CLOSING BELL: Local markets close 0.24pc lower, The Star gets a lifeline and Allkem neighbour Rubix flies high

Pic via Getty Images.

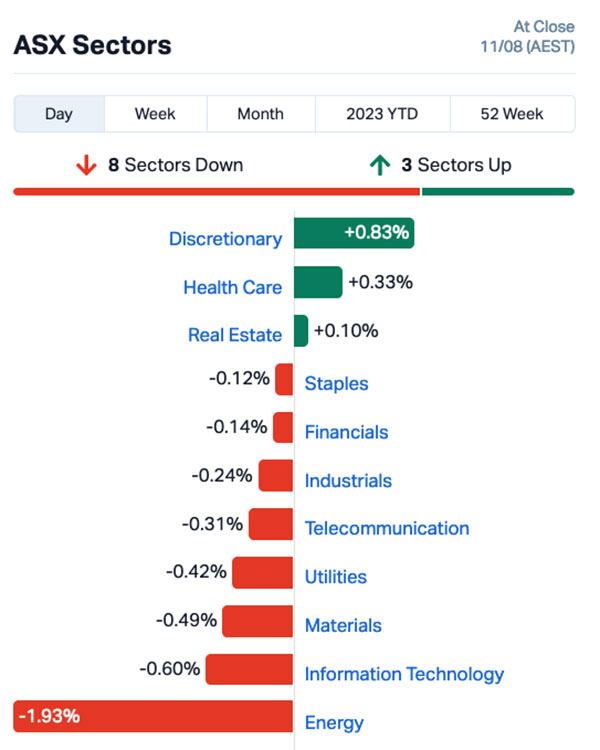

- The benchmark has sagged to -0.24% to close out the week with a world-weary sigh.

- Falling crude prices hobbled the Energy sector, dragging it 1.93% lower.

- Small caps winner Rubix Resources is feeling some neighbourly love, thanks to Allkem at Canada’s James Bay.

It’s been a strangely quiet-ish day on the ASX today, which has seen InfoTech rise and fall like the Roman Empire, while the Energy and Minerals sectors marched hand-in-hand towards certain doom from the moment the Exchange’s doors opened this morning.

Now that all’s said and done, the ASX 200 benchmark is at -0.24%, reflective of an overall suboptimal mood among investors, to which I suspect that we’re all quietly happy it’s the weekend tomorrow.

The shellacking that Energy took throughout the day had a profound effect on the market as a whole, with the likes of Whitehaven Coal (ASX:WHC) and New Hope (ASX:NHC) both falling more than 3.0% lower by late afternoon.

At the top of the heap among the big kids today is Star Entertainment Group, up close to 18% for the day, over reasons I’ll get to shortly.

And – bafflingly – AMP is rising again today, up 7.6% despite being demonstrably awful.

FROM THE HEADLINES

RBA boss Phillip “I Failed to Keep Inflation” Lowe has made his final parliamentary appearance today, stepping up to take questions from the federal government’s house economics committee in Canberra.

In his final Canberra show, Lowe didn’t leave fans disappointed, drawing deeply from a back catalogue of crowd pleasers, including There’s Loads More Hurtin’ to Come, and the 2023 Grammy-nominated Don’t You Cry, Crybaby (None of this is Actually My Fault).

Lowe and The Rate Rise Orchestra closed the show with the DJ Mortgage Pain remix of Pick a Number from 1 to 100, the perennial favourite that critics believe was criminally overlooked as the 2023 FIFA Women’s World Cup anthem.

Meanwhile, the NSW Government has handed Star Entertainment Group (ASX:SGR) an extremely early Christmas gift, gutting a proposed taxation and duty change that was set to put the casino operator into an even more fraught financial position than it’s found itself in so far this year.

SGR was staring down the barrel of a massive 60.7% tax on poker machine revenue, and had used that impending cash outflow as justification for shedding about 500 staff in March – but that staggeringly huge bite of The Star’s lucrative cherry is now off the table.

In return, SGR is locked into an alternative updated tax regime – set to deliver $500 million more per annum for the state government’s coffers – provided it adheres to the government requirements that it maintains 3,000 jobs at Sydney’s Glitziest VIP Lounge™until 2030, something the company is sure to adhere to, given its track record of compliance in recent years…

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 1,272,000 | $15,642,574 |

| PIL | Peppermint Inv Ltd | 0.007 | 40% | 9,555,790 | $10,189,284 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 50,002 | $8,737,021 |

| EDE | Eden Inv Ltd | 0.004 | 33% | 8,844,559 | $8,990,911 |

| NGS | NGS Ltd | 0.02 | 33% | 2,326,900 | $3,768,411 |

| VSR | Voltaic Strategic | 0.043 | 30% | 15,344,020 | $14,892,907 |

| ETR | Entyr Limited | 0.009 | 29% | 4,101,679 | $13,837,977 |

| RB6 | Rubixresources | 0.205 | 28% | 566,486 | $6,728,000 |

| GPR | Geopacific Resources | 0.019 | 27% | 2,522,341 | $12,317,867 |

| LDX | Lumos Diagnostics | 0.075 | 25% | 18,967,358 | $26,223,595 |

| BP8 | Bph Global Ltd | 0.0025 | 25% | 562,468 | $2,669,460 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 368,890 | $7,784,719 |

| FGH | Foresta Group | 0.017 | 21% | 1,413,659 | $28,868,544 |

| CZR | CZR Resources Ltd | 0.18 | 20% | 30,282 | $35,360,197 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 34,791 | $24,182,996 |

| TRT | Todd River Res Ltd | 0.012 | 20% | 3,447,903 | $6,515,475 |

| TTT | Titomic Limited | 0.024 | 20% | 5,389,251 | $17,310,571 |

| STM | Sunstone Metals Ltd | 0.0275 | 20% | 11,691,175 | $70,885,652 |

| PEC | Perpetual Res Ltd | 0.031 | 19% | 4,961,657 | $14,182,583 |

| SGR | The Star Ent Grp | 1.155 | 18% | 39,076,064 | $1,578,213,855 |

| SVG | Savannah Goldfields | 0.084 | 18% | 21,079 | $14,231,256 |

| OAK | Oakridge | 0.13 | 18% | 131,040 | $1,891,525 |

| SKF | Skyfii Ltd | 0.046 | 18% | 502,083 | $16,367,838 |

| WA8 | Warriedarresourltd | 0.105 | 17% | 317,018 | $38,795,293 |

| ADY | Admiralty Resources. | 0.007 | 17% | 500,000 | $7,821,475 |

The Small Caps winners today include Rubix Resources (ASX:RB6), which added more than 28% today thanks to the good fortunes of The Allkems (ASX:AKE), that lovely family that lives down the street from Rubix’s holiday home in James Bay, Canada.

Allkem recently announced a whopping 173% increase in its James Bay mineral resource, which now stands proud at 110.2Mt @ 1.30% Li2O, including 54.3Mt @ 1/30% Li2O in the indicated category and 55.9Mt @ 1.29% Li2O in the inferred category.

Elsewhere, Lumos Diagnostics (ASX:LDX) has stormed home with a 25% increase today, after revealing a healthy cash injection of $705,193 related to its Research and Development Tax Incentive for the FY2022 financial year ending 30 June 2022.

It’s not a patch on the company’s mega-leap late last month that saw it move from $0.011 to $0.155 in a single session, but it’s a large enough bump to push the LDX trading price through a 47% increase for the week.

And in third place on our list today, Sunstone Metals (ASX:STM) is up more than 17% for no appreciable reason I can spot at this very late stage of a Friday afternoon.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ICG | Inca Minerals Ltd | 0.02 | -33% | 2,576,257 | $14,550,299 |

| GCM | Green Critical Min | 0.01 | -29% | 12,050,905 | $13,810,701 |

| FAU | First Au Ltd | 0.003 | -25% | 916,667 | $5,807,973 |

| GCR | Golden Cross | 0.003 | -25% | 1,404 | $4,389,024 |

| THR | Thor Energy PLC | 0.0035 | -22% | 4,257,519 | $6,566,812 |

| TEM | Tempest Minerals | 0.013 | -19% | 1,239,974 | $8,109,146 |

| ZGL | Zicom Group Limited | 0.049 | -17% | 91,584 | $12,659,040 |

| RSH | Respiri Limited | 0.035 | -17% | 3,599,873 | $39,236,560 |

| MRQ | Mrg Metals Limited | 0.0025 | -17% | 50,000 | $6,557,756 |

| PNX | PNX Metals Limited | 0.0025 | -17% | 1,587,665 | $16,141,874 |

| BEX | Bikeexchange Ltd | 0.006 | -14% | 4,170 | $8,324,051 |

| NIS | Nickelsearch | 0.063 | -14% | 76,770 | $6,981,018 |

| MPR | Mpower Group Limited | 0.019 | -14% | 1,414,970 | $7,561,472 |

| 1TT | Thrive Tribe Tech | 0.026 | -13% | 9,386 | $8,898,646 |

| CZN | Corazon Ltd | 0.014 | -13% | 2 | $9,765,289 |

| SBR | Sabre Resources | 0.036 | -12% | 50,001 | $11,950,934 |

| WYX | Western Yilgarn NL | 0.15 | -12% | 120,367 | $8,441,776 |

| 14D | 1414 Degrees Limited | 0.046 | -12% | 147,100 | $10,685,244 |

| IMI | Infinitymining | 0.115 | -12% | 39,156 | $10,036,180 |

| CI1 | Credit Intelligence | 0.16 | -11% | 48,502 | $15,029,849 |

| ESR | Estrella Res Ltd | 0.008 | -11% | 3,432,432 | $13,352,147 |

| ODE | Odessa Minerals Ltd | 0.008 | -11% | 933,296 | $8,524,006 |

| ROG | Red Sky Energy. | 0.004 | -11% | 346,102 | $23,860,022 |

| LLI | Loyal Lithium Ltd | 0.485 | -11% | 3,072,597 | $37,327,051 |

| DEL | Delorean Corporation | 0.033 | -11% | 71,610 | $7,981,674 |

LAST ORDERS

Melodiol Global Health (ASX:ME1) has replied to a request for information from the ASX, which basically boiled down to “why was your announcement on 24 January marked as ‘Market Sensitive’.

Melodiol has replied to point out that the January announcement – plus two subsequent announcements – were marked as Market Sensitive on the basis that they revealed information about the restructure of an existing US$2 million loan between La Plata Capital and Sierra Sage Herbs, a wholly owned subsidiary of Melodiol.

“Further announcements relating to the Restructured Loan released on 6 March 2023 and 14 June 2023, were marked ‘market sensitive’ in line with the Company’s view that the Restructured Loan is considered information that a reasonable person would expect to have a material effect on the price or value of its securities,” Melodiol told the ASX.

Meanwhile, Boadicea Resources (ASX:BOA) has announced that MD Jon Reynolds has tendered his resignation, after deciding to retire. “due to a number of unforeseen personal factors”.

Reynolds had stepped into the role to replace former managing director and chairman Clarke Dudley, who passed away from cancer on 15 April, 2020.

“It’s been a privilege to serve on this board and be part of the transformation of the company,” Reynolds said. “While our company’s exploration portfolio has grown, challenging times in the industry haven’t always reflected the quality of the work and efforts we are doing.”

“I am proud of the company, the ‘team’, culture and assets we have built at Boadicea, and I look forward to monitoring the progress and success of the portfolio as they are advanced.”

The search is underway for a replacement for Reynolds, who joins current chairman Domenic De Marco in departing from the company this year.

In happier news, Future Battery Minerals (ASX:FBM) says that it’s now the proud 100% owner of the Kangaroo Hills lithium project, following the completion of a deal to snap up the remaining 20% it didn’t already own.

FBM has paid Lodestar Minerals (ASX:LSR) subsidiary Goldfellas $250,000 in cash, and issued 27,505,429 fully paid ordinary shares to complete the sale, with an identical quantity of performance rights which will vest and convert into fully paid shares if and when FBM is able to delineate a JORC compliant Mineral Resource of at least 10M @ 1.0% Li2O at the project.

TRADING HALTS

Australian Potash Limited (ASX:APC) – Halted ahead of an update to the market in relation to the Lake Wells sulphate of potash project.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.