Closing Bell: Party on the ASX as market amps up the bass, raves to new heights

Crank up that bass! The ASX is partying to new record highs today. Pic: Getty Images.

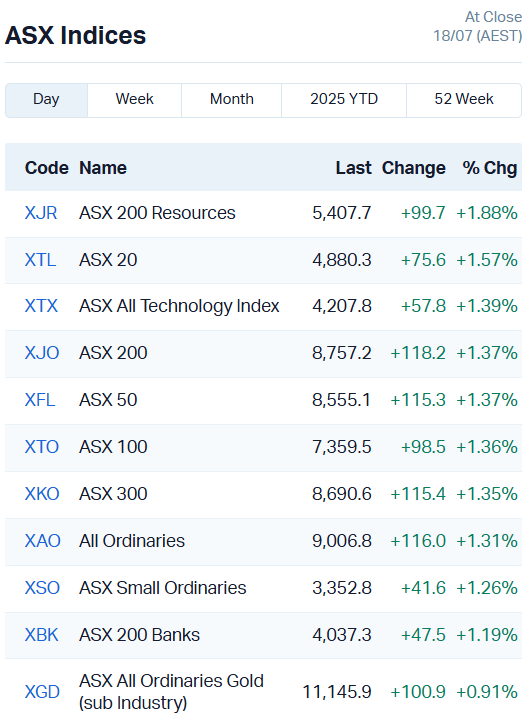

- ASX surges 1.37pc, smashing through record to close at 8757 points

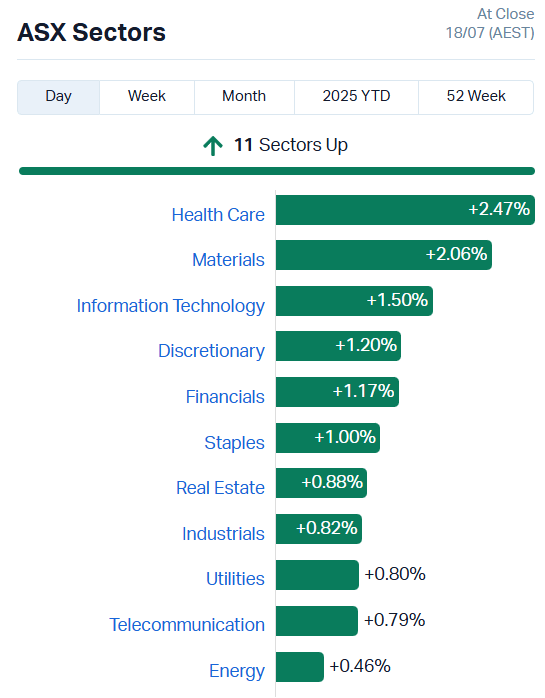

- All 11 sectors neon green, up between 2.47pc and 0.46pc

- Healthcare and resources stocks crank higher, leading gains

DJ play it louder

It was a raver of a party on the ASX today, surging 1.37% in its best performance since April.

Just as we’d finished celebrating its latest record breaking close last night, the ASX smashed through that barrier by a solid 100 points, setting the new ceiling at 8757.

Traders were riffing off weaker-than-expected employment data at home yesterday – strongly signalling another interest rate cut in August – and better-than-expected retail data out of the US today.

Retail numbers over the pond lifted 0.6% compared to fears of just 0.1% in June, soothing fears of a major economic slowdown and lowering simmering tensions between the White House and the Fed Reserve.

It all came together to set a pulsing beat for Aussie trade today, with every sector joining the party again.

Healthcare (+2.47%) and materials (+2.06%) were strutting their stuff, showing the rest of the market how it’s done.

The ASX 200 Resources index topped the indices charts today, lifting 1.88%, but the banks, tech and gold indices were enjoying the neon lights just as much.

Health and resource stocks break it down

With the entire market feeling the rhythm, let’s take a closer look at why some stocks killed it in trade today.

Mesoblast (ASX:MSB) pumped it up, surging 34.6% on sale numbers for its stem cell product Ryoncil. It’s only been on the shelves since late March, but MSB has already raked in US$13.2 million gross revenue (unaudited).

Clarity Pharmaceuticals (ASX:CU6) is also kicking it, hot stepping 11.7% higher after completing recruitment for a study assessing a new imaging agent for prostate cancer. It’s a disease with a huge unmet need, and a global market estimated at US$12.9 billion.

Flipping to our resources track, battery metals got a kick from surging lithium and rare earth stocks on Wall Street overnight, benefiting from improving sentiment around the critical commodities (and some fresh tension with China over supply chains).

While they’ve had no news the last couple days, Pilbara Minerals (ASX:PLS) jumped 8.5% and Brazilian Rare Earths (ASX:BRE) 10.2%. They were joined by Iluka Resources (ASX:ILU), up just about 5% and Min Res (ASX:MIN) up 4.8%.

We can’t mention resources without acknowledging today’s dancing queen – BHP (ASX:BHP) smashed it in trade, adding more than a dollar to its share price after hitting some of its best production numbers ever.

“[BHP’s] iron ore out of WA smashed records, with South Flank running above nameplate in its first full year. Even the coal division chipped in, lifting output 5% despite getting slapped by wet weather and moody geology at Broadmeadow,” our own Eddy Sunarto reported in today’s Lunch Wrap.

“Over in copper, BHP pumped out over 2 million tonnes group-wide, a record haul in a metal that’s fast becoming the lifeblood of the clean energy boom.”

BHP shares closed out the day 3% higher at $40.29 each.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.002 | 100% | 29425880 | $1,706,300 |

| TR2 | Tali Resources Ltd | 0.37 | 85% | 2480529 | $7,501,000 |

| AS2 | Askarimetalslimited | 0.012 | 50% | 43553469 | $3,233,365 |

| AUH | Austchina Holdings | 0.0015 | 50% | 558600 | $3,025,384 |

| GGE | Grand Gulf Energy | 0.003 | 50% | 11211 | $5,640,850 |

| VRC | Volt Resources Ltd | 0.005 | 43% | 3745598 | $16,396,973 |

| DTZ | Dotz Nano Ltd | 0.041 | 37% | 2134834 | $17,761,929 |

| VBS | Vectus Biosystems | 0.05 | 35% | 65744 | $1,971,298 |

| ALR | Altairminerals | 0.004 | 33% | 593100 | $12,890,233 |

| FAU | First Au Ltd | 0.004 | 33% | 1234769 | $6,228,874 |

| HLX | Helix Resources | 0.002 | 33% | 1760084 | $5,046,291 |

| SHP | South Harz Potash | 0.004 | 33% | 1181196 | $3,849,186 |

| FAL | Falconmetalsltd | 0.665 | 32% | 3759496 | $89,385,000 |

| BRX | Belararoxlimited | 0.08 | 31% | 674443 | $9,881,938 |

| IPB | IPB Petroleum Ltd | 0.007 | 27% | 1580453 | $3,885,217 |

| PIL | Peppermint Inv Ltd | 0.0025 | 25% | 404020 | $4,602,180 |

| PXX | Polarx Limited | 0.01 | 25% | 5175889 | $19,004,008 |

| ROG | Red Sky Energy. | 0.005 | 25% | 527666 | $21,688,909 |

| CYP | Cynata Therapeutics | 0.185 | 23% | 1513058 | $33,893,155 |

| CHL | Camplifyholdings | 0.49 | 23% | 133350 | $28,600,140 |

| LMG | Latrobe Magnesium | 0.011 | 22% | 16487031 | $23,639,310 |

| NVQ | Noviqtech Limited | 0.039 | 22% | 721525 | $8,049,170 |

| ZGL | Zicom Group Limited | 0.14 | 22% | 126775 | $24,674,401 |

| INF | Infinity Lithium | 0.017 | 21% | 302402 | $6,616,289 |

| FRS | Forrestaniaresources | 0.145 | 21% | 1666346 | $37,322,691 |

Making news…

With copper prices heating up, Askari Metals (ASX:AS2) is hitting all the right notes at the Nejo gold project in Ethiopia, unearthing 14m at 3.2% and 35m at 0.82% copper in historical drilling results.

The company has at least 6 copper targets to hit with the drill bit, with one of particular interest stretching over a 600m by 30m strike.

There’s also more than 1170 square kilometres of project to explore in a fertile, underexplored region in the same greenstone belt as the 3.4-million-ounce Kurmuk Mine and the 1.7-million-ounce Tulu Kapi Mine.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PAB | Patrys Limited | 0.001 | -50% | 4095800 | $4,731,620 |

| 1TTDB | Thrive Tribe Tech | 0.011 | -45% | 688814 | $2,031,723 |

| AOK | Australian Oil. | 0.002 | -33% | 2400330 | $3,005,349 |

| CRB | Carbine Resources | 0.003 | -25% | 459 | $4,000,652 |

| CT1 | Constellation Tech | 0.0015 | -25% | 1956076 | $2,949,467 |

| EEL | Enrg Elements Ltd | 0.0015 | -25% | 20495001 | $6,507,557 |

| NPM | Newpeak Metals | 0.021 | -25% | 1155564 | $9,018,008 |

| BUY | Bounty Oil & Gas NL | 0.002 | -20% | 276214 | $3,903,680 |

| MEL | Metgasco Ltd | 0.002 | -20% | 120000 | $4,581,467 |

| QXR | Qx Resources Limited | 0.004 | -20% | 1157066 | $6,551,644 |

| TOU | Tlou Energy Ltd | 0.025 | -19% | 123162 | $40,256,114 |

| PLN | Pioneer Lithium | 0.115 | -18% | 17378 | $6,182,636 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 16008493 | $13,492,060 |

| ADR | Adherium Ltd | 0.005 | -17% | 3640331 | $9,438,997 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 9498886 | $12,091,165 |

| TEG | Triangle Energy Ltd | 0.0025 | -17% | 1460016 | $6,267,702 |

| XPN | Xpon Technologies | 0.01 | -17% | 321808 | $4,971,039 |

| FRM | Farm Pride Foods | 0.29 | -16% | 244556 | $79,622,983 |

| ORD | Ordell Minerals Ltd | 0.35 | -16% | 427461 | $17,773,483 |

| SRI | Sipa Resources Ltd | 0.017 | -15% | 5553643 | $8,327,966 |

| AN1 | Anagenics Limited | 0.006 | -14% | 7576 | $3,474,243 |

| ECT | Env Clean Tech Ltd. | 0.003 | -14% | 200000 | $14,054,024 |

| ID8 | Identitii Limited | 0.006 | -14% | 29293 | $5,446,095 |

| OMG | OMG Group Limited | 0.006 | -14% | 201588 | $5,098,064 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 79120 | $11,509,489 |

IN CASE YOU MISSED IT

Aldoro Resources (ASX:ARN) continues to build the Kameelburg niobium and REE project’s scale with TREO results up to 2.1pc.

Break it Down: AnteoTech’s (ASX:ADO) recent testing of its Ultranode X battery has achieved nearly 900 cycles at 80% capacity retention.

Hillgrove Resources (ASX:HGO) made further operational improvements at Kanmantoo copper mine in South Australia, improving both mine development and ore processing numbers.

TRADING HALTS

Arika Resources (ASX:ARI) – ASX price query response

Aurumin (ASX:AUN) – potential change of control

Brightstar Resources (ASX:BTR) – change of control and cap raise

Dart Mining (ASX:DTM) – Triumph drilling results

Power Minerals (ASX:PNN) – cap raise

Tivan (ASX:TVN) – material fluorite project deals

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.