CLOSING BELL: Lithium Australia’s MinRes deal was a bright shining light on an otherwise dreary day

"Tell us where the gains are, pal... or we're sending you to bed with no screen time!". Pic via Getty Images.

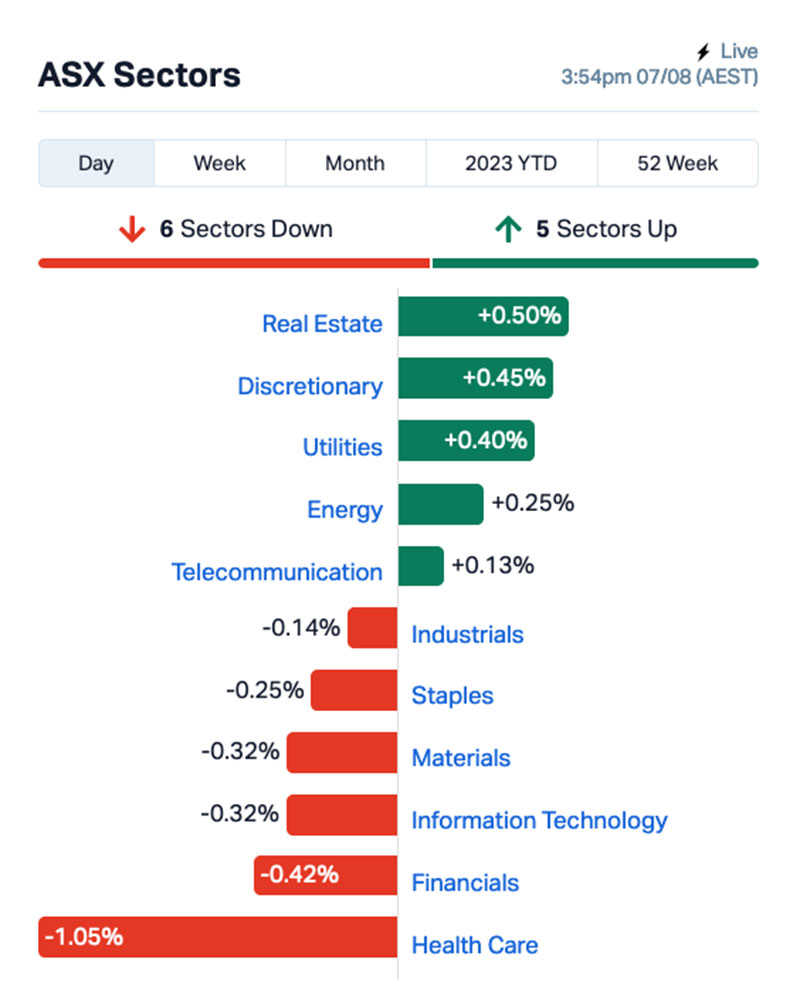

- ASX sleepwalks to an underwhelming -0.3% loss for the day.

- Real Estate the ‘highlight’, on a paltry +0.5%.

- Lithium Australia’s tech-for-facilities deal with MinRes saw it climb past +80% for the session.

It’s been a weak and sorry day on the bourse, even taking into account that it’s a Monday, and in spite of a rare patch of purple form for the Real Estate sector.

The ASX didn’t really have much to work with off the back of a fairly ordinary result from Wall Street on Friday, which saw the S&P down 0.53$, the Dow Jones lower by 0.43% and the Nasdaq pointing 0.36% lower as well.

Pre-market, the ASX Futures index was pointing to a mild dip when the doors opened, which saw the benchmark hit -0.2% in early trade, and drop to -0.3% by lunchtime.

As the day wore on, the benchmark’s slow leak stabilised there for most of the afternoon, ending the session within millimetres of where it was sitting at Sandwich O’Clock.

Real Estate did the best of the sectors, at around +0.5% – but even that was outweighed by a plunge across Health Care, InfoTech and Financials, but without a clear nail to hang it all on, I’m putting it down to a sense of spiritual ennui (it’s French for “meh”) and a deepening disdain for boring days at work.

Most notable among the big players today was Block Inc’s (ASX:SQ2) 10.1% loss, after investors took the buy now pay later and payments services firm out to the woodshed for a series of licks with the belt.

The dual-lister dropped a quarterly trading update delivered at the end of last week which it’s safe to say was not entirely encouraging, driving its US shares down 19% – about as clear a signpost as local investors needed to try the same kind of beating on the ASX today.

There’s likely to be more excitement (or ‘reasons for the market to do stuff’, anyway) over the coming days, with some ASX heavyweights due to report earnings.

Tomorrow, it’s James Hardie’s (ASX:JHX) turn, the big banks are coming on Wednesday – with ANZ (ASX:ANZ) and Suncorp (ASX:SUN) the ones to watch after the ACCC scuttled their wedding plans – and AMP (ASX:AMP) is set to barf out yet another profound disappointment on Thursday.

FROM THE HEADLINES

Beyond the ASX, it was a pretty quiet day as well – I suspect because the infamous Diggers & Dealers conference is on in Kalgoorlie this week, so everyone who’s anyone in the gold game is there to talk about shiny stuff while doing their best to drink the town dry.

It’s a very big deal – so much so, that we’ve sent both Reuben and Josh along to cover it – or, at the very least, cover for each other when they turn up somewhere weird next weekend with terrifying hangovers and only vague memories of what’s go on.

Also in WA news, The Yindjibarndi Aboriginal Corporation has revealed that it’s seeking $500m a year in compo from Fortescue Metals Group (ASX:FMG), due to the “economic and cultural loss” caused by mining at the company’s iron ore operations at the Solomon Hub.

The Federal Court has taken its show on the road to hear evidence from locals at the town of Roebourne where a large proportion of Yindjibarndi people live, as well as the remote mining area at Bangkangarra.

The hearings mark what could be the final chapter in a native title claim that’s been going on for more than 20 years – in that time, the Yindjibarndi Aboriginal Corporation was awarded native title in 2017, but that was held up until 2020 before Fortescue’s challenge to the decision was dismissed.

In the past three years, negotiations over a land use agreement between the two parties have failed, leaving the community divided, but still searching for a resolution.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LIT | Lithium Australia | 0.061 | 85% | 100,658,620 | $40,299,325 |

| EDE | Eden Inv Ltd | 0.004 | 33% | 349,989 | $8,990,833 |

| BDX | Bcaldiagnostics | 0.14 | 33% | 1,440,904 | $22,201,597 |

| SCT | Scout Security Ltd | 0.02 | 33% | 100,491 | $3,460,020 |

| G1A | Galena Mining | 0.12 | 32% | 7,544,743 | $68,483,751 |

| ARV | Artemis Resources | 0.022 | 29% | 8,442,643 | $26,688,612 |

| 14D | 1414 Degrees Limited | 0.055 | 28% | 92,096 | $8,835,875 |

| GES | Genesis Resources | 0.005 | 25% | 7,500 | $3,131,365 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 4,741,265 | $6,469,430 |

| TSN | The Sust Nutri Grp | 0.01 | 25% | 18,087 | $1,126,103 |

| CAV | Carnavale Resources | 0.008 | 23% | 54,106,458 | $21,668,086 |

| GMN | Gold Mountain Ltd | 0.011 | 22% | 60,500,557 | $20,421,707 |

| CRS | Caprice Resources | 0.05 | 22% | 115,996 | $4,787,034 |

| KNB | Koonenberrygold | 0.053 | 20% | 100,000 | $3,333,284 |

| LML | Lincoln Minerals | 0.006 | 20% | 102,915 | $7,103,559 |

| RML | Resolution Minerals | 0.006 | 20% | 1,012,451 | $6,286,459 |

| SGC | Sacgasco Ltd | 0.006 | 20% | 376,400 | $3,867,914 |

| MQR | Marquee Resource Ltd | 0.043 | 19% | 2,439,041 | $11,905,470 |

| FGL | Frugl Group Limited | 0.019 | 19% | 4,335,215 | $15,296,992 |

| NNG | Nexion Group | 0.013 | 18% | 16,847 | $2,225,386 |

| RR1 | Reach Resources Ltd | 0.013 | 18% | 30,878,184 | $34,705,557 |

| GRE | Greentechmetals | 0.515 | 17% | 2,120,564 | $24,902,044 |

| TIG | Tigers Realm Coal | 0.007 | 17% | 270,801 | $78,400,214 |

| HXL | Hexima | 0.022 | 16% | 224,883 | $3,173,753 |

| VAR | Variscan Mines Ltd | 0.015 | 15% | 817,000 | $4,394,047 |

Not much has changed at the top of the Small Caps ladder since lunchtime today, with Lithium Australia (ASX:LIT) still on top with a better-than 75% jump on news that the company has signed a landmark agreement with industry giant Mineral Resources (ASX:MIN), related to LIT’s “disruptive lithium extraction technology” called LieNA.

The agreement is simple enough: Lithium Australia is bringing its LieNA technology to the table, which is shaping up as a game-changer for lithium production offering up to 50% improvements to extraction yields over existing tech.

In return, MinRes is opening its hefty-sized chequebook to solely fund the development and operation of a pilot plant up to the total budgeted cost of $4.5 million and provide raw materials for the pilot plant at no cost.

A 50:50 joint venture to own and commercialise the LieNA technology through a licensing model is also potentially on the table.

Second-best this morning is Bcal Diagnostics (ASX:BDX), continuing its run of gains in the wake of last week’s news of breakthrough results from a clinical study, giving the company a solid footing towards commercialisation of its much-needed breast cancer screening tech.

At the end of today’s session, Bcal had put on another 33% or so.

And in third place, it’s Galena Mining (ASX:G1A) on news of a JORC-compliant Mineral Resource Estimate update from the company’s Abra Base Metals Mine, which has pushed G1A’s trading price close to 32% higher for the day.

It’s the first MRE annual update including all underground diamond drilling up to 5 May 2023, and all underground geological mapping, and mining and processing up to 30 June 2023.

The company reports that the updated MRE of 33.4Mt at 7.1% Pb and 17g/t Ag (5% Pb cut-off grade) – including 0.3Mt at 7.3% Pb and 32g/t Ag measured, 16.2Mt at 7.3% Pb and 19g/t Ag indicated and 16.9Mt at 6.9% Pb and 15g/t Ag inferred – shows “no material difference” from the previous MRE in April 2021, supporting Abra’s long-term lead-silver mining plans.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 313,016 | $11,649,361 |

| CLE | Cyclone Metals | 0.001 | -50% | 2,161,227 | $20,529,010 |

| DXN | DXN Limited | 0.001 | -50% | 204,082 | $3,442,630 |

| MEB | Medibio Limited | 0.001 | -33% | 11,449,310 | $7,725,891 |

| MTH | Mithril Resources | 0.001 | -33% | 934,832 | $5,053,207 |

| TD1 | Tali Digital Limited | 0.001 | -33% | 4,581 | $4,942,733 |

| IVX | Invion Ltd | 0.005 | -29% | 1,521,242 | $44,951,425 |

| CLA | Celsius Resource Ltd | 0.016 | -27% | 49,440,635 | $49,293,637 |

| NSM | Northstaw | 0.066 | -26% | 33,527 | $10,691,303 |

| MCT | Metalicity Limited | 0.0015 | -25% | 50 | $7,472,172 |

| NYR | Nyrada Inc. | 0.032 | -22% | 169,801 | $6,396,357 |

| NUC | Nuchev Limited | 0.18 | -22% | 38,350 | $19,413,674 |

| MXO | Motio Ltd | 0.037 | -21% | 98,543 | $12,287,429 |

| KFM | Kingfisher Mining | 0.24 | -20% | 1,061,906 | $16,114,500 |

| BPP | Babylon Pump & Power | 0.004 | -20% | 216,666 | $12,288,857 |

| LSR | Lodestar Minerals | 0.008 | -20% | 17,448,527 | $18,433,973 |

| ROO | Roots Sustainable | 0.004 | -20% | 3,333 | $693,611 |

| LKE | Lake Resources | 0.175 | -19% | 23,769,400 | $305,825,612 |

| SHO | Sportshero Ltd | 0.023 | -18% | 1,962,891 | $16,100,030 |

| CMX | Chemxmaterials | 0.095 | -17% | 153,169 | $5,826,029 |

| DMM | Dmcmininglimited | 0.07 | -17% | 100,000 | $2,515,800 |

| AJX | Alexium Int Group | 0.015 | -17% | 6,511 | $11,725,016 |

| BNO | Bionomics Limited | 0.01 | -17% | 3,155,907 | $17,624,825 |

| CT1 | Constellation Tech | 0.0025 | -17% | 600,994 | $4,413,601 |

| EMU | EMU NL | 0.0025 | -17% | 4,812,259 | $4,350,064 |

LAST ORDERS

Some happy news for Eastern Metals (ASX:EMS), which has announced that it has chosen Ms Ley Kingdom as the Company’s Chief Executive Officer, effective immediately.

EMS says that Kingdom is “a qualified geologist with over 25 years’ experience having worked for Western Mining Corporation, BHP and a number of juniors and mid-tiers on greenfield projects through to resource definition and feasibility”, adding that she brings “a comprehensive understanding of resource projects and their development, and her broad experience” to the company.

Intelligent Monitoring Group (ASX:IMB) has supplied the market with a clarification on its recent Supply and Services Agreement with Syber Sense and SecureNet, following the completion of its recently announced acquisition of ADT in Australia and New Zealand.

The ASX had asked for a bit more information, to which IMB explained that it plans to change ADT’s mix of security product offering to include a DIY monitorable product range, in order to reduce the high capex required under its existing strategy, and provide a more flexible alternative to the traditional security hardware offering.

That agreement, which is set to run for an initial term of two years, and automatically renews for successive two year terms unless cancelled by either party, “will not have a material impact on the Company’s earnings or operations”, IMB said.

And finally, Clearvue Technologies (ASX:CPV) has told the ASX that it’s as mystified as the watchdog is, over the company’s recent drive from a low of $0.265 since the close of trade on Monday 31 July 2023 to an intraday high of $0.35 today.

The company’s not had anything to say via the ASX since it dropped its quarterly on 31 July this year, but since then there’s been a pretty solid run on the stock, up just over 32% in that time with a sizable jump in volume, to boot.

TRADING HALTS

EQ Resources (ASX:EQR) – Material acquisition and capital raising.

IRIS Metals (ASX:IR1) – Update on exploration results.

European Lithium (ASX:EUR) – NASDAQ merger transaction.

Forbidden Foods (ASX:FFF) – Capital raising.

Peak Rare Earths (ASX:PEK) – Material commercial agreement announcement.

Pantoro (ASX:PNR) – Capital raising.

InvoCare (ASX:IVC) – Material announcement in relation to TPG Capital Global’s revised non-binding indicative proposal of 15 May 2023.

Perpetual Resources (ASX:PEC) – Potential acquisition and capital raise.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.