Closing Bell: Telix, banks lift ASX; but Newmont and Fortescue trip over soaring costs

Newmont and Fortescue trip over weak results. Picutre via Getty Images

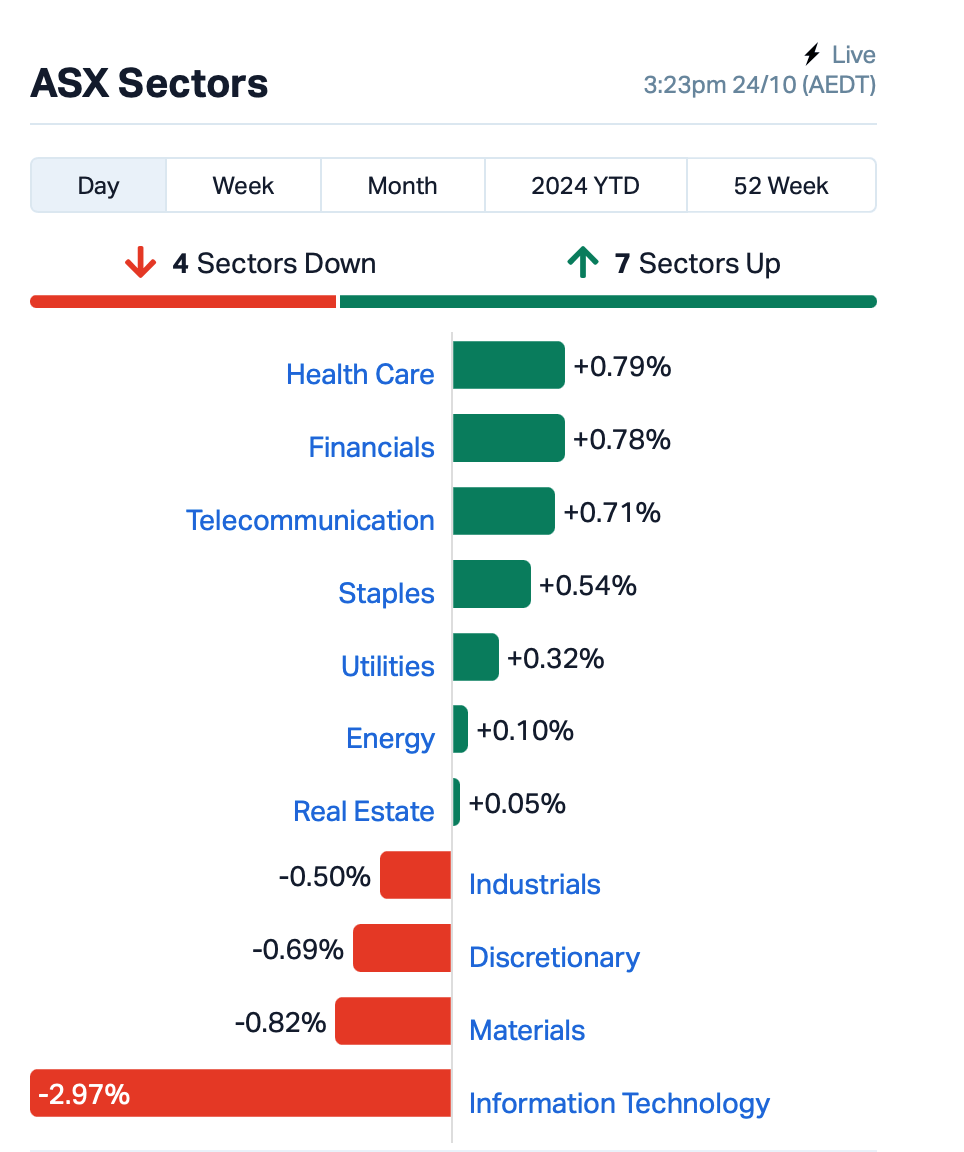

- ASX ends very modestly lower after a mixed session

- Newmont and Fortescue shares drop on disappointing updates

- WiseTech continues its slide as investors start to grumble

Aussie shares swung to a flattish close today after earlier losses.

Overnight in the US, things weren’t too great either, with the tech-heavy Nasdaq dropping 1.6% as tech giant Apple said that its iPhone orders have been down significantly.

Tesla shares, however, posted an 8% gain in post-market trading after its Q3 numbers surpassed analysts’ predictions. The company’s net income rose 17.3% year-over-year to $2.17 billion, fuelled by a 6.4% increase in vehicle sales.

On the ASX today, Telix Pharmaceuticals (ASX:TLX) helped the Healthcare sector higher after rising 2.6%. Telix said it was moving closer to launching its second or third commercial product after the FDA accepted its New Drug Application for Pixclara, a diagnostic agent for gliomas (brain cancers).

Bank stocks also helped to lift the market with Commonwealth Bank (ASX:CBA) seeing a 1.2% rise after a tough week.

However gold stocks, alongside some large cap names, struggled.

Newmont Corporation (ASX:NEM) and Brambles (ASX:BXB) posted less-than-great updates, dragging their share prices down.

Newmont fell almost 6% after its Q3 update disappointed investors. While gold production increased by 4% to 1.7 million ounces—roughly in line with expectations—the company reported higher-than-expected costs. As a result, its earnings per share of 81 US cents missed the consensus estimate by 5 cents.

Fortescue Metals Group (ASX:FMG) also dropped over 3% after reporting a record iron ore shipment quarter, but there was big concern around costs and pricing. Fortescue reported C1 costs of US$20.16 per wet metric tonne (wmt), which was significantly higher than the consensus estimate of US$19.20 wmt.

Super Retail Group (ASX:SUL) , the owner of sports retail brand Rebel, fell almost 5% after the company said it will discount more products to clear space for new stock ahead of the holiday season. Sales at Supercheap Auto, its largest division, have particularly decelerated over the past nine weeks.

Still in large caps, the embattled WiseTech Global (ASX:WTC) was dragging down the Tech sector once again, down a further 6% following a 16% drop over the last six sessions amid revelations about founder Richard White’s personal life.

Across the region, Asian stocks mostly fell today as worries about China’s economic outlook lingered, while the yen managed to rise after a three-day slump.

In tech news, Taiwan Semiconductor Manufacturing (TSMC) halted shipments to a client due to concerns about US sanctions; while rival chipmaker SK Hynix in South Korea saw its shares rise after reporting record profits.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IEC | Intra Energy Corp | 0.002 | 50% | 250,000 | $1,690,782 |

| DGR | DGR Global Ltd | 0.014 | 40% | 3,030,285 | $10,436,960 |

| OVT | Ovanti Limited | 0.029 | 38% | 97,108,236 | $42,633,057 |

| BNL | Blue Star Helium Ltd | 0.004 | 33% | 496,632 | $7,293,320 |

| CRB | Carbine Resources | 0.004 | 33% | 502,857 | $1,655,213 |

| NTM | Nt Minerals Limited | 0.004 | 33% | 321,321 | $3,632,709 |

| ASQ | Australian Silica | 0.043 | 30% | 1,378,926 | $9,301,392 |

| OMX | Orangeminerals | 0.032 | 28% | 629,389 | $2,735,890 |

| GBE | Globe Metals &Mining | 0.047 | 27% | 2,400 | $25,609,661 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 734,996 | $57,867,624 |

| AKN | Auking Mining Ltd | 0.005 | 25% | 547,781 | $1,468,258 |

| HOR | Horseshoe Metals Ltd | 0.010 | 25% | 1,548,736 | $5,306,254 |

| LPD | Lepidico Ltd | 0.003 | 25% | 2,039,543 | $17,178,250 |

| SUH | Southern Hem Min | 0.040 | 25% | 638,810 | $23,559,681 |

| TMK | TMK Energy Limited | 0.003 | 25% | 1,025,042 | $15,183,224 |

| GRV | Greenvale Energy Ltd | 0.031 | 24% | 1,665,241 | $11,843,222 |

| WNX | Wellnex Life Ltd | 0.765 | 23% | 45,171 | $17,384,025 |

| CVR | Cavalierresources | 0.140 | 22% | 37,500 | $6,214,121 |

| BCB | Bowen Coal Limited | 0.009 | 21% | 21,812,119 | $20,513,428 |

| HTA | Hutchison | 0.029 | 21% | 52,473 | $325,740,206 |

| DME | Dome Gold Mines Ltd | 0.120 | 20% | 8,000 | $37,692,866 |

| AVE | Avecho Biotech Ltd | 0.003 | 20% | 6,565,978 | $7,923,243 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 1,317,549 | $5,831,140 |

Bowen Coking Coal (ASX:BCB) released its quarterly this morning, announcing that “robust mining performance” has delivered 769Kt ROM for the quarter, while the company has managed a mining cost reduction of 7% to $53/ROMt including boxcut costs and 52% lower than this time last year. That has led to 444Kt of saleable coal produced with sales of 415Kt recorded in the quarter, at an average coal price of A$216/t, down slightly on pcp.

Auking Mining (ASX:AKN) was rising today on news that the company has completed the purchase of the Grand Codroy uranium exploration project in Newfoundland,Canada. The project features uranium mineralisation within extensive, organic-rich siliciclastic rocks is similar to sandstone-hosted uranium districts in the western United States, and exploration work has returned high-grade historical rock samples including Sample 153: >20,000ppm (2%) Cu and 435ppm U, and Sample 3522: >20,000ppm (2%) Cu and 400ppm U.

Adelong Gold (ASX:ADG) was up on news that it has entered a binding farm-in agreement with Great Divide Mining (ASX:GDM) for a staged acquisition of up to 51% interest in the Adelong Gold Project. Under the agreement, GDM is set to invest $300,000 for an initial 15% stake in Challenger Gold Mines (following successful due diligence), and will earn a further 36% interest upon achieving first gold production from the refurbished Adelong Gold Plant within 12 months, bringing their total interest to 51%.

Earlier, Chimeric Therapeutics (ASX:CHM) was up on news that the company’s Phase 1B ADVENT-AML clinical trial has completed enrolment of relapsed or refractory Acute Myeloid Leukaemia subjects in the dose-finding portion of the clinical trial. The trial is an investigator-initiated study currently open to enrolment at The University of Texas MD Anderson Cancer Center under Principal Investigator Abhishek Maiti MD, Assistant Professor in the Department of Leukaemia.

Duketon Mining (ASX:DKM) was riding high on the release of its September quarterly report which goes into detail of early exploration activities currently underway at the Barlee gold and lithium project, 200km north of Southern Cross in WA. Various programs including desktop reviews, field reconnaissance, mapping and rock-chip sampling are on the go with a number of incoming proposals from external third parties being reviewed as well. Duketon’s tenement package lies along strike and adjacent to Regis Resources’ (ASX:RRL) landholding including the Rosemont, Garden Well and Moolart Well gold mines.

TMK Energy (ASX:TMK) reminded eligible shareholders that its Entitlement Issue closes tomorrow, 25 October, at 5.00pm AWST, with no extensions. Many shareholders, including the Board and Management, have shown strong support for the offer, taking up significant portions of their entitlements. Currently, the second pilot well (LF-06) is drilling at 226 metres in Mongolia, with further updates expected as drilling progresses. CEO Dougal Ferguson encourages all eligible shareholders to consider this opportunity to participate in the company’s success before the deadline.

Greenvale Energy (ASX:GRV) rose after announcing positive results from its Liquefaction Test Program 5, conducted by the University of Jordan for its Alpha Torbanite Project in Queensland. This program aimed to improve the viscosity of the bitumen product, with results suggesting that a premium-grade C170 product could be achieved with further adjustments.

The tests explored various conditions, including temperature and pressure, to maximise bitumen yield and quality. While viscosity measurements were limited due to small sample sizes, the findings indicate that optimising these conditions could lead to a product that meets the desired specifications. The Greenvale Board will now evaluate the results to decide on the next steps for the project.

Wellnex Life (ASX:WNX) said it was progressing with its dual listing on the London Stock Exchange (LSE) after announcing plans in April. The company successfully completed a placement with UK investors at $1.40 per share, showing strong support for its move. Wellnex expects to generate a significant portion of its revenue from the UK and Europe, particularly with its Haleon partnership. The company is finalising the necessary regulatory steps, including those related to its medicinal cannabis business, and aims to complete the listing by the end of 2024. An extraordinary general meeting held on 26 September approved the issuance of shares to support this process, which will enhance its international presence and investor reach.

And, Rhythm Biosciences (ASX:RHY) said it hopes to be able to get its blood-based bowel cancer screening test to market.

In a prezzo released this morning, Rhythm says it is in the “final stages of development” of the second-generation version of its lead assay, Colostat. Colostat shows great promise in replacing the maligned ‘poo test’, which is less accurate and not exactly user-friendly. The federal government’s national program provides free poo tests for those aged between 45 to 74. But the ‘ick’ factor means participation is low which is a pity because (a) it saves lives and (b) the program costs a sh*tload to run.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.003 | -40% | 2,807,636 | $1,522,557 |

| CDD | Cardno Limited | 0.150 | -38% | 527,101 | $9,374,559 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 136,500 | $1,858,622 |

| TEM | Tempest Minerals | 0.006 | -25% | 10,658,096 | $5,018,158 |

| TOY | Toys R Us | 0.050 | -23% | 299,517 | $9,832,040 |

| M4M | Macro Metals Limited | 0.012 | -20% | 38,596,382 | $54,346,604 |

| TZN | Terramin Australia | 0.080 | -20% | 615,767 | $211,656,272 |

| RIL | Redivium Limited | 0.004 | -20% | 760,250 | $13,734,274 |

| MOV | Move Logistics Group | 0.170 | -19% | 10,059 | $26,798,944 |

| IBX | Imagion Biosys Ltd | 0.052 | -19% | 354,529 | $2,281,379 |

| ARC | ARC Funds Limited | 0.100 | -17% | 87,582 | $4,695,104 |

| LOT | Lotus Resources Ltd | 0.263 | -17% | 25,701,485 | $577,573,751 |

| ERA | Energy Resources | 0.003 | -17% | 11,932,307 | $66,444,898 |

| FHS | Freehill Mining Ltd. | 0.005 | -17% | 303,601 | $18,471,167 |

| GTI | Gratifii | 0.005 | -17% | 156,000 | $12,895,177 |

| AIV | Activex Limited | 0.011 | -15% | 50,691 | $2,801,534 |

| RMI | Resource Mining Corp | 0.011 | -15% | 56,987 | $8,480,521 |

| SBW | Shekel Brainweigh | 0.041 | -15% | 142,517 | $10,946,939 |

| CTN | Catalina Resources | 0.003 | -14% | 1,000,000 | $4,334,704 |

| ILA | Island Pharma | 0.120 | -14% | 302,828 | $21,783,636 |

| LDR | Lode Resources | 0.120 | -14% | 822,731 | $14,949,780 |

IN CASE YOU MISSED IT

Antipa Minerals’ (ASX:AZY) updated scoping study has delivered NPV and IRR estimates of up to $1.2bn and 79% respectively for its Minyari Dome project, highlighting the attractiveness of a standalone gold-focused development.

Greenvale Energy’s (ASX:GRV) Liquefaction Test Program 5 conducted by the University of Jordan has successfully produced premium-grade C170 bitumen with strong recovery rates using a blend of ore material sourced from its Alpha Torbanite project.

Suvo Strategic Minerals’ (ASX:SUV) subsidiary Climate Tech Cement has executed a shareholders’ agreement with PERMAcast R&D for 50/50 ownership of EcoCast Concrete and EcoCast Solutions to bring low-carbon concrete products and projects to market.

Pursuit Minerals (ASX:PUR) has announced that it has entered into commitment letters, to secure $1 million in immediate funding through the issue of loan notes which will automatically convert into shares and options, subject to shareholder approval to be sought at the company’s annual general meeting on November 28 2024.

Proceeds will be principally used to fund the ongoing works at the Rio Grande Sur project, with a particular focus on progressing towards first production of lithium carbonate from its 250tpa plant in Salta, as well as “feasibility studies for the larger commercial operation and assessment of complementary acquisitions opportunities in the critical metals’ asset classes of lithium and copper”.

TRADING HALTS

Brightstar Resources (ASX:BTR) – pending an announcement regarding a response to an ASX Price Query.

Great Divide Mining (ASX:GDM) – potential material transaction.

Orthocell (ASX:OCC) – pending an announcement in relation to a proposed capital raising.

Mithril Silver and Gold (ASX:MTH) – pending an announcement in relation to a proposed capital raising.

Lefroy Exploration (ASX:LEX) – pending release of an announcement regarding a capital raising.

Nyrada (ASX:NYR) – pending an announcement regarding a proposed capital raising.

QX Resources (ASX:QXR) – pending an announcement in respect of a capital raising.

Sultan Resources (ASX:SLZ) – pending an announcement in relation to a capital raising.

Cosmo Metals (ASX:CMO) – pending an announcement regarding a capital raising.

Asian Battery Metals (ASX:AZ9) – following receipt of material assay results which requires time to compile and release to the market.

Eureka Group (ASX:EGH) – pending an announcement regarding a capital raising.

HMC Capital (ASX: HMC) – pending an announcement in connection with a proposed acquisition and an equity raising.

OncoSil Medical (ASX:OSL) – pending an announcement in relation to a capital raise.

At Stockhead we tell it like it is. While Antipa Minerals, Greenvale Energy, Pursuit Minerals and Suvo Strategic Minerals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.