Closing Bell: Nothing inflated about ASX as steady August CPI baked into latest loss, benchmark now short -2.4pc this week

Via Getty

- Benchmark index down -0.3% at close, -0.1% after settlement

- All sectors bar Real Estate and Financials in the red

- Small caps led by huge day for Haranga Resources and fintech Peppermint Innovations

Local markets made it a fourth straight fall at the open on Wednesday, after all three major US indices shed weight on weak new home sales and consumer confidence reports.

The benchmark ASX200 was down -0.3% at 4pm, before climbing again into settlement to finish a lucky -0.1% short. The XJO is already down -2.4% this week.

The Small Ords (XSO) index lost -0.3% and the Emerging Companies (XEC) index lost -0.65%, to take the XEC’s losses since Monday to circa -3.5%.

With the US government shutdown now within a few sessions of reality, Wall Street couldn’t hold its bottle over the multitudinous headwinds pummelling the resilient-this-far US economy.

The Dow Jones Industrial Average fell overnight by almost 400 points, or 1.14%, to log its worst day since March.

The S&P 500 lost -1.5% % to end below 4,300 for the first time since June.

And the tech-heavy Nasdaq Composite walked back -1.6%.

At home, stocks looked lost well before the Bureau of Stats’ Monthly CPI Indicator landed at 11.30am – “bang on expectations” – neither helping nor hindering local traders.

IG Markets’ Tony Sycamore told Stockhead to get back to staring at US bond yields – “Nothing to see here, so back to watching the price action in US Treasuries.”

The August CPI came in at 5.2%, rising from 4.9% in July. The core measure rose by 5.5% in August, easing from 5.8% in July.

The most significant price rises were Housing (+6.6%), Transport (+7.4%), Food and non-alcoholic beverages (+4.4%) and Insurance and financial services (+8.8%).

ABS head of prices statistics Michelle Marquardt noted that Aussie annual inflation “remains below the peak of 8.4% in December 2022”.

To surely no-one’s surprise, the largest contributor to August inflation was the ridonkulous fuel prices I keep seeing about the place. Automotive fuel prices rose by 9.1%/mth in August, according to the ABS.

At CBA, economist Stephen Wu agreed.

“As expected, the rise in automotive fuel prices contributed around 0.3 percentage points (or half the total monthly increase) to inflation.

“The rise in oil prices and elevated diesel refining margins have increased the price of petrol and diesel. Prices at the bowser have increased further over September.”

As CBA’s mining and resources strategic guru Vivek Dhar said, Saudi Arabia and Russia’s extension of oil production cuts has heaped upside risks for oil prices – and by extension petrol and diesel prices at the bowser.

“We view the uptick in inflation in August as a temporary hump in the downward trend in train since December last year,” Stephen Wu said on Wednesday.

“We think the RBA will be inclined to see it that way too when it meets next Tuesday for the October rate decision. We don’t anticipate the August CPI will alter their view the current cash rate of 4.1% is restrictive enough to pull inflation back inside the target band.”

The CPI drop encouraged a very wee bump in the Aussie dollar which is back under US64¢ again as home-made bond yields slipped – the local 10-year looks steady at 4.3%, while the 2-year dropped to 4.03%.

The data managed to extract about +7 points from a very dull ASX200 wicket, for the benchmark to be monetarily down only -0.1% at around 11.40am Sydenham time. It didn’t last long.

“Today’s inflation data won’t move the dial ahead of the October RBA meeting, where the RBA is widely expected to stay on hold,” IG’s Tony Sycamore says. “However, jobs data for September (October 20th) and Q3 inflation data (October 25th) will decide whether the RBA hikes rates in November or keeps its cash rate on hold into year end.”

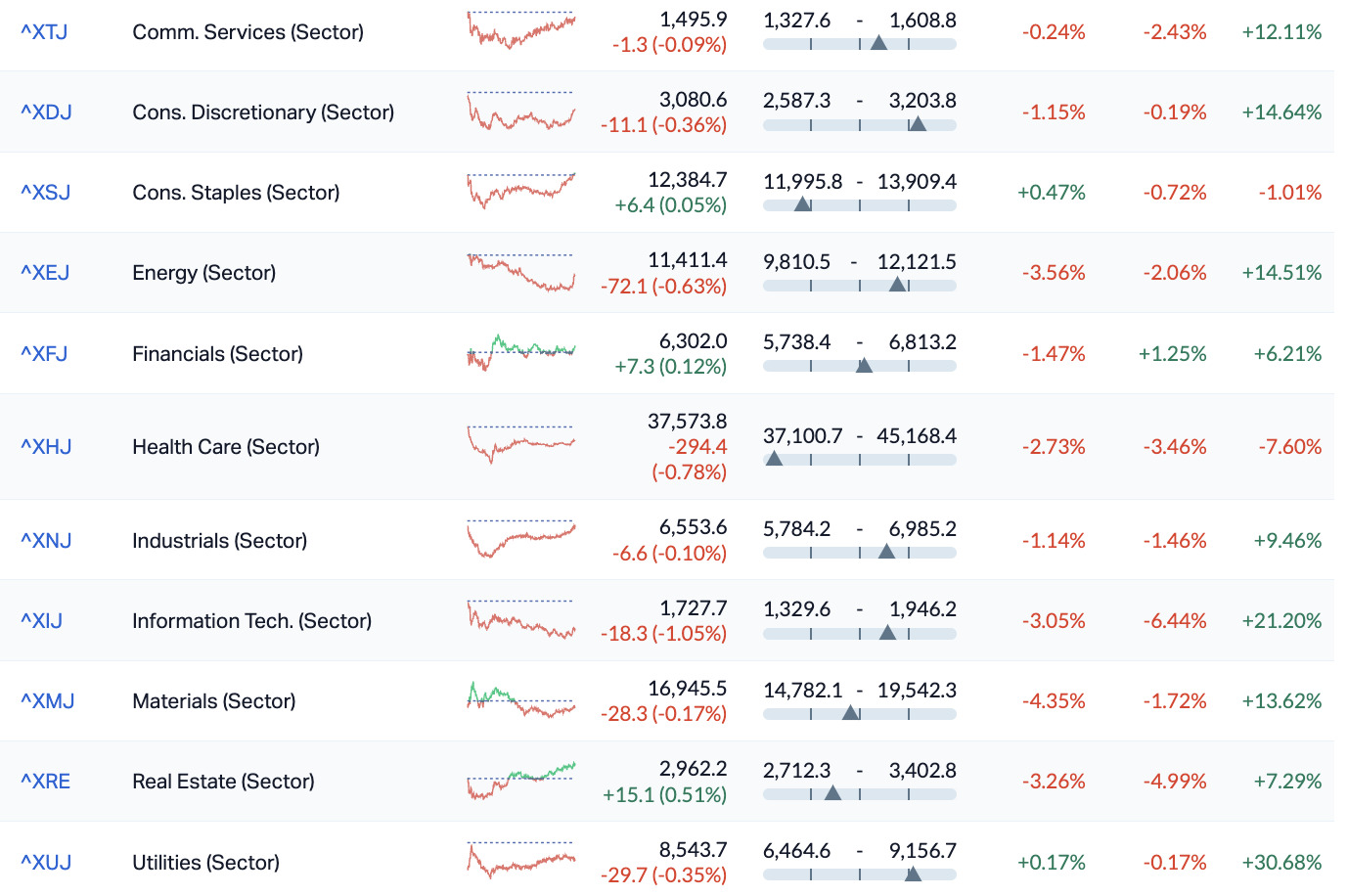

ASX Sectors on Wednesday — Intraday — 52 Week Range — Week – Month – Year

In small cap news, the iSynergy Group (ASX:IS3) board says CEO Shah Mohammad Ali tendered his resignation – fairly abruptly as these things go – but will remain in the role until 5 October.

Mr Shah has advised his resignation is a decision related to his desire to focus on other priorities.

IS3’s Executive Chair, Dato’ Lawrence Teo will take up the flag and assume CEO duties (with no change to his existing remuneration).

“We understand and respect the reasons for Mr Shah’s decision to resign. We are grateful to Mr Shah for his contributions to the business and wish him well for his future endeavours.” Mr Teo said.

The search is on for a new CEO and shareholders will get the word “once a suitably credentialed candidate has been appointed to deliver on the Company’s strategic objectives.”

In lihtium land, MetalsTech (ASX:MTC) has just acquired a 100% interest in a district-scale hard-rock lithium exploration project out in that highest of highly prospective lithium locations – James Bay, Quebec in Canuckland.

The Sauvolles Lithium Project covers approximately 300km2 on the highly prospective east-west trending Lac Guyer Greenstone Belt, which hosts the Adina Lithium Project (Winsome Resources (ASX:WR1), which has intersected high-grade lithium mineralisation in recent drilling including 107.6m @ 1.34% Li2O, just 3km from Sauvolles.

On the plus side Sauvolles’ total area is almost seven times larger than Winsome’s Adina Lithium Project and x 1.5 times larger than Patriot Battery Metals (ASX:PMT) Corvette Lithium Project.

The acquisition makes MetalsTech one of the largest land holders within the highly prospective Lac Guyer Greenstone Belt.

MTC says the acquisition contains ‘multiple mapped pegmatites and strong indicator minerology along the Lac Guyer Greenstone Belt, including anomalous historical lithium assay results’ from samples collected by the Geological Survey of Quebec.

On a mighty similar theme, Todd River Resources (ASX:TRT) reports its own set of deals leading to the acquisition of 3x lithium exploration projects in the Northwest Territories of Canuckland.

“At completion, the Company will have the largest lithium exploration footprint of any ASX listed company in the Northwest Territories. The total lithium prospective land package is approximately 500 square kilometres with additional adjacent ground expected to become available,” TRT told the ASX on Wednesday.

All projects apparently have known pegmatite systems ‘mapped and present.’

Meanwhile TRT says that firm commitments have been received to raise $5mn (before costs) at $0.01 per share under a placement to new and existing sophisticated and professional investors.

All the cash will be used on exploration at the Canadian projects, existing projects and working capital.

“Completion of the acquisition and placement is subject to obtaining shareholder approval to issue the relevant securities, and both transactions are inter-conditional on the other completing,” TRT says.

On a slightly more southern but otherwise similar theme, multi-commodity small cap miner Bastion Minerals (ASX:BMO) rationalised permanent employment contracts for operating staff in Chile as the copper and battery metals play awaits Hot Chili (ASX:HCH) to complete due diligence exploration activities on Bastion’s Cometa project.

Bastion recently signed a binding Letter of Intent with Hot Chili for an option for HCH to acquire the Cometa Copper Project in Chile for up to US$3.3 million in cash.

Bastion’s Executive Chairman, Mr Ross Landles said the reduction in recurring staff costs from Chile is expected to result in an annual saving of circa $700,000.

“Following the recent binding LOI to divest our Cometa Copper project to Hot Chilli for up US$3.3million, the Board believes it is prudent capital management to now manage its Chilean operations solely via consultants which will significantly reduce the current expenses incurred by our in-country permanent staff,” Landles said.

“We remain focused on creating value for our shareholders, and we are confident that the best way forward is to concentrate our efforts and our funds towards exploring our Canadian Lithium Portfolio, and our REE Project in Sweden.”

Bastion’s exploration activities across its lithium portfolio in Canada and Gyttorp REE project in Sweden ‘are progressing’ under the beady eye of experienced Consultant Geologist, Murray Brooker.

Up about 5% on Wednesday, BMO says it is also ‘actively engaged in assessing new project acquisitions’ in the battery minerals sector.

Ripped from the headlines

In devastating news for fans of well filled-out tax reports, the Colombian pop singer Shakira, heading to a Barcelona court in November for tax fraud, is reportedly facing fresh charges by Spanish prosecutors who claim she cheated the tax office – and the Spanish people – out of circa US$7mn.

The case first came to light in July when a court near Barcelona agreed to look into 2x possible cases of tax fraud by the singer dating back to 2018, although it did not say how much money was involved.

Details of the latest case were only made public overnight after Shakira was formally notified while at home in Miami. The 46-year-old has repeatedly denied any wrongdoing and says, like so many of us, that she owes nothing to the Spanish tax office.

The former US president Donald Trump committed fraud for years by deceiving banks, insurers and others by massively overvaluing his assets and exaggerating his net worth on documents used to cut deals and secure financing, a US judge has ruled in a civil lawsuit brought by New York’s attorney-general.

Mr Trump has Truth-Social’d all about the decision, saying it was UnAmerican and flouted his civil rights. An appeal is pending, to be sure.

China’s recently awful offshore yuan has lingered back around 7.31 per US dollar as the People’s Bank of China (PBoC) reassured investors that it would “resolutely prevent currency overshooting risks and keep the yuan basically stable at reasonable and balanced levels.”

The news has bolstered shaky mainland markets, and led the Shanghai composite higher despite new data showing industrial profits fell 11.7% YTD amid weak demand.

On the monetary policy front, The PBOC left its 1-year and 5-year loan prime rates (LPR) steady earlier at 3.45% and 4.2%, respectively, shoring up confidence that China’s faltering economy is showing signs of stability.

In earlier stimulus measures the PBoC cut leading banks’ reserve requirement ratios by 25 basis points in order to ensure there’s ample liquidity just in case someone wants to borrow something to help kickstart China’s still in the post economic recovery.

At about 3.30pm in Sydenham, someone called Jacinta Allan emerged from a Victorian Labor caucus meeting as Victoria’s premier-elect. She’ll take the reins down south after nine-year incumbent Daniel Andrews called it quits on Tuesday. He packs up the desk at 5pm.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PIL | Peppermint Inv Ltd | 0.009 | 50% | 13,655,647 | $12,227,141 |

| HAR | Harangaresources | 0.225 | 50% | 6,589,146 | $7,622,103 |

| VPR | Volt Power Group | 0.0015 | 50% | 50,105 | $10,716,208 |

| XTC | Xantippe Res Ltd | 0.0015 | 50% | 4,995,402 | $17,528,005 |

| ADR | Adherium Ltd | 0.004 | 33% | 100,000 | $14,998,225 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 321,917 | $6,727,274 |

| GES | Genesis Resources | 0.005 | 25% | 150,000 | $3,131,365 |

| OAR | OAR Resources Ltd | 0.005 | 25% | 11,575,706 | $10,452,543 |

| SPX | Spenda Limited | 0.01 | 25% | 6,820,945 | $29,371,377 |

| MKL | Mighty Kingdom Ltd | 0.013 | 18% | 64,729 | $3,588,416 |

| OZM | Ozaurum Resources | 0.105 | 17% | 8,517,626 | $11,430,000 |

| CAV | Carnavale Resources | 0.007 | 17% | 10,045,555 | $20,541,310 |

| RML | Resolution Minerals | 0.007 | 17% | 500,289 | $7,543,751 |

| SOM | SomnoMed Limited | 0.67 | 16% | 100 | $57,465,957 |

| PPG | Pro-Pac Packaging | 0.3 | 15% | 16,557 | $47,238,805 |

| 1AG | Alterra Limited | 0.008 | 14% | 217,390 | $4,875,868 |

| NET | Netlinkz Limited | 0.008 | 14% | 5,580,053 | $24,713,699 |

| PAB | Patrys Limited | 0.008 | 14% | 210,564 | $14,402,131 |

| YPB | YPB Group Ltd | 0.004 | 14% | 250,000 | $2,602,115 |

| JGH | Jade Gas Holdings | 0.04 | 14% | 1,459,012 | $35,217,147 |

| KZA | Kazia Therapeutics | 0.16 | 14% | 54,034 | $33,088,912 |

| CST | Castile Resources | 0.057 | 14% | 60,000 | $12,095,121 |

| NWM | Norwest Minerals | 0.033 | 14% | 9,384 | $8,339,516 |

| WZR | Wisr Ltd | 0.033 | 14% | 3,061,790 | $39,495,818 |

| PGY | Pilot Energy Ltd | 0.025 | 14% | 4,990,102 | $22,826,267 |

Haranga Resources (ASX:HAR), is smashing Wednesday, climbing throughout the day to sit comfortably atop the small cap ladder at with a gain of 63% late in afternoon trade.

That’s all happening because the company’s secured firm commitments for $2.86m in heavily oversubscribed funding.

Haranga says the money will “primarily be used for drilling at Haranga’s Saraya uranium project in West Africa as the Company moves towards extending on its maiden JORC mineral resource (Inferred 12.5Mt @ 587ppm eU3O8 for 16.1 Mlbs1) at the Saraya project”.

The $10.9m market-capped uranium explorer is looking to expand its maiden JORC uranium resource of 12.5Mt @ 587ppm eU3O8 for 16.1Mlbs at the Saraya uranium project in Senegal.

The funds were raised through a placement of 26 million shares @ 11c/sh, representing a pretty decent discount to the company’s share price at the close on Tuesday.

As detailed in this morning’s timely and very special report , the Saraya prospect has a maiden resource of 12.5Mt at 587ppm eU3O8, with mineralisation remaining open along strike, down-dip and down-plunge.

Additionally, the prospect covers just a tiny part of the broader Saraya permit and exploration to date has already identified six other potential uranium anomalies.

HAR share price

Philippines-focused Aussie fintech Peppermint Innovation (ASX:PIL) has jumped about 50% after sharing the long-awaited and terribly welcome news that its subsidiary, Peppermint Bizmoto Inc has secured 2 x “vitally important certifications” from the Central Bank of the Philippines, Bangko Sentral ng Pilipinas.

In an acronym-rich release to the ASX, PIL says that the BSP issued PIL’s PBI with:

1) A Certificate of Registration (COR) as Operator of Payment System (OPS) and;

2) A Certificate of Eligibility (COE) for membership in the Philippines Payments Management Inc. (PPMI)

The certificates allow Peppermint a direct connection to the PESONet and InstaPay Automated Clearing Houses as a Sending and Receiving Participant under the Philippines National Retail Payment System.

Over to Peppermint MD and CEO Chris Kain:

“The BSP’s certification of our operations is an important milestone in Peppermint’s strategy to fully leverage our Electronic Money Issuer (“EMI”) licence and use it to drive revenue growth via increased transactions across the bizmoto platform.”

“While we have previously offered PESONet and InstaPay via bizmoto, this has been through a third party relationship.”

“We will now improve our margins and revenue profile for these types of transaction by having direct membership to the PPMI and therefore direct connection to the ACH for PESONet and InstaPay.”

“The BSP’s OPS and COE certification of PBI, which facilitates bizmoto’s complete and direct interoperability across the Philippines payment landscape, also emphasises the potential value of our EMI licenced platform.

“By way of some comparison, a Philippines mobile-App based platform with an EMI licence called Coins.ph was sold in early 2021 for US$200 million, after having been purchased by Gojek for around US$95 million in 2019.

“Peppermint has a commercially proven, deployed and growing mobile-App based ecosystem in the Philippines which is underpinned by a Finance Company Licence and an EMI licence,” Kain said.

“We are currently valued at circa $13mn.”

Up exactly 50% at the time of writing, that’s about $20mn now.

Shares in Mighty Kingdom (ASX:MKL) have jumped in late arvo trade, after the gaming stock revealed that exactly 52,496,666 fully paid ordinary shares will be released from escrow on 2 October 2023, as per its prospectus.

The release is welcome news for the Aussie gaming minnow, which hired lawyers last week to chase down their own ex-CEO for circa $2.1 million, and which it says are owed by the gaming company’s largest shareholder Gamestar Studios founded by ex MKL CEO Shane Yeend.

Gamestar’s outstanding contribution to a $7mn placement last year was circa $2.3mn. Mighty Kingdom says only $200k of that has been handed over.

Mighty Kingdom, chaired by former ABC boss Michelle Guthrie, says the funds “have not been forthcoming despite efforts to resolve the delays”, with the announcement released just 18 days after the Gamestar Studios founder quit MKL.

MKL reassured investors late last week that it’d be in a position ‘to finance its ongoing business operations without immediate recourse to the Gamestar+ settlement monies’.

Caprice Resources (ASX:CRS) popped more than 20% this morning on no news other being a miner with a little nuclear connection.

Flynn Gold (ASX:FG1) also surged this morning on news that the company has commenced drilling at Tasmania’s Warrentinna Project testing a high grade, near-surface gold target zone identified by historical drill results that include a thumping 5.0m @ 28.93g/t Au from 36.0m, including 1.0m @ 103.25g/t Au from 37.0m.

Gregor notes as well that recent market leader OzAurum Resources (ASX:OZM) has gained another double digit increase this morning on an amended announcement that the company has completed its due diligence on the Linopolis Jaime hard rock lithium project acquisition in the state of Minas Gerais, Brazil.

The buy is a go, which means managing director/CEO Andrew Pumphrey will be travelling to Brazil mid-October to commence fieldwork, progress the purchase of OZM diamond drilling rig and “pursue any other potential lithium opportunities should they arise”.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MXC | Mgc Pharmaceuticals | 0.0015 | -40% | 72,982,488 | $11,069,920 |

| IGN | Ignite Ltd | 0.052 | -31% | 53,559 | $6,718,663 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | 2,799,999 | $24,408,512 |

| CMX | Chemxmaterials | 0.092 | -23% | 126,249 | $6,369,226 |

| VRC | Volt Resources Ltd | 0.007 | -22% | 8,588,911 | $35,454,815 |

| KCC | Kincora Copper | 0.031 | -21% | 335,318 | $6,254,783 |

| DXN | DXN Limited | 0.002 | -20% | 5,785,149 | $4,308,350 |

| MRQ | Mrg Metals Limited | 0.002 | -20% | 741,071 | $5,464,797 |

| ICG | Inca Minerals Ltd | 0.014 | -18% | 306,771 | $8,347,170 |

| M2R | Miramar | 0.043 | -17% | 133,154 | $7,741,216 |

| AEV | Avenira Limited | 0.01 | -17% | 19,415,143 | $20,760,087 |

| LSR | Lodestar Minerals | 0.005 | -17% | 2,010,000 | $12,140,384 |

| MOM | Moab Minerals Ltd | 0.01 | -17% | 10,937,287 | $8,543,562 |

| PEC | Perpetual Res Ltd | 0.02 | -17% | 1,923,103 | $14,727,979 |

| RIE | Riedel Resources Ltd | 0.005 | -17% | 3,160,000 | $12,356,442 |

| VMS | Venture Minerals | 0.01 | -17% | 334,367 | $23,400,156 |

| CBL | Control Bionics | 0.073 | -15% | 75,400 | $8,807,167 |

| TZL | TZ Limited | 0.017 | -15% | 905 | $5,135,162 |

| 88E | 88 Energy Ltd | 0.006 | -14% | 2,640,066 | $154,830,585 |

| ECT | Env Clean Tech Ltd. | 0.006 | -14% | 8,079,326 | $19,932,886 |

| RGS | Regeneus Ltd | 0.006 | -14% | 10,131 | $2,145,058 |

| SKN | Skin Elements Ltd | 0.006 | -14% | 575,004 | $3,986,403 |

| AUN | Aurumin | 0.025 | -14% | 115,303 | $8,654,849 |

| MQR | Marquee Resource Ltd | 0.032 | -14% | 979,095 | $12,236,178 |

| CCZ | Castillo Copper Ltd | 0.007 | -13% | 34,622 | $10,396,043 |

TRADING HALTS

Lithium Power International (ASX:LPI) –Pending the release of an announcement in response to recent media speculation involving the Company

Dreadnought Resources (ASX:DRE) – Pending a release regarding a capital raising

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.