Closing Bell: Sigma soars 22pc, Qantas feels heat from Qatar, and traders cash in on miners’ rally

Traders lock in gains from miners rally. Picture Getty

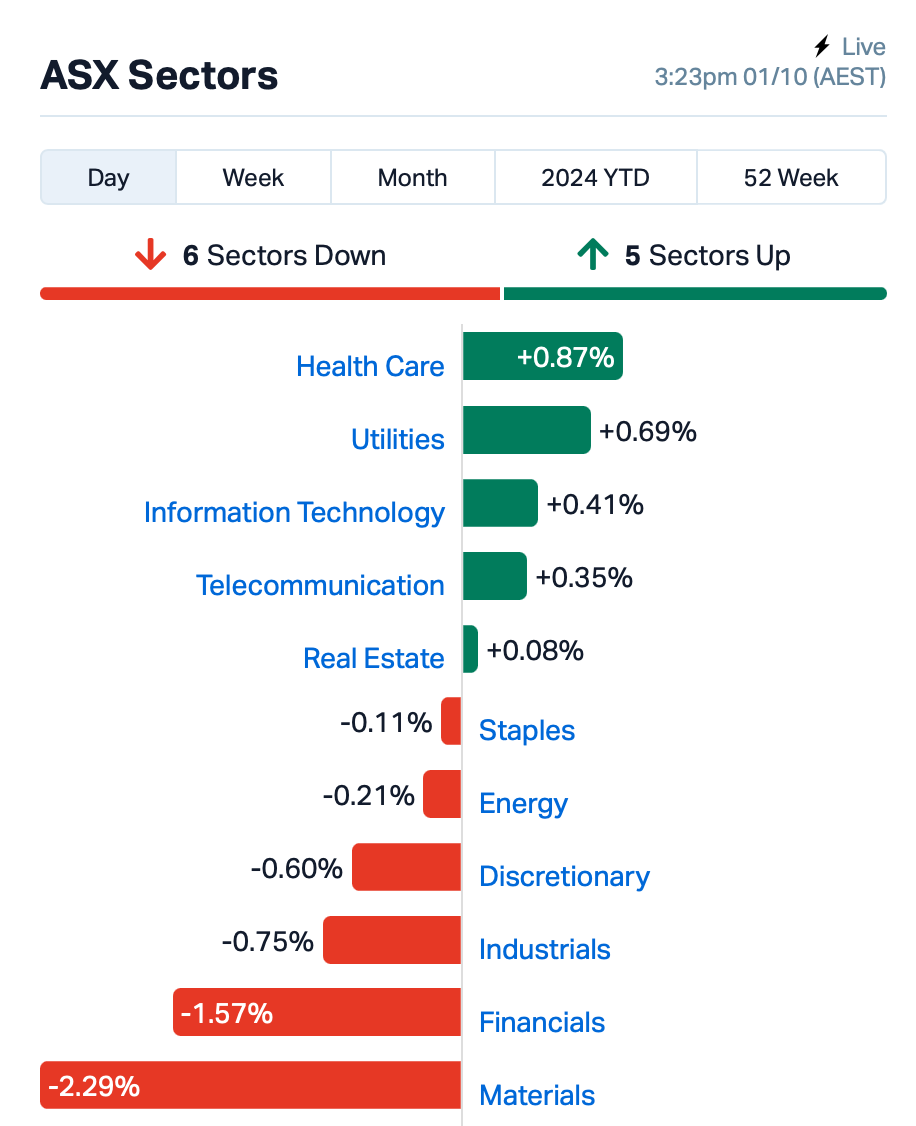

- ASX dips as miners lead selloff as Chinese markets close for holidays

- Sigma Healthcare soars 22pc after merger update

- Qantas tumbles 4pc as Qatar eyes Virgin Australia stake

The ASX dipped from its record high as miners led the selloff. At the close of Tuesdsay, the benchmark ASX 200 index was down 0.74%

Traders locked in some profits from mining stocks today after the sector enjoyed a solid 10% gain in September thanks to the big stimulus from China.

Commonwealth Bank (ASX:CBA) which took the crown from BHP (ASX:BHP) as Australia’s largest stock in June, slipped 1.6%.

Sigma Healthcare (ASX:SIG) was the best performing large cap today, soaring by 23% after announcing new data-sharing rules aimed at addressing regulatory concerns surrounding its merger with Chemist Warehouse.

Under these new rules, Sigma will allow its franchisees to terminate agreements with Chemist Warehouse and will restrict the use of confidential data from Sigma Wholesale customers and franchisees for the next three years.

As you may recall, Sigma and Chemist Warehouse signed a merger agreement in December, under which Sigma will acquire all the shares of CW in exchange for Sigma shares and a cash payment of $700 million.

Still in large caps, Qantas (ASX:QAN) tumbled by 4% after Qatar Airways announced plans to buy a 25% stake in Virgin Australia. Experts believe Qatar’s move will force Qantas to “defend” its market share.

And, REA Group (ASX:REA) has decided to walk away from its bid for a UK real estate site after Rightmove rejected its fourth offer. Investors are giving a thumbs-up to this decision, sending REA’s shares up 4%.

Elsewhere, the Aussie dollar has strengthened to US69.35¢ after data shows that retail sales rose 0.7% in August, which was better than expected.

What else happened today?

Asian shares kicked off Q4 on a sluggish note, though a weaker yen gave Japanese markets a boost.

The Nikkei 225 index bounced back with a 2% rally after taking a nearly 5% drop yesterday following a leadership shake-up in the ruling party.

China’s markets are on a week-long holiday after a massive surge yesterday.

Traders are also keeping an eye on the situation in the Middle East, as news breaks about Israel starting “targeted ground raids” in Lebanon.

Oil prices nudged up slightly this morning as investors weighed the risks of a wider conflict.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| WEL | Winchester Energy | 0.002 | 100% | 279,662 | $1,363,019 |

| NYR | Nyrada Inc. | 0.115 | 77% | 10,628,549 | $11,843,565 |

| CCZ | Castillo Copper Ltd | 0.006 | 50% | 3,015,396 | $5,198,021 |

| IBG | Ironbark Zinc Ltd | 0.003 | 50% | 452,378 | $3,667,296 |

| WML | Woomera Mining Ltd | 0.003 | 50% | 2,157,448 | $3,250,278 |

| RGT | Argent Biopharma Ltd | 0.510 | 46% | 92,239 | $16,941,961 |

| LM8 | Lunnonmetalslimited | 0.225 | 36% | 3,406,184 | $36,377,343 |

| WNR | Wingara Ag Ltd | 0.008 | 33% | 268,969 | $1,053,255 |

| IBX | Imagion Biosys Ltd | 0.053 | 33% | 1,814,745 | $1,425,862 |

| ATC | Altech Batt Ltd | 0.050 | 32% | 9,443,776 | $71,587,842 |

| AR3 | Austrare | 0.150 | 25% | 1,497,884 | $18,955,649 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 50,000 | $2,447,531 |

| CR9 | Corellares | 0.010 | 25% | 275,530 | $3,720,739 |

| GGE | Grand Gulf Energy | 0.005 | 25% | 400,197 | $9,801,549 |

| OVT | Ovanti Limited | 0.005 | 25% | 5,657,592 | $6,225,393 |

| PV1 | Provaris Energy Ltd | 0.020 | 25% | 454,674 | $10,095,477 |

| SIG | Sigma Health Ltd | 1.775 | 23% | 15,126,239 | $2,349,887,234 |

| IMI | Infinitymining | 0.043 | 23% | 275,000 | $4,751,045 |

| SES | Secos Group Ltd | 0.022 | 22% | 613,170 | $10,738,980 |

| ZMM | Zimi Ltd | 0.011 | 22% | 171,025 | $1,139,982 |

| REC | Rechargemetals | 0.034 | 21% | 440,821 | $3,911,319 |

| TOE | Toro Energy Limited | 0.285 | 21% | 4,464,874 | $28,266,234 |

| DOU | Douugh Limited | 0.006 | 20% | 1,000,000 | $5,410,345 |

Lunnon Metals (ASX:LM8) has revealed that it has identified a new gold zone from surface at its Kambalda gold and nickel project, with fresh significant, near surface, high-grade intercepts from the current diamond drill and in-fill reverse circulation program returning 23m at 16.61g/t Au from surface including 6m at 62.47g/t Au from 17m in hole FOS24RC_056, and 13m at 4.10g/t Au from 3m in hole FOS24RC_023.

5E Advanced Materials (ASX:5EA) was rising on news that it has received a non-binding letter of interest from the Export-Import Bank of the United States (EXIM), expressing potential for the creation of a debt facility to backstop project debt financing of up to $285 million, which would be utilised for commercial scale development and construction of 5E’s Boron Americas Complex, under the Make More in America Initiative.

Provaris Energy (ASX:PV1) was up on news that it has entered into a binding Joint Development Agreement with Yinson Production to develop storage tank solutions for the bulk storage and marine transportation of carbon dioxide. The Collaboration will also assess the potential for other hydrogen derivatives such as ammonia, combining the track records of both companies in that area of engineering solutions.

Altech Batteries (ASX:ATC) has announced that its first CERENERGY ABS60 battery prototype is online and operating successfully, with the unit “passing all physical tests with flying colours”. Altech reports that the prototype was installed at its joint venture partner Fraunhofer IKTS’ test lab in Germany, integrated into a specially designed battery test station that enables continuous daily charging and discharging cycles to assess the battery’s efficiency, stability, and overall performance under real-world conditions.

Exploration at Perpetual Resources’ (ASX:PEC) Isabella Lithium Project has confirmed several spodumene-bearing pegmatite trends stretching up to 800 metres, supported by new artisanal workings. Multiple spodumene occurrences have been found, with lab results pending. Before the project was acquired, rock samples showed high lithium grades of up to 5.62%. The Isabella site is close to two established spodumene projects: Atlas Lithium’s Das Neves Project, which is building a lithium processing plant, and Sigma Lithium’s advanced Sao Jose Project. Perpetual expects to share preliminary rock chip results in the next three weeks.

Earlier, NickelSearch (ASX:NIS) was up on news that it has commenced reconnaissance work at the recently acquired Mt Isa North project, with geologists onsite prepping for the company’s maiden drilling campaign. Rock chip and grab samples collected and assayed during the due diligence site visit returned copper, gold and silver grades including 24.8% Cu & 1.23g/t Au, and 30.0% Cu & 64.7g/t Ag from different areas of the project.

Copper explorer Golden Mile Resources (ASX:G88) caught a wave this morning after loading the finding of up to 930g/t silver, 10.05% copper and 8.09% zinc in rock chip assays during first pass sampling at the Odyssey prospect within its Pearl project in Arizona. The project was acquired in August this year after the company entered a joint venture acquisition with Outcrop Silver and Gold Corporation. It lies within the world-class Laramide porphyry copper zone, which is in the prolific Southwestern North American porphyry copper province – an area that accounted for around 70% of total USA copper production in 2023.

Lung imager 4D Medical (ASX:4DX) expects first revenue from its long-awaited US distribution deal with Philips to start flowing this calendar year, with one analyst estimating an initial US$300 million US “revenue opportunity” across 12 million scans annually. In a presentation this morning, the company cited a global lung imaging market of US$30 billion per annum, but it’s targeting the US veterans’ market via its Philips tie-up.

Announced last Friday, the deal confers the medical device giant with exclusive five-year distribution rights to US government contracts and non-exclusive dibs on other scans. Philips takes a 20-35% cut on sales, with undisclosed minimum sales to maintain exclusivity.

In other action, commodities trader Louis Dreyfus has scooped up a 47% stake in Namoi Cotton (ASX:NAM) and raised its offer to 68¢, causing shares to jump 8% before trading was halted.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CNJ | Conico Ltd | 0.001 | -50% | 85,425,776 | $4,403,055 |

| FHE | Frontier Energy Ltd | 0.118 | -47% | 13,918,161 | $113,034,561 |

| CDE | Codeifai Limited | 0.001 | -33% | 37,000,000 | $3,961,942 |

| VML | Vital Metals Limited | 0.002 | -33% | 93,172 | $17,685,201 |

| LNR | Lanthanein Resources | 0.003 | -25% | 1,611,109 | $9,774,545 |

| NTM | Nt Minerals Limited | 0.003 | -25% | 24,392 | $4,069,612 |

| RNE | Renu Energy Ltd | 0.002 | -25% | 2,590,918 | $1,608,268 |

| TTI | Traffic Technologies | 0.003 | -25% | 2,683,334 | $3,891,541 |

| TAT | Tartana Minerals Ltd | 0.030 | -23% | 84,696 | $7,123,190 |

| NSM | Northstaw | 0.014 | -22% | 40,000 | $2,893,964 |

| AKN | Auking Mining Ltd | 0.004 | -20% | 1,000,000 | $1,762,851 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 1,836,911 | $15,000,000 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 250,000 | $16,439,627 |

| VRX | VRX Silica Ltd | 0.034 | -19% | 543,159 | $26,386,738 |

| SRR | Saramaresourcesltd | 0.028 | -18% | 2,233,187 | $5,671,953 |

| CAN | Cann Group Ltd | 0.079 | -17% | 6,863,969 | $44,523,316 |

| AHN | Athena Resources | 0.005 | -17% | 162,978 | $6,422,805 |

| DMG | Dragon Mountain Gold | 0.005 | -17% | 94,384 | $2,368,030 |

| ICE | Icetana Limited | 0.020 | -17% | 197,672 | $6,351,082 |

| ICU | Investor Centre Ltd | 0.005 | -17% | 77,122 | $1,827,068 |

| LPD | Lepidico Ltd | 0.003 | -17% | 318,223 | $25,767,375 |

| NAE | New Age Exploration | 0.005 | -17% | 27,477,642 | $10,763,393 |

IN CASE YOU MISSED IT

Sun Silver (ASX:SS1) is using pXRF technology to analyse drill samples in real time and confirm mineralisation in the field at the Maverick Springs silver-gold project in Nevada. This method has identified thick zones of silver mineralisation and has delivered intercepts up to 440g/t over 106m averaging 54g/t silver from 196.6m.

While these results can’t be relied on to quantify resources, they do allow for immediate on-site decisions on any necessary adjustments to drilling strategies by suggesting where significant accumulations of the target mineral could be found. All drill intercepts will also be sent to an independent laboratory to check for accurate analysis.

Altech Batteries’ (ASX:ATC) first CERENERGY ABS60 salt-based battery prototype is officially operating across a range of temperatures, confirming its thermal stability.

These ABS60 CERENERGY® batteries use common table salt and ceramic solid-state technology, and do not require critical minerals like lithium, copper, graphite, nickel and cobalt. As well as being completely fire and explosion proof, the batteries feature a life span of more than 15 years and are capable to operate in all but the most extreme conditions.

Resouro Strategic Metals (ASX:RAU) has kicked off the next phase of metallurgical testwork on ore from its 1.7Bt Tiros titanium and rare earths project in Brazil. The upcoming round is scaled-up version of the sighter test work completed just a few weeks ago when the metallurgy group achieved the highest known rare earth extractions. It will also inform discussions with offtakers and assist with the Preliminary Economic Assessment (PEA).

Eagle Mountain (ASX:EM2) is homing in on the porphyry potential of the Silver Mountain project in Arizona, USA, where multiple large, high-priority targets have been identified by new and existing geophysics work. Detailed drill planning in progress for both near-surface high-grade breccias and veins and deeper porphyry targets. The company plans to confirm the potential of targets and identify additional zones that could provide near-surface high-grade copper mineralisation.

Perpetual Resources (ASX:PEC) has stumbled across several spodumene-bearing pegmatites at the Isabella project in Brazil. The company says over 30 artisanal excavations have now been identified, featuring substantial underground workings. PEC expects to report a set of preliminary rock chip results within the next three weeks, with exploration efforts ongoing targeting identification of drilling prospects for a maiden drilling campaign in H1 2025.

New Age Exploration (ASX:NAE) has uncovered multiple intercepts of gold mineralisation during maiden aircore drill program at its Wagyu gold project in WA’s Pilbara. Drilling so far has returned 21 gold mineralised intercepts for 127m across 18 drillholes as part of a planned first pass aircore drill program which covered 7640m for a total 156 drillholes. NAE is now eagerly awaiting the results from single metre resamples of Phase 1.

QMines (ASX:QML) has completed the purchase of the remaining 49% stake in the Develin Creek copper-zinc project from Zenith Minerals for $1.66m in cash and shares. The stock has also hit high-grade copper and zinc during maiden drilling at the Scorpion prospect. QML considers the initial strikes “outstanding”, pegging Scorpion as a shallow, high-grade copper and zinc deposit with potential to grow the mine life of its flagship Mt Chalmers project.

Brightstar Resources (ASX:BTR) Second Fortune mine is shaping up well after a combined surface and underground drilling program demonstrated the vein system continues at depth. The results pave the way for more exploration with additional drilling already confirmed. BTR is now planning to further improve the geological knowledge and confidence at Second Fortune ahead of a mineral resource estimate.

Major Hong Kong-based shareholder Denala has increased its stake in Belararox as the Argentinian copper explorer proves up its Toro-Malambo-Toro (TMT) project. It comes on top of the 21 million shares picked up by Denala as part of a recent $7.7m cap raise. Payment is expected to be received by November 14 this year.

Rock chip assays at Golden Mile Resources (ASX:G88) Pearl copper project have delivered 930g/t silver, 10.05% copper and 8.09% zinc in first pass sampling at the Odyssey prospect. While initially viewed as an epithermal copper target, the company says the presence of silver and zinc mineralisation indicates much broader multi-element mineralisation potential.

Of the 14 first pass rock chip samples taken to test for mineralisation at Odyssey, 10 samples assayed >30 g/t silver, 12 samples assayed >1.5% copper, and 10 samples assayed > 1.0% zinc.

QEM (ASX:QEM) has invited shareholders and investors to a webinar on Wednesday 2 October at 10.00AM (AEST) / 8.00AM (AWST), where chair Tim Wall and managing director Gavin Loyden will provide a company update. The presentation will centre on the exploration and development of the Julia Creek project, one of the world’s largest, single vanadium resources as well as the latest scoping study findings. Joanne Bergamin is the person to call if you have questions to be addressed during the webinar.

Vertex Minerals (ASX:VTX) has acquired a Boart Longyear LM90 underground drill rig as part of its strategy to advance exploration drill works at the high-grade Reward gold mine. The plan is to advance exploration below the existing resource, particularly focussing on the Fosters target and South Star prospect area along with the ‘Reward mid depths’ target which is around 80-200m below the Amalgamated Adit, where drilling has only reached 50m below.

TRADING HALTS

Nyrada (ASX:NYR) – pending an announcement regarding study results of a new indication outside of current programs.

Elixinol Wellness (ASX:EXL) – pending the release of an announcement about a potential capital raising and acquisition.

Octava Minerals (ASX:OCT) – pending the release of an announcement regarding a proposed capital raising.

Genmin (ASX:GEN) – pending the release of an announcement relating to a capital raising.

Island Pharmaceuticals (ASX:ILA) – pending an announcement in relation to a proposed capital raise.

Zeta Resources (ASX:ZER) – pending an announcement in relation to an investment sale transaction.

American West Metals (ASX:AW1) – for the purpose of considering, planning and executing a capital raising.

At Stockhead, we tell it like it is. While Pan Asia Metals and QMines are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.