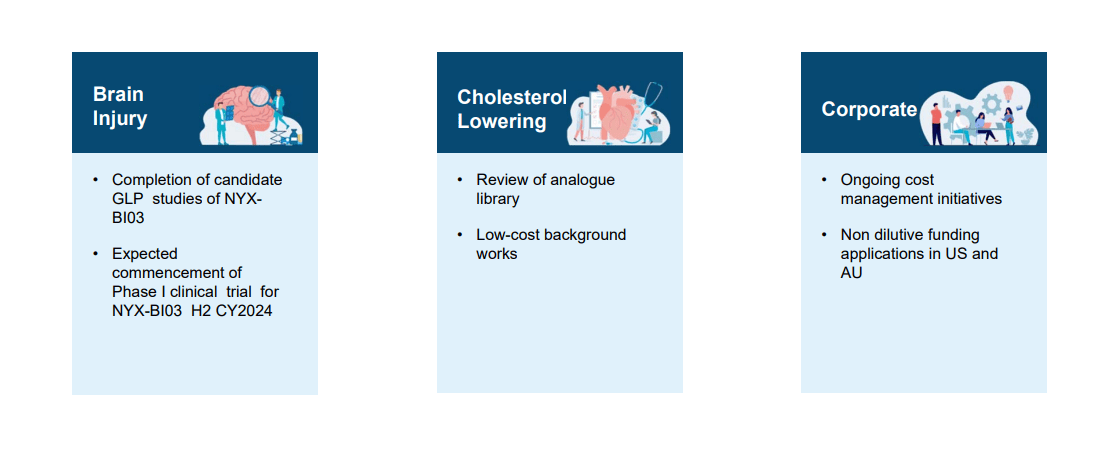

Nyrada Inc is a locally-listed US biotech with a focus fon ‘small molecule drugs in non-oncology fields, and it’s aapprently had a great AGM today. The mini pharma/medtech/small cap is up about 30% on what appears to be a cracking presso (this is the ‘in summation’ plate)…

Nyrada remains focused on advancing two drug programs:

The programs are 1) a TRPC ion channel blocker for secondary brain injury treatment; and 2) an oral PCSK9 inhibitor for cholesterol lowering.

These drug candidates target indications where there is an unmet clinical need, or where current treatments are suboptimal.

The markets for these drugs are large and benefit from key thematic tailwinds:

- greater awareness of the costs and consequence of brain injury from the sporting and combat fields,

- changing demographics with an ageing population, particularly lifestyle and dietary changes leading in increased incidence of high cholesterol

- increasing incidence and expanding awareness of the need for better treatment options for both of our target indications.

In the case of our brain injury program, there are no current FDA-approved treatments despite more than 27 million cases of medically assessed traumatic brain injuries occurring annually . For our hypercholesterolemia program, the current injectable options are both expensive and inconvenient. These present significant market opportunities.

Menwhile, how good is TG Metals (ASX:TG6)?

The lithium, nickel and gold exploration junior is still rising on Monday, having most recently intercepted high-grade lithium at its Lake Johnston Li-Ni-Au project in the Lake Johnston Greenstone Belt of WA.

The company has nothing fresh to report today that we can see specifically, however, there’s certainly some action going on in the Lake Johnston area with some other projects of note, which could be helping to move neighbouring junior explorer share prices today.

What’s doing then?

Fellow battery metals hunter Charger Metals (ASX:CHR) and mining behemoth Rio Tinto (ASX:RIO) have signed a farm-in agreement for what’s known as the Lake Johnston Lithium Project (a different project from TG6’s), while Charger has simultaneously entered into a binding agreement with Lithium Australia (ASX:LIT) to purchase its minority interest in the project for $2 million to increase Charger’s interest to 100%.

You’d think that’d be sending the CHR and LIT prices skywards, by the way, wouldn’t you? Er, at the time of key tapping, CHR and LIT are both in the red. Certainly good news for the juniors of the Lake Johnston rush more generally though that Rio Tinto is taking an interest.

Late last week, meanwhile, TG6 gave this positive update on its Burmeister prospect at its Lake Johnston Li-Ni-Au project…

🔊#Drilling at the Burmeister #Lithium Discovery Progressing well with 6 holes completed to-date

⚒️A further 7 holes planned

⚒️Phase 2 drill samples commenced with first assays due within 2 weeksMore: https://t.co/QAOnxnqvaI#TG6 #exploration #WesternAustralia #asxnews pic.twitter.com/vvrgWepNS7

— TG Metals Limited (@TGMetals) November 16, 2023

Killi Resources (ASX:KLI), a gold, copper and REEs explorer which is up over +30% on Monday. The stock has been rising after entering a trading halt earlier today, pending an announcement in relation to a potential acquisition of a mineral project.

For the company’s last piece of major news, we travel back briefly in time to October 30, when it announced soil assay results from the Baloo prospect at its Mt Rawdon West project in Queensland, highlighting extensive copper-gold-molybdenum anomalies at surface.

And that appears to be a large system that extends the historical Cu-Au-Mo soil anomaly to 4.5km x 1.5km along a structural corridor – interpreted as the linking structure between the two mineralised regional faults.

CEO, Kathryn Cutler said, regarding the find: “We remain convinced we are potentially looking at a new copper-gold mineral discovery for the region.”

Kathryn could be closer, we’ll find out tomorrow.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.001 | -33% | 33,333 | $4,535,648 |

| PEN | Peninsula Energy Ltd | 0.082 | -32% | 81,526,762 | $150,935,782 |

| FGH | Foresta Group | 0.01 | -29% | 4,397,710 | $31,353,039 |

| CHR | Charger Metals | 0.275 | -28% | 2,873,165 | $23,603,460 |

| R3D | R3D Resources Ltd | 0.04 | -25% | 136,321 | $7,901,783 |

| ADS | Adslot Ltd. | 0.003 | -25% | 8,158,308 | $12,897,982 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 1,802,542 | $3,231,126 |

| MXC | Mgc Pharmaceuticals | 0.72 | -24% | 50,380 | $33,481,814 |

| IRX | Inhalerx Limited | 0.03 | -23% | 307,463 | $7,400,911 |

| IVZ | Invictus Energy Ltd | 0.1475 | -22% | 25,047,331 | $245,256,596 |

| MKG | Mako Gold | 0.011 | -21% | 5,611,127 | $8,064,115 |

| ROG | Red Sky Energy. | 0.0055 | -21% | 6,620,085 | $37,115,590 |

| ACM | Aus Critical Mineral | 0.36 | -20% | 1,323,057 | $13,379,063 |

| RBX | Resource B | 0.08 | -20% | 208,000 | $8,268,449 |

| GPR | Geopacific Resources | 0.016 | -20% | 1,868,159 | $16,423,822 |

| GTG | Genetic Technologies | 0.002 | -20% | 2,117,331 | $28,854,145 |

| SIS | Simble Solutions | 0.004 | -20% | 7,662,892 | $3,014,754 |

| YOJ | Yojee Limited | 0.004 | -20% | 17,764 | $5,676,023 |

| PVT | Pivotal Metals Ltd | 0.017 | -19% | 4,020,009 | $11,505,234 |

| NOX | Noxopharm Limited | 0.11 | -19% | 990,771 | $39,452,123 |

| FGL | Frugl Group Limited | 0.009 | -18% | 10,928,970 | $10,571,682 |

| SRN | Surefire Rescs NL | 0.009 | -18% | 12,817,680 | $20,204,284 |

| YOW | Yowie Group | 0.024 | -17% | 680 | $6,338,469 |

| IXR | Ionic Rare Earths | 0.0225 | -17% | 30,256,739 | $106,814,833 |

| 8IH | 8I Holdings Ltd | 0.01 | -17% | 20,082 | $4,288,272 |

TRADING HALTS

Killi Resources (ASX:KLI) – Pending an announcement in relation to a potential acquisition of a mineral project

Genesis Resources (ASX:GES) – Pending a material announcement to the market in relation to the results of a drilling program

Norfolk Metals (ASX:NFL) – Pending the release of an announcement in relation to a capital raising

Great Northern Minerals (ASX:GNM) – Pending an announcement regarding

a proposed divestment of certain assets by the Company

Alterity Therapeutics (ASX:ATH) – Pending an announcement in relation to a capital raise

WT Financial Group (ASX:WTL) – Pending an announcement by the Company regarding

a corporate acquisition

Healius (ASX:HLS) – Pending an announcement to ASX in connection with its debt financing and related capital structure initiatives

ADX Energy (ASX:ADX) – Pending an announcement regarding a capital raising,

Firebird Metals (ASX:FRB) – Pending release of an announcement by the Company in relation to the results of an updated Manganese Sulphate scoping study.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.