CLOSING BELL: Orexplore’s +150pc ray of BHP deal sunshine pours light on a dismal day

Bradley's new homeopathic sunscreen didn't work out very well at all. Pic via Getty Images.

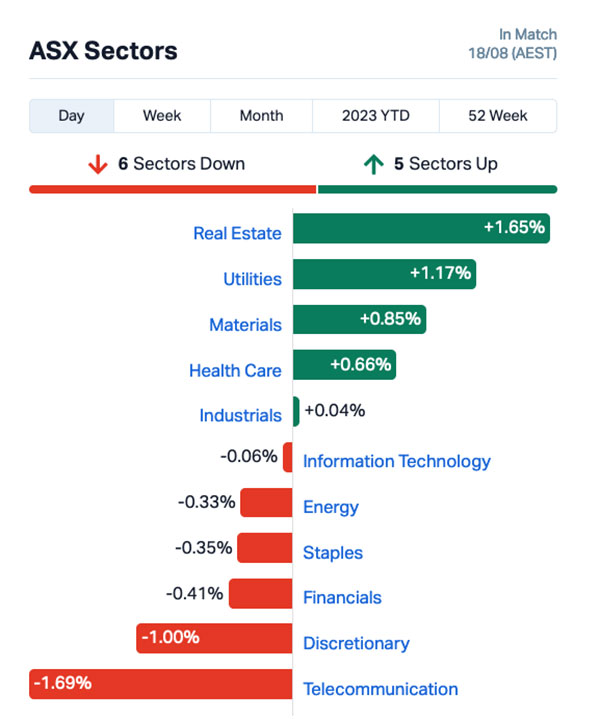

- ASX 200 benchmark falls, gains and wanes its way to just 0.03% for the day.

- Real Estate, resources and gold (oh my!) lead a troubled bourse from disaster.

- Mining tech minnow Orexplore’s $1.55m BHP deal delivers a +150% gift for investors.

The ASX has ended the day pretty much flat, a profound disappointment as pretty much everything came off the boil after lunch leaving the benchmark at +0.03%.

There were two notable exceptions to the afternoon’s downward trend, the first being today’s Small Caps champion Orexplore Technologies (ASX:OXT), and the second being how woefully poor the Telco sector’s performance was.

The reasons the benchmark went from bad to good and then meh are the same as they were a few hours ago – a shocking lead-in from Wall Street and China being very Beijing about a bunch of stuff – with a now-standard round from ASX Friday arvo apathy thrown in for good measure.

Real Estate ended the day well out in front, thanks in no small part to global integrated property group Goodman (ASX:GMG), a $42 billion market cap behemoth which shot up 8.3% this morning, before easing back to +6.5% for the day.

That’s off the back of the company’s yearly report, which showed an operating profit of $1.78 billion (up 17% on FY22), driving a statutory profit of $1.56 billion.

Two indices stood out from the pack today, too – the XJR ASX 200 Resources and the KGD All Ords Gold both going around 0.65% higher.

FROM THE HEADLINES

With the US Fed’s recent minutes doing thunderous damage to sentiment on Wall Street, all eyes are looking towards a very important gathering at Jackson Hole next week.

(I’d like you to note that I resisted the urge to make a Michael Jackson joke there. Mostly.)

Jackson Hole, in the otherwise unremarkable US state of Wyoming, will once again host its annual global conference of central bankers, where bread-heads from around the world gather to finalise plans to enslave the entire human race discuss fiscal policy and – hopefully – come to some sort of agreement on how best to manipulate money markets for their own personal gain get rising inflation and its associated cost-of-living crisis under some semblance of control.

And while we’re on the topic of money, it’s worth noting that Bitcoin has taken an icepick to the spine over the past 24 hours, and you’ll never guess who’s behind it.

To the surprise of absolutely no one, it’s International Heavyweight Fight-Dodger Elon Musk, whose company SpaceX helped (along with Tesla) build a ton of value for Bitcoin.

Tesla quite famously bought a large quantity of BTC back in the day, and SpaceX reportedly bought in big around that time as well.

However, revelations overnight that SpaceX’s purchase was A) Not really all that large (about $US373 million worth), and B) has all been sold off since, was enough for those fickle crypto-loving Muskovites to dump BTC en masse, causing it to crash horribly by more than 9% overnight.

Rob “I’d Fight Elon for $1” Badman knows a lot more about this stuff than I do, so you’re probably going to want to go read his round up of crypto here.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OXT | Orexploretechnologie | 0.105 | 128% | 30,343,449 | $4,768,553 |

| FTL | Firetail Resources | 0.155 | 35% | 1,253,010 | $11,068,750 |

| 4DS | 4Ds Memory Limited | 0.067 | 34% | 41,109,568 | $81,627,161 |

| AHN | Athena Resources | 0.008 | 33% | 1,441,571 | $6,422,805 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 1,418,735 | $8,737,021 |

| NNG | Nexion Group | 0.016 | 33% | 541,267 | $2,427,694 |

| SAN | Sagalio Energy Ltd | 0.012 | 33% | 184,526 | $1,841,941 |

| RLG | Roolife Group Ltd | 0.009 | 29% | 304,911 | $5,043,907 |

| IEC | Intra Energy Corp | 0.007 | 27% | 47,731,969 | $8,914,299 |

| IBG | Ironbark Zinc Ltd | 0.01 | 25% | 971,004 | $11,734,274 |

| ROG | Red Sky Energy. | 0.005 | 25% | 56,276,511 | $21,208,909 |

| BCB | Bowen Coal Limited | 0.135 | 23% | 30,198,331 | $234,958,447 |

| AN1 | Anagenics Limited | 0.022 | 22% | 92,357 | $6,581,159 |

| OLY | Olympio Metals Ltd | 0.23 | 21% | 941,983 | $9,719,460 |

| CZN | Corazon Ltd | 0.018 | 20% | 3,169,788 | $9,154,958 |

| IMI | Infinitymining | 0.12 | 20% | 24,952 | $7,765,139 |

| PNX | PNX Metals Limited | 0.003 | 20% | 1,927,629 | $13,451,562 |

| SI6 | SI6 Metals Limited | 0.006 | 20% | 1,300,000 | $9,969,297 |

| SLM | Solismineralsltd | 0.435 | 19% | 1,578,244 | $24,462,273 |

| KGD | Kula Gold Limited | 0.019 | 19% | 375,812 | $5,971,391 |

| LU7 | Lithium Universe Ltd | 0.064 | 19% | 42,256,523 | $20,980,182 |

| XGL | Xamble Group Limited | 0.039 | 18% | 26,796 | $9,377,156 |

| GSR | Greenstone Resources | 0.013 | 18% | 1,294,603 | $14,750,503 |

| DOU | Douugh Limited | 0.007 | 17% | 532,803 | $6,341,852 |

| EEL | Enrg Elements Ltd | 0.007 | 17% | 747,124 | $6,059,790 |

As mentioned earlier, Orexplore Technologies (ASX:OXT) has won the Small Caps Cup today, climbing up more than 150% since revealing that the company has inked a $1.55 million deal with mining giant BHP.

The deal will see the deployment of Orexplore’s mobile field scanning installation and technology platform to BHP’s Carrapateena operation in South Australia, which is obviously huge news for the exploration tech minnow.

“This agreement further demonstrates increasing global demand for non-destructive, 3D information sourced rapidly from the field to inform decision processes, drive traditionally siloed collaboration around digital models, and create value within an operating mine,” Orexplore MD Brett Giroud said.

4DS Memory (ASX:4DS) came flying up the ladder this afternoon, stacking on 32%. But, because there’s no visible reason that happened, the company was gifted a speeding ticket by the ASX, to which it replied “We have no idea why, either”.

Also up on a no-news boost was Firetail Resources (ASX:FTL), which added more than 26% despite not telling the market a thing since 04 August, when Valor Resources (ASX:VAL) revealed that the Peruvian Ministry of Energy and Mines gave the go-ahead for drilling at Valor’s Picha copper project in (obviously) Peru.

That was big news for Firetail, because it had already negotiated to buy the Picha project from Valor, which was announced to the market in late July. Valor hasn’t had any news today either, but it’s down 12.5%.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.002 | -33% | 100,005 | $4,413,601 |

| TD1 | Tali Digital Limited | 0.001 | -33% | 49,068 | $4,942,733 |

| AJQ | Armour Energy Ltd | 0.091 | -30% | 282,309 | $13,405,615 |

| MTB | Mount Burgess Mining | 0.003 | -25% | 3,190,407 | $4,062,587 |

| SPT | Splitit | 0.052 | -21% | 9,737,306 | $36,516,746 |

| HTG | Harvest Tech Grp Ltd | 0.027 | -21% | 1,289,830 | $23,411,590 |

| ADR | Adherium Ltd | 0.004 | -20% | 1,351,348 | $24,997,042 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 3,000,000 | $8,256,420 |

| ELE | Elmore Ltd | 0.004 | -20% | 11,098,800 | $6,996,919 |

| GSM | Golden State Mining | 0.032 | -20% | 10,270,026 | $7,643,531 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 20,959,685 | $19,462,207 |

| CPV | Clearvue Technologie | 0.26 | -19% | 815,030 | $69,958,962 |

| SGC | Sacgasco Ltd | 0.005 | -17% | 7,735,833 | $4,641,496 |

| TSK | Task Group Holdings | 0.47 | -16% | 28,779 | $198,747,833 |

| VBC | Verbrec Limited | 0.105 | -16% | 7,000 | $27,684,521 |

| NHE | Nobleheliumlimited | 0.215 | -16% | 4,377,166 | $50,586,759 |

| IMU | Imugene Limited | 0.0795 | -15% | 82,395,971 | $603,765,676 |

| CXU | Cauldron Energy Ltd | 0.006 | -14% | 2,717,612 | $6,660,981 |

| TIG | Tigers Realm Coal | 0.006 | -14% | 2,964,090 | $91,466,917 |

| EQX | Equatorial Res Ltd | 0.155 | -14% | 92 | $23,570,164 |

| OSM | Osmondresources | 0.13 | -13% | 15,714 | $7,034,406 |

| BDX | Bcaldiagnostics | 0.135 | -13% | 261,449 | $33,051,067 |

| AXN | Alliance Nickel Ltd | 0.075 | -13% | 1,307,943 | $61,327,140 |

| AL8 | Alderan Resource Ltd | 0.007 | -13% | 91,910 | $4,933,557 |

| BEX | Bikeexchange Ltd | 0.007 | -13% | 1,309,800 | $9,513,201 |

LAST ORDERS

Not so much a headline news announcement, but more of an oh-so-glorious typo, thanks to the team at Invex Therapeutics (ASX:IXC).

Before I go on, I should point out that I’m not having a go at IXC – I am the reigning world champion of spelling mistakes – but this has tickled my funny bone and I can’t not bring it the attention it deserves.

Invex Therapeutics announced a trading halt today, while it awaits a report that the company commissioned, and the announcement included this explanatory paragraph:

“The Company expects to make a material announcement to the market in relation to the receipt of a commissioned report in relation to the Idiopathic Intercranial Hypertension market (market assessment report) initiated by the Board (ASX Release 28 June 2023) from an independent healthcare market intelligence group and the Board’s strategic review of the Company’s Phase III Trial.”

That should, obviously, be “Idiopathic Intracranial Hypertension”, because it’s about rising blood pressure inside the patient’s own head.

But the erroneous description above translates into non-medico speech as “a rise in blood pressure caused by something that’s happening in someone else’s head for no discernible reason”.

And that’s a malady that I’m certain everyone has experienced at some point in their lives.

Meanwhile, Chrysos Corporation (ASX:C79) has asked for some time off to prepare a Chrysos response to an ASX speeding ticket, so it’s out of the pool until Monday (probably… it’s 30 minutes from the end of today’s session, so I doubt we’ll be getting something back from them today).

And lastly, Aquis Canberra Holdings (Aus) Pty Ltd (ACHL) has told the ASX that it intends to compulsorily acquire the 10% of Aquis Entertainment (ASX:AQS) that it doesn’t currently own, “pursuant to Part 6A.2 of the Corporations Act”, offering all remaining shareholders $0.20 per share.

It’s a cracker of an announcement because, thanks to its vaguely-menacing tone and the fact that it’s both poorly photocopied and uses dozens of different fonts, it both looks and sounds like a ransom note.

You can revel in its glory here.

TRADING HALTS

Queensland Pacific Metals (ASX:QPM) – Capital raising.

Invex Therapeutics (ASX:IXC) – Material announcement to the market in relation to the receipt of a commissioned report.

Enova Mining (ASX:ENV) – Capital raising.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.