Closing Bell: Miners, Energy stocks sink ASX; Nanovue up 60pc on EyeFly3D deal

Miners, Energy stocks sink ASX; Nanovue up 60pc on EyeFly3D deal. Pic via Getty Images

- ASX down by -0.5pc, weekly loss surpasses 2pc

- Mining, Energy stocks main laggards today

- Asian stocks also decline, North Korea fires ballistic missiles

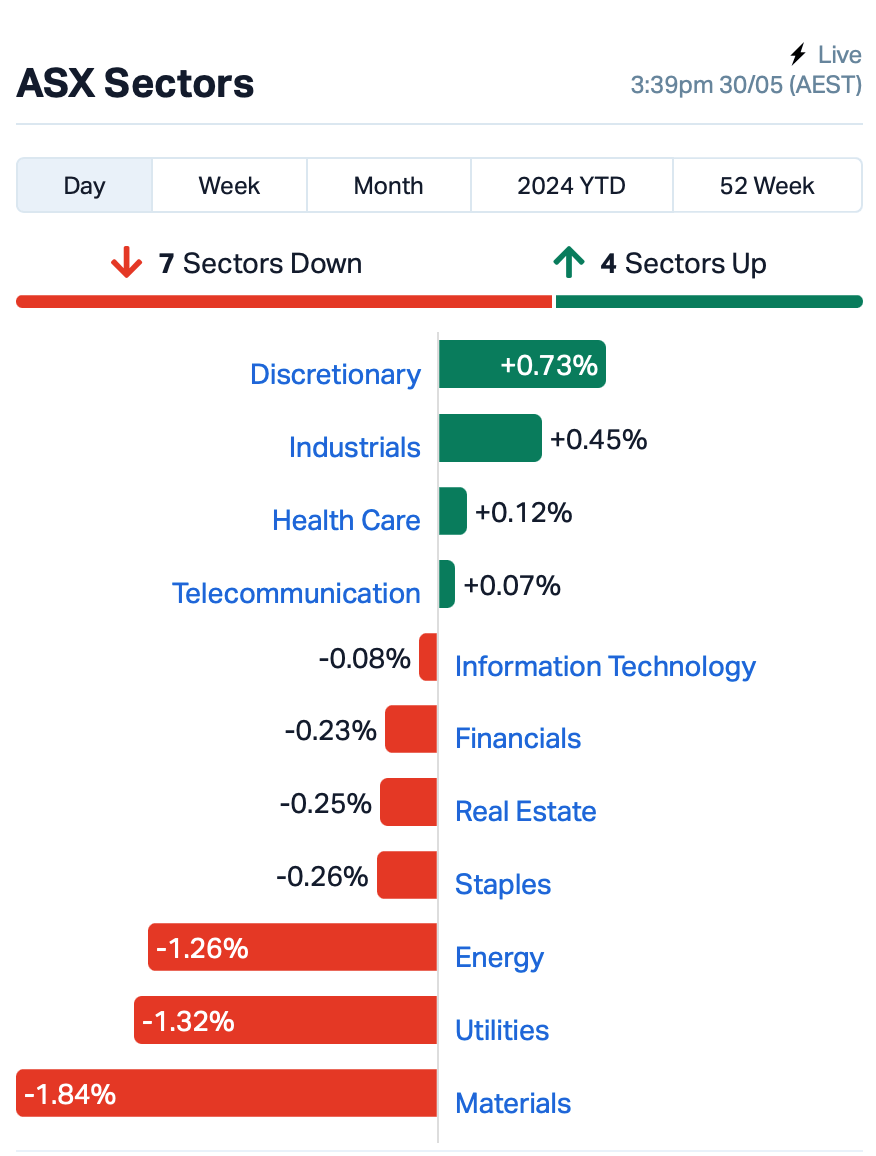

The ASX200 index has dipped lower by -0.5% on Thursday, taking its weekly loss to more than -2%.

Most ASX sectors were down, with Mining taking the biggest hit.

The losses mirrored the selloff in US and European stock markets overnight, where worries about interest rates continued to dampen sentiment.

Confidence has been sapped as US bond yields continue to rise after two days of weak demand at US government debt auctions.

Weak auction demand can indicate a few things. Investors might expect higher inflation and therefore avoid bonds, or they might anticipate future interest rate hikes, making current bonds less attractive.

On the ASX today, the losers cohort was led by lithium stock IGO (ASX:IGO), gold miner Newcrest (ASX:NST) and iron ore giant Fortescue (ASX:FMG), all down around -3% each.

BHP (ASX:BHP) also dropped almost -2% after abandoning its plan to take over rival Anglo American as Anglo rejected a last-minute request for more time.

According to UK rules, BHP cannot make another offer for at least six months unless there is a new bid for the London-listed company. BHP shares on NYSE fell by -0.23%.

In the winners’ circle, beef producers’ stocks climbed following confirmation from Agriculture Minister Murray Watt that China has lifted its ban on Australian beef exports.

Senator Watt disclosed to ABC that the government was informed last night about the immediate lifting of suspension for five major Australian beef exporters, allowing them to resume trade with China without restrictions.

“We had already seen a couple of other processing operations have their trade bans lifted, but now it’s another five,” Senator Watt said.

Australian Agricultural (ASX:AAC) was up +2% while Elders (ASX:ELD) rose as much as +0.5% before closing lower.

Tensions flare in the region

Across the region, Asian stocks, currencies, and bonds also took a hit on rates concerns.

Japanese and South Korean stocks were hit hardest, dragging down the MSCI Asia Pacific Index to its lowest point in three weeks.

Tensions rose as North Korea fired several short-range ballistic missiles, according to Seoul’s military, just hours after sending hundreds of balloons filled with trash across the border to retaliate against South Korea.

Per a news.com.au article:

South Korean activists sometimes release balloons carrying anti-Kim Jong Un regime propaganda leaflets and money intended for people living north of the border.

Pyongyang has long been infuriated by the propaganda campaigns, possibly due to concerns that an influx of outside information in the tightly controlled society could pose a threat to the Kim regime.

North Korea recently threatened to retaliate.

ALSO, NOW READ: How horribly dirty has North Korea been fighting this week?

Looking ahead to tonight’s US session, investors are eagerly awaiting the second estimate of the March quarter GDP, as well as the weekly report on new unemployment claims.

Additionally, three Fed Reserve officials are set to make public statements.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHI | Merchant House | 0.059 | 69% | 218,317 | $3,299,327 |

| 88E | 88 Energy Ltd | 0.003 | 50% | 18,166,110 | $57,785,344 |

| MRQ | Mrg Metals Limited | 0.002 | 50% | 61,335 | $2,525,119 |

| NGS | NGS Ltd | 0.003 | 50% | 333,333 | $502,455 |

| NVU | Nanoveu Limited | 0.030 | 36% | 56,965,408 | $9,805,303 |

| FAL | Falconmetalsltd | 0.285 | 36% | 2,110,622 | $37,170,000 |

| MGA | Metalsgrovemining | 0.059 | 34% | 1,400,956 | $3,956,062 |

| SKN | Skin Elements Ltd | 0.004 | 33% | 307,361 | $1,768,458 |

| AL8 | Alderan Resource Ltd | 0.005 | 25% | 16,424,684 | $4,427,445 |

| EDE | Eden Inv Ltd | 0.003 | 25% | 200,000 | $7,356,542 |

| HHR | Hartshead Resources | 0.010 | 25% | 39,734,860 | $22,469,457 |

| IS3 | I Synergy Group Ltd | 0.010 | 25% | 248,526 | $2,832,643 |

| NRZ | Neurizer Ltd | 0.003 | 25% | 1,228,030 | $3,804,861 |

| OAU | Ora Gold Limited | 0.005 | 25% | 132,949,813 | $23,224,004 |

| AGC | AGC Ltd | 0.485 | 24% | 2,719,474 | $86,666,667 |

| AHK | Ark Mines Limited | 0.165 | 22% | 77,231 | $7,485,266 |

| MDX | Mindax Limited | 0.041 | 21% | 1,137,795 | $69,658,649 |

| EQS | Equitystorygroupltd | 0.030 | 20% | 446,447 | $2,724,837 |

| FTC | Fintech Chain Ltd | 0.012 | 20% | 153,732 | $6,507,696 |

| TSL | Titanium Sands Ltd | 0.006 | 20% | 2,622,890 | $11,058,736 |

| LRD | Lordresourceslimited | 0.065 | 18% | 68,877 | $2,961,729 |

| MMI | Metro Mining Ltd | 0.049 | 17% | 48,217,659 | $244,345,851 |

| WEC | White Energy | 0.042 | 17% | 1,219 | $4,076,472 |

| AVE | Avecho Biotech Ltd | 0.004 | 17% | 109,514 | $9,507,891 |

Nanoveu (ASX:NVU) climbed on news that the company has signed a binding deal giving Rahum Nanotech exclusive distribution rights in South Korea for the EyeFly3D product, which “allows users to experience 3D without the need for glasses on everyday handheld devices”. NVU says Rahum must receive orders of ~$30 million by the end of 2026 to maintain exclusivity.

Big news for Ora Gold (ASX:OAU), after the explorer revealed that it is set to team up with miner Westgold (ASX:WGX) to bring OAU’s high grade 240,000oz Crown Prince deposit into production, with WGX signing on to snap up $6 million worth of shares in the junior for a cornerstone stake of around 15%.

Merchant House (ASX:MHI) announced that it’s set to sell off its 33% shareholding in Tianjin Tianxing Kesheng Leather Products Company to Tianjin Wuxi International Trading Company, for the equivalent of a cool $8.3 million Aussie dollars.

Sports data and analytics company, Catapult Group (ASX:CAT) was up +9% after the company hit a milestone revenue mark of US$100m for FY24, up 20% on pcp.

Ark Mines (ASX:AHK) surged due to a significant increase in mineral estimates at its Sandy Mitchell rare earth and heavy mineral project in northern Queensland. The company has announced a Maiden Indicated Mineral Resource Estimate (MRE) of 21.7 million tonnes, surpassing expectations.

This includes a variety of valuable heavy minerals such as monazite, zircon, rutile, xenotime, and ilmenite. The company anticipates strong project economics from these findings, as they can be processed at a low cost. Additionally, this places Sandy Mitchell as the first surface-expressed Placer Rare Earth deposit with a JORC resource on the ASX.

Lord Resources (ASX:LRD) has confirmed the presence of significant lithium-caesium-tantalum geochemical anomalies at its Jingjing lithium project in WA’s Eastern Goldfields through infill soil sampling work.

The Jingjing project, acquired in May 2023, comprises two tenements located in an area known for lithium-caesium-tantalum deposits. This project is distinct from the company’s exploration activities at Horse Rocks, where Mineral Resources (ASX:MIN) is conducting exploration under a strategic partnership.

Falcon Metals (ASX:FAL) is continuing to soar after its recent announcement about a significant mineral sands discovery in Bendigo. The company’s 91-hole aircore (AC) drilling program at the Farrelly mineral sands prospect in Victoria has returned high-grade results. This confirms Farrelly as a substantial mineral sands find, with a thick zone of mineralization (Main Zone) covering an area of approximately 1,200 meters by 600 meters and still open in multiple directions.

And, Clarity Pharmaceuticals (ASX:CU6) has signed a Supply Agreement with SpectronRx for Cu-64 production. This adds a new Cu-64 manufacturer to Clarity’s network, addressing supply constraints and benefiting patients, especially in the US oncology market. Cu-64’s longer half-life overcomes limitations of other isotopes, providing broader access to PET imaging for cancer diagnosis.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SNX | Sierra Nevada Gold | 0.075 | -38% | 435,737 | $9,128,991 |

| APC | Aust Potash Ltd | 0.001 | -33% | 150,000 | $6,030,284 |

| ME1 | Melodiol Glb Health | 0.002 | -33% | 13,021,314 | $2,469,412 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | 87,472 | $36,612,769 |

| BFC | Beston Global Ltd | 0.003 | -25% | 3,340,386 | $7,988,188 |

| LPD | Lepidico Ltd | 0.003 | -25% | 3,773,878 | $34,356,478 |

| PPY | Papyrus Australia | 0.012 | -25% | 426,666 | $7,883,081 |

| SI6 | SI6 Metals Limited | 0.003 | -25% | 16,265,642 | $9,475,438 |

| EXT | Excite Technology | 0.007 | -22% | 10,546,375 | $13,088,176 |

| CLZ | Classic Min Ltd | 0.004 | -20% | 12,173,687 | $2,042,925 |

| DOU | Douugh Limited | 0.004 | -20% | 128,321 | $5,410,345 |

| EEL | Enrg Elements Ltd | 0.004 | -20% | 200,000 | $5,049,825 |

| EXL | Elixinol Wellness | 0.004 | -20% | 43,771 | $6,505,370 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 442,500 | $20,793,391 |

| 5EA | 5Eadvanced | 0.210 | -19% | 887,361 | $86,727,118 |

| CUS | Coppersearchlimited | 0.110 | -19% | 386,684 | $12,458,530 |

| GTG | Genetic Technologies | 0.100 | -17% | 476,100 | $15,866,070 |

| TSI | Top Shelf | 0.100 | -17% | 725,987 | $25,041,103 |

| BUY | Bounty Oil & Gas NL | 0.005 | -17% | 91,300 | $8,991,006 |

| GGE | Grand Gulf Energy | 0.005 | -17% | 1,730,796 | $12,571,482 |

| MEL | Metgasco Ltd | 0.005 | -17% | 230,000 | $7,493,320 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 265,000 | $6,353,323 |

| LMG | Latrobe Magnesium | 0.047 | -16% | 5,027,240 | $108,430,973 |

| CNB | Carnaby Resource Ltd | 0.640 | -15% | 1,607,415 | $129,812,621 |

IN CASE YOU MISSED IT

Alvo Minerals (ASX:ALV) has completed a maiden auger drill program at the highly prospective Ipora project in Brazil to determine follow-up exploration at the ionic adsorption clay play.

Anax Metals (ASX:ANX) and Develop Global (ASX:DVP) have received a big boost to their plan to build the latter’s Sulphur Springs zinc-copper project after heap leach testing achieved recoveries of up to 95% copper and 99% zinc.

Aura Energy (ASX:AEE) has raised another $2m through a share purchase plan that will go towards progressing its Tiris uranium project, which a front end engineering design study had revealed to be a near-term low-cost 2Mlbs U3O8 per annum uranium mine with a 17-year mine life and excellent economics.

Latin Resources (ASX:LRS) has highlighted Colina as one of the world’s largest scale undeveloped lithium deposits after upgrading 95% of the deposit’s resource into the higher confidence measured and indicated categories.

Mithril Resources (ASX:MTH) has started an initial 4000m drill program over high priority targets in a bid to double the current 529,000 ounces at 6.8 g/t gold equivalent resource at the first target area.

New World Resources (ASX:NWC) has agreed to purchase a total of 134 acres of mineral rights that include and immediately surround the Pinafore copper deposit in northern Arizona, 75km from the cornerstone Antler project.

NickelX (ASX:NKL) has expanded its Elliot Lake uranium project in Ontario by 51km2 to 180km2 with the acquisition of the Blind River Block. It has also started mapping, sampling and drill hole siting over high priority uranium targets.

Sun Silver’s (ASX:SS1) assessment of historical core samples using pXRF analysis will help define targets for drilling and a subsequent resource upgrade of its Maverick Springs project in Nevada.

Copper Search (ASX:CUS) has raised $2m through a private placement of shares priced at 10c each to sophisticated, professional and institutional investors. Proceeds from the placement will be used to fund drilling at its Peake project in South Australia, which starts next week, along with assessing the gold prospectivity of the Mt Denison claim. The six week diamond drill program will test the Paradise Dam and Douglas Creek prospects for large-scale copper deposits.

Prospect Resources (ASX:PSC) has finalised the second part of its acquisition of a 85% interest in its highly prospective Mumbezhi copper project within the world-class Zambian Copper Belt. The company will now transfer US$5.35m and issue about 7 million PSC shares to the vendor Global Development Cooperation Consulting Zambia.

It is currently well advanced in the evaluation of the Orpheus drilling data from the 2021 drill programs and integrated geological datasets on Mumbezhi.

Results from this will provide guidance for its planned activities during H2 2024 with initial drilling and metallurgical test work expected to start during Q3 2024.

Riversgold (ASX:RGL) has identified several channel iron deposits at its Wodgina East project in WA’s Pilbara project following completion of the Phase 1 reconnaissance exploration program of geological mapping and rock chip sampling.

Historical rock chip sampling from Mesa 2 returned eight samples returned iron grades of between 51.94% and 56.67%. The company plans to carry out infill and extensional sampling along with metallurgical bulk sampling to determine its beneficiation potential.

TRADING HALTS

Mount Burgess Mining (ASX:MTB) – pending an announcement in respect of a capital raising.

Generation Development Group (ASX:GDG) – pending a release about a potential acquisition and associated capital raising.

Argent Minerals (ASX:ARD) – pending an announcement regarding a capital raising.

Galileo Mining (ASX:GAL) – pending the release of an announcement in relation to a Farm-in and Joint Venture Agreement over lithium rights at the Norseman Project.

Javelin Minerals (ASX:JAV) – pending a capital raising.

Thunderbird Resources (ASX:THB) – pending the release of an announcement regarding a Capital Raising.

Iondrive (ASX:ION) – pending an announcement to the market in relation to a capital raising.

At Stockhead, we tell it like it is. While Alvo Minerals, Anax Metals, Aura Energy, Latin Resources, Mithril Resources, New World Resources, NickelX, Sun SilverCopper Search, Prospect Resources and Riversgold are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.