Closing Bell: Small cap biopharma injects a little excitement as ASX finally finds a Thursday butt to kick

Stand still. Via Getty

- Benchmark index finds some rare greenage, up 0.5%

- Property and IT Sectors lead broad-based gains, XEC Emerging Co’s index now down 14% from July highs

- Fascinating small caps action: led by Dimerix, Bluglass and Experience Co.

The ASX200 has turned a first positive session this week and in October, following a relief rally on Wall Street as US yields eased following the release of cooler-than-expected US economic data.

The benchmark ASX200 found 35 points or +0.51% at the close on Thursday.

Local markets took their cues from a broadly positive lead from Wall Street as softer-than-expected US jobs data drove bond yields lower, giving equities a much-needed reprieve.

As CBA’s Harry Ottley noted in the AM: US companies added the fewest number of jobs since the start of 2021 in September, increasing trader bets that the US Federal Reserve can refrain from further interest rate increases.

ANZ bank’s morning missive was of the same measure – if not a little more visceral in its use of the English language – saying the new reality was taking time for traders to accept.

“A fragile calm helped to stabilise markets overnight, following the whipsaw price action of the last 24 hours… Markets are adjusting to the reality that central banks will not pivot early on rates and volatility looks set to continue.”

On the ASX it was a return to form for the Property Sector – down by double-digits since the end of August, with most major property groups sharing the gains. Elsewhere, real estate names were aided and abetted by the IT Sector, fickle as it is.

Lithium downgrades overnight from UBS and JP Morgan have weighed on locals as fears around falling lithium prices weighed on the bigger ASX names, Core Lithium (ASX:CXO), Vulcan Energy (ASX:VUL) and IGO (ASX:IGO) were among the lithium names to share the losses.

Regional equity markets also found some buyers on Thursday.

The Nikkei 225 Index rose 0.7% to above 30,700 while the broader Topix Index gained 0.5% both indices snapping a five-day stretch of losses.

Markets in China remain shut for a week-long holiday.

The ASX Small Ords (XSO) added 0.8% and the absolutely-can-not-win-a-trick ASX Emerging Co’s (XEC) index ended flatski.

From the XEC’s most recent peak of July 27, the index has lost 14% in about 11 weeks of trade.

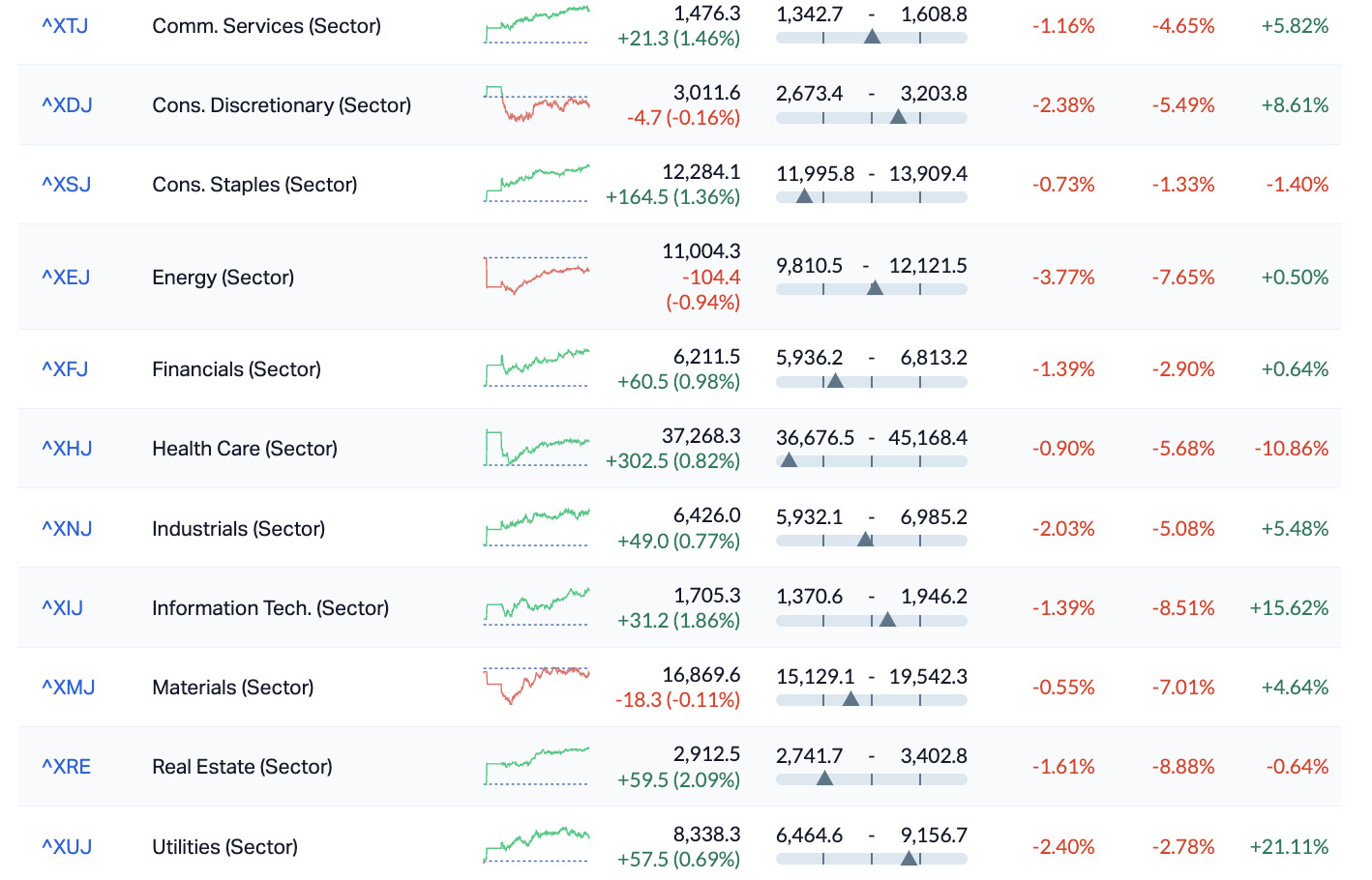

ASX by Sectors today — Intraday — 52 Week Range — Week – Month – Year

RIPPED FROM THE HEADLINES

Oil

The US oil benchmark really ran itself off a cliff overnight, plunging for an interminable (more than) 5% ending somewhere at its deepest darkest levels in around… a month.

Still, WTI crude futures look to have stabilised during our session – hovering above US$84 per barrel after some official US data highlighted unexpected and extremely weakness in US fuel demand. One never expects that.

Because OPEC+ made no changes to its output policy and maintained previously announced production cuts, ie: Saudi Arabia’s voluntary output cut of 1 million barrels per day and Russia’s 300,000 bpd voluntary export curb until the end of the year. Russia could do all sorts of things between now and then, but the price fall, I’ll take.

Russia

Meantime, the UK government is remembering how Cold War mentality weighs upon the mind, warning that Russia could target civilian shipping in the Black Sea by just laying a bunch of old school mines everywhere, making mincemeat of the key shipping transit.

Russian mines could target the temporary “humanitarian corridor” in the Black Sea setup by laying them on the approach to Ukrainian ports, Mi5, or is it Mi6 has whispered to someone in the British government who’ve issued a warning overnight, saying without saying that that’s what they’d probably do in the same circumstances.

EU

A new study by the Potsdam Institute for Climate Impact Research reckons if the EU can invest about €2 trillion on transitioning out of fossil fuels and and into renewables, the entire union’ could be energy self-sufficient by 2040.’ The Potsdam pack added that while that might seem like a lot of euros, in 2022 alone, the union forked out over €790bn, just trying to keep the lights on and the status, quo.

Home

The trade surplus rose to $9.6bn in August 2023, up from a downwardly revised $A7.3bn in July 2023, with punters hardly anticipating such a large jump, CBA had pegged for a rise to $9bn while the market expected an $8.7bn lift – correctly forecasting a widening of the trade surplus.

Total exports were 4.0% higher in the month, driven by non‑monetary gold according to CBA’s Harry Ottley, while imports contracted by just 0.4%.

“As we flagged as likely in the preview for this release, a rise in goods exports drove the drove the headline result, up 4.5% in August. Non‑monetary gold exports (which is highly volatile) was the biggest driver of the increase, surging by 96.7%. The value of non‑monetary gold reached a record high in the month at close to A$4bn.” Mr Ottley added.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DXB | Dimerix Ltd | 0.17 | 179% | 41,784,301 | $24,104,121 |

| BLG | Bluglass Limited | 0.053 | 43% | 13,093,919 | $56,537,689 |

| LML | Lincoln Minerals | 0.007 | 40% | 621,992 | $7,103,559 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 1,999,000 | $11,677,324 |

| NET | Netlinkz Limited | 0.008 | 33% | 904,632 | $21,363,170 |

| TOY | Toys R Us | 0.012 | 33% | 5,722,995 | $8,306,262 |

| ERG | Eneco Refresh Ltd | 0.021 | 31% | 279,000 | $4,357,734 |

| NGS | NGS Ltd | 0.018 | 29% | 1,255,580 | $3,517,184 |

| EWC | Energy World Corpor. | 0.038 | 27% | 164,731 | $92,367,637 |

| MTL | Mantle Minerals Ltd | 0.0025 | 25% | 5,832,162 | $12,294,892 |

| RBR | RBR Group Ltd | 0.0025 | 25% | 750,063 | $3,236,809 |

| TMH | The Market Herald | 0.265 | 23% | 8,943 | $69,009,105 |

| EXP | Experience Co Ltd | 0.24 | 23% | 116,318 | $147,704,190 |

| GTE | Great Western Exp. | 0.049 | 23% | 105,418 | $10,107,925 |

| B4P | Beforepay Group | 0.455 | 21% | 14,617 | $13,128,494 |

| GAP | Gale Pacific Limited | 0.2 | 21% | 56,539 | $46,862,416 |

| NWF | Newfield Resources | 0.15 | 20% | 5,000 | $110,255,905 |

| RGS | Regeneus Ltd | 0.006 | 20% | 54,113 | $1,532,185 |

| LEG | Legend Mining | 0.025 | 19% | 12,330,432 | $60,994,021 |

| HTG | Harvest Tech Grp Ltd | 0.032 | 19% | 2,790 | $19,074,510 |

| S2R | S2 Resources | 0.2 | 18% | 4,959,177 | $69,715,559 |

| RVS | Revasum | 0.135 | 17% | 30,316 | $12,180,415 |

| LRL | Labyrinth Resources | 0.007 | 17% | 41,688 | $7,125,262 |

| M2R | Miramar | 0.043 | 16% | 233,825 | $5,508,173 |

| PVT | Pivotal Metals Ltd | 0.022 | 16% | 1,956,359 | $10,347,406 |

Dimerix (ASX:DXB), has kept rising out of its morning trading halt, up 100% ahead of lunch and at 3.30pm in Sydenham, the stock looked comfy, if not positively bouyant at +130%

The clinical-stage Aussie biopharm announced it’s entered into an exclusive license agreement for the European Economic Area, the UK, Switzerland, Canada, Australia, and New Zealand for the commercialisation of Dimerix’ Phase 3 drug candidate DMX-200.

And that’s a treatment in development for focal segmental glomerulosclerosis (FSGS) kidney disease, following regulatory approval.

Here’s the X which set it all off.

We are delighted to announce an exclusive license agreement with ADVANZ PHARMA to register & commercialise DMX-200 for #FSGS in the EU, UK, Switzerland, Canada & ANZ: https://t.co/s5FrjJdnSI

— Dimerix (@dimerixltd) October 4, 2023

Meanwhile, clean tech stock and global semiconductor developer BluGlass (ASX:BLG) joined an exclusive club, sharing the news it’s just been named a member of CLAWS.

Yes, CLAWS.

Sadly, it’s not a secret cabal of super villains or a left-leaning plot to bring down Mi5 (or 6), but in fact the…

“Commercial Leap Ahead for Wide-bandgap Semiconductors (CLAWS) Hub”.

Turns out this is “one of eight Microelectronics Commons regional innovation hubs announced by the US Department of Defense (sic).

The DOD awarded US$238M in CHIPS and Science Act funding in FY231 for the establishment of eight regional innovation hubs, as part of the US$2B allocated to the ME Commons Program from FY23-272.

“The Microelectronics Commons is focused on bridging and accelerating the lab-to-fab transition and mitigating supply chain risks and will supercharge America’s ability to develop, prototype, manufacture, and produce cutting-edge microelectronics at scale,” the company says.

BLG adds that The CLAWS Hub, is led by North Carolina State University (NCSU), and has been awarded US$39.4mn ‘for the base year of performance’ and now includes these seven other magnificent (in alphabetical order!) members:

• North Carolina State University (Hub Lead)

• Adroit Materials

• BluGlass Limited

• Coherent

• General Electric

• Kyma

• North Carolina A&T State University

• Wolfspeed

BluGlass CEO Jim Haden said his team was thrilled.

“Thrilled to be part of the CLAWS Hub to develop next-generation photonic devices that will have significant commercial and strategic defence applications in the decades ahead.

“The work we will be contributing to the hub perfectly aligns with BluGlass’ wide-bandgap and extended-wavelength roadmaps and will leverage the benefits of our proprietary RPCVD technology.”

This is what we know so far about ‘wide bandgap semiconductors’ at 345pm:

These chips use indium gallium nitride (and other compounds), which can offer higher voltage and temperature capacity than traditional silicon chips.

They also have wide and growing applications in:

- power electronics

- radio frequency

- wireless devices; as well as

- photonics devices such as visible lasers for next-generation sensing, communications, artificial intelligence, and quantum technology applications

Also climbing the charts is Experience Co (ASX:EXP). Nothing new, although it is worth going back into the FY23 reults of late August to say ‘well done to this kind of let’s-have-fun Aussie business, surviving through the let’s-not-have-fun pandemic:

• Revenue of $108.6 million (FY22: $55.8 million) reflecting the strongest trading conditions since the emergence of the pandemic and the benefits of the diversification of the portfolio.

• Statutory net loss after tax of $0.5 million (FY22: $13.6 million loss).

• Underlying EBITDA profit of $11.3 million (FY22: $2.4million loss) reflecting the strongest trading result for the business since the onset of the pandemic

• Continued investment in growth including the expansion of Bamurru Plains, 2 new Treetops Adventure sites and the acquisition of the Australian Jump Pilot Academy.

• Domestic market remains a critical source market. The Australian domestic leisure and tourism market underpinned the performance of our Adventure Experiences and Skydiving business units.

• International recovery gaining momentum as aviation capacity and visitor arrivals continue to grow and return closer to pre pandemic levels (holiday arrivals to Australia in July 2023 were 70% of volumes for the corresponding period in 2019). Pleasingly, Australia has recently had its Approved Destination Status (ADS) reinstated for Chinese travellers.

CEO John O’Sullivan said at the time:

“Following the most challenging year for our business in FY22, we were pleased to see momentum improve throughout the year. Domestic markets continued to be the key earnings driver in FY23 as international visitation improved notably as the year progressed.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| C1X | Cosmosexploration | 0.155 | -47% | 6,907,596 | $13,120,125 |

| TG1 | Techgen Metals Ltd | 0.02 | -31% | 1,293,049 | $2,237,880 |

| ICN | Icon Energy Limited | 0.008 | -27% | 150,485 | $8,448,150 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 1,417,060 | $31,285,147 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 1,023,700 | $8,855,936 |

| PHL | Propell Holdings Ltd | 0.014 | -22% | 25,596 | $2,166,399 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 459,628 | $14,368,295 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 17,245 | $8,256,420 |

| JTL | Jayex Technology Ltd | 0.008 | -20% | 325,000 | $2,812,785 |

| NGY | Nuenergy Gas Ltd | 0.025 | -19% | 140,000 | $45,909,620 |

| BLU | Blue Energy Limited | 0.014 | -18% | 1,414,656 | $31,466,551 |

| G88 | Golden Mile Res Ltd | 0.024 | -17% | 7,727,549 | $9,552,296 |

| ADV | Ardiden Ltd | 0.005 | -17% | 50,000 | $16,130,012 |

| AHN | Athena Resources | 0.005 | -17% | 2,868,300 | $6,422,805 |

| BXN | Bioxyne Ltd | 0.01 | -17% | 4,592,857 | $22,819,745 |

| CNJ | Conico Ltd | 0.005 | -17% | 110,000 | $9,420,570 |

| CRB | Carbine Resources | 0.005 | -17% | 45,000 | $3,310,427 |

| EDE | Eden Inv Ltd | 0.0025 | -17% | 37,592 | $10,090,911 |

| NOX | Noxopharm Limited | 0.084 | -16% | 3,227,968 | $29,223,795 |

| AAP | Australian Agri Ltd | 0.016 | -16% | 75,000 | $5,796,890 |

| FTZ | Fertoz Ltd | 0.075 | -16% | 321,244 | $22,947,299 |

| XF1 | Xref Limited | 0.17 | -15% | 28,815 | $37,235,258 |

| KNG | Kingsland Minerals | 0.2 | -15% | 250,261 | $11,604,113 |

| A1G | African Gold Ltd. | 0.035 | -15% | 770,688 | $6,941,760 |

| OCN | Oceanalithiumlimited | 0.18 | -14% | 232,912 | $11,146,065 |

TRADING HALTS

Winsome Resources (ASX:WR1) – pending release of details of a Canadian flow-through capital raising

QX Resources (ASX:QXR) – Pending an announcement regarding a proposed capital raising

FBR Limited (ASX: FBR) – Pending a proposed capital raising

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.