Closing Bell: Miners, Woolies weigh on ASX; Michael Hill’s CEO passes away overnight

The ASX slid again, for the seventh time in eight days. Picture via Getty Images

- ASX slides again, seven losses in eight days

- Copper tariff talk spooks miners, Rio and BHP down

- Woolies, Platinum, and Flight Centre also take a hit

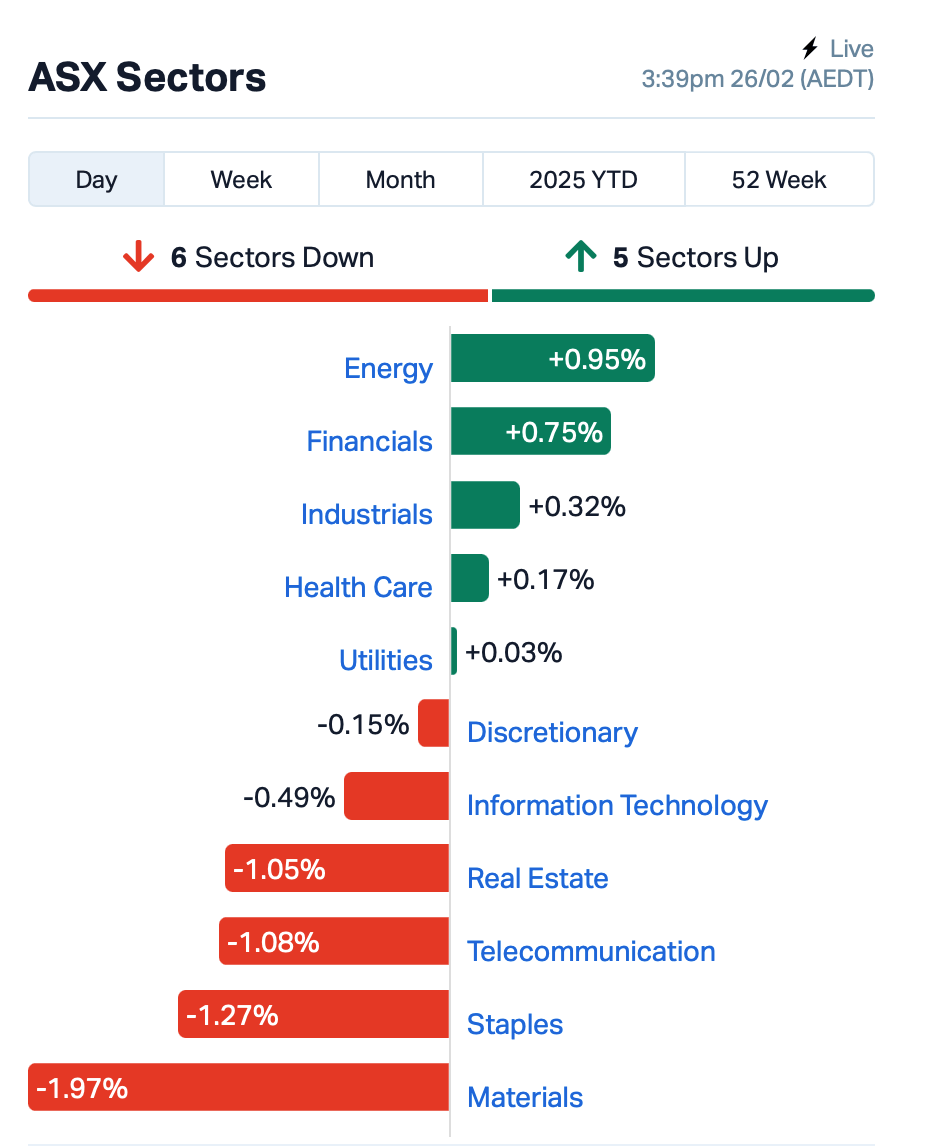

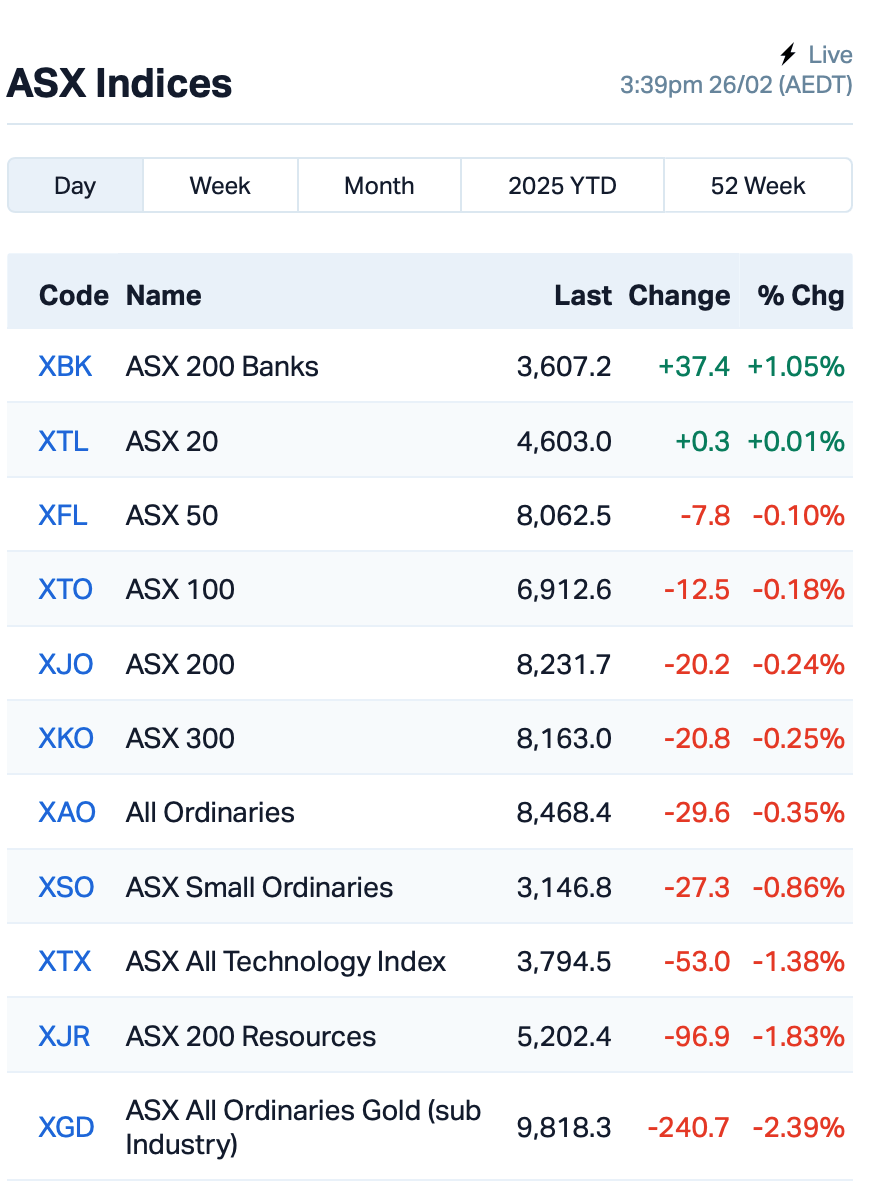

It was another rocky ride for local stocks today, with the ASX 200 benchmark down by 0.14%, taking its record to seven losses in eight sessions.

Miners were the biggest losers, and it’s no surprise – this sector tends to feel the pinch when there’s talk of global uncertainty.

Speaking of which, US President Trump has caused ripples in the market again, this time by threatening to slap tariffs on copper.

Traders are already spooked by his previous moves on aluminium and steel, and now they’re worried about how these potential tariffs could slow demand for metals globally.

Experts are already betting that copper tariffs will create price gaps between the US and the rest of the world.

All this talk is dragging down Aussie miners on Wednesday, with BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) all getting hammered.

And if you’re looking for any good news this earnings season, well, it’s not exactly raining profits.

Woolworths (ASX:WOW) dragged down the staples sector after tumbling by 4%, not helped by a 20% drop in first-half profit. The retailer said it lost a lot of sales during the pre-Christmas strike madness, to the tune of $240 million; while ongoing inflation and lower margins added to the pain.

Fundie Platinum Asset Management (ASX:PTM) plunged by 19% after reporting a big drop in its funds under management (FUM) of 20% vs the previous half, leading to lower fee revenues. However, Platinum’s CEO Jeff Peters is leading a turnaround plan and has just announced a new investment leadership team.

Over at Flight Centre (ASX:FLT), shares dropped 11% despite a 7% increase in underlying profit for the half.

And, SiteMinder’s (ASX:SDR) shares dived 10% after it missed earnings expectations. The software provider reported a net loss of $13.9 million for the half, slightly improved from last year.

Now, if you’re looking for some winners, Bapcor (ASX:BAP) was on fire, up 14%. The auto parts seller has had a good run in the last half after cutting costs and hitting its targets.

Engineering company Worley (ASX:WOR) was also doing a little victory dance with a 10.5% jump after announcing a $500 million share buyback.

And last but not least, a bit of shocking news to end the day.

Jewellery retailer Michael Hill’s (ASX:MHJ) CEO Daniel Bracken passed away unexpectedly overnight due to an adverse reaction to medical treatment.

“Daniel was a passionate retailer, an innovative and strategic thinker and an inspiring leader, who transformed the Michael Hill Group into the company that it is today,” said the announcement. Shares fell 5%.

This is where things stood leading up to today’s close of day:

Elsewhere, Aussie inflation data came in steady today at 2.5% for January, matching the figure from December.

But this shows that prices aren’t easing up much, and with wages slowing down and hours being cut, things are still looking tough.

There’s a bit of relief with a rate cut last week, but another cut isn’t looking likely right now.

“For now, another cut isn’t likely in April, particularly with the ongoing strength in the labour market,” said eToro’s Josh Gilbert.

Over in Asia, Chinese President Xi Jinping’s told officials to stay calm and focused, as the US ramps up pressure with tougher trade and investment restrictions.

Trump is taking big steps to challenge China, including curbing Chinese spending in key sectors and slapping tariffs.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap FFF Forbidden Foods 0.009 80% 24,511,321 $3,560,510 HTM High-Tech Metals Ltd 0.260 53% 2,380,853 $5,582,802 EEL Enrg Elements Ltd 0.002 50% 500,000 $3,253,779 WYX Western Yilgarn NL 0.038 46% 1,207,591 $3,219,048 VRC Volt Resources Ltd 0.005 43% 60,369,293 $15,852,877 WOA Wide Open Agricultur 0.017 42% 44,397,612 $6,404,239 HYD Hydrix Limited 0.023 35% 2,469,224 $4,637,070 OLY Olympio Metals Ltd 0.054 35% 6,535,954 $3,479,059 ERL Empire Resources 0.004 33% 150,000 $4,451,740 RLL Rapid Lithium Ltd 0.004 33% 28,488,528 $3,097,334 PBH Pointsbet Holdings 1.090 31% 8,915,506 $275,331,976 ZMI Zinc of Ireland NL 0.014 27% 8,417,569 $6,237,118 REM Remsensetechnologies 0.059 26% 934,366 $7,815,380 1TT Thrive Tribe Tech 0.003 25% 16,727 $4,063,446 ADD Adavale Resource Ltd 0.003 25% 5,877,153 $4,546,558 ERA Energy Resources 0.003 25% 11,833,427 $810,792,482 LNR Lanthanein Resources 0.003 25% 35,399 $4,887,272 ENV Enova Mining Limited 0.008 23% 4,486,313 $7,999,184 BPH BPH Energy Ltd 0.011 22% 392,815 $10,964,095 EWC Energy World Corpor. 0.023 21% 312,212 $58,499,504 AMS Atomos 0.006 20% 4,100,512 $6,075,092 ASR Asra Minerals Ltd 0.003 20% 3,500,000 $5,932,817 IS3 I Synergy Group Ltd 0.006 20% 270,313 $1,981,089 WBE Whitebark Energy 0.006 20% 162,698 $1,541,046 ALV Alvomin 0.056 19% 240,862 $5,506,468

High-Tech Metals (ASX:HTM) has acquired the Mt Fisher and Mt Eureka gold projects, which include a 100% stake in Mt Fisher and 51% gold rights for Mt Eureka. These projects are in the Northern Goldfields, with a big 1,150km² area and active mining leases. Mt Fisher has previously produced 30,000 ounces of gold, and there’s potential for more, with nearby mills just 120km away. It’s a prime spot for gold, close to major deposits like Jundee and Bronzewing, and the region has been hot for acquisitions with big players like Northern Star and Kedalion snapping up projects nearby.

Big news from Western Yilgarn (ASX:WYX) , with a massive 168Mt bauxite resource found at the Julimar West project, sitting at 36.1% Al2O3 grade. The project covers a huge area of 49km in length and up to 13km wide. It’s also well-positioned near Perth, with access to major ports and infrastructure, making it prime for exporting high-grade bauxite to China and the Middle East.

Olympio Metals (ASX:OLY) is set to acquire up to 80% of the Bousquet gold project in Quebec, Canada. The project’s located on the Cadillac Break, known for world-class gold and copper, and has high-grade prospects like Paquin East with a historic intercept of 9m at 16.96g/t Au. It’s close to major gold mines like Agnico Eagle’s La Ronde and Iamgold’s Westwood. The property’s got a 24km² area with quartz-hosted veins, similar to nearby high-yield projects. And, it’s underexplored, with most drilling done before 1947.

Bluebet (ASX:BBT) has made an offer to acquire Pointsbet (ASX:PBH) for $340-$360 million, including a cash pool of $240-$260 million and $100-$120 million in scrip. The deal could unlock $40 million in annual synergies, and BlueBet reckons it’s a solid offer for PointsBet shareholders.

Thrive Tribe Technologies (ASX:1TT) said it’s rebranding Kumu to MyTribe, a hybrid platform that combines content monetisation with business support for creators, athletes, and influencers, helping them build long-term brands and equity. MyTribe will offer premium content and training, while providing funding and strategic support for scaling businesses in sectors like health, wellness, and tech.

Adavale Resources (ASX:ADD) has hit high-grade gold, copper, and silver at the Ashes prospect in NSW, just 10km from Northparkes. First rock chip results include 7.95 g/t gold, 2.2% copper, and 96.4 g/t silver. These results back up historical findings, showing promising gold and copper levels. The area also shows high levels of pathfinder elements, hinting at strong mineralisation. Adavale is now planning a soil geochemistry program and more rock chip sampling to explore the 5km² area.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 6,036,842 | $13,149,361 |

| OVT | Ovanti Limited | 0.008 | -38% | 94,563,524 | $27,978,574 |

| APX | Appen Limited | 1.890 | -34% | 50,566,199 | $752,131,172 |

| VPR | Voltgroupltd | 0.001 | -33% | 16,584 | $16,074,312 |

| ALA | Arovella Therapeutic | 0.135 | -31% | 11,246,741 | $207,509,941 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 4,431,283 | $57,867,624 |

| MOM | Moab Minerals Ltd | 0.002 | -25% | 600,000 | $3,133,999 |

| PTM | Platinum Asset | 0.598 | -20% | 10,263,602 | $436,625,337 |

| CAV | Carnavale Resources | 0.004 | -20% | 42,666 | $20,451,092 |

| FAU | First Au Ltd | 0.002 | -20% | 200,000 | $5,179,983 |

| HFY | Hubify Ltd | 0.008 | -20% | 900,000 | $5,111,363 |

| NRZ | Neurizer Ltd | 0.002 | -20% | 651,228 | $8,395,010 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 125 | $7,937,639 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 900,000 | $8,419,651 |

| ASQ | Australian Silica | 0.025 | -19% | 15,664 | $8,737,672 |

| 1MC | Morella Corporation | 0.017 | -19% | 184,163 | $6,935,576 |

| HLO | Helloworld Travl Ltd | 1.660 | -19% | 2,562,946 | $333,776,129 |

| WZR | Wisr Ltd | 0.032 | -18% | 3,636,828 | $54,286,124 |

| BXN | Bioxyne Ltd | 0.029 | -17% | 3,855,711 | $71,723,006 |

| 1AI | Algorae Pharma | 0.005 | -17% | 20,000 | $10,124,368 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 2,000,001 | $9,518,072 |

| BPP | Babylon Pump | 0.005 | -17% | 4,952,001 | $14,997,294 |

| CUL | Cullen Resources | 0.005 | -17% | 1,660,858 | $4,160,411 |

| DTM | Dart Mining NL | 0.005 | -17% | 8,301,772 | $3,588,333 |

IN CASE YOU MISSED IT

Brazilian Critical Minerals (ASX:BCM) claims it has “no peers” after releasing a scoping study for its Ema rare earths project in Brazil’s Amazonas state. The study highlights industry-low capital and operating costs, with a projected life-of-mine cash flow exceeding US$900 million, even at current depressed spot prices.

Koonenberry Gold (ASX:KNB) is off to a strong start at its Enmore project in NSW, making another gold find in the second drill hole at the Sunnyside prospect. The company acquired the asset last year and began drilling earlier this month. The 3000m drill program continues and results are expected in April.

Western Yilgarn (ASX:WYX) has delivered a standout maiden resource of 168.3Mt at 36.1% Al₂O₃ for its Julimar West bauxite project in WA. The timing is ideal, with bauxite prices surging last year and forecasts suggesting they’ll continue to run upward in 2025.

Drilling has kicked off at Zenith Minerals’ (ASX:ZNC) Dulcie Far North gold project in WA to expand and improve confidence in the current 210,000oz inferred gold resource. Results of the effort are expected in Q2 2025.

Recce Pharmaceuticals (ASX:) has received a notice of allowance from the Japanese Patent Office for Patent Family 4 for its anti-infectives with an expiry of 2041.Recce said the Japan patent claims are for its two anti-infective products RECCE 327 (R327) and RECCE 529 (R529) for the treatment of disease, particularly bacterial and viral infections and more. Recce said this is the fourth Family 4 patent, alongside Australia, Canada, and Israel, with further Patent Cooperation Treaty (PCT) country submissions in respective stages of review or approval.

Summit Minerals (ASX:SUM) has mutually agreed to withdraw from acquiring the Mundo Novo niobium-REE-phosphate carbonatite project in Brazil. The decision aligns with the company’s focus on advancing its flagship Ecuador niobium and rare earth project.

Blue Star Helium (ASX:BNL) has completed drilling the intermediate hole section of Jackson 31 at its Galactica helium project in Las Animas County, Colorado. The company is now casing and cementing, with the next steps including a cement bond log (CBL) and drilling into the target Lyons formation to reach total depth (TD).

At Stockhead, we tell it like it is. While Brazilian Critical Minerals, Koonenberry Gold, Western Yilgarn, Zenith Minerals, Recce Pharmaceuticals, Summit Minerals and Blue Star Helium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.