Pantera Minerals shifts exploration into high gear at three WA projects

Pantera will be keeping busy with exploration work. Pic: David Madison (Stone) via Getty Images

Pantera Minerals is all set to explode into action across its Hellcat, Weelarrana and Yampi projects in Western Australia, after laying out all the critical groundwork.

First off the rank – due in part to heavy rain in some of the state – is a planned drilling program at the Hellcat lead-silver project that will begin towards the end of June or early July.

Speaking to Stockhead, Pantera Minerals (ASX:PFE) Chief Executive Officer, Matt Hansen, says Hellcat is probably the best undrilled target around at the moment, and has the potential to be a company maker.

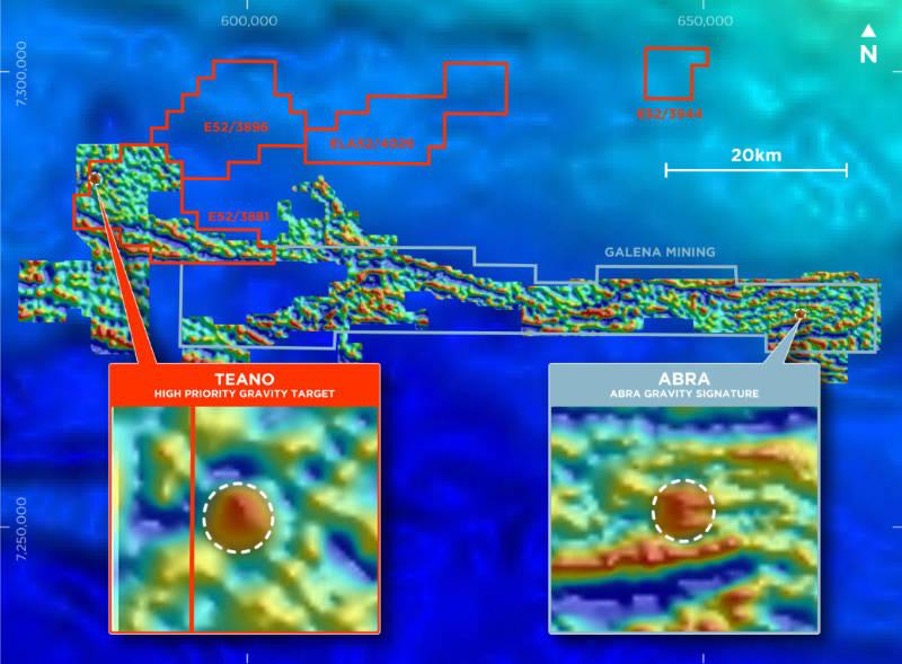

While Hellcat is located within the same stratigraphic sequence and structural setting as Galena Mining’s Abra lead-silver project, the company believes the geophysics and geochemistry at the Teano prospect are stronger.

Teano is a geophysical anomaly with proximal mineralisation at surface. The gravity anomaly is modelled as being 185m below surface, shallower than Abra, and could represent significant galena, barite, chalcopyrite, iron oxide mineralisation at depth.

“Our geologists think that if you were looking at Teano and Abra at the same time and only had the option to drill one at a time, you’d actually drill Teano as it is stronger than Abra,” Hansen says.

“It is really unusual to find a target in this day and age so good and obvious that has never been drilled.”

Pantera had snapped up the 80% interest in Hellcat in December last year with Hansen noting at the time that the project could well be spun off into its own vehicle and listed on its own merits.

“But the vendors wanted to drill it pretty quickly and we were in the position to do so and we jumped on it,” he added.

This acquisition was quickly followed by a heli-borne versatile time domain electromagnetic (VTEM) survey that identified multiple conductor targets that coincide with the Teano and Yarvi gravity anomalies.

Approval for its Programme of Works has been received from the WA Department of Mines, Industry Regulation and Safety.

This provides for the drilling of up to 18 diamond holes if required, with an initial four holes planned.

New direction for Yampi

Of equal importance – but delayed due to its remote location and bad weather – is the Yampi project, which had the company recently undergoing a bit of a rethink.

Results from its 2021 diamond drilling revealed that Yampi’s real prize wasn’t iron ore, but porphyry copper-gold.

This has returned anomalous levels of gold (up to 32 parts per billion), molybdenum (3.34 parts per million), antimony (28.3ppm), arsenic and bismuth within hematite alteration, which indicates the presence of a large hydrothermal alteration system.

“The drilling revealed that the outcropping hematite is hydrothermal in nature and is introduced into the rock along fractures and veins,” Hansen explains.

“It is not a primary hematite like we first thought, which means the hematite is likely an iron alteration zone along a porphyry, and the trace element geochemistry indicates possible gold-copper porphyry.

“We think it is looking kind of the same as the North Parkes copper-gold mine in New South Wales.”

Third party activity in the immediate region also provides further evidence that the company has a porphyry play on its hands, with nearby Dreadnought Resources progressing its own massive Orion copper, silver, gold, cobalt, and zinc massive sulphide discovery.

“The copper mineralisation that Dreadnought has been intersecting is fault controlled. They believe the source of this commodity is to the north and that the copper has leaked out through the faults from the primary source to the north, which we think we have,” Hansen says.

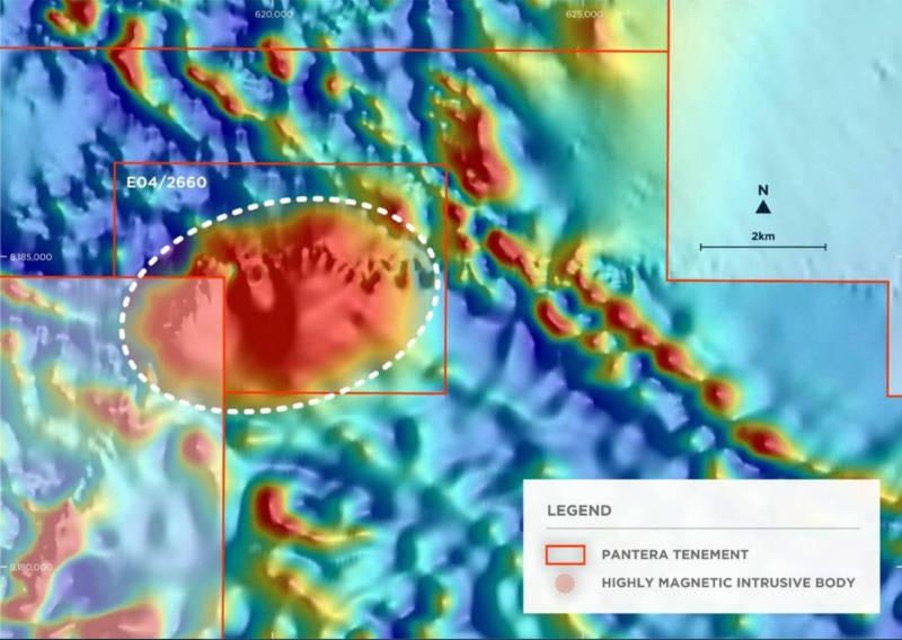

“So, for us, it is a bit of a rethink of the area. We have done some aeromagnetic surveys – the program this year is to target that porphyry copper-gold mineralisation and do some rock chip sampling and some mapping of the area.

“In our tenements E04/2660 there is a very high magnetic intrusive anomaly that pops up, which we think is the source.”

Attention turning to manganese

Pantera is also preparing to kick off drilling at its Weelarrana manganese project in early or mid-July, depending on the rains, as the commodity starts to gain attention in the market.

“There is talk of it being a replacement for cobalt, which is getting too expensive. And you are seeing more manganese come to the market as explorers search for it,” Hansen notes.

While the company is now keen to see what is present there, it wasn’t always a project high on it’s to do list.

“When we first picked it up, we weren’t overly impressed with it but when we got out there, it actually looked much better than we thought it was. There was an outcropping we thought was 250m that has now been expanded to 750m-800m of high-grade manganese,” he adds.

“Weelarrana has some high-grade rock chip samples and it has multiple targets with a genuine chance of being a high-grade manganese discovery.

“It is in a good location and bar the unusual rains, we have year-round access that allow us to fast-track a discovery there.”

Hansen adds that while there’s a strong similarity with E25’s Butcherbird, the company believes that Weelarrana has higher grades than the other company’s high-tonnage, low-grade project along with better access to the highway.

“There are a couple of other targets that we think are under a bit of cover and we will drill Weelarrana, hopefully in early or mid-July,” he says.

“Weelarrana is a pretty easy one, you just get in there and drill 25 holes, it is cheap to drill compared to everywhere else.”

Pipeline of activity

With the activity on both Hellcat and Weelaranna (for now), the company has an exciting June to September schedule.

“Hellcat will be a good six weeks of drilling, and then we will be able to see what’s coming out of the core, though we won’t get assays for some time after, but we will have a portable XRF out there,” Hansen explains. “We will know pretty quickly, I think.”

This article was developed in collaboration with Pantera Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.