Closing Bell: Somebody told somebody China might want Aussie coal again, willing markets bite

Chinese whispers lift ASX 200 Via Getty

- The ASX 200 is up, the XEC is up solidly

- Energy, resources, materials are back in black

- US CPI was a tough read, but not fatal

Australian small caps are trading well over 1.5% higher on Thursday afternoon as mining and energy stocks come back in favour, boosted by commodity prices and the cheeky rumour out of Shaw and Partners of good news for Aussie coal in the August post from China.

In fact, if I’ve got a hard copy of Pete O’Connor from Shaw and Partners’ note entitled, Coal: China reversing import ban (headline) then it’s fair to say this bag is entirely cat-less.

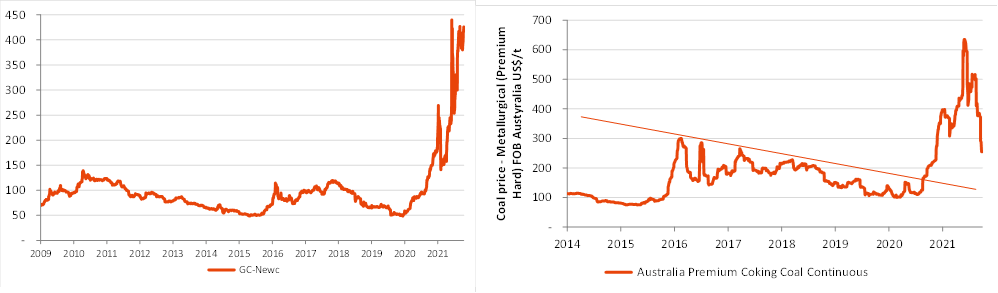

Still, reliable source or no – one cannot argue with the Shaw charts, which are always marvellous:

Coal price trends … thermal coal sticky around US$400/t whilst met coal back-tracked to ~$250/t

That’s some pretty spiky met and thermal prices.

In any case this is the tale of the tape for coal co’s after 3.30pm on Thursday:

- Coronado Coal up circa 8.5%

- Yancoal added 8%

- Whitehaven added 7%

- New Hope Coal added 7%

“After recording five consecutive weeks of falls and desperate to avoid a sixth, the Materials sector has rebounded, led by another round of stellar gains for the coal miners on talk that China would end its unofficial ban on Australian coal imports in the coming months,” Tony Sycamore at City Index says.

The rebound follows another ripping yarn of a US June CPI read (9.1%) and at home, a further decline in the unemployment rates to 3.5% in June.

Booktopia closed the chapter on Tony Nash as CEO. Sigh. I think that was his baby.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 14 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.0015 | 50% | 2,130,686 |

| ZLD | Zelira Therapeutics | 3.2 | 43% | 94,880 |

| KLI | Killi Resources | 0.195 | 34% | 18,100 |

| AFW | Applyflow Limited | 0.002 | 33% | 713,009 |

| VPR | Volt Power Group | 0.002 | 33% | 5,731,183 |

| WBE | Whitebark Energy | 0.002 | 33% | 260,498 |

| DEV | Devex Resources Ltd | 0.3 | 30% | 400,234 |

| MKL | Mighty Kingdom Ltd | 0.04 | 29% | 569,050 |

| PNT | Panther Metals | 0.24 | 26% | 1,250,135 |

| W2V | Way2Vat | 0.039 | 26% | 588,820 |

| HCD | Hydrocarbon Dynamic | 0.016 | 23% | 1,138,098 |

| ZAG | Zuleika Gold Ltd | 0.027 | 23% | 940,847 |

| EQS | Equity Story Group | 0.087 | 23% | 13,467 |

| CAY | Canyon Resources Ltd | 0.058 | 21% | 4,276,131 |

| VOL | Victory Offices Ltd | 0.018 | 20% | 225,500 |

| AYM | Australia United Min | 0.006 | 20% | 83,333 |

| GMN | Gold Mountain Ltd | 0.006 | 20% | 154,976 |

| TSC | Twenty Seven Co. Ltd | 0.003 | 20% | 356,350 |

| AQC | Auspac Coal Ltd | 0.105 | 19% | 14,658 |

| GGG | Greenland Minerals | 0.058 | 18% | 1,533,664 |

| SMX | Security Matters | 0.13 | 18% | 32,720 |

| CNB | Carnaby Resource Ltd | 1.09 | 18% | 1,576,846 |

| ACB | A-Cap Energy Ltd | 0.06 | 18% | 1,816,263 |

| GW1 | Greenwing Resources | 0.235 | 18% | 253,882 |

| BTN | Butn Limited | 0.14 | 17% | 99,885 |

Panther Metals (ASX:PNT) wins, with the explorer smashing out a bonanza-grade gold find at its Burtville East prospect.

Investors just about broke their backs today says Sir Gregor of Stronach, piling on board as PNT found circa 30%, thanks to visible gold being panned out of one hole at the prospect, and gob-smacking results like 15m at 53.94g/t gold from 27m, including:

- 1m at 79.90g/t gold from 27m,

- 1m at 478.00g/t gold from 28m,

- 1m at 125.50g/t gold from 34m, and

- 1m at 43.80g/t gold from 35m

Also up a stonking 30% or so is Killi Resources (ASX:KLI). They’re out at their West Tanami project in WA mobilising drill rigs for a maiden drilling program.

The company plans to complete around 10,000m of air-core (AC) and reverse-circulation (RC) drilling, with the focus on high priority gold and rare earth element hydrothermal targets generated at the northern end of the tenement package.

Killi says it is also mobilising a diamond drill rig to complete at least one deep drill hole to a depth of ~800-1,000m – which will be funded by the Western Australian Geological Survey’s latest round of Exploration Incentive Scheme (EIS) funding.

The EIS will contribute up to $150k towards the drill hole.

“We’ve been working hard over the last few months to get on the ground and start our drilling campaign for the year,” CEO Kathryn Cutler said.

“Drill rigs are now mobilising to site, to complete the first RC and Diamond holes on the project.

“We look forward to getting the rods spinning soon and unlocking the potential of the project,” she added.

Also having a corker this morning were Australian Pacific Coal (ASX:AQC), up 19% on soaring coal prices.

And finally, Zelira Therapeutics (ASX:ZLD) keeps on rocketing (up circa 34%) after its product approval news from German regulatory authority BfArM (The Federal Institute for Drugs and Medical Devices – Bundesinstitut für Arzneimittel und Medizinprodukte – if you’re a curious one), now that it’s all been squared away with the ASX as well.

ASX SMALL CAP LOSERS

Here are the best performing ASX small cap stocks for July 14 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Security | Description | Last | % | Volume |

|---|---|---|---|---|

| KWR | Kingwest Resources | 0.065 | -19% | 2,110,822 |

| AL3 | Aml3D | 0.066 | -18% | 1,690,836 |

| AJX | Alexium Int Group | 0.024 | -17% | 219,486 |

| TNY | Tinybeans Group Ltd | 0.2 | -17% | 1,000 |

| BAT | Battery Minerals Ltd | 0.005 | -17% | 1,936,646 |

| TKL | Traka Resources | 0.005 | -17% | 1,767,142 |

| GCR | Golden Cross | 0.011 | -15% | 9,344 |

| EXP | Experience Co Ltd | 0.18 | -14% | 448,466 |

| ADV | Ardiden Ltd | 0.006 | -14% | 4,569,309 |

| CTO | Citigold Corp Ltd | 0.006 | -14% | 166,666 |

| LNU | Linius Tech Limited | 0.006 | -14% | 627,086 |

| RR1 | Reach Resources Ltd | 0.003 | -14% | 12,077,522 |

| NIM | Nimy Resources | 0.305 | -14% | 190,719 |

| RNT | Rent.Com.Au Limited | 0.032 | -14% | 627,956 |

| BNZ | Benzmining | 0.37 | -13% | 36,060 |

| SKY | SKY Metals Ltd | 0.054 | -13% | 66,667 |

| ST1 | Spirit Technology | 0.055 | -13% | 322,030 |

| ARO | Astro Resources NL | 0.0035 | -13% | 1,000,000 |

| CLE | Cyclone Metals | 0.0035 | -13% | 5,347,892 |

| INP | Incentiapay Ltd | 0.007 | -13% | 400,000 |

| FG1 | Flynngold | 0.105 | -13% | 287,107 |

| PFT | Pure Foods Tas Ltd | 0.175 | -13% | 147,637 |

| GCX | GCX Metals Limited | 0.057 | -12% | 67,103 |

| SRZ | Stellar Resources | 0.015 | -12% | 2,350,734 |

| MAU | Magnetic Resources | 0.975 | -11% | 47,397 |

There are no small cap losers, only small companies which did not perform as well as hoped today.

IN CASE YOU MISSED IT

It’s a case of do you want the good news or bad news for BBX Minerals (ASX:BBX), which has released mixed assay results for diamond drill holes TED 011 and TED 012 from its 2020-21 drilling program at the Três Estados project in Brazil.

BBX said TED 012 results show consistent platinum mineralisation and local iridium and rhodium values from surface to 31m and 19.74m to the end of the hole at 80.74m.

But TED 011 returned no value for PGMs and only sporadic low values for gold.

CEO Andre J Douhane said to understand how the hole could be void, BBX undertook a detailed review of its geology.

“To me personally, the positive thing about the barren hole was that since the previous hole (TED 010) contained significant results in terms of grade, and the subsequent hole (TED 012) had significant grades and continuity, the blank hole further validates both the assay method and results from other holes.”

In further resources news, American Rare Earths (ASX: ARR) said drill assay results from the Overton Mountain area confirm Halleck Creek’s potential as one of the largest rare earths deposits in North America.

From March to April ARR drilled nine holes for 917m and collected 650 core samples. Assay results from 382 samples from five core holes demonstrates consistent rare earth mineralisation associated with clinopyroxene quartz monzonite (CQM) rocks of the Red Mountain Pluton (RMP)

ARR said it’s now well progressed in planning for an exploration drilling campaign in CY2022 to define a maiden JORC resource at Halleck Creek.

Finally, it’s a slow-go at Moho – with comprehensive assays still some time away – but the digger says it has already received encouraging signs of nickel sulphides at the Black Swan prospect.

The recently completed drill program outlined the apparently undisturbed basal contact of target komatiite ultramafics that could host nickel sulphides due to evidence of substantial settling and accumulation of olivine over about 300m strike of the komatiite.

Hmm… komatiite ultramafics.

Moho Resources (ASX:MOH) noted that four of the 12 holes drilled had identified a 25m to 30m depression in the komatiites at the southern end plunging southeast.

Further drilling of the depression will be required to determine if it develops further into a channel at depth and provides a site for settling and accumulation of nickel sulphide mineralisation. This komatiite is also open to the southeast but closed off to the northwest.

“This drill program has provided critical information for Moho to vector in on the nickel sulphide potential at Black Swan South,” managing director Ralph Winter says.

TRADING HALTS

Kincora Copper (ASX:KCC) – in relation to material assay results

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.