Closing Bell: Tech, Retail, and Banking stocks feel the heat as ASX tumbles over 1pc

https://stockhead.com.au/health/asx-health-stocks-fda-gives-nod-to-pyc-and-altheas-new-jv-puts-cannabis-drinks-in-us-bottle-shops/

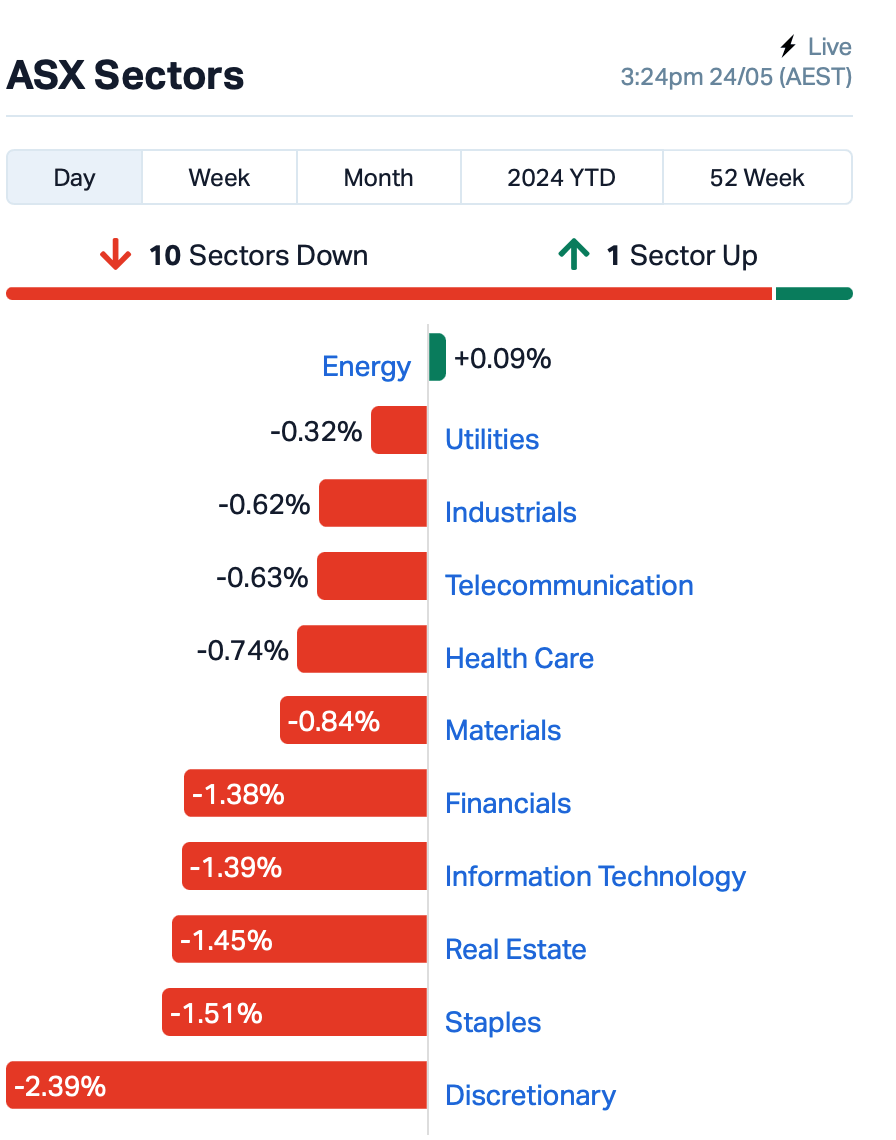

- ASX drops over 1pc as tech, retail, banks fall; energy resists

- Bond yields surge, impacting goldies

- Ethereum ETFs approved, await filings

Energy was the only sector showing some sort of resistance on Friday as the ASX was engulfed in a sea of red, finishing more than -1% lower.

For the week, the ASX200 index was also down over -1%.

The yield on the 10-year Aussie government bond surged by 8 basis points, pushing down tech, retail, and banking stocks as traders dialled back hopes for a Fed interest rate cut following an unexpectedly strong US PMI (Purchasing Managers’ Index) reading last night.

The Discretionary sector was the worst performer, dragged down by Wesfarmers (ASX:WES) which slipped by -3.5%.

Real Estate took a hit with Fletcher Building (ASX:FBU) leading the losses, dropping over 5%.

Gold stocks also struggled as bullion dipped below $US2,334/oz on the back of higher bond yields.

Ethereum meanwhile has been trading flattish today despite the U.S. SEC approving key regulatory filings for spot ether exchange-traded funds.

While the SEC has approved what’s called 19b-4 forms for the ETFs, they still need to give the green light to their S-1 filings before investors can actually trade the ETF.

NOW READ: Snap! Ethereum ETFs approved by SEC. ‘It was inevitable’ says BTC Markets boss

What else happened today?

Not much but across the region, Asian stocks and currencies also took a hit following Wall Street’s selloff last night.

Shares across Hong Kong, mainland China, and Japan all dipped.

Alibaba has just sold US$4.5 billion worth of convertible bonds in one of the largest offerings of its kind in recent years. The company said it plans to use most of the cash to further buy back its own shares.

Singapore Airlines has just put stricter cabin restrictions in place to deal with turbulence following an incident this week that left one passenger dead and many injured. The airline’s share price was down -0.3%.

Looking ahead to tonight, keep an eye out for the closely-followed US May consumer sentiment reading from the University of Michigan.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SER | Strategic Energy | 0.035 | 119% | 86,514,548 | $7,773,042 |

| EDE | Eden Inv Ltd | 0.002 | 100% | 1,914,026 | $3,678,271 |

| AN1 | Anagenics Limited | 0.012 | 71% | 4,200,308 | $3,229,243 |

| KED | Keypath Education | 0.825 | 54% | 472,640 | $114,861,657 |

| 1MC | Morella Corporation | 0.003 | 50% | 1,596,578 | $12,357,599 |

| GMN | Gold Mountain Ltd | 0.004 | 33% | 7,853,019 | $8,926,517 |

| FTZ | Fertoz Ltd | 0.040 | 33% | 33,338 | $7,507,466 |

| M4M | Macro Metals Limited | 0.037 | 28% | 29,337,961 | $104,355,976 |

| TSL | Titanium Sands Ltd | 0.007 | 27% | 1,625,914 | $12,164,610 |

| ADR | Adherium Ltd | 0.024 | 26% | 16,959,336 | $7,410,760 |

| PSL | Paterson Resources | 0.015 | 25% | 3,305,343 | $5,472,455 |

| AIV | Activex Limited | 0.005 | 25% | 100,000 | $862,010 |

| ENT | Enterprise Metals | 0.005 | 25% | 1,476,866 | $3,538,884 |

| H2G | Greenhy2 Limited | 0.010 | 25% | 195,000 | $4,113,473 |

| ME1 | Melodiol Glb Health | 0.003 | 25% | 7,837,517 | $1,426,974 |

| PSC | Prospect Res Ltd | 0.195 | 22% | 3,285,340 | $75,466,447 |

| HMD | Heramed Limited | 0.018 | 20% | 1,374,068 | $5,823,747 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 50 | $6,620,957 |

| CDT | Castle Minerals | 0.006 | 20% | 102,833 | $6,122,465 |

| PFT | Pure Foods Tas Ltd | 0.037 | 19% | 195,449 | $3,419,136 |

| RIL | Redivium Limited | 0.004 | 17% | 1,209,869 | $8,192,564 |

| T3D | 333D Limited | 0.007 | 17% | 187,613 | $716,670 |

| TMX | Terrain Minerals | 0.004 | 17% | 77,200 | $4,295,012 |

| BEO | Beonic Ltd | 0.029 | 16% | 230,226 | $10,612,374 |

Strategic Energy Resources (ASX:SER) was once again at the top of the small caps heap on Friday morning, building on the previous day’s news that the company has raised a cool $2 million to explore the Achilles 1 polymetallic prospect in the South Cobar Basin. The placement, done at a small 8.3% discount to the last traded price, is cornerstoned by Datt Capital and Lowell Resources Fund (ASX:LRT).

Appen (ASX:APX) rose after telling investors at the AGM that generative AI will have a significant impact on its total addressable market. Appen also said it was aiming for breakeven on an operating basis sometime in FY24.

Keypath Education (ASX:KED) was up thanks to a merger and delisting deal signed with Sterling Partners, with an offer of $0.87 cash per share on the table that the Keypath board has grabbed firmly with both hands – it’s an 88.3% premium to the 6-month volume weighted average price (‘VWAP’) of Keypath CDIs prior to the announcement being made.

Adherium (ASX:ADR) jumped on Friday morning, on news that drug behemoth AstraZeneca has selected the company’s Hailie Smartinhaler platform for a clinical trial, with the contract valued at $1.1 million over the course of three years.

Lending platform Propell Holdings (ASX:PHL) was up in early trade, clearly enjoying significantly increased deal volumes in April and May that has seen average loan size continue to grow, reaching $82k quarter-to-date – a 20% uplift on Q3.

Greenhy2 (ASX:H2G) moved sharply on Friday in the wake of an investor presentation from the Chairman and Managing Director in Sydney.

And Paterson Resources (ASX:PSL) got a shot in the arm on Friday after announcing the strategic sale of 100% of the issued capital of its wholly owned subsidiaries Burraga Copper, BC Exploration and Old Lloyds Mine – which bolt together like Voltron to form the basis of the Burraga Project in NSW.

Bubalus Resources (ASX:BUS) – the critical minerals-exploring junior – is faring rather fine-to-fantastic on Friday. The company has been given the go-ahead to kick off its maiden drilling at its Nolans East REE project in the Northern Territory. And that comes after receiving a key Heritage Authority Certificate. Nolans East is 15km from Arafura Resources’ (ASX:ARU) Nolans Bore project where Australia’s next REE mine and refinery are under construction with $840m in government funding support.

Bubalus has defined 22 drill-ready targets at Nolans East from a sampling program that returned more than 500 parts per million (ppm) total rare earth oxides (TREO) with a peak value of 2053ppm TREO.Notably, valuable neodymium-praseodymium (NdPr), which is used to manufacture permanent magnets for electric vehicles and wind turbines average 22% of that total REE content.

Paterson Resources (ASX:PSL) has decided to make a “strategic sale” of its Burraga copper-gold project in NSW – to a company called Octo Mining Burraga for the goodly amount of $2.85 million. Paterson’s focus will now turn to its Grace gold-copper project in WA instead, and these funds, once all due diligence is completed by Octo and pen is put to final paperwork, will be pushed towards advancing that operation. The Grace project and its surrounding exploration licences cover roughly 350km2 and are located 25km to the southeast of the 32 Moz gold and 1mt copper Telfer gold copper mine – owned by big gun miner Newcrest Mining.

Gold Mountain (ASX:GMN) was up on no news. The gold price has taken a bit of a dip today, but there are still some golden gains being made by minnow goldies on the bourse. This one is at least sporting some high trading volume at the time of writing and a 33% gain. Not sure what’s up with that, but we can at least tell you that the company seems excited about its Wabag project over in Papua New Guinea. Earlier this month, GMN announced it had undertaken a “major review” of the project, gaining new insights into its promising porphyry systems.

Drug behemoth AstraZeneca selected Adherium’s (ASX:ADR) Hailie Smartinhaler platform for a clinical trial. This contract is valued at $1.1m over the course of three years, ADR says.

Nanoveu (ASX:NVU) and Chinese manufacturing partner Fulland entered into a joint venture for the exclusive manufacturing and marketing of 3D technologies.

Lending platform Propell Holdings (ASX:PHL) is enjoying significantly increased deal volumes in April and May. Average loan size continues to grow reaching $82k quarter-to-date – a 20% uplift on Q3.

Althea Group (ASX:AGH) announce that its wholly-owned subsidiary, Peak Processing, has signed a binding JV deal in the US with Flora Growth (NASDAQ:FLGC) to enter the thriving legal hemp derived delta-9-THC cannabis-infused beverages market. The US cannabis beverages market is valued at US$966.92 million in 2024, and projected to reach US$19.06 billion by 2028.

Oceania Healthcare (ASX:OCA) advised that Suzanne Dvorak has today been appointed as Chief Executive Officer. Dvorak has been in the Australian aged care and retirement living sectors for the past decade, which included leading the single largest residential aged care provider in Australia. She has most recently been an external advisor at Bain & Company in Melbourne.

And, PlaySide Studios (ASX:PLY) and Warner Bros have announced the development of a new “Game of Thrones” real time strategy game for the PC. Featuring multiple game modes, fans will be able to play on their own, team up with friends or engage in multiplayer skirmishes.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUK | Aumake Limited | 0.002 | -33% | 10,125,380 | $5,743,220 |

| NRZ | Neurizer Ltd | 0.002 | -33% | 208,103,485 | $4,961,875 |

| RML | Resolution Minerals | 0.002 | -33% | 542,006 | $4,830,065 |

| AEV | Avenira Limited | 0.005 | -29% | 1,342,311 | $16,443,238 |

| AMM | Armada Metals | 0.013 | -28% | 50,000 | $3,744,000 |

| BEL | Bentley Capital Ltd | 0.029 | -26% | 118,871 | $2,968,989 |

| BFC | Beston Global Ltd | 0.003 | -25% | 3,148,577 | $7,988,188 |

| CTN | Catalina Resources | 0.003 | -25% | 203,035 | $4,953,948 |

| CUL | Cullen Resources | 0.006 | -25% | 1,667,583 | $4,561,386 |

| ECT | Env Clean Tech Ltd. | 0.003 | -25% | 510,311 | $12,687,242 |

| JAV | Javelin Minerals Ltd | 0.002 | -25% | 1,738,084 | $4,352,462 |

| BMG | BMG Resources Ltd | 0.010 | -23% | 3,901,380 | $8,239,363 |

| NIS | Nickelsearch | 0.028 | -20% | 2,031,640 | $7,473,986 |

| ROG | Red Sky Energy. | 0.004 | -20% | 1,131,984 | $27,111,136 |

| WYX | Western Yilgarn NL | 0.031 | -18% | 1,563,023 | $3,492,485 |

| 88E | 88 Energy Ltd | 0.003 | -17% | 27,580,210 | $86,678,016 |

| MEL | Metgasco Ltd | 0.005 | -17% | 115,000 | $7,397,320 |

| MOM | Moab Minerals Ltd | 0.005 | -17% | 364,650 | $4,271,778 |

| MTL | Mantle Minerals Ltd | 0.003 | -17% | 1,314,792 | $18,592,338 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 5,150,656 | $6,041,322 |

| TTI | Traffic Technologies | 0.005 | -17% | 505,280 | $5,546,989 |

| VFX | Visionflex Group Ltd | 0.005 | -17% | 736,328 | $8,501,947 |

| ENL | Enlitic Inc. | 0.260 | -16% | 21,171 | $24,401,535 |

| ZMM | Zimi Ltd | 0.021 | -16% | 96,000 | $3,083,701 |

IN CASE YOU MISSED IT

AC drilling has kicked off at Riversgold’s (ASX:RGL) Northern Zone gold project near Kalgoorlie, WA, to test for supergene gold mineralisation centred around a large identified >100m wide porphyry system. Gold at Northern Zone is hosted in a massive porphyry intrusion with drilled widths exceeding 100m, with results from the target area to form a planned maiden resource.

RC drilling at three targets within New Age Exploration’s (ASX:NAE) Quartz Hill project has indicated the fractionation of lithium, a sign that mineralisation might exist undercover. Several of these target areas lie on the margins of the Mungarinya Monzogranite within the surrounding Cheearra Monzogranite and boast lithium concentrations >100ppm.

Pan Asia Metals (ASX:PAM)‘s KT East lithium prospect is shaping up to be a promising pegmatite field, with preliminary field work at the KT East lithium prospect vectoring in on previously reported anomalous stream sediments up to 1,464ppm Li2O.Geochem results suggest a 2.4km-long x 2.4km-wide strike length open in the north, east and west directions and plans for a grid-based sampling pattern are underway.

TRADING HALTS

Forrestania Resources (ASX:FRS) – pending the release of an announcement regarding a potential acquisition.

Anagenics (ASX:AN1) – pending an announcement in relation to a recent announcement made by LSE-listed Roquefort Therapeutics.

Falcon Metals (ASX:FAL) – pending an announcement in relation to exploration results at its Farrelly Mineral Sands Prospect.

HMC Capital (ASX:HMC) – pending an announcement by HMC in connection with a proposed acquisition and an equity raising.

Cyclopharm (ASX:CYC) – pending the release of an announcement relating to the completion of a capital raising.

Intelligent Monitoring Group (ASX:IMB) – pending an announcement in relation to two proposed strategic acquisitions, funded by proposed equity raising.

Asra Minerals (ASX:ASR) – pending the release of an announcement in relation to a material project acquisition and a proposed capital raising.

At Stockhead, we tell it like it is. While Pan Asia Metals, Riversgold and New Age Exploration are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.