Closing Bell: Small caps up 1% as Invictus gets gas, rises 38%

Via Getty

- ASX closes flat

- Small cap index up 1%

- IVZ digs deeper into Zimbabwe gas riches

Outgoing Chinese Premier Li Keqiang has bumped hearts with Our Albo in Phnom Phen and declared China is ‘ready to meet Australia half way’, according to reports out of Xinhua.

Li this morning apparently spoke with Marrickville PM Anthony Albanese at the ASEAN summit in Cambodia, his status as persona non gratis and soon-to-be retired ex-Premier not really worth mentioning.

Halfway suggests China can leave most of its illegal military outposts across the South China Sea and we can get back to the business of flogging lobsters and coal.

Importantly, the Commonwealth Bank appear to be true believers in the re-emergence of a China with plenty of COVID.

This morning mainland indices continued their strong rise. The Hang Seng, Hong Kong’s benchmark index popped after closing the previous week on a burn.

The Hang Seng rose 3% from the open. The Shanghai Composite added 0.5% and in Shenzhen stocks gained around 1%.

At CBA Vivek Dhar said:

“We think there’s good reason to think that China is reconsidering their approach to its COVID-zero policy especially with the changes to China’s COVID-zero policy coinciding with COVID-19 cases in China surging to a six-month high.”

Elsewhere the excitement has punched a hole through iron ore doubters with Fortescue Minerals ahead by 9% this morning.

The promise of less COVID-zero and less US inflation helped Wall Street to handsome gains on Friday.

The benchmark S&P 500 jumped 0.9 per cent, the Dow Jones Industrial Average firmed 0.1 per cent and the Nasdaq vaulted 1.9 per cent.

US bond yields fell. Cryptocurrencies are lower. Oil rose, As did base metals and the ore we spoke of which makes iron.

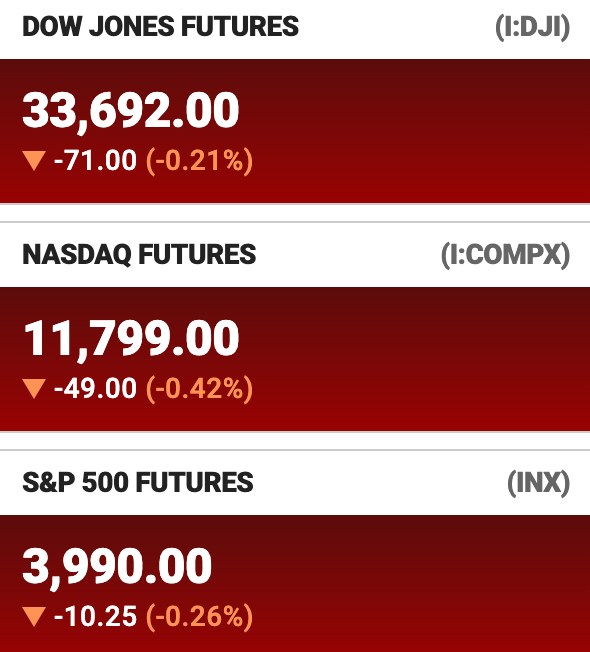

This is where US Futures are at 3.45pm in Sydney:

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ICN | Icon Energy Limited | 0.012 | 71% | 2,825,873 | $5,376,096 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | 279,986 | $23,693,441 |

| TCG | Turaco Gold Limited | 0.068 | 39% | 318,293 | $20,958,117 |

| IVZ | Invictus Energy Ltd | 0.33 | 38% | 66,493,715 | $210,326,062 |

| TMB | Tambourah Metals | 0.205 | 32% | 11,267,335 | $6,384,853 |

| NGY | Nuenergy Gas Ltd | 0.021 | 31% | 1,254,003 | $23,695,288 |

| LDX | Lumos Diagnostics | 0.05 | 25% | 844,289 | $8,396,258 |

| AQX | Alice Queen Ltd | 0.0025 | 25% | 491,000 | $4,400,500 |

| AUK | Aumake Limited | 0.005 | 25% | 19,618,788 | $3,085,788 |

| DW8 | DW8 Limited | 0.0025 | 25% | 1,769,312 | $5,903,045 |

| GMN | Gold Mountain Ltd | 0.01 | 25% | 13,689,153 | $11,865,193 |

| PVE | Po Valley Energy Ltd | 0.068 | 24% | 577,330 | $63,102,889 |

| CUL | Cullen Resources | 0.016 | 23% | 862,326 | $6,339,115 |

| RIE | Riedel Resources Ltd | 0.011 | 22% | 359,250 | $11,985,364 |

| EMH | European Metals Hldg | 0.95 | 22% | 181,147 | $92,881,841 |

| NET | Netlinkz Limited | 0.034 | 21% | 13,369,872 | $91,669,472 |

| SPT | Splitit | 0.15 | 20% | 4,833,206 | $66,501,694 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 1,933,993 | $12,288,857 |

| DDT | DataDot Technology | 0.006 | 20% | 572,314 | $6,219,347 |

| SIS | Simble Solutions | 0.013 | 18% | 590,948 | $4,700,661 |

| WC1 | West Cobar Metals | 0.23 | 18% | 325,769 | $13,601,265 |

| GGE | Grand Gulf Energy | 0.02 | 18% | 5,738,684 | $26,292,381 |

| G50 | Gold50Limited | 0.2 | 18% | 128,452 | $9,680,310 |

| BBX | BBX Minerals Ltd | 0.076 | 17% | 2,622,433 | $31,636,896 |

| TYM | Tymlez Group | 0.021 | 17% | 1,401,948 | $17,808,573 |

Here’s what’s got Invictus Energy (ASX:IVZ) up on Monday — a snazzy new Mukuyu-1 drilling update.

The busy bees have hit a Total Depth (TD) of 3618 metres and lo! there were zones of elevated gas and fluorescence out at Zimbabwe’s richly historic Cabora Bassa Basin.

Tambourah Metals (ASX:TMB) says rock chip sampling has uncovered pegmatites swarms up to 8m high and 500m long at RJ 101, part of the early-stage Russian Jack lithium project in the Pilbara region of WA.

TMB also just added to the acquisition with a neat purchase called Tambina for $5K. Bargain.

The recently listed $9m market cap stock is up 60% over the past month.

Brazilian gold play BBX (ASX:BBX) has struggled with “complex” mineralisation at its Tres Estados and Ema precious metals projects for years.

The gold + PGEs mineralisation is weird, confusing and hard to assay and extract, leading to some tussles with the ASX.

But some initial bioleaching test results were a success, showing a significant increase in gold, platinum, palladium, iridium and rhodium.

CEO Andre J Douchane says it’s just the start, but, if successful, laboratory pilot plant testing could begin.

ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ALY | Alchemy Resource Ltd | 0.029 | -34% | 87,948,650 | $51,615,355 |

| AO1 | Assetowl Limited | 0.001 | -33% | 10,000 | $2,358,195 |

| ARE | Argonaut Resources | 0.002 | -33% | 62,484,612 | $19,085,614 |

| GGX | Gas2Grid Limited | 0.001 | -33% | 10,491 | $6,087,153 |

| MEB | Medibio Limited | 0.001 | -33% | 200,000 | $4,980,891 |

| NZS | New Zealand Coastal | 0.003 | -25% | 1,501 | $4,508,020 |

| TD1 | Tali Digital Limited | 0.003 | -25% | 4,436,103 | $4,930,522 |

| TSC | Twenty Seven Co. Ltd | 0.0015 | -25% | 2,805,032 | $10,643,256 |

| AFA | ASF Group Limited | 0.04 | -23% | 1,721 | $41,213,836 |

| ELD | Elders Limited | 10.21 | -23% | 7,991,808 | $2,073,314,606 |

| CAU | Cronos Australia | 0.58 | -23% | 2,587,929 | $416,110,482 |

| NKL | Nickelxltd | 0.105 | -22% | 4,895,859 | $10,569,441 |

| FNX | Finexia Financial | 0.055 | -20% | 14,591 | $11,185,390 |

| GCR | Golden Cross | 0.008 | -20% | 46,056 | $10,972,561 |

| DUN | Dundas Minerals | 0.39 | -18% | 488,539 | $19,116,019 |

| NUC | Nuchev Limited | 0.185 | -18% | 30,445 | $11,642,490 |

| TGH | Terragen | 0.099 | -18% | 45,400 | $23,282,308 |

| GLV | Global Oil & Gas | 0.0025 | -17% | 821,683 | $5,620,064 |

| OAR | OAR Resources Ltd | 0.005 | -17% | 1,500 | $13,266,227 |

| LRL | Labyrinth Resources | 0.016 | -16% | 838,435 | $16,593,968 |

| AN1 | Anagenics Limited | 0.027 | -16% | 91,035 | $7,072,682 |

| 8VI | 8Vi Holdings Limited | 0.71 | -14% | 100 | $35,176,580 |

| BTR | Brightstar Resources | 0.018 | -14% | 179,030 | $15,130,450 |

| CFO | Cfoam Limited | 0.003 | -14% | 395,736 | $2,568,442 |

| DVL | Dorsavi Ltd | 0.012 | -14% | 40,000 | $6,090,087 |

TRADING HALTS ON MONDAY

Classic Minerals (ASX:CLZ) – CLZ has announcements relating to government approval for the Kat Gap processing plant on the way.

Globe Metals & Mining (ASX:GBE) – Capital raise

Orbital Corporation (ASX:OEC) – Capital raise

South Harz Potash (ASX:SHP) – Capital raise

WA1 Resources (ASX:WA1) – More results on the way for WA1

Magmatic Resources (ASX:MAG) – Capital raise

Southern Gold (ASX:SAU) – Capital raise

The GO2 People (ASX:GO2) – Capital raise

Zenith Minerals (ASX:ZNC) – Zenith has “significant lithium drill results” on the way from its Split Rocks project.

Burley Minerals (ASX:BUR) – And lastly, Burley’s got some news about an acquisition. Neato.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.