Closing Bell: Small caps show big heart with unlikely rise

Via Getty

- Emerging Companies (XEC) index jumps more than 2% before trimming gains

- Benchmark ASX200 down 0.15%

- Greentech Metals up over 120%, in trading halt

Inspired by strength in gold and metals Aussie small caps have bounced off the canvas on Thursday, proving once and forever they could take large caps in a knife fight.

Overnight in the states the Federal Reserve jacked the federal funds rate by 75 basis points (bps), to 1.75%.

This was a big one. The biggest in 28 years, when this audio abomination ruled the earth:

The Bureau of Stats reports a 60,600 rise in May jobs, a king hit on the expected 25k.

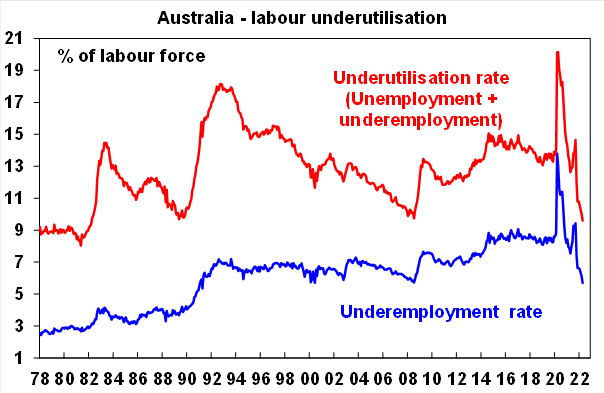

But while unemployment was basically flat, underemployment fell to 5.7% taking unused labour down to 9.6%.

Which is its lowest since 1982. When this wonderful nonsense happened:

The Melbourne Institute Consumer Inflation expectation survey’s trimmed mean measure for June jumped 1.7pc on-month to 6.7%, its highest level since mid-2008. When Flo Rida and Huckleberry du jour T-Pain did this, but not as well as Tom Cruise did it:

In a note following the data releases RBC Capital Markets warned that in combo, along with the “increasingly front-loaded nature of Fed hiking and many other global central banks, suggest to us that the RBA will likely keep hiking in 50bp increments beyond July.”

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| GRE | Green Tech Metals | 0.345 | 146% | 13,040,013 |

| EVE | EVE Health Group Ltd | 0.0015 | 50% | 1,307,500 |

| PFE | Pantera Minerals | 0.13 | 35% | 193,438 |

| ATU | Atrum Coal Ltd | 0.008 | 33% | 767,655 |

| CLE | Cyclone Metals | 0.004 | 33% | 1,038,002 |

| GLV | Global Oil & Gas | 0.004 | 33% | 2,788,019 |

| JXT | Jaxstaltd | 0.0275 | 31% | 2,705,332 |

| AJL | AJ Lucas Group | 0.052 | 30% | 1,572,569 |

| MXC | Mgc Pharmaceuticals | 0.022 | 29% | 10,652,370 |

| RLC | Reedy Lagoon Corp. | 0.018 | 29% | 6,396,523 |

| TAR | Taruga Minerals | 0.024 | 26% | 1,514,444 |

| NXM | Nexus Minerals Ltd | 0.24 | 26% | 1,316,987 |

| AHN | Athena Resources | 0.029 | 26% | 66,959,412 |

| GML | Gateway Mining | 0.01 | 25% | 3,354,775 |

| PRM | Prominence Energy | 0.0025 | 25% | 5,577,744 |

| RR1 | Reach Resources Ltd | 0.005 | 25% | 170,000 |

| ECS | ECS Botanics Holding | 0.021 | 24% | 8,085,760 |

| UUL | Ultima Utd Ltd | 0.07 | 23% | 7,000 |

| STK | Strickland Metals | 0.067 | 22% | 1,603,179 |

| EV1 | Evolution Energy | 0.335 | 22% | 49,992 |

| TYX | Tyranna Res Ltd | 0.017 | 21% | 5,524,163 |

| NWE | Norwest Energy NL | 0.04 | 21% | 29,351,661 |

| S3N | Sensore Ltd | 0.46 | 21% | 29,713 |

| 1MC | Morella Corporation | 0.018 | 20% | 10,636,367 |

| WCN | White Cliff Min Ltd | 0.018 | 20% | 3,168,263 |

Greentech Metals (ASX:GRE) is in a trading halt.

It’s a winner, and a big one at that today, but my spidey-sense is tingling and tingling something awful – either that, I’m overdue a bath or we’re raising capital.

Because GRE has got a bunch of new rather thrilling drill hits to ponder – like 32m @ 2.43% copper – the multi-metal green machine has screamed into the halt pending an update on the original news laid out below in articulate bullet point glory by Reuben:

Other notable assay results from GRE’s 25 hole, 3,800m program include:

- 19m @ 1.6% Cu, 2.27% Zn and 0.51g/t Au from 21m

- 12m @ 9.17% Zn, 2.34% Cu and 0.62g/t Au from 52m; and

- 8m @ 2.65% Cu, 0.64% Zn and 0.11g/t Au from 141m

This drilling confirms that the high-grade copper and zinc at Whundo persists at depth and beyond the current resource envelope, GRE says.

Then there’s the bonus gold grades of up to 3.34g/t, which accompany the higher-grade copper zones and “further enhances the potential economics of the project”.

Whundo is at the core of a much broader copper and zinc mineralised system, GRE exec director Thomas Reddicliffe says.

“Drilling has demonstrated that the mineralisation at Whundo remains open at depth and with grades persisting,” he says.

“This and the identification of two additional mineralised horizons provides further impetus for the company to build upon the known resource.”

Assay results for three additional holes drilled at Whundo, and seven holes drilled at the nearby ‘Ayshia’ deposit are expected in the coming weeks.

Once all assays are received, GRE will look to update the existing resource at Whundo/Ayshia of 3.6 Mt @ 1.2% copper and 1.4% zinc.

The $9m market cap Artemis Resources (ASX:ARV) spinout is up 40% on its December IPO price of 20c per share. It had $4m in the bank at the end of March.

A 1,800m drilling program is due to kick off at Pantera Minerals (ASX:PFE) ‘Hellcat’ project in WA, prospective for ‘Abra’-like lead-silver deposits.

The program will test high priority gravity targets and modelled Electromagnetic (EM) conductors, PFE says.

Speaking to Stockhead, PFE CEO Matt Hansen said Hellcat is probably the best undrilled target around at the moment, and has the potential to be a company maker.

The explorer is also preparing to kick off drilling at its ‘Weelarrana’ manganese project in early or mid-July.

$7m market cap PFE is down 20% year-to-date. It had $5.8m in the bank at the end of March.

Renascor Resources’ (ASX:RNU) says its latest drill results are big stride toward an improved and accelerated mining schedule

In an updated Battery Anode Material Study, RNU has recent drilling at Siviour Graphite Deposit in South Australia intersected “widespread, high-grade graphite intersections.”

Siviour is currently the second largest reported Proven Graphite Reserve in the world and the largest Graphite Reserve outside Africa supporting a 40 year mine life with production of Graphite Concentrates of up to 150,000 tonne per annum.

Outside of the resources space it is all about Aussie and elsewhere listed European based biopharma MGC Pharmaceuticals (ASX:MXC), which has completed a successful in-vitro preclinical research study into the use of cannabinoids to treat brain cancer.

The company – which specialises in the production and development of phytomedicines, says it’s just wrapped up a three year pre-clinical in-vitro research into the use of cannabinoids in the treatment of Glioblastoma, a fast-growing and aggressive form of brain tumour and it’s delivered “outstanding results.”

Without going into further medicinal detail, the shares have gone skyward.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| GO2 | The GO2 People | 0.013 | -28% | 613,446 |

| SIT | Site Group Int Ltd | 0.003 | -25% | 120,000 |

| CBL | Control Bionics | 0.125 | -24% | 355,655 |

| C29 | C29 Metals Limited | 0.11 | -24% | 348,199 |

| TGH | Terragen | 0.13 | -24% | 8,699 |

| AQS | Aquis Ent Ltd | 0.1 | -23% | 11,766 |

| RML | Resolution Minerals | 0.007 | -22% | 2,481,000 |

| AYA | Artryalimited | 0.56 | -22% | 129,517 |

| HMI | Hiremii | 0.051 | -18% | 465,030 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | 5,370,588 |

| MIO | Macarthur Minerals | 0.225 | -17% | 79,834 |

| IVT | Inventis Limited | 0.082 | -16% | 24,107 |

| PLG | Pearlgullironlimited | 0.038 | -16% | 1,607,221 |

| C1X | Cosmos Exploration | 0.115 | -15% | 58,000 |

| HUM | Humm Group Limited | 0.575 | -15% | 2,765,797 |

| CR1 | Constellation Res | 0.15 | -14% | 19,077 |

| JAY | Jayride Group | 0.15 | -14% | 178,598 |

| GCR | Golden Cross | 0.06 | -14% | 9,025 |

| ILA | Island Pharma | 0.12 | -14% | 145,910 |

| TTB | Total Brain Ltd | 0.055 | -14% | 80,472 |

| EOF | Ecofibre Limited | 0.235 | -13% | 239,097 |

| TKL | Traka Resources | 0.007 | -13% | 150,936 |

| VBC | Verbrec Limited | 0.105 | -13% | 22,250 |

| DC2 | Dctwo | 0.05 | -12% | 187,295 |

| IDT | IDT Australia Ltd | 0.11 | -12% | 476,563 |

ANNOUNCEMENTS YOU MAY’VE MISSED

Nexion Group (ASX:NNG) jumped by almost 20% today, after announcing that non executive chairman Peter Christie has acquired more shares in the company, showing that he’s prepared to put his bonus where his mouth is and back the company to the hilt. Christie, who rose to prominence as founder of infrastructure-as-a-service (IaaS) for AI and cloud gaming platform Radian Arc, has snapped up an extra 189,235 shares at market price, bringing his total stake to 5,340,570 – which could be his highest score yet.

A missive from far-off Africa tells us that Walkabout Resources’ (ASX:WKT) efforts to turn its Lindi Jumbo project into a Super-Jumbo (or Mega-Lindi – either works) continue apace, with site development now well underway. Walkabout also says that long-awaited shipping of major processing equipment to the site in Tanzania is looming, after COVID clampdowns saw several shipments of much-needed gear left in limbo on the docks in China.

And last cab off the rank today is Cash Converters (ASX: CCV), which told the market that it’s signed a renewal of its loan securitisation facility with Fortress Investment Group. Cash Converters says its loan book has climbed to an unaudited gross value of over $211.3m, and the new deal has been “refinanced on competitive terms”, which – surprisingly – don’t include having to forfeit ownership of two Gibson guitars and a Playstation3 console if payments aren’t made by the end the month.

TRADING HALTS

Greentech Metals (ASX:GRE) – clarifying statement regarding today’s announcement

Indiana Resources (ASX:IDA) – capital raise

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.