Closing Bell: Shazam for coughing and THIS is how the small cap index surfs the chop – up 10% in a month

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

- ASX Emerging Companies (XEC) index has closed 1.5% on Tuesday

- Index now over 10% the better since February 22

- Tuesday winners: ResApp (ASX:RAP), RiversGold (ASX:RGL)

The ASX Emerging Companies (XEC) index is 1.5% higher in late trade. It’s now up well over 7% since this time last week. And 10% for the last month.

Since February 22, by comparison, the top 200 Aussie stocks are up 1.7%. And about half that has come from today’s 0.8% win.

The ASX 200 shrugged off choppy old trade to nudge an eight-week high thanks to resurgently-surging commodity prices.

But once the market agreed that oil’s gone top-wards again and a few of those baser metals are looking good, then the chips were cashed in – the energy names and material sector both driving profits ahead of late falls.

Australia get confident, stupid!

Yes, it’s that time of the week when our consumer confidence gets a shellacking or a pat on the back.

Today’s it’s a right old shellacking.

Australian consumer confidence has stooped to its lowest level since September 2020 as inflationary pressures and pain at the pump scuttle the great Australian outlook.

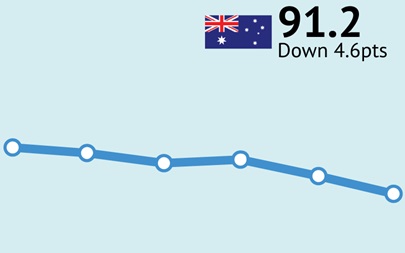

The chart below courtesy of Roy Morgan may import very little in the way of data, but you must get the sense of our lack of confidence as a nation of shoppers — just bleeding our blue blood out under a timid Aussie flag.

The latest read from the ANZ-Roy Morgan weekly measurement has Aussie consumer confidence falling 4.8%, or some 4.6 Roy Morgan-ANZ points.

And finally, speaking at the Walkley’s RBA Governor Philip Lowe says he’s waiting on wages growth data and ‘a pervasive rise in inflation’ before tweaking interest rates off its record low 0.1%.

Oh, and this is a great story.

Think of… Shazam For Coughing and you’ll pretty much have it.

We sent the ever ready Eddy Sunarto to cover it all here. Enjoy.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Description | Price | % | Volume |

|---|---|---|---|---|

| VMG | VDM Group Limited | 0.0015 | 50.0% | 500,000 |

| BRU | Buru Energy | 0.245 | 36.1% | 7,375,196 |

| RAP | Resapp Health Ltd | 0.084 | 35.5% | 38,848,918 |

| WMG | Western Mines | 0.25 | 28.2% | 1,548,943 |

| BDX | Bcaldiagnostics | 0.12 | 26.3% | 73,395 |

| RGL | Riversgold | 0.045 | 25.0% | 30,285,883 |

| NOX | Noxopharm Limited | 0.385 | 20.3% | 1,027,770 |

| WSR | Westar Resources | 0.11 | 19.6% | 70,196 |

| YOJ | Yojee Limited | 0.125 | 19.0% | 1,258,093 |

| VKA | Viking Mines Ltd | 0.013 | 18.2% | 4,907,137 |

| AL8 | Alderan Resource Ltd | 0.021 | 16.7% | 863,390 |

| MTB | Mount Burgess Mining | 0.007 | 16.7% | 4,670,397 |

| TIG | Tigers Realm Coal | 0.014 | 16.7% | 1,700,436 |

| STA | Strandline Res Ltd | 0.4 | 15.9% | 12,547,259 |

| RNU | Renascor Res Ltd | 0.335 | 15.5% | 27,719,613 |

| MPG | Manypeaksgoldlimited | 0.265 | 15.2% | 879,793 |

| KNI | Kunikolimited | 1.595 | 14.7% | 3,368,189 |

| AHK | Ark Mines Limited | 0.275 | 14.6% | 230,282 |

| MLS | Metals Australia | 0.088 | 14.3% | 19,635,281 |

| ICG | Inca Minerals Ltd | 0.12 | 14.3% | 2,077,950 |

| SPX | Spenda Limited | 0.024 | 14.3% | 11,649,550 |

| AGE | Alligator Energy | 0.09 | 13.9% | 86,462,791 |

| RDT | Red Dirt Metals Ltd | 0.625 | 13.6% | 1,573,219 |

| SW1 | Swift Networks Group | 0.017 | 13.3% | 444,421 |

| HGO | Hillgrove Res Ltd | 0.06 | 13.2% | 5,424,805 |

ResApp (ASX:RAP) was up about 60% last time I looked. (Dang, I just looked again and it’s 36% now).

And why not – the medtech busting out of a trading halt to reveal a “92% sensitivity” for its smartphone-based COVID-19 detector – apparently the bloody thing uses a “cough audio-based algorithm”.

More medtech business on Tuesday – Noxopharm (ASX:NOX) also rose strongly after announcing that the US FDA had granted an Orphan Drug Designation to its Veyonda drug for use in soft-tissue caner treatments

In small cap resources, RiversGold (ASX:RGL) was the best performer after a field visit confirmed confirmed multiple lithium-bearing pegmatite dykes within the company’s Tambourah project in WA.

And KGL Resources (ASX:KGL) shares popped over 10% this afternoon after the miner secured a deal with Glencore for the sale of copper concentrate from KGL’s Jervois copper project.

The sale price is volume based for copper concentrate and calculated by reference to the London Metals Exchange cash settlement price.

Oil and gas explorer Buru Energy (ASX:BRU) is up a delightful 33.33% after positive results from recently completed flow testing at its Rafael 1 well in Western Australia’s Canning Basin.

Results of the field measurements including ideal gas composition with high condensate content and low level of inerts with ~2% CO2 content in a conventional free flow reservoir. The initial reservoir pressure of ~6200 psi was measured with no observed pressure depletion during the test flow.

Elsewhere, EOS and XTek are winners again following today’s news the Australian Defence Force (ADF) has a new wing command – Defence Minister Peter Dutton announcing the formation of Defence Space Command.

“Space is becoming more congested and is already contested, particularly as the boundaries between competition and conflict become increasingly blurred through grey zone activities,” Dutton said in a speech at an Air Force conference. Space focused defence tech companies look set to benefit – Xtek up about n5% and EOS up 4.5%.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.0015 | -25.0% | 1,792,987 |

| MOQ | MOQ Limited | 0.05 | -24.2% | 47,452 |

| IEC | Intra Energy Corp | 0.016 | -20.0% | 361,500 |

| AHI | Adv Human Imag Ltd | 0.31 | -17.3% | 1,957,216 |

| AAP | Australian Agri Ltd | 0.02 | -16.7% | 45,000 |

| AFW | Applyflow Limited | 0.0025 | -16.7% | 269,000 |

| SIH | Sihayo Gold Limited | 0.005 | -16.7% | 85,001 |

| VPR | Volt Power Group | 0.0025 | -16.7% | 125,000 |

| BXN | Bioxyne Ltd | 0.017 | -15.0% | 473,754 |

| 3MF | 3D Metalforge | 0.053 | -14.5% | 18,664 |

| RFR | Rafaella Resources | 0.048 | -14.3% | 3,628,432 |

| AIV | Activex Limited | 0.049 | -14.0% | 125,000 |

| EQE | Equus Mining Ltd | 0.165 | -13.2% | 259,568 |

| TCG | Turaco Gold Limited | 0.1 | -13.0% | 924,422 |

| GBR | Greatbould Resources | 0.145 | -12.1% | 4,676,991 |

| TGH | Terragen | 0.13 | -11.9% | 29,600 |

| PTR | Petratherm Ltd | 0.04 | -11.1% | 1,500 |

| VRX | VRX Silica Ltd | 0.16 | -11.1% | 1,442,606 |

| DCX | Discovex Res Ltd | 0.008 | -11.1% | 21,057,362 |

| PWN | Parkway Corp Ltd | 0.008 | -11.1% | 3,541 |

| RNX | Renegade Exploration | 0.008 | -11.1% | 100,000 |

| GLL | Galilee Energy Ltd | 0.245 | -10.9% | 738,700 |

| IBG | Ironbark Zinc Ltd | 0.035 | -10.3% | 5,203,349 |

| ANR | Anatara Ls Ltd | 0.09 | -10.0% | 249,323 |

| SKS | SKS Tech Group Ltd | 0.18 | -10.0% | 67,057 |

Down about 5% on Tuesday is Botanix Pharmaceuticals (ASX:BOT) the clinical dermatology company not getting the resounding nod of market approval after appointing investment banker Daniel Sharp as a non-executive director.

Executive Chair Vince Ippolito said Sharp’s arrival comes at a critical juncture, coinciding with the advancement of BOT’s drug commercialisation portfolio and broadening strategic opportunities. Sharp is currently a non-executive director of health informatics company Alcidion Group and on the investment committee of the Baker Heart and Diabetes Institute.

ANNOUNCEMENTS YOU MAY HAVE MISSED

Not quite super good news at Nuix (ASX:NXL), but nevertheless, it is news of a kind.

And its share price has lifted about 2.4% – which makes for a nice change. This transpired after its chairman – and ex special counsel to former US president Barack Obama – Jeffrey Bleich, poured some $140K into his stake of the embattled tech business.

The on-market purchase of 100,000 shares was made on March 18, according to a director’s note released to the local exchange.

Industrial company MAAS Group Holdings (ASX:MGH) has announced completion of its acquisition of Blackwater quarries for ~$26 million cash and issue of ~195k shares in MGH.

Blackwater Quarries operates four quarries and one concrete plant in Central Queensland hoping to produce more than 550,000 tonnes annually of construction aggregate with the concrete batch plant producing ~10,000m3.

TRADING HALTS

Incannex Healthcare Limited (ASX:ICH) trading halt, pending an announcement regarding a potential business acquisition

Piedmont Lithium (ASX:PLL ) – trading halt, pending a proposed capital raising being undertaken via a US public offering of the company’s shares.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.