Closing Bell: Tech leads markets lower after Tesla falls flat and Hongkers goes bonkers, retreats to 2009 (sans the freedom)

Hong Kong circa 2009. Via Getty

- ASX 200 ends 1%

- Small caps 1.5%

- Tesla, Askari, BidenRedBubble, Inflation, Jobs and Hang Seng hurt

The ASX 200 and the Emerging Companies (XEC) index fell 1.02% and 1.5% respectively on Thursday.

The major miners and the IT sector weighed, more than offsetting gains won by a resurgent energy sector led by Santos and Woodside, after the twin oil and gas giants delivered record quarterly revenue and flagged stronger production numbers respectively.

The strength in oil and gas explorers, along with firmer oil prices, drove the sector gains to well over 3.4% after lunch.

Local tech stocks largely followed the softness in the states, down about 3%, as all three major US indices ended lower, while the fulsomely-tech Nasdaq led the losses on a day of disappointing data and ordinary Q3 corporate performances.

Already under pressure after Chinese officials chose to stay mum on official GDP data, Hong Kong’s Hang Seng fell to a 13 year low, driven again by tech losses which have amounted to around 4%.

That’s played out to a lesser degree on the ASX today, although Zip Co, bucked the trend, the BNPL jumping almost 9% on the back of strong quarterly transaction volumes.

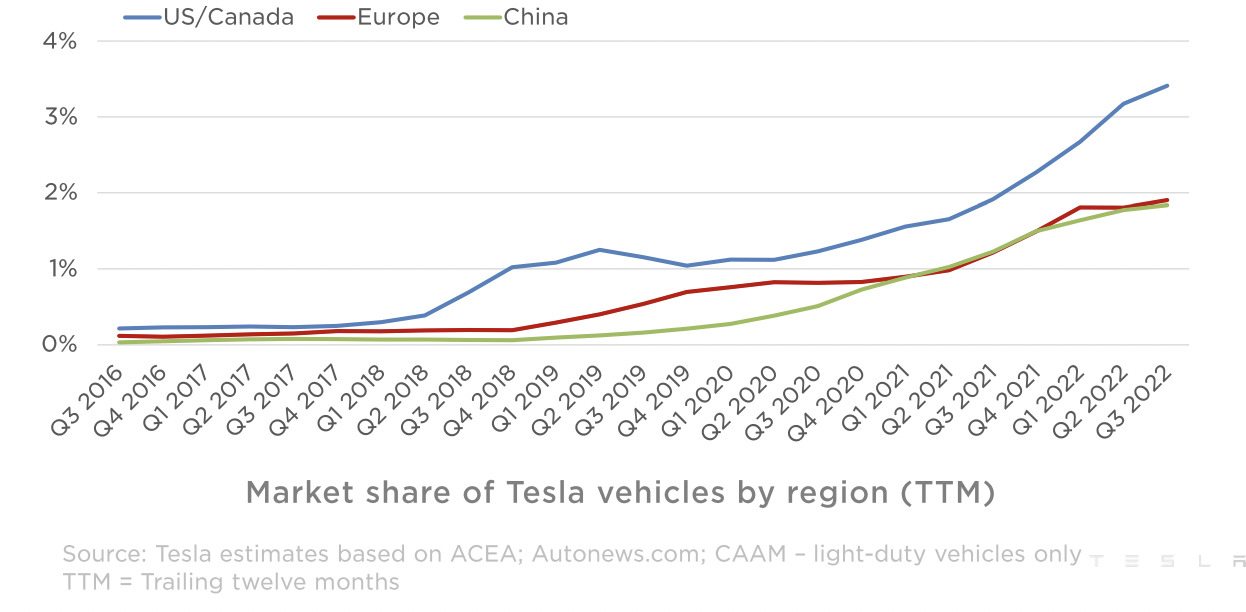

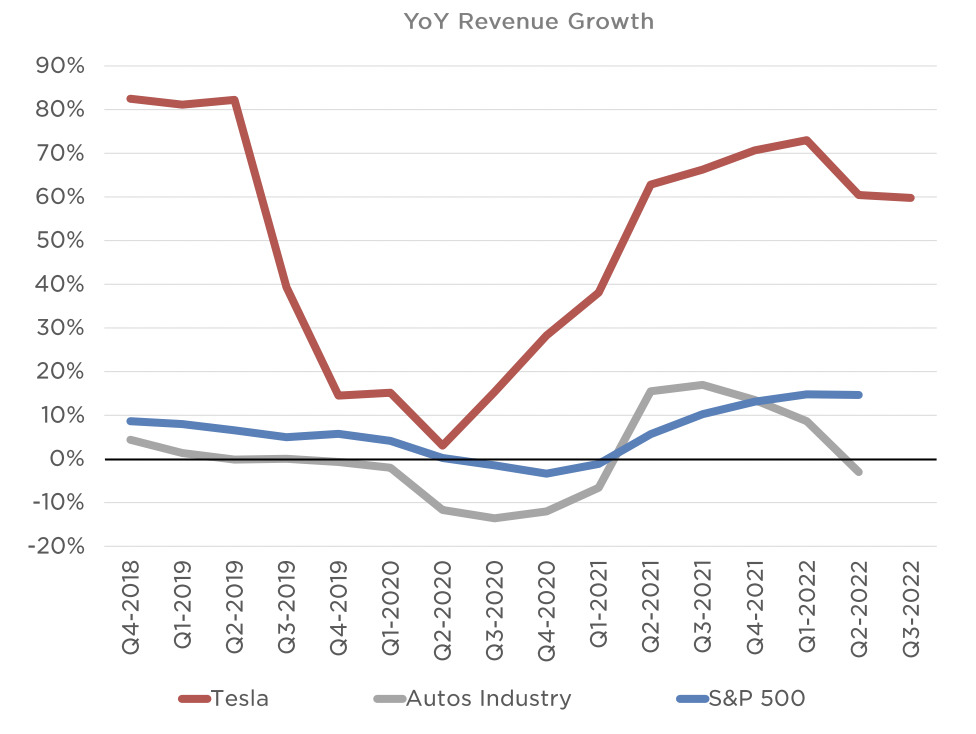

Tesla, reporting after the close, took a chunk out of the Nasdaq on its way out, leaving Elon stocks 5% lower on some pretty decent numbers but a troubled delivery outlook.

Elon reported $1.05 in adjusted EPS, a beat on expectations of 99 cents, although revenue was lower at $21.45 bn, vs. the street’s expectations of $21.96 bn.

Elon’s Net income (GAAP) more than doubled on last year, Q3, while automotive revenue rose by more than half from the same.

In its Q3 earnings release, the company warned about a bottleneck in transportation capacity for delivering new cars while (somehow) “transitioning to a smoother delivery pace.”

Sam Colman over at Lawrance Private Wealth told Stockhead that the recent share price falls in TSLA are providing a much more compelling entry point.

“They ‘re still the leader in EVs and the demand there is only going to grow. Tesla have such a head start on EVs over every other car manufacturer, that it’s really their race to lose.

“The sell off has also just been caught up in the broader growth stock sell off and a few concerns around vehicle delivery and a slight miss on revenue estimates but nothing over concerning.

Once the Fed’s quantitative tightening cycle comes to an end we should see more of a risk on sentiment and companies like Tesla are likely to be a big beneficiary,” the Canberra-based Colman said.

“I think there is value below $200 in TSLA.”

Thanks Sam, you’re a legend. And just quickly, here’s some entirely fresh pics Elon took to show just how giga everything is going:

Three Aussie battery makers Novonix, Piedmont and Syrah rose strongly before lunch on the cracking news, crackingly reported by Josh Chiat that they’ll be divvying up some $800 in US government grants.

Syrah Resources (ASX:SYR), is currently constructing a 11.25ktpa active anode materials plant at Vidalia in Louisiana, has been selected for a grant of up to US$220m, almost half of the expected cost of a phase 3 ramp up to 45,000tpa currently being placed under a DFS microscope.

Novonix (ASX:NVX) is busy building its first 10,000tpa plant for battery grade synthetic graphite, deploying a process it says delivers a 60% reduction in carbon intensity relative to traditional Chinese synthetic graphite, and will receive a grant of US$150m for a new plant in Chattanooga to produce 30,000tpa for EV makers.

Piedmont Lithium (ASX:PLL) will sink its teeth into some US$141.7m towards its Tennessee Lithium hydroxide processing plant in McMinn County, where a US$600m construction program is expected to start next year with first production in 2025, producing 30,000tpa of battery grade lithium hydroxide at full scale.

That would double the processing capacity stateside, with Piedmont potentially producing up to 60,000tpa once all of its lithium assets are operational.

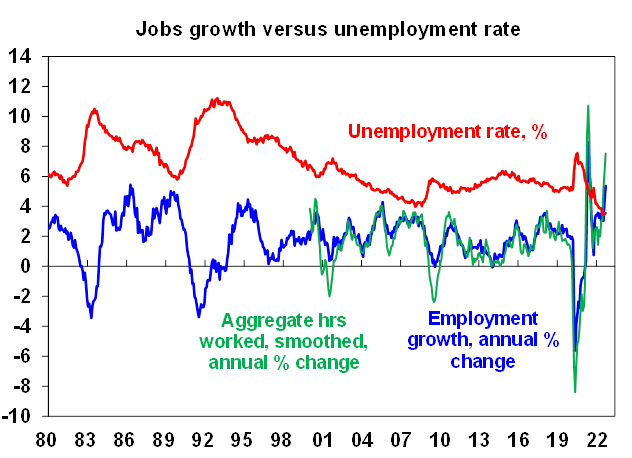

At home this arvo, the ABS reports employment rose by a teeny 0.9K in September, much lower than consensus forecasts of 25K, but Diana Mousina senior economist at AMP Capital says this follows months of strong jobs growth (apart from a blip in July when employment declined).

“Annual employment growth jumped up to 5.4% in September because of base effects (some negative job figures related to Covid lockdowns in 2021 came out of the data). Annual employment growth is close to a record high (apart from covid-related distortions in the data over 2021).”

Australia’s mega strong labour market over the past year

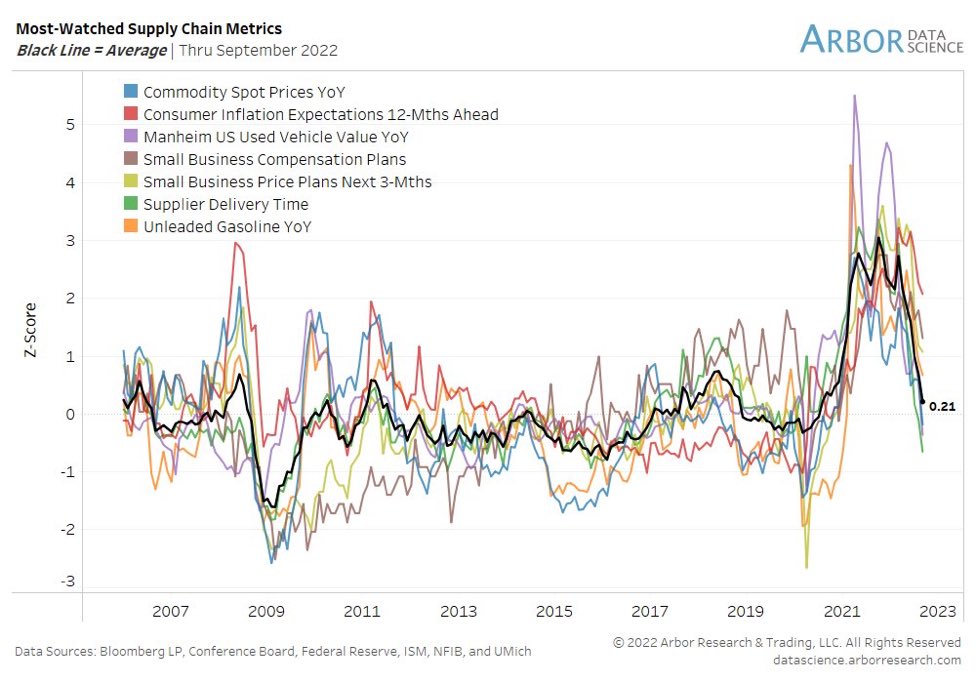

And now to US inflation, the greatest inflation on earth:

Is inflation set to free fall?

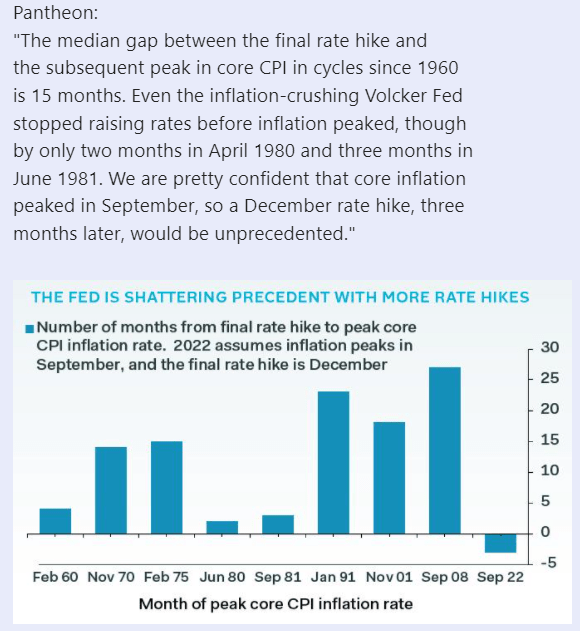

Has core inflation peaked, and if so would The Fed be nuts to persist with rate hikes?

Is the The Kouk happy about the inflation discussion?

A year ago:

Inflation will never rise; inflation targets should be reduced; rate hikes small & distant.

Today:

Inflation will never fall & will never get to the target; more rate hikes needed from an already elevated level.

A year ahead:

Inflation below target, rates cut— Stephen Koukoulas (@TheKouk) October 19, 2022

If it does fall as predicted we must also act…

If it falls more than predicted we must also also act…

What glib nonsense https://t.co/KgIuu0OkAx— Stephen Koukoulas (@TheKouk) October 19, 2022

The fall in global inflation through 2023 is likley to be dramatic.

It is hard to find a meaningful leading indicator of inflation that is even steady, let alone still rising.— Stephen Koukoulas (@TheKouk) October 19, 2022

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PPL | Pureprofile Ltd | 0.037 | 42% | 2,653,035 | $28,782,590 |

| AO1 | Assetowl Limited | 0.002 | 33% | 7,000,000 | $2,358,195 |

| RR1 | Reach Resources Ltd | 0.006 | 33% | 3,896,323 | $8,595,228 |

| ROG | Red Sky Energy. | 0.0065 | 30% | 58,888,689 | $26,511,136 |

| MRL | Mayur Resources Ltd | 0.16 | 28% | 458,173 | $30,242,189 |

| DEL | Delorean Corporation | 0.11 | 26% | 3,289,335 | $18,767,720 |

| LPDR | Lepidico Ltd | 0.0025 | 25% | 9,906,665 | $1,301,438 |

| R3D | R3D Resources Ltd | 0.099 | 24% | 371,746 | $8,730,009 |

| IMB | Intelligent Monitor | 0.092 | 23% | 10,000 | $9,802,522 |

| NES | Nelson Resources. | 0.012 | 20% | 1,234,785 | $2,942,972 |

| AS2 | Askarimetalslimited | 0.465 | 18% | 2,073,929 | $17,964,253 |

| CMD | Cassius Mining Ltd | 0.035 | 17% | 20,453 | $12,112,227 |

| JAT | Jatcorp Limited | 0.014 | 17% | 35,111,322 | $29,975,422 |

| JTL | Jayex Technology Ltd | 0.007 | 17% | 33,780 | $1,495,371 |

| TI1 | Tombador Iron | 0.028 | 17% | 1,886,101 | $51,287,577 |

| RRR | Revolverresources | 0.3 | 15% | 388,578 | $25,574,366 |

| ICN | Icon Energy Limited | 0.015 | 15% | 500,000 | $9,984,178 |

| MXC | Mgc Pharmaceuticals | 0.015 | 15% | 958,165 | $37,058,415 |

| M8S | M8 Sustainable | 0.008 | 14% | 392,989 | $3,436,359 |

| AKN | Auking Mining Ltd | 0.12 | 14% | 2,073,418 | $10,465,834 |

| BTN | Butn Limited | 0.17 | 13% | 92,505 | $11,755,334 |

| TOU | Tlou Energy Ltd | 0.026 | 13% | 727,540 | $13,804,722 |

| CBL | Control Bionics | 0.175 | 13% | 18,385 | $7,801,290 |

Joe Biden’s lithium largesse:

Syrah Resources (ASX:SYR), is up

Novonix (ASX:NVX) is up

Piedmont Lithium (ASX:PLL) also higher.

And Askari Metals (ASX:AS2) is up and away on Thursday, following a strategic deal with Zhejiang Kanglongda Special Protection Technology Co to “develop Australian lithium assets”.

Askari says the agreement will “create a pathway for the rapid development of its Australian Lithium Assets comprised of Barrow Creek in the NT and the portfolio of Eastern Pilbara Lithium Projects (WA) comprising the Yarrie project, the Talga East project and the Myrnas Hill project.”

Strickland Metals (ASX:STK) has hit more shallow, high-grade gold at the new Wanamaker discovery, part of the Millrose project in WA, Reuben writes.

New oxide gold results include 5m @ 14.5g/t from 67m and 5m @ 6.6g/t Au from 83m, in two separate holes.

The first of these is ~200m away from the hit of 7m at 22.2g/t announced earlier this week.

Wanamaker is shaping up as a very exciting high-grade discovery 250m north of the historic 346,000oz Millrose resource, STK CEO Andrew Bray says.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NTM | Nt Minerals Limited | 0.01 | -44% | 16,058,520 | $11,410,213 |

| WWG | Wisewaygroupltd | 0.055 | -35% | 19,514 | $14,219,979 |

| KP2 | Kore Potash PLC | 0.011 | -35% | 14,580,048 | $11,623,964 |

| ANL | Amani Gold Ltd | 0.001 | -33% | 856,634 | $35,540,162 |

| AQX | Alice Queen Ltd | 0.002 | -33% | 200,000 | $6,600,750 |

| YPB | YPB Group Ltd | 0.004 | -27% | 16,422,627 | $2,236,004 |

| RBL | Redbubble Limited | 0.525 | -27% | 3,757,568 | $199,958,561 |

| WBE | Whitebark Energy | 0.0015 | -25% | 374,000 | $12,929,772 |

| LRV | Larvottoresources | 0.195 | -24% | 1,816,145 | $10,590,788 |

| CAV | Carnavale Resources | 0.005 | -23% | 1,200,415 | $17,768,086 |

| A1G | African Gold Ltd. | 0.065 | -23% | 461,739 | $10,030,468 |

| AMS | Atomos | 0.105 | -20% | 3,165,656 | $29,310,386 |

| CLE | Cyclone Metals | 0.002 | -20% | 46,837,879 | $15,291,842 |

| GLV | Global Oil & Gas | 0.002 | -20% | 274,000 | $4,683,387 |

| TSC | Twenty Seven Co. Ltd | 0.002 | -20% | 12,146,667 | $13,304,070 |

| RAD | Radiopharm | 0.13 | -18% | 3,301,075 | $20,716,206 |

| BBX | BBX Minerals Ltd | 0.05 | -17% | 237,962 | $29,203,289 |

| MKL | Mighty Kingdom Ltd | 0.03 | -17% | 264,668 | $5,549,141 |

| W2V | Way2Vatltd | 0.025 | -17% | 67,495 | $5,335,326 |

| POD | Podium Minerals | 0.13 | -16% | 591,888 | $52,166,633 |

| TNG | TNG Limited | 0.075 | -16% | 6,137,018 | $123,569,222 |

| AJL | AJ Lucas Group | 0.082 | -15% | 7,623,702 | $133,445,774 |

| BGE | Bridgesaaslimited | 0.11 | -15% | 128,600 | $3,774,681 |

| TG1 | Techgen Metals Ltd | 0.11 | -15% | 101,892 | $7,117,364 |

| BFC | Beston Global Ltd | 0.039 | -15% | 5,857,914 | $39,940,938 |

RedBubble (ASX:RBL), the print-on-demand marketplace for Independent Artists (Gregor says think ‘Etsy’ but with less seashells and googly-eyes glued on stuff), which is down 24.3% after a YoY decline from the profit-after-tax-on-demand arm of its business.

After making nearly $1m last year, RBL lost *checks notes* $17m this year.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.