Closing Bell: That’ll be another +0.3pc for the ASX Christmas party as materials matter again

Via Getty

- The ASX benchmark has closed higher on Tuesday

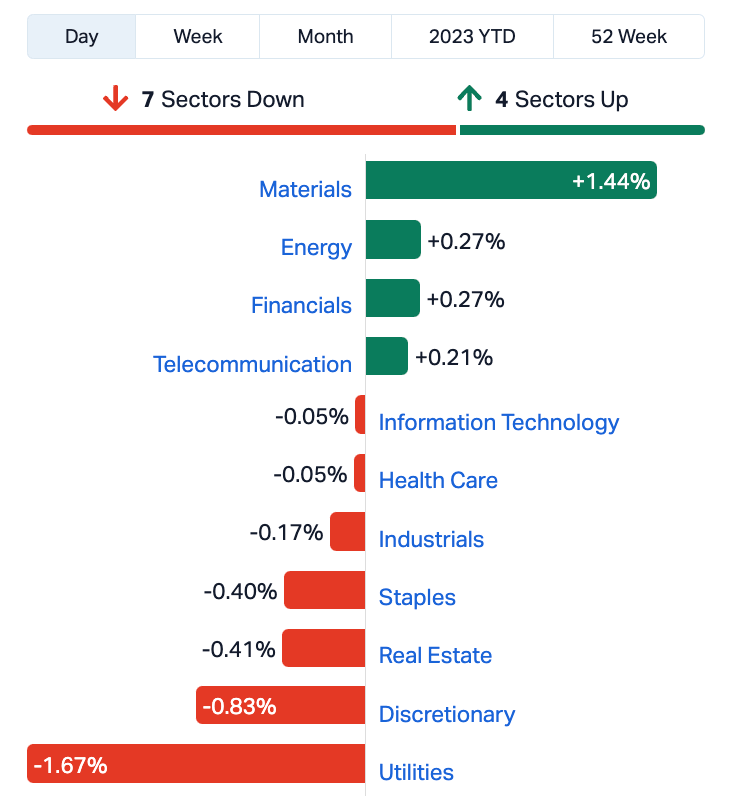

- Materials sector leads gains, up +1.44%

- Small caps led by ROO, CBE

The Aussie sharemarket has made it two on the trot, ending the Tuesday session slightly higher, as markets across the Asia-Pacific largely tracked Wall Street’s tech-led rally overnight.

Light volumes and strong leads were tempered by (in the words of UBS) ‘a surprisingly hawkish’ set of minutes (the SOMP) from the central bank – hastening the UBS view that it’s the local cash rate’s turn to go higher-for-longer. UBS says the cash rate (OCR) is going to stay plugged into 4.35% for about the next year.

Oh, no, wait. There could be another 25 basis point lift after the RBA January holiday.

No one believes that yet.

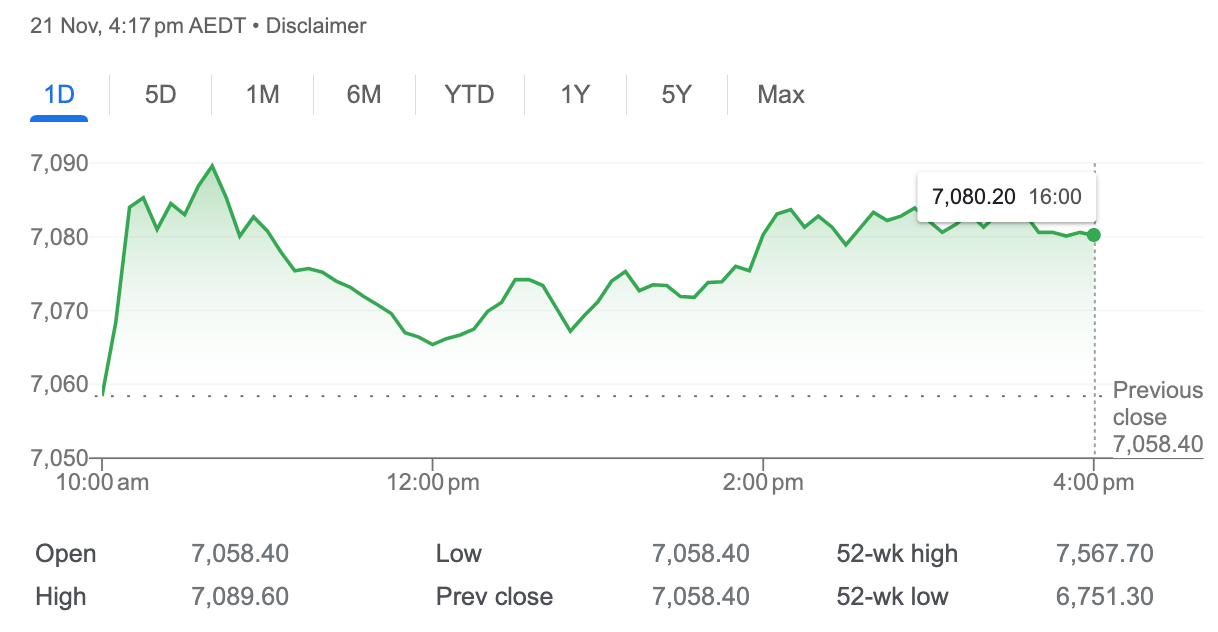

At match-out on Tuesday November 21, the S&P/ASX 200 (XJO) index was up about 19 points, or +0.28% at 7,078:

Local traders were more mesmerised by the iron ore majors than they’ve been in a while. There’s all sorts of rumours that Beijing is prepping a shortlist of about 50 property developers picked out specially for special loans to kickstart the flatlined real estate market.

The materials sector closed almost +1.5% higher, the resources stocks dragging the benchmark higher.

The major mining stocks extended morning gains as iron ore futures in Singapore took off again – rising +1.4%.

ASX Sectors On Tuesday

Chart via Marketindex

In the states the Nasdaq 100 ended at its highest in 22 months, on a flood of madcap bets for anything remotely looking like artiifical intelligence (AI) and the steady stream of quasi-evidence that inflation is done and the US economy can land itself softly over Xmas on dignified and sustainable growth.

Wall Street could almost taste vacation and Nvidia in the air (that’s a very super highly anticipated earnings report) and traders seemed to revel in crazy news like the axing of OpenAI dad and founder Sam Altman and then cheer on the news that Microsoft – OPenAI’s largest investor – had pinched him to come lead their new AI research project.

Equity markets on our side of the planet have joined the fun. Shares are higher in South Korea, Hong Kong and mainland China, while Japanese stocks have finally taken a break from surging every which way and have come to punch lower in Tokyo.

The Shanghai Composite is at one-month highs, while equities in Hongkers literally jumped out of their shoes during the morning session and making it look like an almost unfathomable two-in-a-row for the Hang Seng.

Meanwhile, at home we got to pore/pour(?) over the minutes of the recent Reserve Bank of Australia’s monetary policy meet.

At least I did.

It was important to prevent inflation expectations in Australia from increasing significantly, given the costs of that eventuality said the statement on monetary policy, typed up all nice from the get together on Melbourne Cup Day so many moons ago.

Led for the first time by new implacable Governor Michele Bullock, members agreed they were aware inflation had eased a wee bit, but the lava was underlying and core inflation was hotter than anyone wanted or expected it might still be.

The bank’s rejigged its forecasts, too. CPI inflation is now projected to be around 3-1/2% by the end of 2024 and at the top of the target range of 2 to 3% by the end of 2025.

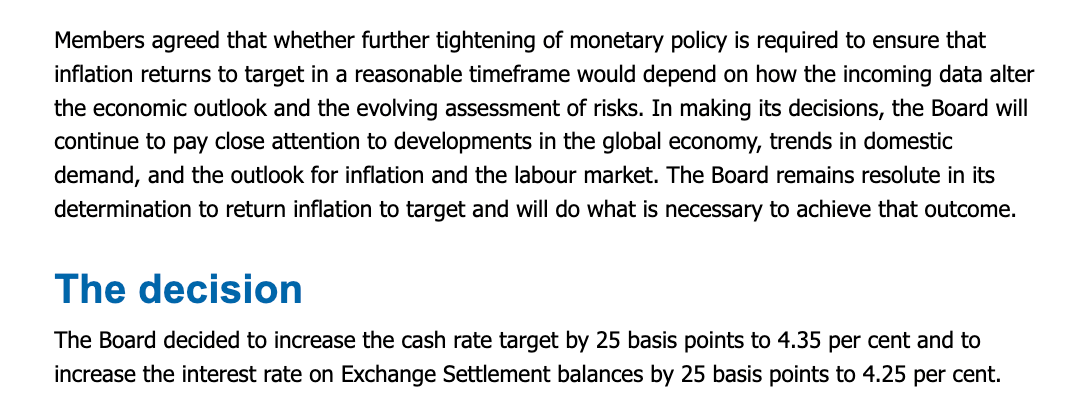

The RBA agreed that “whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe would depend on how the incoming data alter the economic outlook and the evolving assessment of risks.”

Anyway, the best bits are in the last par. If any of the wording below changes, then it’s game on (or off!):

Meantime, US Futures ahead of the Tuesday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ROO | Roots Sustainable | 0.007 | 75% | 17,007,545 | $642,410 |

| AMD | Arrow Minerals | 0.0015 | 50% | 26,970,776 | $3,023,765 |

| PR1 | Pureresourceslimited | 0.245 | 44% | 19,833,472 | $4,360,502 |

| AMM | Armada Metals | 0.04 | 43% | 499,836 | $4,831,906 |

| TG1 | Techgen Metals Ltd | 0.088 | 33% | 16,136,029 | $5,093,107 |

| AYT | Austin Metals Ltd | 0.008 | 33% | 902,783 | $6,095,248 |

| CBE | Cobre | 0.052 | 33% | 3,784,682 | $11,189,529 |

| CCO | The Calmer Co Int | 0.008 | 33% | 9,886,401 | $4,902,716 |

| NRX | Noronex Limited | 0.013 | 30% | 2,188,764 | $3,783,018 |

| BPH | BPH Energy Ltd | 0.032 | 28% | 7,177,846 | $25,637,812 |

| CUF | Cufe Ltd | 0.014 | 27% | 3,472,013 | $12,607,236 |

| CBY | Canterbury Resources | 0.03 | 25% | 578,505 | $3,468,565 |

| YOJ | Yojee Limited | 0.005 | 25% | 549,550 | $4,540,818 |

| TCG | Turaco Gold Limited | 0.086 | 23% | 10,603,734 | $35,190,167 |

| CC9 | Chariot Corporation | 0.5125 | 22% | 1,310,791 | $30,799,259 |

| RHK | Red Hawk Mining Ltd | 0.6 | 21% | 41,086 | $83,580,046 |

| EPM | Eclipse Metals | 0.009 | 20% | 996,837 | $15,328,532 |

| DTR | Dateline Resources | 0.012 | 20% | 780,132 | $13,129,455 |

| FGH | Foresta Group | 0.012 | 20% | 667,489 | $22,395,028 |

| FHS | Freehill Mining Ltd. | 0.003 | 20% | 200,000 | $7,112,003 |

| RIE | Riedel Resources Ltd | 0.006 | 20% | 3,855,090 | $10,297,035 |

| WNR | Wingara Ag Ltd | 0.024 | 20% | 231,666 | $3,510,850 |

| JRV | Jervois Global Ltd | 0.044 | 19% | 21,243,473 | $99,993,265 |

| GHY | Gold Hydrogen | 0.8125 | 19% | 1,434,368 | $38,992,271 |

| CAZ | Cazaly Resources | 0.04 | 18% | 720,876 | $13,430,102 |

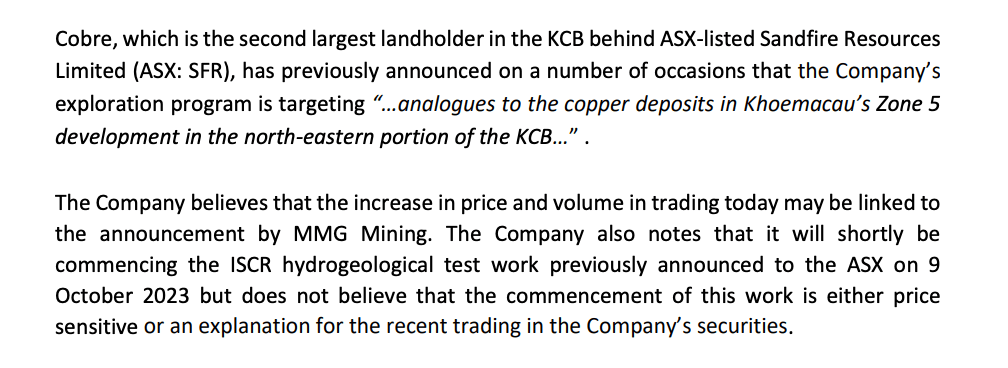

Absolutely smashing it on no news the emerging copper play Cobre (ASX:CBE), with prospective projects in both Botswana and Western Australia.

They got a speeding ticket from the ASX cope for their trouble, but also illuminating:

Cobre was up +33% by the time this was issued.

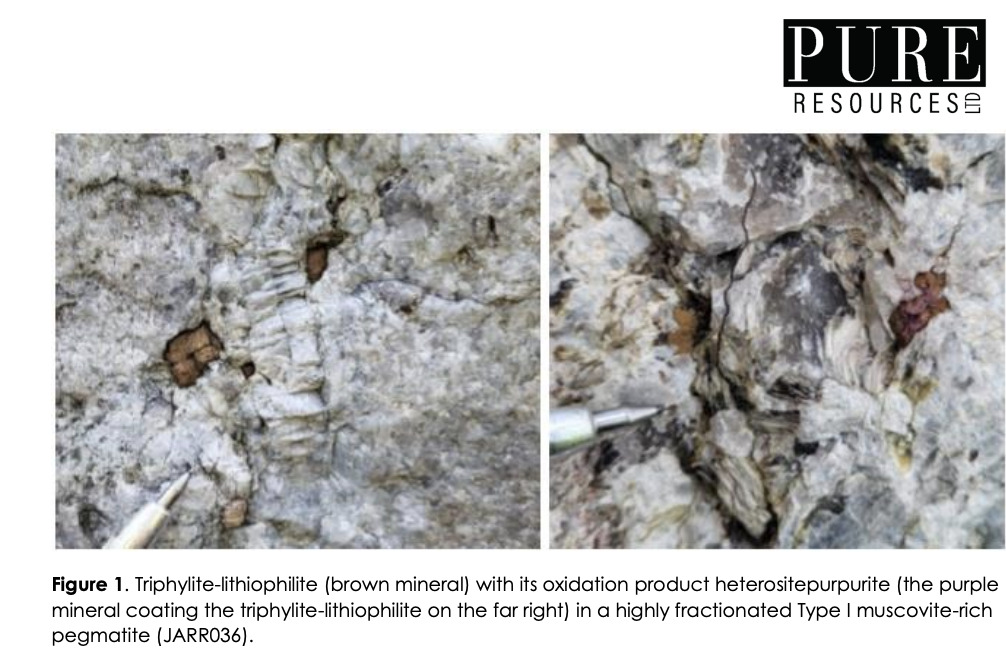

Pure Resources (ASX:PR1) was up over 65% this morning on news of some fabo lithium hits at the company’s Järkvissle project in Sweden.

Apparently the hero of the dish – a sample of up to 11.69% Li2o.

This is how that looks, BTW:

As Gregor my lunchtime doppleganger mused – “That is, clearly, astonishingly high – and it should be noted that the resting was performed using a LIBS system in the field.”

LIBS, short for Laser Induced Breakdown Spectroscopy, is an off-the-shelf, often portable analysis technique that uses spot readings of super-heated samples to determine the chemical composition of the material being tested.

It is similar in many ways to portable XRF readings, in that the accuracy of the sampling method is the subject of some pretty fierce debate.

Roots Sustainable Agricultural Technologies (ASX:ROO) had a terrific day on the bourse, up 75% early and it’s clung onto those gains.

It needed to as well because this has been ROO recently:

The Israeli-based agtech has a passion for managing a plant’s root zone temperatures in the face of the shortage of water for irrigation. It’s jumped today after successfully delivering equipment from Israel to the United Arab Emirates, for a major client Silal Food and Technology.

Roots says the ag-tech it has supplied is set to be installed this week, enabling the demonstration of the “application of Root Zone Temperature optimisation technology as part of its berry farming operations at the COP28 global conference at Expo City, Dubai in early December”.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | -33% | 16,380,970 | $12,477,690 |

| RNE | Renu Energy Ltd | 0.0165 | -25% | 3,820,400 | $9,844,760 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 13,714 | $4,267,580 |

| MTB | Mount Burgess Mining | 0.003 | -25% | 1,000,010 | $4,062,587 |

| TOY | Toys R Us | 0.012 | -25% | 5,191,392 | $15,719,416 |

| ION | Iondrive Limited | 0.011 | -21% | 8,092,028 | $6,807,994 |

| BMR | Ballymore Resources | 0.1 | -20% | 47,615 | $18,274,658 |

| CGR | Cgnresourceslimited | 0.16 | -20% | 1,512,269 | $18,155,638 |

| CHK | Cohiba Min Ltd | 0.002 | -20% | 3,000,000 | $5,533,110 |

| PHO | Phosco Ltd | 0.049 | -18% | 281,399 | $16,464,801 |

| IS3 | I Synergy Group Ltd | 0.009 | -18% | 302,721 | $3,344,884 |

| AI1 | Adisyn Ltd | 0.019 | -17% | 101,580 | $3,215,110 |

| LDR | Lode Resources | 0.075 | -17% | 1,248,001 | $9,610,573 |

| H2G | Greenhy2 Limited | 0.01 | -17% | 413,648 | $5,025,070 |

| MEL | Metgasco Ltd | 0.01 | -17% | 1,442,775 | $12,766,641 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 393,793 | $29,019,595 |

| NYR | Nyrada Inc. | 0.022 | -15% | 70,000 | $4,056,226 |

| CBL | Control Bionics | 0.041 | -15% | 110,100 | $4,915,628 |

| VMC | Venus Metals Cor Ltd | 0.09 | -14% | 344,770 | $19,921,512 |

| ADR | Adherium Ltd | 0.003 | -14% | 2,623,000 | $17,505,578 |

| CCZ | Castillo Copper Ltd | 0.006 | -14% | 2,108,564 | $9,096,537 |

| CVR | Cavalierresources | 0.12 | -14% | 50,000 | $4,456,048 |

| ETR | Entyr Limited | 0.006 | -14% | 1,690 | $13,881,727 |

| IBG | Ironbark Zinc Ltd | 0.006 | -14% | 50,000 | $10,267,490 |

| GSM | Golden State Mining | 0.019 | -14% | 5,676,286 | $5,254,926 |

Trading Halts

Enova Mining (ASX:ENV) – Pending an announcement by Enova Mining pending an announcement in relation to a potential acquisition of a mineral project

Frugl Group (ASX:FGL) – Pending the release of an announcement in connection with capital raising via a placement of securities

Charger Metals (ASX:CHR) pending an announcement from the Company regarding a proposed capital raising

Neometals (ASX:NMT) – Pending an announcement in relation to an equity raising

Great Boulder Resources (ASX:GBR) – Pending an announcement in relation to an capital raising

Australian Critical Minerals (ASX:ACM) pending the release of an announcement regarding assay results

Appen (ASX:APX) – Pending an announcement to ASX in connection with a pro rata accelerated non-renounceable entitlement offer and institutional placement

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.