Closing Bell: Local markets end 0.4pc higher led by big banks and a few small biotechs

Via Getty

- Benchmark index finishes Friday ahead +0.4%

- Sectors led by Financials

- Small caps dominated by Dimerix

The ASX200 is up +0.4% at the end of Friday trade, making the week a 1% loss, which we’ll take at this stage.

US equities ticked lower overnight, as coy US traders fiddled about before tonight’s blockbuster non-farm payrolls.

The Dow Jones Industrial Average lost -0.03%. The S&P 500 lost -0.13% and the Nasdaq Composite walked back -0.12%.

Undoubtedly, there’s some loopier-than-usual movements across money markets one could say. Oddball activity, featuring ‘unprecedented’ swings in various instruments.

Despite the promise of forever inflation and mean-looking central banks, the golden safe haven – the universal hedge against inflation – has been weak at the knees, year-to-date.

Since Christmas, the gold price is off around 16%.

That said, the gold spot has steadied during our session, to be a wee bit above $1,820 an ounce. Bullion prices also found support recently from a pullback in the US dollar and Treasury yields.

These surging US bond yields are taking us all back to pre-GFC times, circa Kevin 07. More concerning, the rising correlation between bond and stock prices has traders scratching their heads. That’s something weird few investors still in the game or bearing a head of teeth can corroborate.

Over the past 18 months, prices in the US 20-year Bond Total Return Index have now crashed circa -40%.

Then there’s the invertedness of the yield curve, which everyone’s been comfy with simply because of its inverted-for-longer status.

It’s been upside down for the better part of a year. Usually an inverted yield was a sure red flag for some kind of impending economic doom.

Amid the contradictions, Dr Shane Oliver, Head of Investment Strategy and Chief Economist at AMP, says shares are oversold at technical support and are due for a bounce, but the risk of a further correction is high.

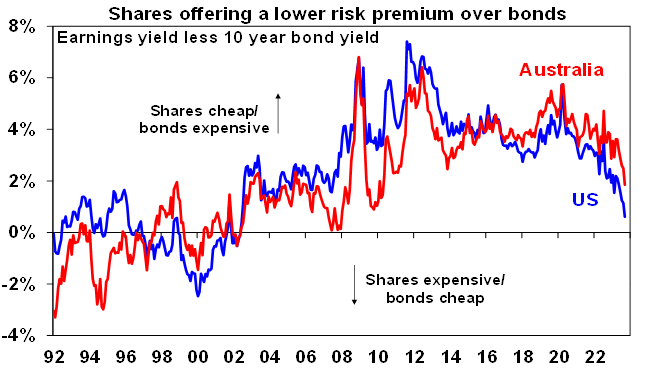

“The continuing rise in bond yields has pushed the risk premium that the US share market offers over bonds to its lowest in over 20 years, and that in Australia to its lowest since 2010. See the next chart.

“While the drivers of the back up in bond yields are arguably less threatening than was the case last year, being less due to inflation and more due to hopes of a soft landing, the risk of recession remains very high and is arguably rising again in the US on the back of the financial tightening flowing from higher bond yields.”

Dr Oliver believes the combination of the high risk of recession, uncertainty around the Chinese economy and US politics (going from bad to worse, see removal of House Speaker McCarthy, K)…

“All suggest the risk premium offered by shares over bonds should be higher than it is now, which in turn implies a high risk of more downside for share markets unless bond yields pull back.”

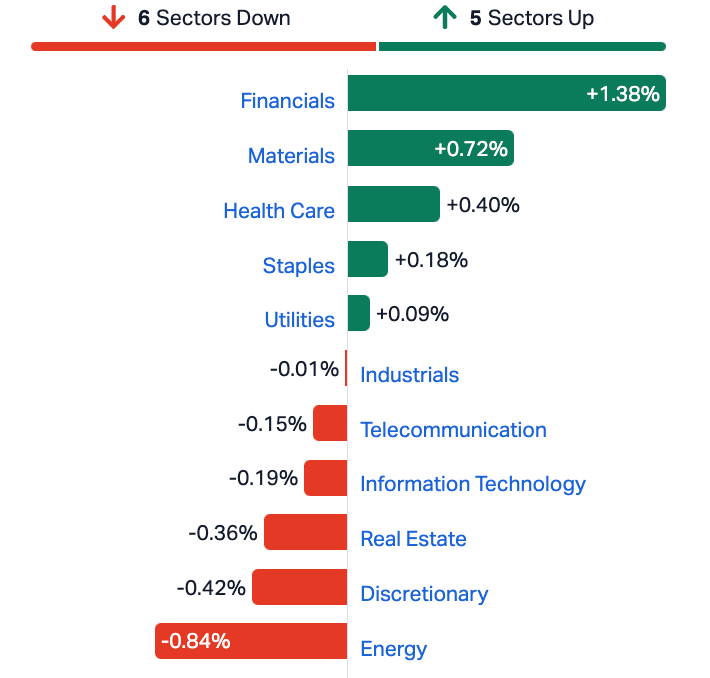

Across the local sectors, the banks drove market gains, the Financial Sector ahead by +1.4%. Not helping much on that front was Magellan Financial Group (ASX:MFG).

The stock took a real dive from the get go on Friday after seeing circa $4 billion in funds slip away in September.

Elsewhere Materials recovered earlier losses, gaining 0.7%, while Energy and Consumer stocks weighed.

ASX Sectors on Friday

Regional equity markets were mixed on Friday. The Hang Seng has surged ahead by 2%, but will come in under parity for the week.

The Nikkei 225 Index shed 0.05%. And the broader Topix Index lost 0.1% giving back Thursday’s gains and making it one win from 6 outings.

Markets in China remain shut for a week-long holiday.

The ASX Small Ords (XSO) added -0.17% and the absolutely-can-not-win-a-trick ASX Emerging Co’s (XEC) index ended -0.71%.

Both small cap indices are down heavily – the XEC by circa 9% for the last month.

RIPPED FROM THE HEADLINES

Central banks collectively increased their gold reserves in August for the third consecutive month, according to new data out of the World Gold Council.

They added 77t to global official reserves during the month, a 38% up-tick from July’s buying. The WGC says that over the last three months, central banks’ combined net buying has totalled 219t, comfortably outweighing the combined net sales from April and May (96t).

China, Poland and Turkey were again the key buyers; while there were no notable sales during the same period.

Brent oil futures fell below $US85/bbl overnight. Futures have now plunged ~13% since peaking at ~$US97/bbl on September 26. The last time Brent futures were at these levels was back in late August. The fall in oil futures has come as markets seriously considered the possibility of prices above $US100/bbl just a week ago.

The largest fall in oil futures this week was attributed to US Energy Information Administration (EIA) data that showed US gasoline demand fell to 8.3mb/d last week – marking the lowest seasonal level since 1998.

The Reserve Bank of India kept its benchmark policy repo at 6.5 percent for the fourth consecutive meeting in October 2023, in line with market expectations. Policymakers said that the decision remains to align inflation to the RBI’s tolerance range of 4% ± 2% while supporting economic growth.

India’s annual inflation eased to 6.83% in August from a 5-month high of 7.44% in July, amid moderating food prices. Additionally, the central bank maintained its economic growth and headline inflation forecast for the fiscal year 2024 at 6.5% and 5.4%, respectively, while declining its core inflation forecast to 4.9%.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 840,655 | $15,642,574 |

| CRB | Carbine Resources | 0.007 | 40% | 3,088,220 | $2,758,689 |

| NOX | Noxopharm Limited | 0.115 | 37% | 7,499,559 | $24,547,988 |

| CRS | Caprice Resources | 0.04 | 29% | 663,652 | $3,619,465 |

| PAB | Patrys Limited | 0.009 | 29% | 8,733,972 | $14,402,131 |

| APS | Allup Silica Ltd | 0.059 | 28% | 333,812 | $1,769,947 |

| BIT | Biotron Limited | 0.097 | 28% | 25,180,963 | $68,547,813 |

| EPN | Epsilon Healthcare | 0.033 | 27% | 1,038,267 | $7,809,204 |

| AX8 | Accelerate Resources | 0.029 | 26% | 9,674,357 | $8,753,840 |

| DXB | Dimerix Ltd | 0.195 | 26% | 30,372,114 | $61,248,175 |

| TG1 | Techgen Metals Ltd | 0.025 | 25% | 827,604 | $1,543,366 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 232,368 | $6,605,136 |

| M4M | Macro Metals Limited | 0.005 | 25% | 107,478 | $7,948,311 |

| NKL | Nickelxltd | 0.063 | 24% | 486,670 | $4,408,199 |

| VMS | Venture Minerals | 0.011 | 22% | 1,206,821 | $17,550,117 |

| FGR | First Graphene Ltd | 0.085 | 21% | 1,289,773 | $41,314,369 |

| VN8 | Vonex Limited. | 0.018 | 20% | 946,078 | $5,427,429 |

| CI1 | Credit Intelligence | 0.15 | 20% | 561,220 | $11,005,651 |

| ADV | Ardiden Ltd | 0.006 | 20% | 100,000 | $13,441,677 |

| AHN | Athena Resources | 0.006 | 20% | 1,300,000 | $5,352,338 |

| BXN | Bioxyne Ltd | 0.012 | 20% | 1,099,400 | $19,016,454 |

| EMU | EMU NL | 0.003 | 20% | 74,562,089 | $3,625,053 |

| NAG | Nagambie Resources | 0.024 | 20% | 100,000 | $11,634,526 |

| RVS | Revasum | 0.16 | 19% | 106,539 | $14,298,748 |

| FTC | Fintech Chain Ltd | 0.013 | 18% | 29,110 | $7,158,465 |

Dimerix (ASX:DXB) is having a field day, up 200% at one stage this week, and it’s continuing on its solid run after yesterday’s barnstorming +150% action.

The clinical-stage Aussie biopharm announced it’s entered into an exclusive licence agreement for the European Economic Area, the UK, Switzerland, Canada, Australia, and New Zealand for the commercialisation of Dimerix’ Phase 3 drug candidate DMX-200.

And that’s a treatment in development for focal segmental glomerulosclerosis (FSGS) kidney disease, following regulatory approval.

Fintech Chain (ASX:FTC), an $8m minnow “integrated payment and merchant industry application solution platform” is up about 18% today on no news we’re seeing.

And still in fintechnical land, Earlypay (ASX:EPY), a $72m market capped firm that provides services to SME businesses “in the form of secured invoice and trade financing and equipment financing” is also up – almost 10% – on no news.

Caprice Resources (ASX:CRS), is ahead strongly on no news. Part of the ASX’s IPO Class of 2018, which produced a batch of high profile winners including Adriatic Metals (ASX:ADT) and Vulcan Energy (ASX:VUL) , up 1650% and 1100% over the journey.

Other resources stocks like Tietto Minerals (ASX:TIE) and Nickel Mines (ASX:NIC) have also enjoyed astronomical growth, just not in market cap because dilution.

CRS is hoping for a rerate from its Mukinbudin rare earths project in WA amongst ground held by majors IGO and Rio Tinto, and fellow ‘C-list’ juniors (haha) Codrus (ASX:CDR) and Cygnus (ASX:CY5).

In late September soil sampling extended Mukinbudin’s Gadolin target to +3.4km, and counting, with peak values of up to 3,839ppm TREO (14.0% MREO).

This sampling has also confirmed a 3.5km long target at Hadrian’s.

More sampling results are due soon from Hadrian’s and Colosseum, where CRS picked up one rock chip grading 5,068ppm (0.5%) TREO (24.8% MREO).

The $5m capped junior had $686,000 in the bank at the end of June.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ICN | Icon Energy Limited | 0.007 | -36% | 936,306 | $8,448,150 |

| ZEU | Zeus Resources Ltd | 0.011 | -27% | 11,295,564 | $6,889,215 |

| AUK | Aumake Limited | 0.003 | -25% | 15,000 | $5,949,038 |

| EWC | Energy World Corpor. | 0.03 | -21% | 1,735,264 | $116,999,007 |

| CT1 | Constellation Tech | 0.002 | -20% | 10,142 | $3,678,001 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 10,000 | $15,368,615 |

| MFG | Magellan Fin Grp Ltd | 7.09 | -20% | 6,251,426 | $1,598,415,030 |

| SCT | Scout Security Ltd | 0.015 | -17% | 910,000 | $4,152,024 |

| ADY | Admiralty Resources. | 0.005 | -17% | 550,153 | $7,821,475 |

| CHK | Cohiba Min Ltd | 0.0025 | -17% | 5,682,051 | $6,639,733 |

| CZN | Corazon Ltd | 0.01 | -17% | 25,000 | $7,387,175 |

| SUM | Summitminerals | 0.093 | -15% | 1,327,238 | $5,242,284 |

| HPR | High Peak Royalties | 0.055 | -15% | 374,926 | $13,523,881 |

| ZNC | Zenith Minerals Ltd | 0.11 | -15% | 12,651 | $45,809,515 |

| ETM | Energy Transition | 0.036 | -14% | 14,718 | $56,941,249 |

| RML | Resolution Minerals | 0.006 | -14% | 5,520,000 | $8,801,043 |

| SI6 | SI6 Metals Limited | 0.006 | -14% | 1,237,824 | $13,957,016 |

| NFL | Norfolkmetalslimited | 0.16 | -14% | 448,013 | $5,610,124 |

| AXN | Alliance Nickel Ltd | 0.052 | -13% | 475,680 | $43,550,377 |

| BLU | Blue Energy Limited | 0.013 | -13% | 1,853,059 | $27,764,604 |

| GRE | Greentechmetals | 0.335 | -13% | 824,761 | $21,789,289 |

| GPR | Geopacific Resources | 0.014 | -13% | 320,800 | $13,139,058 |

| VAL | Valor Resources Ltd | 0.0035 | -13% | 800,000 | $15,493,339 |

| BMM | Balkanminingandmin | 0.18 | -12% | 242,189 | $14,105,471 |

| FRE | Firebrickpharma | 0.037 | -12% | 665,720 | $4,767,596 |

TRADING HALTS

Fin Resources (ASX:FIN) – Pending the release of results from Fin’s maiden fieldwork programme at the Cancet West Project.

Besra Gold (ASX:BEZ) – Pending an announcement concerning funding from Quantum Metal Recovery Inc.

Kazia Therapeutics (ASX:KZA) – Pending an announcement by Kazia regarding the proposed trading solely on Nasdaq and proposed delisting of the Company’s securities from ASX.

Evolution Energy Minerals (ASX:EV1) – Pending an announcement in relation to a proposed capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.