Closing Bell: The ASX has made it 3 wins in a row as rumours grow of a secret Beijing economic intervention

Via Getty

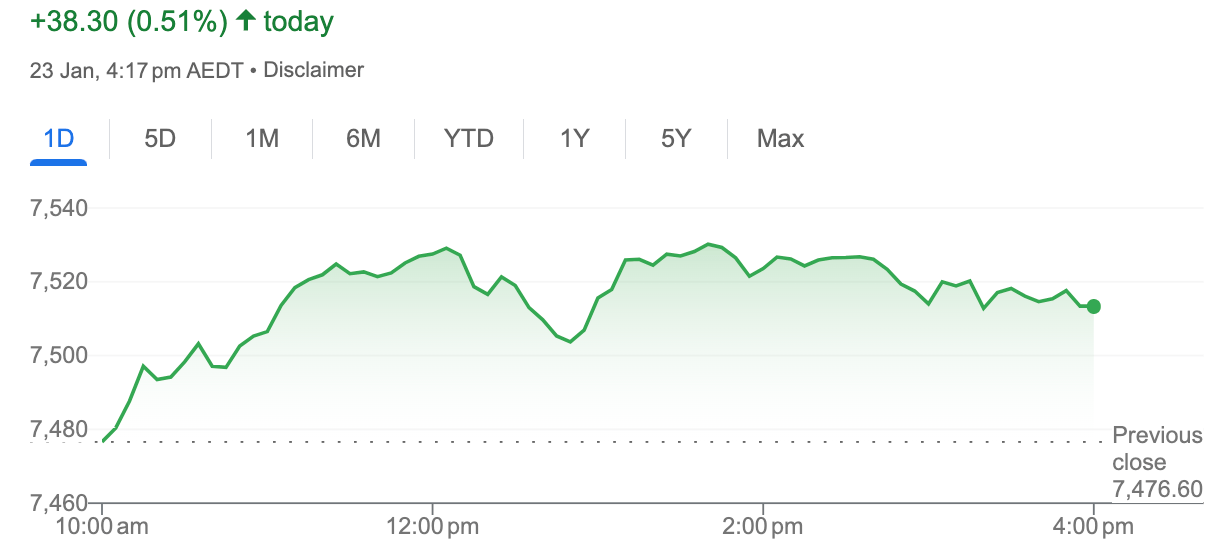

- ASX200 rises for third straight session, up 0.5pc

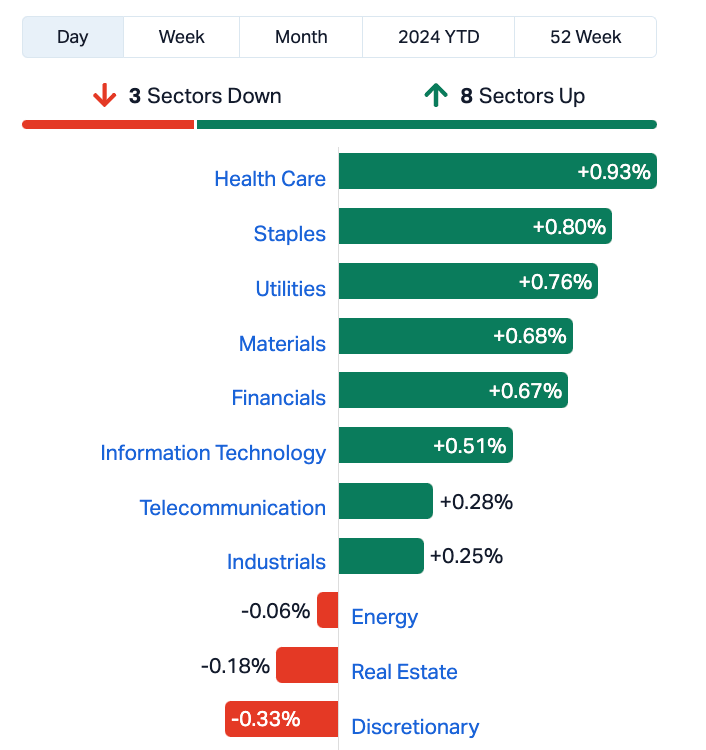

- Most sectors higher, led by Healthcare

- Small cap leaders include True North Copper and Cobre

The benchmark XJO index has made it very rare hat trick of gains on Tuesday, thanks to some positive rumours out of China and a gust of bullishness from the Dow Jones and S&P500 as both benchmarks hit new all-time highs overnight.

At 4.15pm on 23 Jan, the S&P/ASX200 was ahead 38 points or 0.5% to 7,514:

First up, stocks in Hong Kong are on a tear – up well over 3% in early Tuesday trade, following the regionally significant report out of Bloomberg of a mysterious CNY 2 trillion fund being set up to stabilise China’s troubled capital markets.

It’s also likely the Hang Seng is hosting some big game bargain hunters after the index ended Monday at a 15-month nadir.

At home, we have the same 8 of 11 sectors in the green led by a super day for Healthcare.

Also performing well – banks, Consumer Staples stocks, Materials and IT.

Offsetting losses across REITs in the the property space this arvo, Abacus Group (ASX:ABG), which says it’s flogged 2 x non-core Sydney assets for $107mn.

Something (a building) in Surry Hills as well as the remaining 50% share of Ashfield Mall where determined nature lovers can occasionally spot Stockhead‘s Gregor Stronach frozen in indecision at the Aldi cereal isle.

The lithium sector is currently no place for the mild and gentle of spirit right now, being more volatile than mother’s curried egg sandwiches in my lower colon during 5th and 6th period double maths.

Liontown Resources (ASX:LTR) has taken a hit to the tune of about 3%, which investors have to swallow on top of Monday’s revelation that banks had withdrawn a $760 million funding offer.

If EVs dream of electric sheep, then surely LTR management dreams of Gina Rinehart-shaped torpedos.

The other lithium majors featuring in Tuesday’s snatch and jerk: Iluka Resources (ASX:ILU) and IGO (ASX:IGO) cleared more than 4.1% each, while Galan Lithium (ASX:GLN) added 2%.

It’ll be worth watching materials stocks for the rest of this week.

ASX SECTORS at 4.15pm on TUESDAY

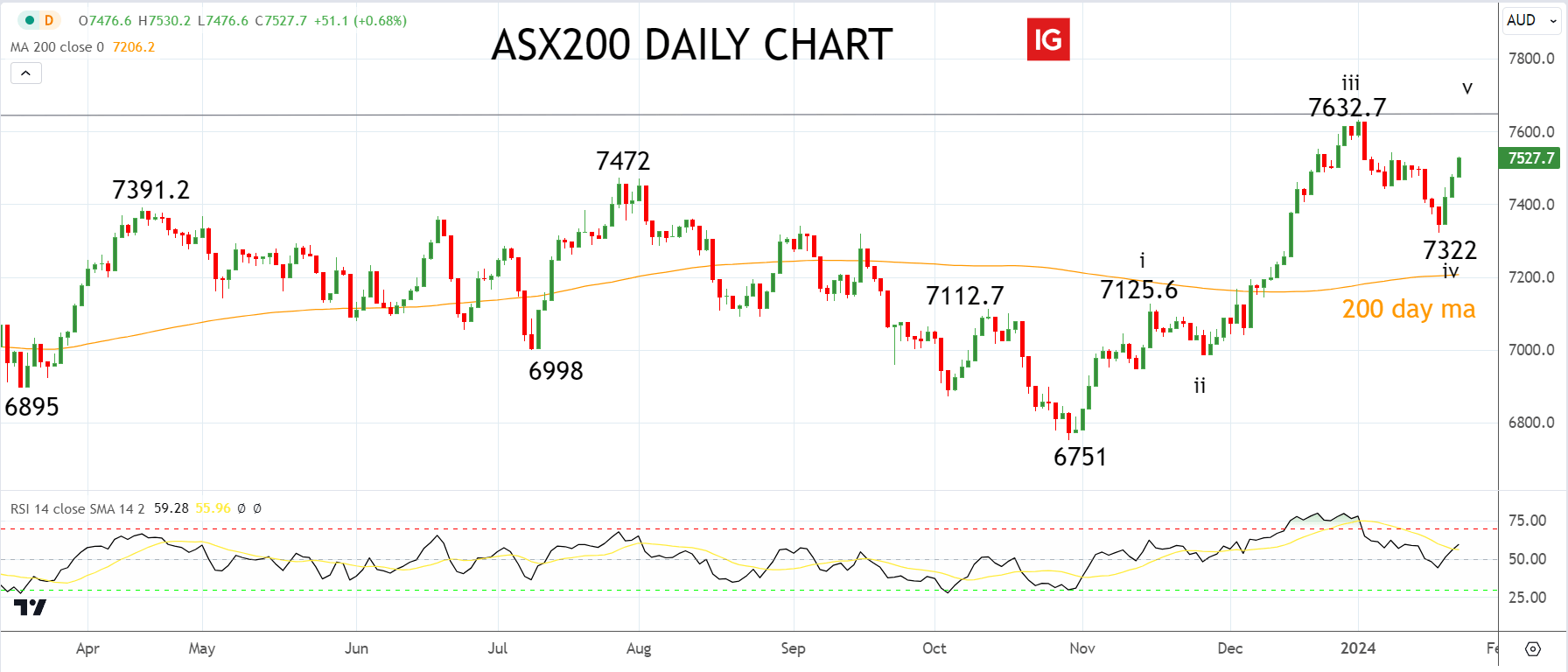

I’m not a particularly technical person…

But being cut from a modern cloth, our old mate at IG Markets Tony Sycamore is.

Tony says that from a technical perspective, “we moved to a neutral/cautious stance” on the local benchmark, after this month’s ASX200 failure (circa early January) to break the index’s August 2021 high (of 7632 points)

“While we were looking for a slightly deeper pullback, the ASX200’s 330-point (4%) retreat to last week’s 7322 low likely completed the pullback we were looking for.

“This interpretation suggests a retest of the 7633 double top is likely in the coming sessions,” Tony says. “Nonetheless, we remain neutral while the ASX200 remains below range and year-to-date highs.”

Around the ‘hood…

Asian-Pacific equity markets have done pretty well at around 3.30pm in Sydenham.

There are sighs of satisfaction as the BoJ (Bank of Japan) decided life outside its ultra-loose monetary policy is still in the too hard basket and maintained rates at about minus a million as per expectations.

After a 2-day policy meeting, board Team BoJ decided to keep interest rates in negative territory artificially keeping the Yen lower vs the US dollar.

Beijing’s No. 2, Premier Li Qiang is back from dissembling in Davos to chairing in China – he ran meet of China’s cabinet, the State Council on Monday – where he made everyone re-pledge (renewed pledgdes?) to get out and stabilise capital markets.

That’s probably momentarily lifted sentiment across mainland markets, where a measurement in Hong Kong last week unsurprisingly showed sentiment is through a deep dark looking glass.

Bloomberg says Li’s meeting was more important and now has Chinese authorities genuinely thinking about whopping out a “package of measures” worth “about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises.”

Regional markets were already tracking the upbeat, albeit modest rally on Wall Street overnight that pushed the Dow and S&P 500 to new record highs. Shares in Japan, South Korea, Hong Kong and mainland China were all higher.

We’re watching gold…

Which is inching back over US$2,030 an ounce on Tuesday, making up some of the losses from Monday as the Greenback eased off last week’s highs. The Aussie dollar was up about 0.5% on Tuesday, too.

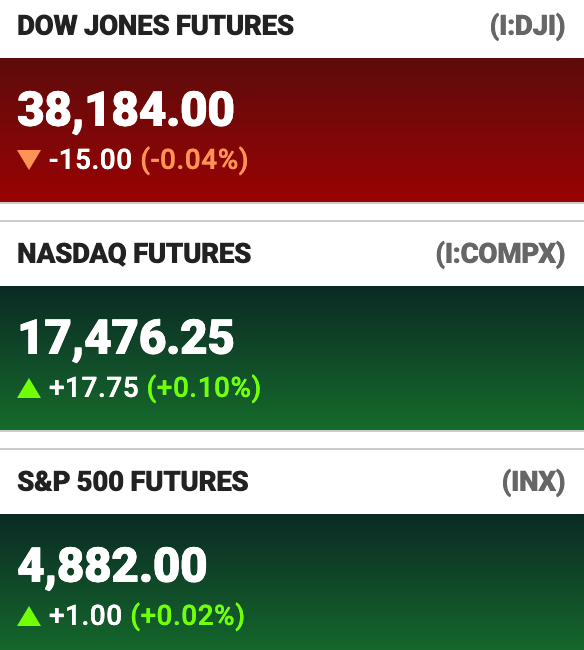

And in the States…

US stock futures were mixed at 4pm in Sydney.

In extended trading, United Airlines gained more than 6% after reporting solid fourth quarter numbers, lifting shares of other airline stocks including American Airlines, Southwest Airlines, Alaska Air Group and Delta Air Lines.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CBE | Cobre | 0.071 | 73% | 52,051,586 | $11,763,351 |

| MSG | Mcs Services Limited | 0.015 | 50% | 645,243 | $1,980,997 |

| TNC | True North Copper | 0.1 | 47% | 9,428,457 | $26,169,219 |

| BXN | Bioxyne Ltd | 0.016 | 33% | 832,256 | $22,819,745 |

| GGE | Grand Gulf Energy | 0.009 | 29% | 27,906,573 | $14,666,729 |

| COY | Coppermoly Limited | 0.014 | 27% | 1,713,037 | $7,657,490 |

| NMR | Native Mineral Res | 0.029 | 21% | 1,112,936 | $5,034,012 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 538,518 | $6,134,373 |

| WTM | Waratah Minerals Ltd | 0.095 | 19% | 285,499 | $11,949,160 |

| BTE | Botala Energy | 0.089 | 19% | 293,896 | $6,176,416 |

| HTA | Hutchison | 0.039 | 18% | 55,000 | $447,892,783 |

| JDO | Judo Cap Holdings | 1.0975 | 17% | 5,228,338 | $1,037,196,279 |

| FDV | Frontier Digital Ltd | 0.52 | 17% | 296,630 | $192,776,818 |

| AHF | Aust Dairy Limited | 0.014 | 17% | 3,025,906 | $7,756,402 |

| CCO | The Calmer Co International | 0.007 | 17% | 2,443,869 | $5,144,971 |

| MTB | Mount Burgess Mining | 0.0035 | 17% | 103,407 | $3,134,440 |

| NOX | Noxopharm Limited | 0.078 | 16% | 120,778 | $19,579,943 |

| FFG | Fatfish Group | 0.05 | 16% | 23,525,531 | $59,780,307 |

| ARN | Aldoro Resources | 0.095 | 16% | 95,472 | $11,039,147 |

| TYX | Tyranna Res Ltd | 0.015 | 15% | 1,980,551 | $42,736,529 |

| MRL | Mayur Resources Ltd | 0.23 | 15% | 2,675,539 | $67,220,239 |

| TBN | Tamboran | 0.1725 | 15% | 525,541 | $309,043,080 |

| CL8 | Carly Holdings Ltd | 0.016 | 14% | 51,400 | $3,757,185 |

| EFE | Eastern Resources | 0.008 | 14% | 75,000 | $8,693,625 |

| RGS | Regeneus Ltd | 0.008 | 14% | 8,019 | $2,145,058 |

Cobre (ASX:CBE) stock has ended about 70% higher on Tuesday, after BHP selected the digger to participate in the 2024 BHP Xplor Program, which the company says will greatly assist the advancement of exploration plans on its Kalahari Copper Belt projects in Botswana.

BHP (ASX:BHP) will supercharge Cobre with some US$500,000 in non-dilutive funding “to support and accelerate its exploration plans.”

The Xplor Program provides not only with funding, but full access to BHP’s “deep expertise and global partnerships.”

Cobre intends to use the US$500,000 to advance its exploration programs by assessing and progressing targets which have the potential to host tier-one copper-silver deposits.

Exploration will focus on the newly identified fold hinge related trap-sites where mineralisation is expected to be upgraded, offering an opportunity for larger deposit formation.

Exactly the same thing happened to Hamelin Gold (ASX:HMG).

Managing director Peter Bewick, commenting on inclusion in the 2024 Xplor Program, was more than delighted.

“We are thrilled to have been selected to participate in the 2024 BHP Xplor program,” he said. “The identification of Ni-Cu-PGE mineralised, mafic-ultramafic intrusions by the Company in mid-2023 was a first for the Tanami region.”

Bewick says the BHP helping hand will facilitate the accelerated assessment of the nickel-copper-PGE potential of the region.

“The Xplor funded program will be completed in parallel to our ongoing gold exploration in the Tanami which includes a planned RC drill program at the Sultan prospect commencing in March-April 2024. This program is following up the identification through aircore drilling of extensive bedrock gold mineralization at Sultan announced earlier in January 2024.”

But gaining strongly in arvo trade was True North Copper (ASX:TNC) after revealing it has signed binding offtake and toll-milling agreements with (Glencore) for its Cloncurry Copper Project up in Queensland.

Glencore is among the world’s largest natural resource companies and has signed up for 100% of the copper concentrate from TNC’s Cloncurry.

TNC will also provide toll-milling services, of up to 1 million tonnes of ore per year for the CCP’s Life of Mine (LoM).

Aside from the certainty of concentrate sales for the mine, TNC says it will be entitled to claim 20% Queensland State Royalty discount for all material processed through the Mt Isa Smelter.

True North MD Marty Costello says the agreements with an industry major such as Glencore marks a significant milestone … with CCP fully permitted and TNC on track to soon be in production for copper with CCP located in a Tier One jurisdiction.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Global Health | 0.001 | -50% | 389,172,765 | $9,833,237 |

| YPB | YPB Group Ltd | 0.001 | -50% | 4,400 | $1,580,923 |

| GCR | Golden Cross | 0.002 | -33% | 4,769,211 | $3,291,768 |

| JAV | Javelin Minerals Ltd | 0.0015 | -25% | 464,132 | $3,267,458 |

| LNR | Lanthanein Resources | 0.006 | -25% | 13,441,309 | $10,318,495 |

| WML | Woomera Mining Ltd | 0.006 | -25% | 21,993,565 | $9,745,112 |

| PEC | Perpetual Res Ltd | 0.0085 | -23% | 6,758,823 | $7,040,324 |

| MI6 | Minerals260Limited | 0.175 | -22% | 1,047,314 | $52,650,000 |

| AIV | Activex Limited | 0.012 | -20% | 100,000 | $3,232,539 |

| AAJ | Aruma Resources Ltd | 0.02 | -20% | 152,703 | $4,922,288 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 283,500 | $15,000,000 |

| S3N | Sensore Ltd | 0.047 | -19% | 1,102,941 | $2,110,808 |

| EDU | EDU Holdings Limited | 0.11 | -19% | 112,544 | $22,303,950 |

| LM8 | Lunnon Metals | 0.285 | -17% | 934,088 | $74,912,313 |

| MXC | MGC Pharmaceuticals | 0.32 | -17% | 65,881 | $16,882,878 |

| CST | Castile Resources | 0.07 | -17% | 426,739 | $20,319,804 |

| TTT | Titomic Limited | 0.035 | -17% | 3,863,983 | $38,335,152 |

| G50 | Gold50Limited | 0.1 | -17% | 147,763 | $13,114,800 |

| PNT | Panther Metals | 0.05 | -17% | 60,000 | $5,101,500 |

| IEC | Intra Energy Corp | 0.0025 | -17% | 687,778 | $4,982,345 |

| PRX | Prodigy Gold NL | 0.005 | -17% | 3,404,730 | $10,506,647 |

| RMX | Red Mount Min Ltd | 0.0025 | -17% | 931,416 | $8,020,728 |

| VML | Vital Metals Limited | 0.005 | -17% | 1,426,796 | $35,370,402 |

| WA8 | Warriedar Resources | 0.041 | -16% | 913,655 | $25,010,673 |

| OEC | Orbital Corp Limited | 0.088 | -16% | 137,484 | $15,309,707 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.