Closing Bell: The ASX has had a Tuesday win after buyers returned for more of Kali

News

The ASX200 has come out on top for only the second time this year after a bright showing overnight on Wall Street.

Local markets were in the kind of ebullient form on Tuesday which comes only from having been in a stupor for several days previous.

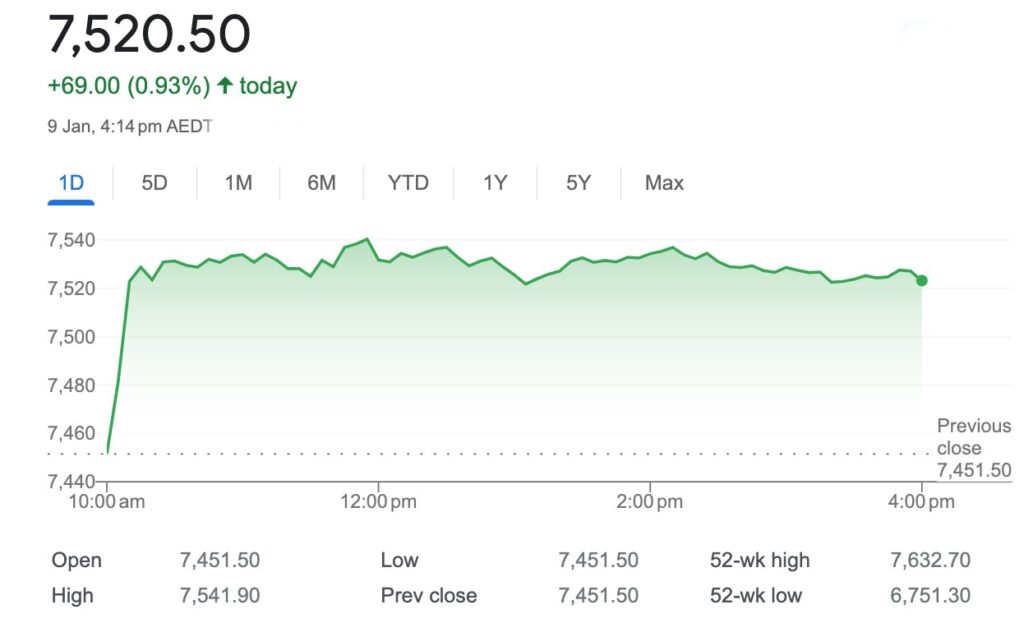

At 4.15pm on Tuesday, the S&P/ASX 200 was up 69 points or 0.93% to 7,520.5

The ASX benchmark has been bleeding out since missing out on a new record high on the first trading session of 2024, but that’s all been put to bed for a day at least.

In New York, Wall Street logged a strong session overnight amid an upturn in tech stocks ahead of what is really an uncertain looking Q4 earnings season.

At home, retail sales lifted by 2% MoM in November, way, way beating market estimates of a 1.2% rise.

According to the Australian Bureau of Stats, this read was the damndest acceleration in retail trade since November 2021, driven by a terrific response to Black Friday events last year.

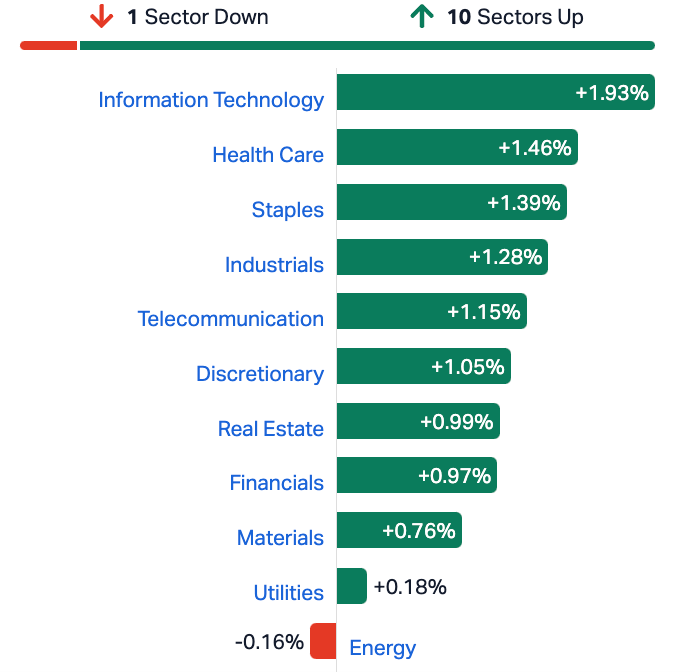

The response on markets was emphatic. All 11 sessions save for Energy were ahead on Tuesday in Sydney. IT, Healthcare and Consumer stocks were leading gains after November sales delivered a big win for retailers.

Zip Co, Block and Xero had blockbusting sessions for local tech.

All the iron ore majors rallied as commodity prices improved and optimism around China emerged.

Fortescue led the trio, up almost 1.5%. Although iron ore minnow Pear Gull eclipsed them all, ahead almost 13.5%.

In local company news, uranium, small cap lithium and goldies were all in demand.

Even Core Lithium, down about 1 million per cent after mothballing its NT ops gained more than 2%.

Around the region, Asian-Pacific equity markets were comparatively euphoric for 2024.

In Japan, the Nikkei 225 and South Korea’s Kopsi were in the green around lunchtime.

Shares in Hong Kong were doing their best to get off that 14 month mat, with morning gains for healthcare, utilities, and consumers.

Mainland stocks were also higher – that part of the world feeling upbeat after a PBoC official seemed to say there could be a shadow of a plan to boost lending with a bit more liquidity sloshing about.

Lenovo led the gains in HK, up circa 6% before lunch.

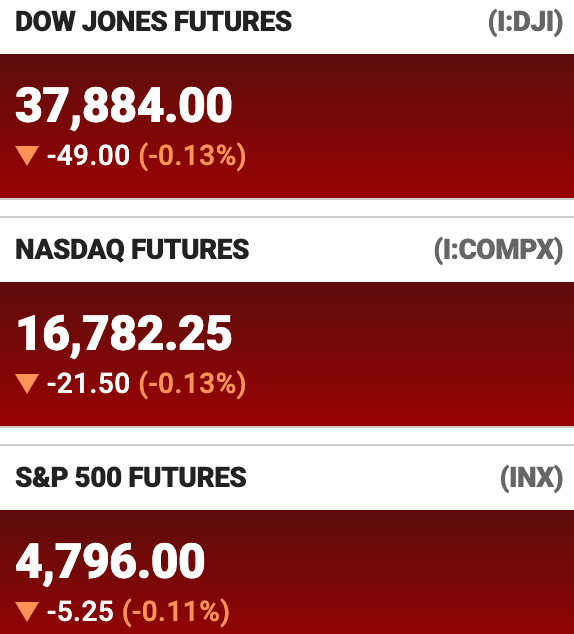

Wall Street is bracing later in the week for the release of key inflation data, which would drop some dots around the Fed’s massive cash rate plot. Hell. It’s a conspiracy.

US stockmarket futures at 4.30pm on Tuesday in Sydney:

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.002 | 33% | 3,000,000 | $3,200,685 |

| FAU | First Au Ltd | 0.004 | 33% | 15,971,679 | $4,985,980 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 6,366,834 | $1,632,173 |

| RCR | Rincon | 0.046 | 31% | 28,634,424 | $6,218,201 |

| KLI | Killiresources | 0.063 | 26% | 276,056 | $2,978,753 |

| RC1 | Redcastle Resources | 0.015 | 25% | 184,908 | $3,939,410 |

| WIN | Widgienickellimited | 0.11 | 24% | 737,316 | $26,517,110 |

| LBT | LBT Innovations | 0.011 | 22% | 271,155 | $11,337,093 |

| KM1 | Kalimetalslimited | 0.53 | 22% | 12,524,917 | $33,208,811 |

| AMD | Arrow Minerals | 0.0085 | 21% | 79,971,322 | $24,316,356 |

| LV1 | Live Verdure Ltd | 0.46 | 21% | 552,406 | $45,294,691 |

| OAR | OAR Resources Ltd | 0.003 | 20% | 331,875 | $6,609,319 |

| RGS | Regeneus Ltd | 0.006 | 20% | 559,213 | $1,532,185 |

| AS1 | Asara Resources Ltd | 0.013 | 18% | 1,423,063 | $8,720,040 |

| COY | Coppermoly Limited | 0.013 | 18% | 50,000 | $7,657,490 |

| PHL | Propell Holdings Ltd | 0.013 | 18% | 75,300 | $1,323,911 |

| CSS | Clean Seas Ltd | 0.305 | 17% | 577,435 | $49,621,083 |

| PGD | Peregrine Gold | 0.34 | 17% | 74,464 | $19,428,979 |

| PIL | Peppermint Inv Ltd | 0.021 | 17% | 9,415,244 | $36,681,423 |

| ADY | Admiralty Resources. | 0.007 | 17% | 554,292 | $7,821,475 |

| AVE | Avecho Biotech Ltd | 0.0035 | 17% | 4,988,878 | $9,507,891 |

| PFG | Prime Financial | 0.25 | 16% | 537,237 | $46,781,313 |

| FIN | FIN Resources Ltd | 0.022 | 16% | 173,911 | $12,336,105 |

| EXT | Excite Technology | 0.008 | 14% | 320,330 | $9,304,692 |

| PXX | Polarx Limited | 0.008 | 14% | 1,940,739 | $11,477,317 |

Up handsomely on Tuesday was Rincon Resources (ASX:RCR), which last had news for the ASX on 03 January when the company announced that drilling had confirmed wide zones of mineralisation at its Westin Prospect in WA.

Meanwhile, Monday’s debutante Kali Metals (ASX:KAL) fired back into life, adding another 23% to the 78% it stacked on during its first day on the bourse.

And Widgie Nickel (ASX:WIN) enjoyed a boost of its own, after investors took their sweet time digesting an early morning announcement that of an updated JORC-compliant Mineral Resource Estimate for its Gillett nickel deposit.

Widgie says there is a lot more nickel at the site and that’s got investors up and out of their seats, pushing the company nearly 24% higher.

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NME | Nex Metals Explorat | 0.019 | -27% | 11,530 | $9,165,846 |

| NVQ | Noviqtech Limited | 0.003 | -25% | 170,000 | $5,237,781 |

| AKM | Aspire Mining Ltd | 0.125 | -22% | 662,608 | $81,221,918 |

| KNB | Koonenberrygold | 0.043 | -22% | 119,812 | $6,586,200 |

| VN8 | Vonex Limited. | 0.02 | -20% | 681,988 | $9,045,716 |

| DOU | Douugh Limited | 0.004 | -20% | 52,770 | $5,410,345 |

| SLM | Solismineralsltd | 0.16 | -16% | 656,529 | $14,896,134 |

| TLM | Talisman Mining | 0.245 | -16% | 831,089 | $54,612,901 |

| NWF | Newfield Resources | 0.11 | -15% | 50,000 | $117,418,915 |

| CR9 | Corellares | 0.022 | -15% | 21,136 | $12,092,363 |

| SNT | Syntara Limited | 0.017 | -15% | 4,476,102 | $16,626,268 |

| MAT | Matsa Resources | 0.03 | -14% | 254,339 | $16,753,591 |

| PUA | Peak Minerals Ltd | 0.003 | -14% | 751,633 | $3,644,818 |

| TMK | TMK Energy Limited | 0.006 | -14% | 37,752,948 | $42,858,055 |

| TSL | Titanium Sands Ltd | 0.012 | -14% | 1,371,978 | $27,912,223 |

| VAL | Valor Resources Ltd | 0.003 | -14% | 1,952,581 | $14,606,672 |

| NGS | NGS Ltd | 0.013 | -13% | 839,249 | $3,768,411 |

| SW1 | Swift Networks Group | 0.013 | -13% | 1,555,053 | $9,698,616 |

| TFL | Tasfoods Ltd | 0.026 | -13% | 25,151 | $13,112,865 |

| ASE | Astute Metals NL | 0.033 | -13% | 20,000 | $15,599,741 |

| WTM | Waratah Minerals Ltd | 0.1 | -13% | 562,937 | $17,176,917 |

| AVL | Aust Vanadium Ltd | 0.02 | -13% | 10,584,988 | $114,277,956 |

| E33 | East 33 Limited. | 0.02 | -13% | 10,772 | $12,353,040 |

| AD1 | AD1 Holdings Limited | 0.007 | -13% | 100,000 | $7,189,187 |

| MHC | Manhattan Corp Ltd | 0.0035 | -13% | 603,000 | $11,747,919 |

Alumina (ASX:AWC) – pending receipt of information in respect of an expected decision by Alcoa Corporation.

NickelX (ASX:NKL) – pending an update to the market in respect of the option agreement the company previously announced regarding the Ransko and Otov exploration projects.

Galena Mining (ASX:G1A) – pending an announcement regarding a strategic review of operations.

Worley (ASX:WOR) – pending a clarificatory announcement to the market.