Closing Bell: The ASX got slow-boiled like a frog in a pot to close at -0.69pc down

Righto... which one of you deviates ordered the 'Dirty Kermit'? Pic via Getty Images

- ASX200 manage to sleepwalk its way to a -0.69pc close on a hot’n’snoozy hump day

- ASX sectors topped by Real Estate and InfoTech, but it wasn’t by much

- Small cap winners include market newbie Kali Metals and a bunch of uranium players

The ASX200 is a bit of a loser today.

At 4.15pm on Wednesday, the S&P/ASX 200 was down 52 points or 0.69% to 7,468.5:

The day panned out in a slow and somewhat tedious fashion, with the rot setting in around the time the ABS delivered what amounted to a drive-by mid-morning, slowing only a little before hurling a sheaf of papers at investors and roaring off again.

And thus, the various prayers, offerings and human sacrifices made upon the ASX altar of inflation were answered, with some apparent consecutive data points out of the Australian Bureau of Stats, confirming the direction of inflation in this country is not up.

The Monthly CPI for November came in at at 4.3% YoY – below the 4.4% expected and way below the 4.9% print of October.

The ABS reports the annual trimmed mean inflation for November was 4.6%, a meaty fall from 5.3% in October.

Excluding volatile items like petrol and food, the ABA pinned the annual rise in November at 4.8 per cent, lower than the annual rise of 5.1 per cent in the previous month.

IG markets senior analyst Tony Sycamore notes that ahead of the release, the local rates market was booking a 100% chance of an RBA rate cut in August before another 25bp rate cut by December.

“Today’s fall in the trimmed mean and the core measure, below 5%, confirms that the disinflation narrative remains firmly in place and expectations of RBA rate cuts in 2024,” Tony says.

“If Q4 inflation data scheduled for release at the end month paints a similar picture, there is a good chance that expectations of the RBA’s first rate cut are brought forward to June, with a third rate cut added into the rates market for 2024.”

In short, the read was good and markets responded accordingly, with the IT sector leading the rise across the benchmark’s more rate sensitive stocks.

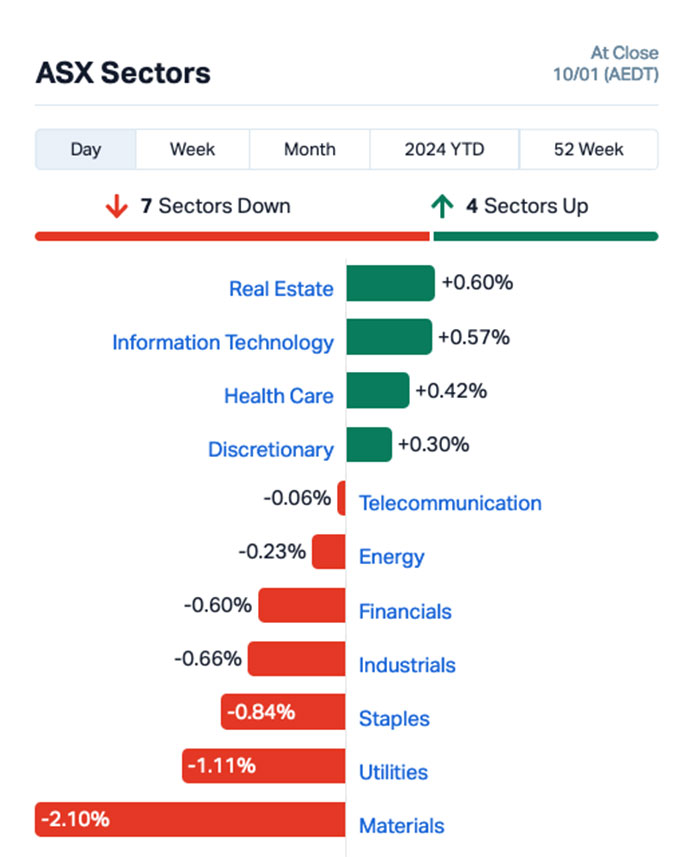

ASX SECTORS ON WEDNESDAY

The chart says it all, really – with the market feeling broadly down in the dumps, and despite four sectors ending the day on the happy side of break even, the rest of the market was the proverbial millstone around the neck of investors.

The results are pretty much colour-by-numbers – Real Estate and InfoTech did okay, Materials did not and everyone else just milled around in between, pretending like they’re not involved.

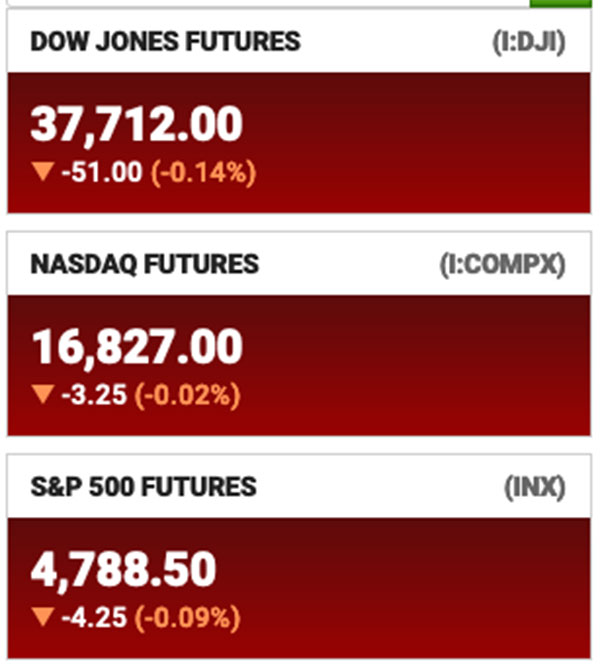

On Wall Street, US stock futures steadied on Wednesday after the 3 big averages ended mixed overnight.

In the regular session, the Dow Jones and the S&P500 retreated 0.4% and 0.15%, respectively, while the Nasdaq Composite inched ahead by 0.1%.

Energy, Materials and Utility stocks led the losers, which Tech and Consumer stocks could not offset.

US traders now have to brace for their own hit of inflation data which will provide the latest breadcrumbs on the Fed’s path for US monetary policy.

US stockmarket futures at 4.30pm on Wednesday in Sydney:

Tonight’s not looking like it’s going to be a red-hot banger for Wall Street… so let’s go take a squizz at who won among the Aussie Small Caps today… that should cheer everyone up.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | 100% | 1,912,869 | $4,728,824 |

| KM1 | Kalimetalslimited | 0.77 | 47% | 24,144,788 | $40,079,600 |

| EMP | Emperor Energy Ltd | 0.015 | 36% | 12,447,577 | $3,748,112 |

| LIO | Lion Energy Limited | 0.019 | 36% | 1,625,227 | $6,117,689 |

| BP8 | Bph Global Ltd | 0.002 | 33% | 250,000 | $2,753,345 |

| NVQ | Noviqtech Limited | 0.004 | 33% | 11,876,446 | $3,928,336 |

| SIS | Simble Solutions | 0.004 | 33% | 3,821,511 | $1,808,852 |

| CPO | Culpeominerals | 0.125 | 30% | 22,866,243 | $11,189,987 |

| GUE | Global Uranium | 0.13 | 30% | 3,017,089 | $21,220,897 |

| ADD | Adavale Resource Ltd | 0.009 | 29% | 6,451,892 | $5,226,120 |

| FFG | Fatfish Group | 0.039 | 26% | 28,469,207 | $43,097,430 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 611,185 | $5,060,460 |

| 29M | 29Metalslimited | 0.7 | 23% | 2,580,461 | $399,749,738 |

| FHS | Freehill Mining Ltd. | 0.011 | 22% | 47,083,083 | $25,648,510 |

| AKM | Aspire Mining Ltd | 0.145 | 21% | 346,928 | $60,916,438 |

| HTA | Hutchison | 0.036 | 20% | 240,070 | $407,175,257 |

| BMG | BMG Resources Ltd | 0.012 | 20% | 5,186,551 | $6,337,972 |

| CXU | Cauldron Energy Ltd | 0.037 | 19% | 10,230,951 | $35,118,011 |

| YRL | Yandal Resources | 0.155 | 19% | 169,002 | $30,514,400 |

| EMD | Emyria Limited | 0.07 | 19% | 2,731,642 | $21,631,134 |

| 1AE | Auroraenergymetals | 0.13 | 18% | 1,314,809 | $17,512,762 |

| NWF | Newfield Resources | 0.13 | 18% | 7,524 | $99,354,467 |

| MAG | Magmatic Resrce Ltd | 0.046 | 18% | 146,796 | $11,922,019 |

| ICE | Icetana Limited | 0.033 | 18% | 91,821 | $7,409,596 |

| NMT | Neometals Ltd | 0.205 | 17% | 3,812,200 | $108,970,805 |

Market newbie Kali Metals (ASX:KM1) was absolutely crushing it again in early trade, up 38% and bucking the overall sell-off trend that has hit the ASX’s lithium players pretty hard today.

Kali dropped a well-timed announcement about rock chip and soil sampling that was carried out prior to its IPO this week, with results confirming that spodumene has been identified at Spargoville, part of its Higginsville lithium district in WA. Kali’s price continued to improve, moving beyond +46% by mid-afternoon.

Culpeo Minerals (ASX:CPO) was also on the move again today, after the company spent a couple of days becoming pen pals with the watchdogs at the ASX over who knew what and when in relation to the company finding a copper-gold porphyry system at La Florida.

The correspondence is all a little convoluted, but the gist of it is that Culpeo got a bunch of results from rock chip sampling on the morning of 26 December – but, Culpeo says, it then took a while to get those results confirmed and the information out to market, which explains why it didn’t go public with the results until 04 January.

So the ASX wanted to know why it looked like there was something similar to a betting plunge on Culpeo stocks over the period between those dates, when the information had not been disclosed.

Culpeo says it’s all above board, and that any delays in getting the data out were simply down to the holiday season and staff availability other such Christmassy things.

While we’re on the topic of correspondence, Fatfish Group (ASX:FFG) got a speeding ticket this afternoon, asking for an explanation for why it’s become hot property in recent days, climbing from $0.013 to $0.039 since 21 December.

Fatfish pointed to its recently completed, oversubscribed cap raise from earlier in the month, and suggested that might be the reason why.

Emperor Energy (ASX:EMP) put on some late value in the wake of an announcement entitled “Judith Permeability Update”, which confirmed that Judith is, indeed, quite permeable and very gassy.

It also noted that Judith isn’t, as I assumed, a nursing home resident… it is, in fact, the name of a well first drilled by Shell in 1989, which Emperor has been busily probing as part of an updated petrophysical evaluation.

Freehill Mining (ASX:FHS) enjoyed an announcement-free surge this morning, with the iron-copper-gold explorer adding a nifty 33.3% so far for the day, while Global Uranium and Enrichment (ASX:GUE) rode the uranium surge that’s had the market excited today, as it too took on extra value without an announcement, adding 30% in early trade

Meanwhile, another uranium explorer, Gladiator Resources (ASX:GLA) , took off rapidly in early trade on the back of news that re-analysis of uranium samples from a trenching program at Southwest Corner – part of the Mkuju project in Tanzania – have come back above the detection limit (4245ppm U3O8) returned grades up to 7139ppm.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.001 | -50% | 649,998 | $4,267,580 |

| TX3 | Trinex Minerals Ltd | 0.006 | -25% | 64,381 | $11,896,197 |

| AUK | Aumake Limited | 0.004 | -20% | 177,320 | $9,572,034 |

| SKN | Skin Elements Ltd | 0.004 | -20% | 2,059,657 | $2,947,430 |

| 8VI | 8Vi Holdings Limited | 0.061 | -19% | 2,530 | $3,143,357 |

| YAR | Yari Minerals Ltd | 0.009 | -18% | 4,666 | $5,305,936 |

| ASQ | Australian Silica | 0.048 | -17% | 360,400 | $16,347,902 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 300,000 | $10,556,231 |

| OAR | OAR Resources Ltd | 0.0025 | -17% | 10,500 | $7,931,183 |

| BVR | Bellavistaresources | 0.099 | -14% | 63,829 | $5,705,262 |

| A1G | African Gold Ltd. | 0.031 | -14% | 217,014 | $6,095,204 |

| KAL | Kalgoorliegoldmining | 0.025 | -14% | 12,094 | $4,596,521 |

| CZN | Corazon Ltd | 0.013 | -13% | 1,000,000 | $9,233,968 |

| EXT | Excite Technology | 0.007 | -13% | 581,900 | $10,633,934 |

| MHC | Manhattan Corp Ltd | 0.0035 | -13% | 150,000 | $11,747,919 |

| C29 | C29Metalslimited | 0.071 | -12% | 60,000 | $4,371,320 |

| OD6 | Od6Metalsltd | 0.11 | -12% | 238,328 | $6,876,937 |

| EVZ | EVZ Limited | 0.15 | -12% | 4,537 | $20,585,626 |

| MBK | Metal Bank Ltd | 0.024 | -11% | 223,334 | $10,542,401 |

| KLI | Killiresources | 0.056 | -11% | 10,000 | $3,753,229 |

| CDD | Cardno Limited | 0.32 | -11% | 11,354 | $14,061,839 |

| EFE | Eastern Resources | 0.008 | -11% | 2,517,209 | $11,177,518 |

| GGE | Grand Gulf Energy | 0.008 | -11% | 2,345,111 | $18,857,223 |

| OSL | Oncosil Medical | 0.008 | -11% | 848,110 | $17,770,870 |

| DKM | Duketon Mining | 0.165 | -11% | 53,151 | $22,612,506 |

TRADING HALTS

MTM Critical Metals (ASX:MTM) – pending an announcement regarding a proposed capital raise.

Rincon Resources (ASX:RCR) – pending the release of an announcement in relation to a capital raising.

Bounty Oil & Gas (ASX:BUY) – pending an announcement in relation to a proposed capital raising.

Yandal Resources (ASX:YRL) – pending a response to an ASX query regarding Yandal’s recent share price movement.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.