Closing Bell: Tech stocks prop up ASX to near highs after Apple’s record quarter

ASX pulls back from highs but mining and tech stocks rise. Pic: Getty Images

- ASX pulls back from highs but mining and tech stocks rise

- Origin Energy slides after downgrading LNG forecast

- Trump to launch tariffs on Canada and Mexico effective tomorrow

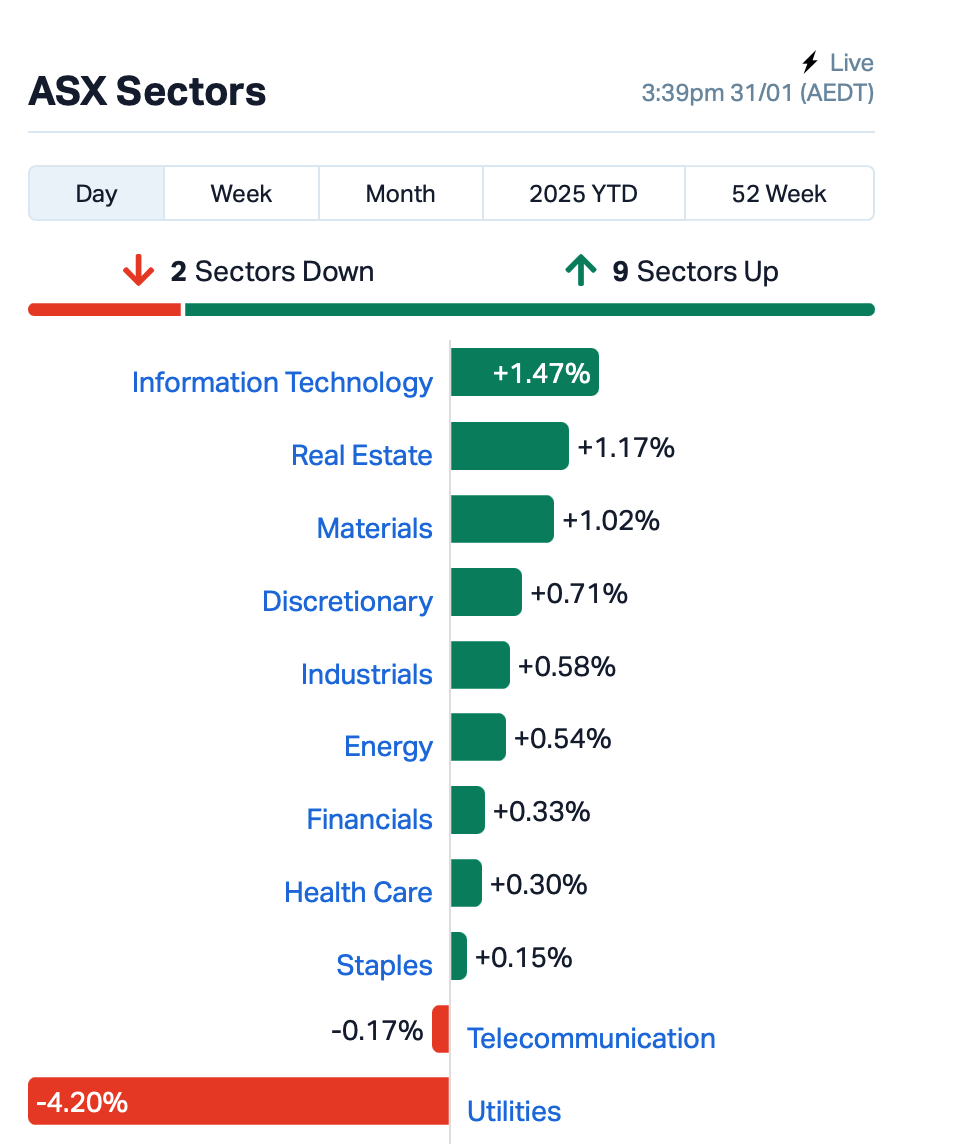

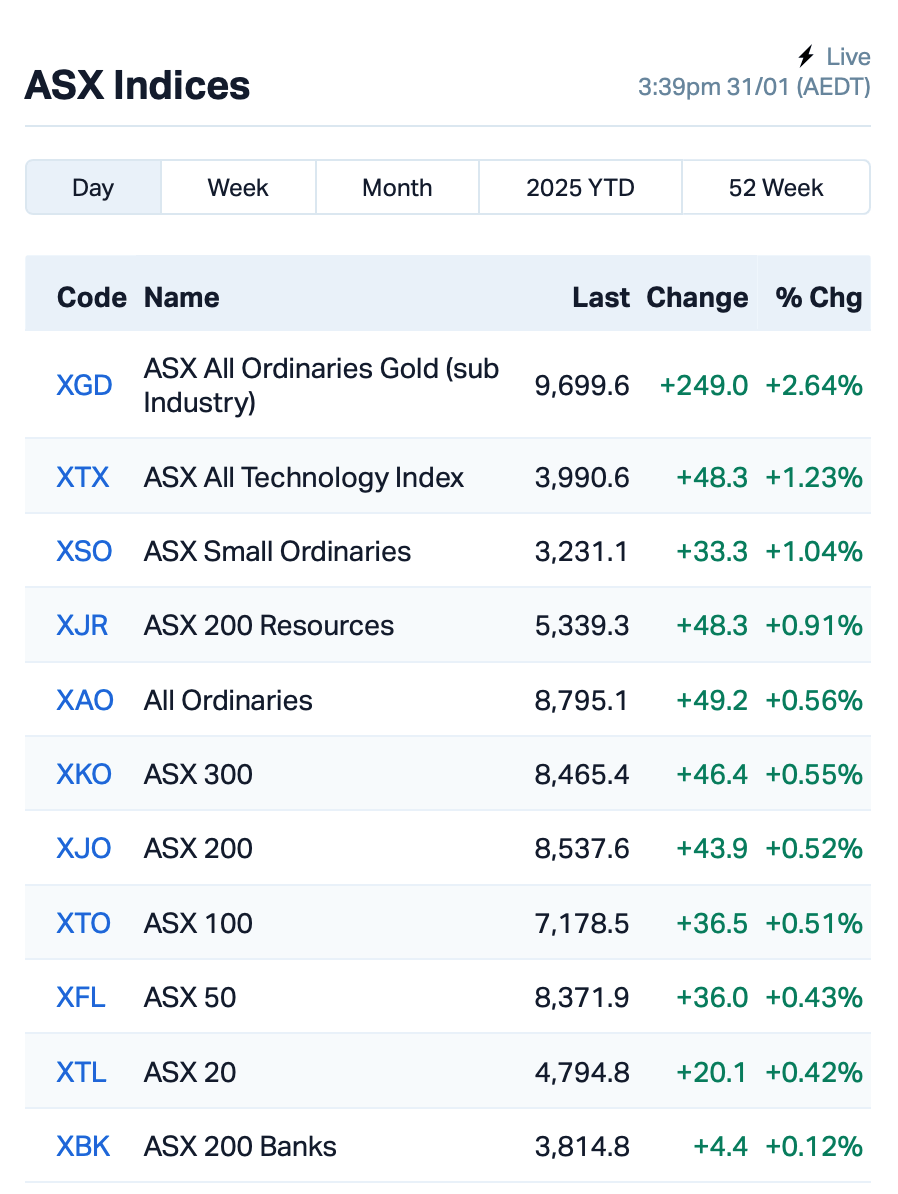

Friday’s afternoon session saw the ASX200 benchmark pull back slightly from its record highs, with the index closing higher by 0.5%. For the week, it was still up almost 2%.

Tech stocks really got going in the afternoon session after Apple reported a mixed quarter, where iPhone sales and China sales were a letdown.

But Apple’s total revenue rose to a record US$26.3 billion in the quarter, up 14%, driven by in-app purchases in areas such as iCloud and Apple Music.

Mining stocks were back in the mix today, as investors shrugged off the tough tariffs talk on China that had spooked the market last week.

Gold prices, meanwhile, are going through the roof, hitting a new all-time high of almost US$2,800/oz.

Sandfire Resources (ASX:SFR) was the best performing miner in the ASX200, jumping up by 4%.

Real estate also had a good day, fuelled by hopes that the RBA might cut interest rates in February. Goodman Group (ASX:GMG), one of the heavyweights in the sector, pushed ahead by 2%.

The utilities sector, however, took a big hit as Origin Energy (ASX:ORG) slid 6% after downgrading its production forecast for the Australia-Pacific LNG project.

Notable news in the large caps space came from Lendlease Group (ASX:LLC), which popped 2% after announcing the sale of Capella Capital to Sojitz Corporation for $235 million.

Healthcare giant Ramsay Health Care (ASX:RHC) dipped after its Aussie CEO, Carmel Monaghan, revealed she’ll retire mid-year after 27 years at the helm.

Fund manager Magellan Financial Group (ASX:MFG) keeps falling, down another 8% today after a shake-up in its senior management.

Elsewhere, Donald Trump is set to roll out a string of tariffs starting tomorrow, February 1, targeting Canada and Mexico with 25% duties on about US$900 billion worth of goods.

This is just the beginning, as more tariffs could hit China later on, he had said previously.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap MVP Medical Developments 0.650 48% 1,222,566 $49,569,663 FHS Freehill Mining Ltd. 0.004 33% 8,757,101 $9,235,583 SIO Simonds Grp Ltd 0.200 33% 155,495 $53,985,968 WWG Wisewaygroupltd 0.130 30% 25,491 $16,735,320 BNL Blue Star Helium Ltd 0.005 25% 656,645 $10,779,541 CTO Citigold Corp Ltd 0.005 25% 1,691,569 $12,000,000 GES Genesis Resources 0.005 25% 117,400 $3,131,365 MEL Metgasco Ltd 0.005 25% 171,243 $5,830,347 RLG Roolife Group Ltd 0.005 25% 100,000 $4,784,125 KAI Kairos Minerals Ltd 0.016 23% 9,820,490 $34,201,858 NPM Newpeak Metals 0.016 23% 718,348 $4,186,933 BXN Bioxyne Ltd 0.044 22% 9,479,426 $73,772,234 HHR Hartshead Resources 0.009 21% 21,785,630 $19,660,775 REM Remsensetechnologies 0.052 21% 783,968 $7,131,967 G11 G11 Resources Ltd 0.018 20% 2,801,803 $14,499,332 MTB Mount Burgess Mining 0.006 20% 206,018 $1,697,687 SPQ Superior Resources 0.006 20% 150,000 $10,849,319 TG6 Tgmetalslimited 0.125 19% 169,942 $7,466,292 BDX Bcaldiagnostics 0.110 18% 1,016,441 $34,035,014 14D 1414 Degrees Limited 0.026 18% 277,812 $6,270,027

Medical Developments International (ASX:MVP) had a solid quarter, with operating cashflow improving nicely. Lead drug Penthrox continues to grow in the Aussie hospital sector, and the cash balance at the end of December hit $17.6 million. Revenue for Q2 FY25 was $10.9 million, up $1.8 million from the previous quarter, and $4.9 million higher for the first half of FY25.

Freehill Mining (ASX:FHS) also reported a strong quarter, with gross sales doubling to $954k, up from $476k last quarter. Cash receipts jumped 56% to $785k. Operating costs are down too, dropping from -$276k to -$114k, thanks to better customer payments and stronger margins.

Homebuilding group, Simonds (ASX:SIO), is set to acquire Dennis Family Homes (DFH) for $10 million. DFH, which builds and sells residential homes in Victoria and NSW, aligns perfectly with Simonds’ strategy to expand affordable homes across Australia, Simonds said. The deal will more than double Simonds’ product range and increase its market presence.

Genesis Resources (ASX:GES) said it is keeping busy with work at its Plavica gold-copper-silver project in North Macedonia, where fieldwork continues for the environmental studies needed to get mining approval. The company’s also gearing up for more drilling at its Alice Springs and Arltunga tenements in the Northern Territory, with plans for follow-up drilling either late March or early June, depending on the weather.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap ATH Alterity Therap Ltd 0.012 -36% 119,411,441 $95,767,764 ADR Adherium Ltd 0.010 -33% 2,166,315 $11,378,699 BDT Birddog 0.038 -32% 6,751,470 $9,043,217 LEG Legend Mining 0.007 -30% 4,416,756 $29,094,772 UCM Uscom Limited 0.021 -30% 150,000 $7,514,310 88E 88 Energy Ltd 0.002 -25% 7,759,377 $57,867,624 AKN Auking Mining Ltd 0.003 -25% 150,000 $2,059,115 CAV Carnavale Resources 0.003 -25% 7,287,104 $16,360,874 CT1 Constellation Tech 0.002 -25% 1,050,000 $2,949,467 EEL Enrg Elements Ltd 0.002 -25% 21,487 $6,507,557 DAF Discovery Alaska Ltd 0.015 -25% 638,879 $4,684,694 ZMM Zimi Ltd 0.010 -23% 474,000 $5,030,273 OCT Octava Minerals 0.075 -20% 528,222 $5,734,875 ADD Adavale Resource Ltd 0.002 -20% 420,032 $5,683,198 T3D 333D Limited 0.009 -18% 500,001 $1,938,018 PEN Peninsula Energy Ltd 1.080 -18% 3,500,843 $209,921,596 DUB Dubber Corp Ltd 0.045 -17% 24,353,491 $140,375,749 1TT Thrive Tribe Tech 0.003 -17% 985,389 $6,095,169 ADY Admiralty Resources. 0.005 -17% 635,200 $15,776,876 ASR Asra Minerals Ltd 0.003 -17% 200,000 $6,937,890 AUG Augustus Minerals 0.040 -17% 1,736,247 $5,721,189 ERA Energy Resources 0.003 -17% 942,973 $1,216,188,722

Pointsbet (ASX:PBH) had a rough ride, tumbling 12% after it downgraded its financial forecast. Its quarterly performance didn’t hit the mark, with Aussie turnover dropping a hefty 34%.

IN CASE YOU MISSED IT

Spartan Resources (ASX:SPR) has kicked off a significant ~85,000m drilling program at its Dalgaranga gold project in WA. The program aims to expand resources and enhance the confidence in the existing 2.87Moz resource. 20,000m of surface drilling has already begun at the Freak and Sly Fox prospects, with the remainder of the drilling planned for the Never Never, Pepper, Freak, Four Pillars, and West Winds deposits.

Pure Hydrogen (ASX:PH2) has grown its offering with the launch of the E-Aries series of mid-sized battery electric commercial trucks, designed specifically for inner-city transportation. Developed by its subsidiary, HDrive International, the trucks address the rising demand for mid-distance logistics, such as warehouse distribution and courier services. The company says it is also in advanced stages of developing a BEV version of its 70t Taurus prime mover.

Everest Metals (ASX:EMC) is issuing $720,000 in Junior Minerals Exploration Incentive (JMEI) exploration credits to eligible shareholders who participated in the company’s $2.4 million capital raising in the last quarter of 2023. Through the JMEI scheme, explorers can convert a portion of their tax losses into credits, which are then passed on to investors as a tax benefit.

Clinical-stage biopharma developer Neurotech International (ASX:NTI) has received a $2.44 million R&D tax incentive refund relating to activities in FY24. The refund strengthens NTI’s cash position as it works to complete the required animal toxicology and human pharmacokinetic studies in preparation for regulatory submissions to the Australian Therapeutic Goods Administration and the US Food and Drug Administration in FY25.

At Stockhead, we tell it like it is. While Spartan Resources, Pure Hydrogen, Everest Metals Corporation and Neurotech International are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.