Closing Bell: Local markets go ex-div and surrender; Peppermint Innovation jumps 41% and a Newtowner on me for anyone who can explain why

Newtowners. Via Christian

- ASX 200 sinks 2%

- Small caps get crushed, down 2.5%

- Region, AUD and miners sink on weaker China activity

The local market is being dragged to hell by mining, materials and gold stocks, which are down between 4% and 5%.

The S&P/ASX 200 did dropped below 2% and the S&P/ASX Emerging Companies (XEC) index was crushed, down 2.5%.

That canary in the Chinese coalmine – the Australian dollar – has weakened throughout the day and has been selling at well under US$0.68 as investors digested the results of a private survey on China’s factory activity.

August’s Caixin/Markit manufacturing Purchasing Managers’ Index (PMI) has the sector retreating into contraction (coming in under 50)

The Caixin read follows China’s more official manufacturing PMI read which this week released on Wednesday showed that factory activity shrank after further interruptions due to Beijing’s zero-COVID shutdowns and the power losses associated with unprecedentedly high temperatures around the manufacturing belts of Jiangsu and Guangdong.

The region has responded to weak US leads and Chinese output concerns. Japan’s Nikkei 225, Hong Kong’s Hang Seng index and the Kospi in South Korea were all between 1.5% and 2% lower in Sydney’s mid afternoon.

At home, the bureau of bad numbers released some decent capex figures, but new housing lending – excluding refinancing – fell by 8.5% in July with both owner-occupier (-7.0%per/month) and investor credit (-11.2%/per month) taking some pretty significant hits.

CBA’s associate economist Harry Ottley says the falls in the demand for housing credit is ‘a natural response’ to the recent interest rate hikes.

“We expect the demand for credit to continue to decline as the RBA tightens monetary policy further. ”

CBA expects the RBA to lift the cash rate by 50 basis points at its next meet, next Tuesday, before a nudging ahead by a further 25bps to 2.6% in October, with some risk of another 50bp hike that month. Balls on the line stuff.

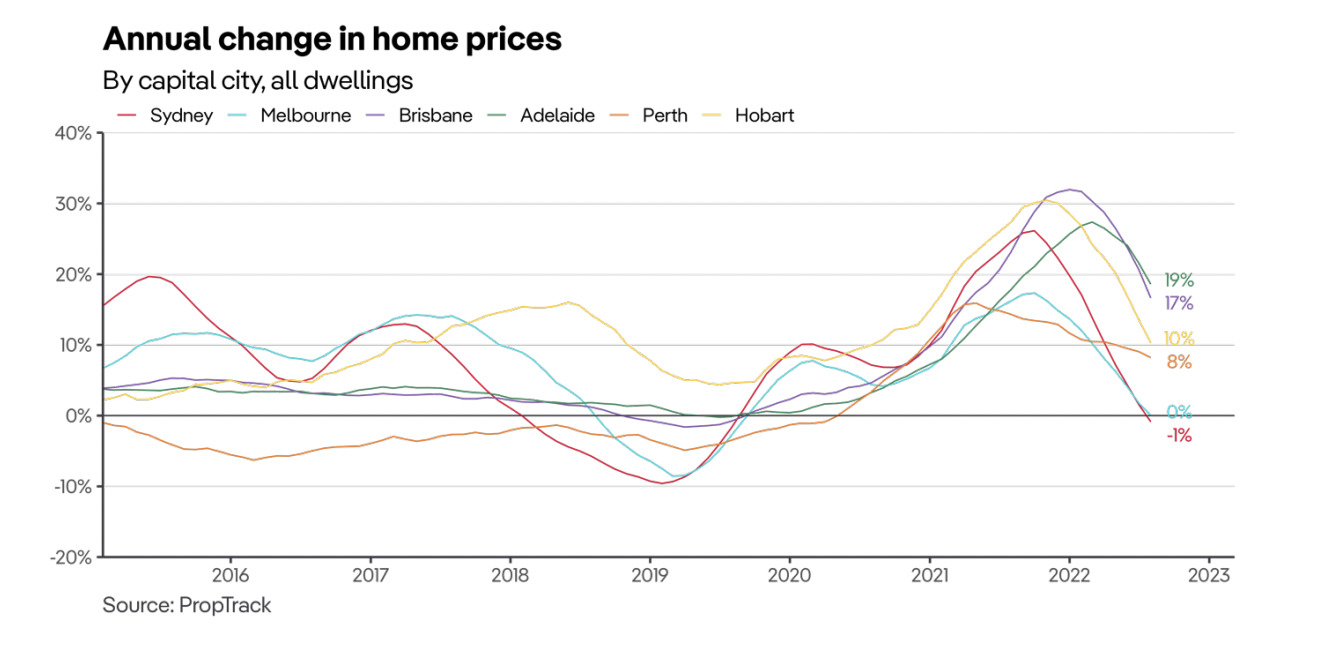

In case you missed it, the latest research from PropTrack shows the hurried changes now pushing through our capital city house markets.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AW1 | Americanwestmetals | 0.255 | 89% | 46,310,437 | $14,988,746.39 |

| MEB | Medibio Limited | 0.0015 | 50% | 1,094,897 | $3,320,593.79 |

| TSC | Twenty Seven Co. Ltd | 0.003 | 50% | 250,000 | $5,321,627.81 |

| PIL | Peppermint Inv Ltd | 0.0155 | 41% | 31,891,406 | $22,416,425.20 |

| SEG | Sports Ent Grp Ltd | 0.28 | 27% | 5,000 | $57,444,646.16 |

| AFW | Applyflow Limited | 0.0025 | 25% | 500,000 | $5,915,216.07 |

| SIH | Sihayo Gold Limited | 0.0025 | 25% | 10,422,239 | $12,204,256.18 |

| PBL | Parabellumresources | 0.375 | 21% | 518,104 | $12,909,175.31 |

| NOX | Noxopharm Limited | 0.295 | 20% | 1,580,028 | $71,598,297.75 |

| AQX | Alice Queen Ltd | 0.003 | 20% | 4,052,369 | $5,384,236.14 |

| RR1 | Reach Resources Ltd | 0.006 | 20% | 13,766,550 | $9,550,253.20 |

| TMK | TMK Energy Limited | 0.012 | 20% | 4,680,230 | $35,207,812.50 |

| PVS | Pivotal Systems | 0.099 | 19% | 55,088 | $13,235,698.75 |

| ATP | Atlas Pearls Ltd | 0.039 | 18% | 512,931 | $14,119,768.01 |

| KFM | Kingfisher Mining | 0.59 | 18% | 1,969,123 | $17,122,500.50 |

| KKO | Kinetiko Energy Ltd | 0.073 | 18% | 567,544 | $42,412,586.08 |

| UUL | Ultima Utd Ltd | 0.08 | 18% | 2,355,763 | $4,984,911.63 |

| PHO | Phosco Ltd | 0.14 | 17% | 58,360 | $32,389,699.68 |

| PO3 | Purifloh Ltd | 0.5 | 16% | 8,781 | $13,555,104.14 |

| HMD | Heramed Limited | 0.185 | 16% | 2,622,700 | $33,902,050.88 |

| ANP | Antisense Therapeut. | 0.105 | 15% | 1,304,468 | $60,860,252.00 |

| DM1 | Desert Metals | 0.425 | 15% | 944,475 | $17,756,972.66 |

| KTG | K-Tig Limited | 0.195 | 15% | 225,458 | $30,788,914.37 |

| MX1 | Micro-X Limited | 0.1375 | 15% | 631,389 | $55,380,598.92 |

| ARO | Astro Resources NL | 0.004 | 14% | 85,250 | $16,468,344.43 |

I’m going to take a wild stab in the dark and say Peppermint Innovation (ASX:PIL) is up because in an update to the market today. The fintech has had all convertible note debt removed from the Company balance sheet.

In today’s preliminary FY report, revenue is down 32% and its net loss is up 26%. Only a few weeks ago the Aussie-listed fintech signed a cracker of an agreement with Visa an exclusive five-year deal enabling the company to go big and expand its digital financial offering globally.

PIL will join Visa’s FinTech Fast Track Program and will initially focus on its key markets of the Philippines, Singapore, and Australia.

Under the agreement, Visa has an exclusive right to provide PIL with credit, debit and pre-paid cards in the Philippines, Singapore, and Australia for a period of five years when Visa will also provide PIL with ‘significant financial incentives’ as well.

Back in May it got its hands on a license to operate as an Electronic Money Issuer (EMI) by the Philippines Central Bank ‘Bangko Sentral ng Pilipinas’ (BSP).

That license is a goodie, allowing PIL to deliver e-wallet services through its bizmoto mobile App allowing any Filipino, not just bizmoto agents, to use the platform to receive digital money and access digital services.

I’m running out of time, so PIL is up 36% and if you know why: [email protected]

Meantime, the property developer Ultima United (ASX:UUL).has enjoyed a quarterly comeback for the ages. That’ll be the 1400% rise in assets YoY to $23 million, and a 94% swing in the right direction of YoY net loss after tax.

Investors beheld this information, and yea verily did they pile on, driving Ultima’s price up more than 80% since breakfast, although with a little consideration of what UUL’s assets were before they increased 1400% should have calmed the market down by now.

American West Minerals (ASX:AW1), whose news of a belter find at its Canadian Storm project energised the market.

The results from drill hole ST22-05 from the 2750N Zone intersected:

- 41m @ 4.18% Cu from 38m downhole, including;

- 15m @ 10.05% Cu from 47m downhole, and including;

- 5m @ 24.28% Cu from 48m downhole

Those are some lovely numbers, which investors rewarded with a +75% surge this mornin’.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AMS | Atomos | 0.185 | -26% | 11,888,199 | $55,587,896.25 |

| MME | Moneyme Limited | 0.515 | -25% | 3,343,561 | $164,114,585.94 |

| CGO | CPT Global Limited | 0.365 | -24% | 203,218 | $19,971,428.64 |

| AE1 | Aerison | 0.15 | -23% | 116,764 | $59,657,810.16 |

| FEX | Fenix Resources Ltd | 0.28 | -22% | 4,439,634 | $196,637,011.20 |

| MBX | Myfoodieboxlimited | 0.073 | -22% | 66,008 | $3,115,499.54 |

| SPN | Sparc Tech Ltd | 0.7 | -20% | 150,121 | $59,381,430.24 |

| OAR | OAR Resources Ltd | 0.004 | -20% | 7,135,636 | $10,855,189.49 |

| ROO | Roots Sustainable | 0.004 | -20% | 30,000 | $3,748,163.44 |

| HVM | Happy Valley | 0.039 | -19% | 92,000 | $10,201,418.21 |

| RD1 | Registry Direct | 0.014 | -18% | 1,809,865 | $7,106,754.89 |

| HIL | Hills Ltd | 0.066 | -18% | 2,208,518 | $18,558,842.08 |

| WFL | Wellfully Limited | 0.027 | -17% | 791,644 | $9,057,659.98 |

| AYM | Australia United Min | 0.005 | -17% | 322,000 | $11,055,464.91 |

| BDG | Black Dragon Gold | 0.04 | -17% | 199,634 | $9,632,162.64 |

| AL3 | Aml3D | 0.105 | -16% | 290,326 | $23,507,928.00 |

| SPT | Splitit | 0.16 | -16% | 4,716,771 | $89,569,226.39 |

| ICN | Icon Energy Limited | 0.016 | -16% | 1,100,000 | $14,340,629.81 |

| PBH | Pointsbet Holdings | 2.445 | -16% | 4,776,409 | $886,343,405.30 |

| DGL | DGL Group Limited | 1.5575 | -15% | 7,759,311 | $513,812,404.48 |

| BPP | Babylon Pump & Power | 0.006 | -14% | 6,342,283 | $17,204,399.40 |

| BRK | Brookside Energy Ltd | 0.012 | -14% | 12,261,782 | $70,171,820.59 |

| RNX | Renegade Exploration | 0.006 | -14% | 220,000 | $6,227,386.47 |

| SPX | Spenda Limited | 0.012 | -14% | 4,332,090 | $44,768,287.75 |

| YPB | YPB Group Ltd | 0.006 | -14% | 2,604,835 | $2,845,823.07 |

YOU MAY’VE MISSED THESE ONES TODAY

It’s a red letter day for Canadian explorer Turquoise Hill Resources, having reached an agreement with Rio Tinto (ASX:RIO) that will see Turquoise absorbed holus-bolus into the Rio mining Borg. The agreement will see Rio shell nearly $48 per share in cash, valuing the bits of Turquoise it doesn’t own at around US$3.3 billion.

We’d like to take this opportunity to remind the newly-cashed-up Turqoise Resources that Christmas isn’t very far away, and we would like something simple as a gift this year. $1 billion oughta do it.

Meanwhile, on a slightly smaller scale, Boadicea (ASX:BOA) has announced it’s commencing a drill-ready tenement farm-in in Eastern Goldfields with multiple rare earth element (REE) and diamond targets.

Boa’s picked out a name for its new baby – they’ve gone with “Kookaburra”, which is cute – on a sign on payment of $40,000 / $650,000 expenditure over 4 years for 75% earn-in, and a walk away at any time, with no obligation to incur the $650k basis with Autumn Gold.

Meeka Metals (ASX:MEK) says it continues to intersect broad zones of shallow, high-grade gold which extend the strike of the St Anne’s prospect within its Murchison gold project in Western Australia.

Notable results are 8m grading 11.78 grams per tonne (g/t) gold within a broader 24m zone at 4.73g/t gold from a down-hole depth of 52m (22SAAC100) and 8m at 11.07g/t gold within a 36m intercept at 3.61g/t gold from 44m (22SAAC083).

These follow results released since the beginning of 2022 such as 32m at 16.07g/t gold from 48m including 16m at 28.59g/t gold (22SAAC058) and 20m at 20.74g/t gold from 48m including 16m at 24.86g/t gold (22SAAC061).

And there’s likely more to come, given assays are pending for a further 28 holes.

Final assays from Thomson’s 2022 drill program at its Bygoo tin project in New South Wales’ Lachlan Fold Belt have delivered Thomson Resources (ASX:TMZ) further extensions to the discovered greisens.

The last of four batches of drill results include a 26m intercept grading 2.1% tin from 94m (BNRC85) at the P380 greisen and 25m at 0.5% tin from 59m (BNRC87) at the Smiths greisen.

TMZ didn’t complete the drill program at Bygoo due to wet weather and farming operations, but executive chairman David Williams noted that the outstanding results from the limited number of holes drilled was still pleasing.

“Given the weather conditions during the planned 2021/2022 drilling program severely curtailed the period available to us to drill, the limited number of holes were very pleasing with the continuation of outstanding results.

“Hopefully the weather will be kinder to us for the 2022/23 season and we can complete the desired programs,” he added.

TRADING HALTS

Dreadnought Resources (ASX:DRE) – Have we done more than enough Dr Dre gags yet? We have? Great… anyway, Dre’s about to drop some (hopefully) Phat exploration results.

MLG Oz (ASX:MLG) – News of contract award is on its way. Exciting times!

Haranga Resources (ASX:HAR) – Haranga’s got some glowing reports (and reports of glowing) from its Saraya Uranium project.

Strike Energy (ASX:STX) – Time to down tools, until our Capital Raise demands are met.

Lotus Resources (ASX:LOT) – And some relaxing stretching and breathing exercises, Lotus assumes the position for a capital raise of its own.

Nuheara (ASX:NUH) – THEY SAID THEY ARE HAVING A CAPITAL RAISE, DEAR!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.