Critica smashes records to deliver Australia’s largest clay-hosted rare earth resource

Jupiter’s contained REE is globally significant and potentially strategic to Australia’s future supply chain. Pic: Getty Images

- Critica delivers globally significant rare earths resource with a high grade component of 500mt at 2200 ppm TREO included within 1.8Bt at 1700 ppm TREO at its Jupiter clay-hosted rare earths project

- Jupiter is just one of six discrete REE discoveries at the broader Brothers project, strategically located in Western Australia

- Initial metallurgical testwork has successfully demonstrated an impressive beneficiation upgrade of 830% along with a 95% reduction in overall mass

- The company is well funded to continue advancing metallurgical testwork and drill satellite targets

Special Report: In just over 18 months since discovery, Critica has delivered Australia’s largest and highest-grade clay-hosted rare earths deposit – and it’s not even a close race.

Critica Ltd (ASX:CRI) has achieved a major milestone with the release of a maiden mineral resource estimate for its flagship Jupiter clay-hosted rare earths project, which now counts as Australia’s largest and highest-grade clay hosted rare earth resource with 1.8Bt or ore at a grade of 1700ppm total rare earth oxides.

That includes a higher-grade component of 500Mt at 2200ppm. The project is unrivalled in both size and grade in Australia, and also benefits from very low in-situ uranium and thorium content.

Jupiter, which forms part of the broader Brothers Project, was first identified through geophysical surveying in November 2023.

In just over 12 months since first discovery, Critica has rapidly grown the project through RC and aircore drilling, delineating a 40km2 discovery area with shallow, broad and continuous mineralisation. That’s 550 MCGs packed to the gills with high grade rare earth elements.

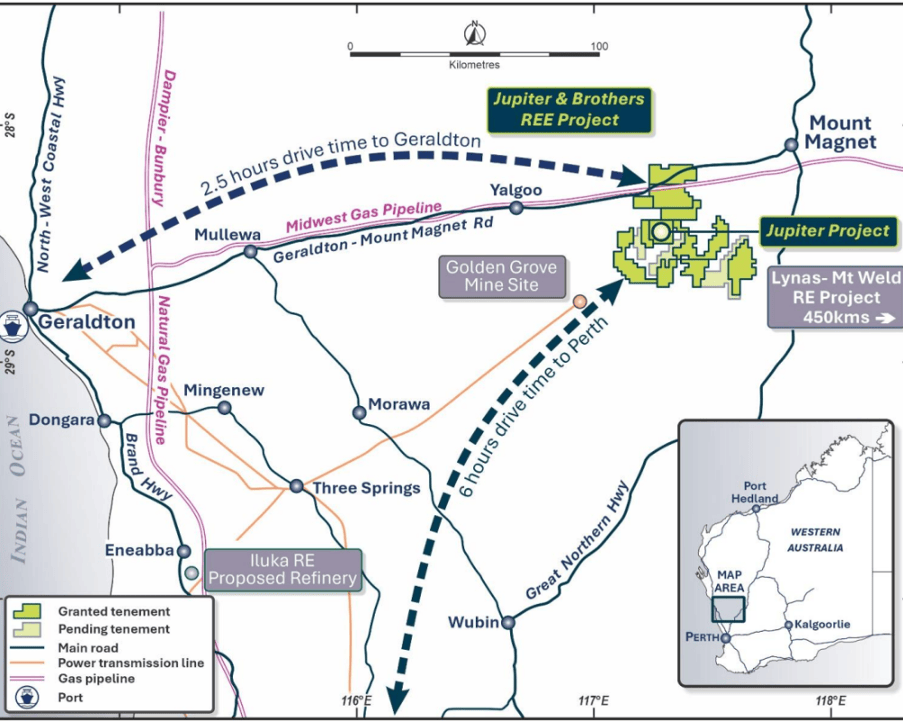

Strategically located in a well-established West Australian mining district, Jupiter and the broader Brothers project sits across semi-contiguous granted tenure 60km west of Mt Magnet, 550km northeast of Perth and down the road from the port city of Geraldton.

As a result, any future development at Jupiter benefits from existing transport and power infrastructure.

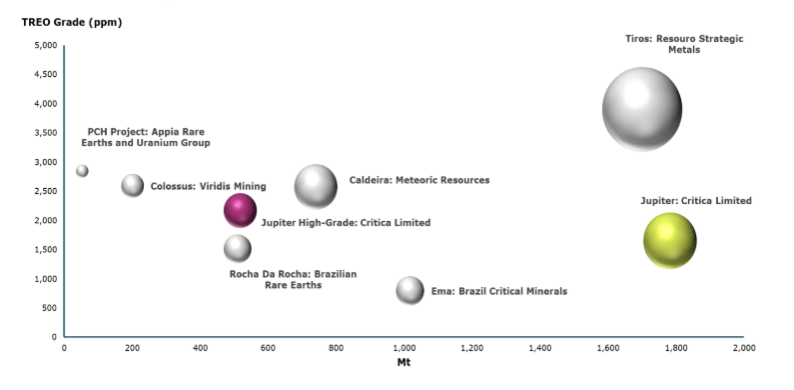

The MRE not only places Jupiter as one of the largest clay-hosted rare earth deposits in Australia, but also positions it as a globally significant resource rivalling clay-hosted rare earths deposits in Brazil that have drawn investor attention from across the globe, including Meteoric’s Caldeira deposit.

Impressive metallurgical results highlight significant commercial potential

The delivery of the MRE swiftly follows another key milestone for Critica. In late January 2025, the company released the results of initial metallurgical work based on composite rare earth samples of Jupiter mineralisation.

These metallurgical results have returned impressive beneficiation results on a composite sample increasing concentration up to 13,310 ppm TREO, an effective upgrade factor of over 9.3x.

Notably, this metallurgical work was also produced with a 95% reduction in overall mass, concentrating the grade into just 5% of the starting mass.

“These initial metallurgical results are quite extraordinary when you look at the size of the resource,” Critica Managing Director Philippa Leggat told Stockhead.

“The huge reduction in mass to just 5%, along with an almost 10 times uplift in grade, are really meaningful for future processing opportunities.

“This result delivers the very real potential for lower costs and higher value outcomes given the implications it has for the much lower required scale in the next phase of processing. It therefore also provides us with significant optionality when it comes to considering future potential development scenarios.”

From a commercial standpoint, Leggat said the provincial-scale asset is also already ticking a lot of boxes.

“The scale of the opportunity at Jupiter is enormous. We’ve also made five other satellite discoveries, including high-value MREO ratios up to 34%,” Leggat said.

“These discoveries are an example of how our outstanding team is leveraging the intellectual property that we are building. We are progressively utilising the same approach, also with considerable benefits, in the metallurgy area.”

In a global sense, most clay-hosted rare earth deposits of commercial scale are situated in southern China and within contested border provinces of politically fraught Myanmar, or Brazil. But Jupiter sits in WA, a first world jurisdiction with deep ties to the West, Europe and the US, and that regularly ranks among the top 5 in the Fraser Institute survey of mining investment attractiveness.

“We’ve locked up something that has provincial scale in the developing rare earth district that is Western Australia – that has obvious appeal. The infrastructure is here, and the scale and grade of Jupiter are remarkably consistent – these are attributes that deliver strong potential for consistency and security of supply,” Leggat said.

Well-placed with M&A potential

Jupiter forms part of the wider Brothers asset, which spans across a dominant 1353km2 landholding less than 10km from the Mount Magnet-Geraldton bitumen highway, which provides direct access to local labour centres and the Port of Geraldton.

Two future energy sources (the mid-west gas pipeline and transmission power lines) have also been identified close to the project, with Lynas’ (ASX:LYC) Mt Weld mine and rare earths concentrator only 450km away.

Iluka Resources (ASX:ILU) is planning a rare earth refinery at Eneabba, which is well within trucking distance of Jupiter.

With growing interest in the region from major Australian rare earth players, Critica appears an attractive potential candidate for M&A interest further down the track.

Notably, Wesfarmers – having lobbed a $1.5b bid for LYC two years ago – has revealed its intention to hunt for more rare earths at the end of last year and is pegging tenements in WA.

There’s plenty of interest from non-Chinese customers in securing Aussie supply. Neighbours Victory Metals (ASX:VTM) snagged an offtake deal with Japanese trading company Sumitomo for 30% of North Stanmore’s rare earths annually for a period of five years, demonstrating the marketing potential despite a recent lull in rare earths spot pricing.

“This shows us that even though rare earths prices are a long way from their peaks, strategically these bigger players still see a reason for wanting to secure longer term supply,” Leggat said.

Next on the agenda

Critica continues to build on its discovery, expanding its exploration and geological team and utilising its impressive IP to identify new discoveries.

This IP, backed by three PhD accredited geologists and metallurgists who discovered Jupiter a little over 18 months ago, has continued to produce exploration success.

Critica’s priorities for 2025 are focused on additional exploration and evaluation works, including further comprehensive metallurgical testwork and the drill testing of satellite targets in the coming months.

“What we’ve put out is only first pass metallurgical testwork. We’re expecting to improve on that before we start working on our next development stages,” Leggat said.

Well-funded and backed by recent exploration success, Critica remains on the fast-track to advance its Jupiter Project. The ultimate aim is to take what has quickly emerged as one of Australia’s most significant, clay-hosted rare earth discoveries and turn it into a major potential REE development project.

This article was developed in collaboration with Critica, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.