Closing Bell: Shares drop again on the eve of Fed decision; Adbri says goodbye to ASX after 62 years

ASX drops again. Picture Getty

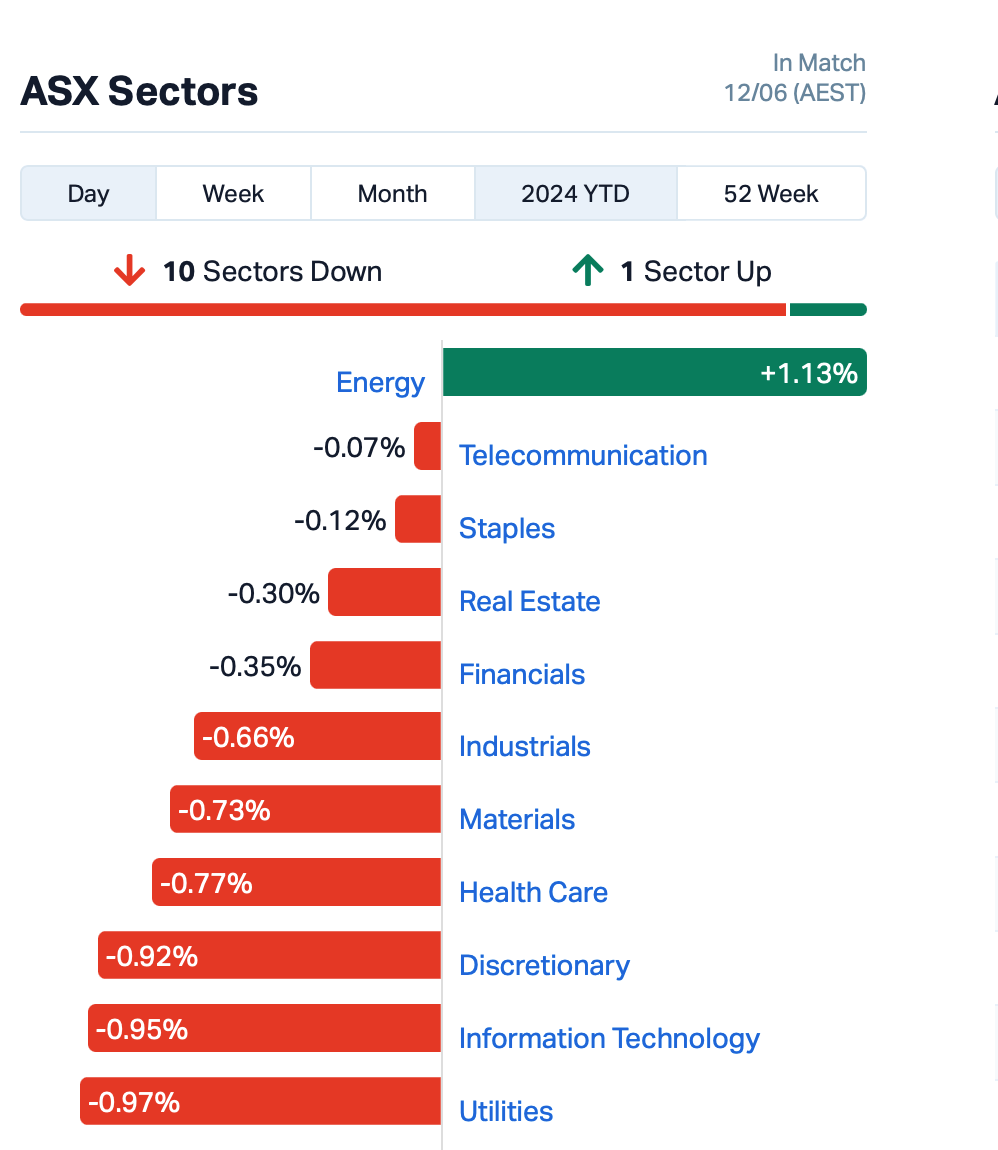

- ASX down 0.5pc, Energy sector up due mainly to Woodside’s upgrade.

- CRH to acquire Adbri, ending Adbri’s 62-year ASX presence

- China’s data CPI keeps increasing, new data shows

The ASX continued yesterday’s decline, down another -0.5% today as stocks sold off broadly across the board.

Local investors are remaining cautious particularly in light of the looming US inflation report and the Fed Reserve’s decision on interest rates – both slated for tomorrow morning AEST.

The only sector to show any kind of resistance was Energy, which rose mostly on the back of a 2% rise in Woodside Energy (ASX:WDS). The boost came after Macquarie Bank upgraded Woodside’s rating to “outperform.”

Retail stocks also climbed today with JB H-Fi and Harvey Norman showing a 2% rise.

Most large cap miners like BHP, Rio Tinto and Fortescue however declined after a 2% fall in iron ore prices.

And CRH, an Irish conglomerate, is set to acquire Adbri (ASX:ABC), the cement manufacturing company after Adbri’s shareholders approved the $2.1 billion takeover bid this afternoon. This acquisition marks the end of Adbri’s 62-year presence on the ASX.

What’s happening elsewhere?

Despite Wall Street’s rally last night, most Asian stock markets saw declines today as investors remained cautious of the key US catalysts later tonight.

In Hong Kong, the main stock index dropped by over 1%; Japanese stocks also fell but the Indian stock market pointed towards potential new record highs.

In key Asian data, China’s consumer prices continued their gradual ascent in May, signalling stability and resilience, while factory-gate prices remained unmoved in deflationary territory.

And later tonight, the Fed Reserve is anticipated to maintain rates at their current two-decade high.

However, there’s more uncertainty surrounding officials’ quarterly rate projections, often referred to as the Fed’s “dot plot.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 8VI | 8Vi Holdings Limited | 0.200 | 67% | 79,233 | $5,029,371 |

| NRZ | Neurizer Ltd | 0.011 | 57% | 15,293,653 | $13,317,015 |

| TMG | Trigg Minerals Ltd | 0.009 | 50% | 75,942,569 | $2,592,784 |

| ADS | Adslot Ltd. | 0.002 | 50% | 423,530 | $3,224,496 |

| RR1 | Reach Resources Ltd | 0.017 | 42% | 37,178,492 | $10,493,176 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 353,125 | $5,517,407 |

| TIG | Tigers Realm Coal | 0.004 | 33% | 776,988 | $39,200,107 |

| VPR | Voltgroupltd | 0.002 | 33% | 81,500 | $16,074,312 |

| ION | Iondrive Limited | 0.013 | 30% | 1,072,060 | $6,048,566 |

| VBS | Vectus Biosystems | 0.110 | 29% | 178,238 | $4,522,894 |

| BGE | Bridgesaaslimited | 0.023 | 28% | 178,222 | $2,149,147 |

| JPR | Jupiter Energy | 0.025 | 25% | 121,282 | $25,473,044 |

| IVX | Invion Ltd | 0.005 | 25% | 113,407 | $25,698,129 |

| MCT | Metalicity Limited | 0.003 | 25% | 12,900,920 | $8,971,705 |

| MTL | Mantle Minerals Ltd | 0.003 | 25% | 1,477,573 | $12,394,892 |

| LSR | Lodestar Minerals | 0.002 | 25% | 4,882,823 | $3,237,436 |

| KNG | Kingsland Minerals | 0.205 | 21% | 160,494 | $8,929,965 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 1,000,000 | $6,620,957 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 583,419 | $12,497,745 |

| EEL | Enrg Elements Ltd | 0.003 | 20% | 2,218,262 | $2,524,913 |

| FGH | Foresta Group | 0.012 | 20% | 423,296 | $23,553,791 |

| YPB | YPB Group Ltd | 0.003 | 20% | 333,333 | $2,019,904 |

| VN8 | Vonex Limited. | 0.019 | 19% | 127,560 | $5,789,258 |

| DXN | DXN Limited | 0.071 | 18% | 1,742,381 | $11,093,361 |

| ARV | Artemis Resources | 0.014 | 17% | 2,611,559 | $21,170,354 |

Reach Resources (ASX:RR1) jumped on news that it has bitten into high-grade niobium and REEs during the latest program of rock chip sampling at Wabli Creek, Gascoyne, Western Australia. The company says that it has recorded samples up to 17.65% Nb2O5, 0.15% Y2O3, 10.81% Ta2O5, 31.39% TiO2, 0.37% TREO, chipped directly off in-situ bedrock at the site, and stack up well against previous alluvial sampling of 32% Nb2O5 and 2.57% TREO reported in December last year.

One Click Group (ASX:1CG) made headway on the heels of an investor presentation about its One Click Life financial services platform, revealing that the company has seen user growth of 83% to 120,000 users in CY23, which the company expects to continue with increased marketing spend in 2024.

BirdDog Technology (ASX:BDT) lifted on low volume this morning after announcing a selective buyback of 31.6 million shares, which is the totality of Home Made Robots’ interests in BirdDog and represents approximately 16.3% of BirdDog’s issued share capital.

And some big price-boosting news this morning from Inoviq (ASX:IIQ) is an announcement that the company’s Neuro-Net technology can isolate brain-derived exosomes in Alzheimer’s Disease. I’ll let the company explain why it’s big, because they know what they’re talking about…

“Exosomes provide a ‘fingerprint’ of the health or disease status of the parent cell and can cross the ‘blood-brain barrier’, making them promising candidates as diagnostics for neurological diseases. The ability to weaponize exosomes and target them to cells is the end game for therapy and cure.”

Ora Gold (ASX:OAU) rose despite incurring an after-tax operating loss for the half-year ended March 31 2024 – of $1,529,041. This is up from its half-year accounts this time a year ago, which was a reported loss of $876,084.

Nevertheless, the company has had needle-moving news lately, with its binding agreement with the dominant gold miner in the Murchison region – Westgold Resources (ASX:WGX).

That’s an alliance that aims to advance the development of Ora’s Crown Prince deposit into production, and comes with a strategic placement capital raise of $6m.

An updated Mineral Resource Estimate at Crown Prince is due for completion in the September quarter.

Classic Minerals (ASX:CLZ)is having a good day on the back of some news regarding its Forrestania Gold Project (FGP), about 120km south of Southern Cross in WA. Classic has revealed its made a significant gold resource upgrade at the project, after recently announcing the successful grant of mining lease M77/1310 over the project area. This has reportedly upgraded the resource to Indicated, which the company regards as a pivotal milestone towards the further development of Forrestania.

Its combined Indicated Resource (from its Lady Ada and Lady Magdalene prospects) now total 69,966oz gold, with an Inferred resource figure of 227,613oz combined.

Boom Logistics (ASX:BOL) announced the award of a contract with Squadron Energy for maintenance work on wind turbines within Squadron’s wind asset portfolio. The $12 million contract will see the company provide crane support for wind turbine maintenance tasks. The work is expected to commence in 1H FY25.

NICO Resources (ASX:NC1) announced that the Minister for Environment, Reece Whitby, has granted an extension to the previous EPA approval for the Wingellina Nickel-Cobalt Project. This project, located in Western Australia’s Musgrave Ranges, boasts significant reserves of nickel and cobalt and is positioned near BHP’s planned West Musgrave Nickel-Copper Project.

Singular Health (ASX:SHG) announced the launch of its new online DICOM viewer, along with an integration of ChatGPT 3.5 AI. This advancement aims to enhance patient education by providing prompts based on medical imaging records. With this new viewer, Singular’s customers can access their records without needing to download desktop applications, improving medical record management for all.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.004 | -60% | 54,123,508 | $3,766,215 |

| PNT | Panthermetalsltd | 0.030 | -33% | 361,312 | $3,922,477 |

| AUK | Aumake Limited | 0.002 | -33% | 3,000,000 | $5,743,220 |

| RIL | Redivium Limited | 0.002 | -33% | 327,003 | $8,192,564 |

| AU1 | The Agency Group Aus | 0.021 | -30% | 122,205 | $12,857,298 |

| NUC | Nuchev Limited | 0.110 | -27% | 3,850 | $13,504,041 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 13,000 | $12,677,188 |

| ECT | Env Clean Tech Ltd. | 0.003 | -25% | 91,023 | $12,687,242 |

| GCM | Green Critical Min | 0.003 | -25% | 257,750 | $4,546,340 |

| OAR | OAR Resources Ltd | 0.002 | -25% | 1,405,000 | $6,444,200 |

| TD1 | Tali Digital Limited | 0.002 | -25% | 710,000 | $6,590,311 |

| VML | Vital Metals Limited | 0.003 | -25% | 133,243 | $23,580,268 |

| ARC | ARC Funds Limited | 0.091 | -24% | 16,679 | $4,695,104 |

| BEL | Bentley Capital Ltd | 0.022 | -24% | 10,480 | $2,207,710 |

| MKL | Mighty Kingdom Ltd | 0.004 | -20% | 6,248,021 | $12,487,999 |

| RIE | Riedel Resources Ltd | 0.002 | -20% | 15,845,510 | $5,559,589 |

| ROG | Red Sky Energy. | 0.004 | -20% | 3,882,847 | $27,111,136 |

| PLC | Premier1 Lithium Ltd | 0.021 | -19% | 734,000 | $4,538,926 |

| HMD | Heramed Limited | 0.018 | -18% | 2,061,910 | $8,651,496 |

| BTH | Bigtincan Hldgs Ltd | 0.108 | -17% | 2,027,353 | $80,115,367 |

| CBH | Coolabah Metals Limi | 0.083 | -17% | 253,723 | $12,040,628 |

| SCN | Scorpion Minerals | 0.015 | -17% | 2,401,001 | $7,370,211 |

IN CASE YOU MISSED IT

Ark Mines’ (ASX:AHK) reconnaissance exploration has extended unique placer-style rare earths (REE) mineralisation at Sandy Mitchell past the existing resource area.

Classic Minerals (ASX:CLZ) has increased resources at its Forrestania project to 377,946oz gold after further defining the Lady Ada and Lady Magdalene deposits.

The mineralisation extension program at Culpeo Minerals’ (ASX:CPO) Lana Corina project in Chile has delivered a huge intersection of 298m grading 0.98% copper-molybdenum intersection from the first hole.

Iltani Resources (ASX:ILT) has started drilling a deep diamond hole at its Orient silver-lead-zinc-indium project in northern Queensland to test a large-scale geophysical anomaly.

Once the hole is completed, the company will conduct a downhole electromagnetic (DHEM) survey.

Both the drilling and DHEM survey are supported by a $299,000 grant awarded to the company through Round 8 of the Collaborative Exploration Initiative (CEI) under the Queensland Department of Resources’ Industry Development Plan.

Kingsland Minerals (ASX:KNG) has significantly de-risked the Leliyn project after metallurgical testing produced commercial grade concentrate of +94% total graphitic carbon (TGC).

Mithril Resources (ASX:MTH) is building up its inventory of drill targets at its flagship Copalquin gold-silver project in Mexico after channel sampling returned high-grade results.

QMines (ASX:QML) is embarking on its first ever drilling campaign at the Develin Creek project in QLD, focusing on improving confidence at the Sulphide City, Scorpion and Window deposits.

Sovereign Metals’ (ASX:SVM) site construction for the ongoing pilot mining and land rehabilitation program at its Kasiya Rutile-Graphite Project in Malawi is on schedule with groundworks underway.

Sun Silver’s (ASX:SS1) rock chip sampling at its Maverick Springs asset has returned elevated arsenic readings, a key pathfinder element in the exploration of silver and gold prospects.

Assays from Trinex Minerals’ (ASX:TX3) winter 2024 diamond drilling has confirmed anomalous uranium at Airstrip, part of the Gibbons Creek project in Canada’s Athabasca Basin.

Viridis Mining & Minerals’ (ASX:VMM) step-out drilling intersects multiple high-grade zones grading up to +7000ppm TREO outside the Cupim South resource, part of its Colossus project in Brazil.

Anson Resources (ASX:ASN) has increased the size of its Ajana project in WA’s Mid-West region by 175% after pegging the adjacent tenement to advance its search for critical minerals.

Australian Mines (ASX:AUZ) has added rare earths to the lithium, tin and tantalum already known to be present at its Resende project in Brazil’s Minas Gerais state following successful stream sediment sampling.

Dateline Resources (ASX:DTR) is raising up to $4.2m through a partially underwritten non-renounceable rights issue to fund further gold and rare earths exploration at its Colosseum project. The offer of 1 share priced at 1c each for every 3.5 shares held will be made to all holders of shares as of Monday, 17 June 2024.

Non-executive chairman Mark Johnson has already committed to take his full entitlement of ~$0.84m worth of shares while managing director Stephen Baghdadi has committed to taking up his entitlement of ~$0.57m worth of shares and to underwrite up to ~$0.177m worth of any shortfall.

Desoto Resources (ASX:DES) has uncovered four prospective copper-REE targets at the Spectrum project using advanced modelling.

Equinox Resources (ASX:EQN) has expanded its landholding at the Mata da Corda rare earths (REE) project in Brazil by 15% to almost 1000km2.

RareX (ASX:REE) review of 65,000m of gold-focused historical aircore drilling data has uncovered niobium enrichment up to 1,000ppm at its Khaleesi project in WA’s eastern Yilgarn region.

Riversgold (ASX:RGL) has identified historical copper intersections of up to 30.5m at 1.1% copper from exploration carried out in the 1970’s at Tambourah.

TRADING HALTS

Pearl Gull Iron (ASX:PLG) – pending an announcement regarding a proposed acquisition.

Opthea (ASX:OPT) – pending news of a proposed equity raising.

MRG Metals (ASX:MRQ) – pending the release of an announcement to the market in relation to a Joint Venture Agreement and Funding Arrangement on its Heavy Mineral Sands Projects.

Brazilian Rare Earths (ASX:BRE) – pending an announcement regarding the results of a capital raising.

At Stockhead, we tell it like it is. While Anson Resources, Australian Mines, Dateline Resources, DeSoto Resources, RareX, Riversgold Ark Mines, Classic Minerals, Culpeo Minerals, Iltani Resources, Kingsland Minerals, Mithril Resources, QMines, Sovereign Metals, Sun Silver, Trinex Minerals and Viridis Mining & Mineralsare Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.