Closing Bell: It certainly wasn’t cricket as Monday markets in Australia knocked right back to last year

Via Getty

- Benchmark ASX index closes at new 12-month lows

- Energy and Materials the worst of 9 dipping ASX sectors on Monday

- Small caps led by CHM, TON

On Monday Aussie markets rediscovered their nadir of the year. No real surprises, since every new noise and movement rattles the frayed, raw nerves of investors.

The benchmark ASX200 lost -0.9% at the open and that stayed lost all day, ending -0.9% down. October is turning worse than September for the business of equities – as more global conflict augments everything from oil to uncertainty.

The ASX200 has closed sharply lower again after Wall Street fell on Friday and then agonised over the weekend as Middle East peace failed to break out.

As Tony Sycamore from IG Markets said in a one-line message to Stockhead this afternoon – “It’s a carbon copy of last Monday’s session as we see a partial unwind of the safe haven flows put on ahead of the weekend”:

- SP500 futures at 4260 (+0.3%)

- US 10-year yields at 4.945% + 3bp

- Crude Oil at $87.82 (-0.3%)

- Gold at $1971 (-0.5%)

Global investors were far from comfy to hold risk going into the weekend as the markets nervously awaited a possible ground invasion by Israel into the Gaza Strip.

So far, such an incursion hasn’t occurred. On Monday gold then has stepped off its five-month highs of the previous (Friday) session. But merely, as Tony implies, just the traders who have retrieved a little of what they’ve previously put in the asset for safe keeping over the weekend.

There’s little enthusiasm or optimism that any shuttle diplomacy can have much impact on the Israel-Hamas war from spilling into a wider expression of long-simmering, perhaps long-constrained violence – across the Middle East and elsewhere.

As Tony says, traders have retrieved a little too dented demand for the safe-haven asset.

Investors are also in a few knots over incoming US GDP and inflation data this week, which could entirely unhook any plans around monetary policy outlook.

The Fed Chair Jay Powell last week banged on that US inflation was still too high and would likely require lower economic growth, adding that current monetary settings were not yet too tight. Still, markets expect the central bank to hold rates steady at its October 30-31 policy meeting.

But Kyle Rodda over at Capital.com says maybe don’t make any plans just yet because ‘this situation is very fluid’.

“The risk of a widening regional conflict has also increased: hostilities in the West Bank have flared, and Israel warned over the weekend that escalating tensions on the country’s northern border with Hezbollah could draw Lebanon into the fray. It’s a dangerous and volatile state of affairs, and stocks responded accordingly on Friday night.

Wall Street plunged in another sell-off, which set the local benchmark up for Monday’s familiar dive at the open.

“The other factor driving markets is the surge in global yields.

“While still pressing, that dynamic reversed briefly on Friday night as the risk-off move across markets pushed Treasury yields lower. The US 10-year closed at 4.91%, trading a whisker above 5% in Asian trade.”

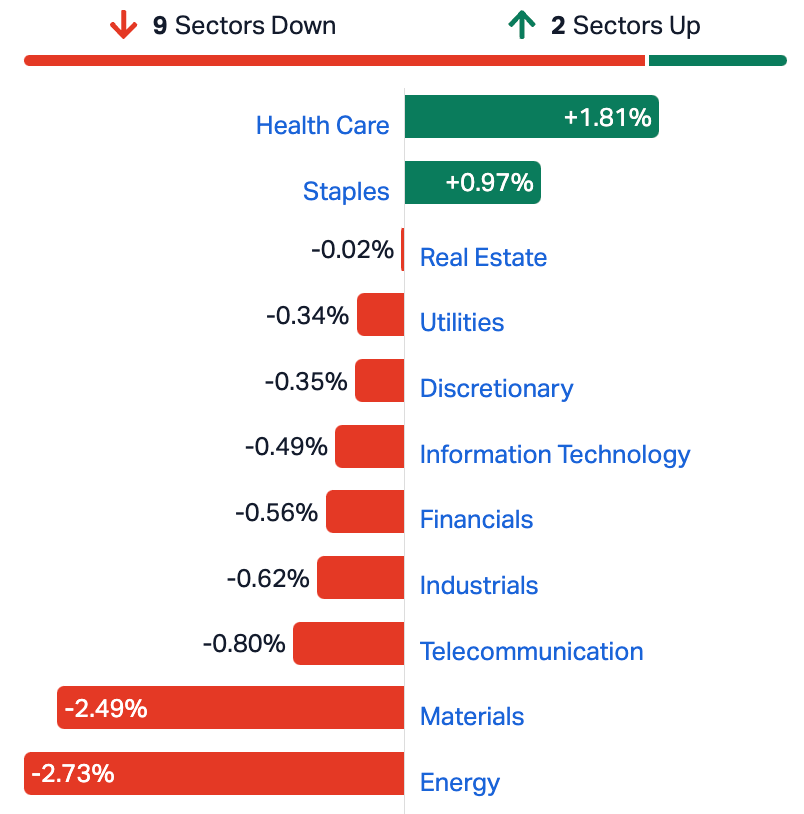

At home nine out of our miscreant 11 sectors fell, with the major miners and the Energy Sector leading losses.

ASX Sectors

US FUTURES at 1am in New York:

RIPPED FROM THE HEADLINES

In China, the Shanghai Composite fell -0.8% to hit 1-year lows below 2,970 while the Shenzhen Component sank to -1% to hit 4-year lows – as higher bond yields and geopolitical upheaval messed with market sentiment everywhere.

Little signs of the momentary hope inspired by some positive data last week, nor the decision by the People’s Bank of China (PBoC) to hold its 1-year and 5-year loan prime rates unchanged at 3.45% and 4.2%, respectively, during its October fixing in a widely expected move as China’s economy showed signs of stabilising.

China’s tech names drove the losses – IEIT Systems (-5%), Cambricon Technologies (-12%) and Eoptolink Technology (-8%).

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.01 | 100% | 802,570 | $1,445,402 |

| TON | Triton Min Ltd | 0.029 | 45% | 7,262,705 | $31,227,112 |

| SYR | Syrah Resources | 0.765 | 44% | 48,668,837 | $358,225,797 |

| CRS | Caprice Resources | 0.031 | 41% | 256,727 | $2,568,652 |

| MEM | Memphasys Ltd | 0.014 | 40% | 1,178,460 | $9,595,204 |

| R3D | R3D Resources Ltd | 0.057 | 39% | 159,900 | $5,971,715 |

| RNU | Renascor Res Ltd | 0.15 | 36% | 20,289,307 | $279,334,825 |

| ITM | Itech Minerals Ltd | 0.125 | 36% | 565,555 | $11,240,888 |

| BKT | Black Rock Mining | 0.13 | 35% | 8,301,978 | $105,324,105 |

| ADS | Adslot Ltd. | 0.004 | 33% | 421,255 | $9,673,487 |

| GCM | Green Critical Min | 0.008 | 33% | 4,453,332 | $6,819,510 |

| CHM | Chimeric Therapeutic | 0.037 | 32% | 9,990,019 | $14,957,683 |

| WC8 | Wildcat Resources | 0.6 | 30% | 31,853,007 | $478,790,772 |

| MCT | Metalicity Limited | 0.0025 | 25% | 3,037,665 | $7,472,172 |

| TMX | Terrain Minerals | 0.005 | 25% | 1,067,500 | $5,030,575 |

| SGA | Sarytogan | 0.21 | 24% | 1,414,779 | $13,081,484 |

| EGN | Engenco Limited | 0.375 | 23% | 14,745 | $96,316,991 |

| NVX | Novonix Limited | 0.805 | 23% | 10,562,865 | $319,941,427 |

| YRL | Yandal Resources | 0.065 | 23% | 218,734 | $8,363,563 |

| TKM | Trek Metals Ltd | 0.038 | 23% | 2,855,938 | $15,426,843 |

| EGR | Ecograf Limited | 0.1375 | 22% | 3,681,893 | $50,916,586 |

| IMM | Immutep Ltd | 0.335 | 22% | 6,597,851 | $326,929,504 |

| ODY | Odyssey Gold Ltd | 0.028 | 22% | 2,604,191 | $17,607,369 |

| EV1 | Evolutionenergy | 0.17 | 21% | 581,624 | $24,550,784 |

| WKT | Walkabout Resources | 0.13 | 18% | 1,426,225 | $73,343,055 |

Aussie Medtech Chimeric Therapeutics (ASX:CHM), has ended around +50% off the back of some positive clinical data for CLTX CAR T in heavily pretreated, late stage, recurrent Glioblastoma patients in its recently-run Phase 1A trial at City of Hope, one of the largest cancer research and treatment organisations in the US.

The headline news is that a “55% Disease Control Rate (DCR) was achieved in patients treated with CLTX CAR T, exceeding historical disease control rates of 20-37%.”

“Roughly 10 months’ median survival was demonstrated in patients that achieved disease control”, against survival expectations for patients after first line therapy that generally come in around the seven-month mark.

“The CLTX CAR T dose escalation preliminary data are truly encouraging and have exceeded our expectations, particularly given that the patients enrolled were heavily pretreated and very late stage,” Chimeric CEO and MD Jennifer Chow said.

Triton Minerals (ASX:TON) is up 45% after signing on Soluções De Desenvolvimento Sustentável (SDS) to assist with the development of its Ancuabe and Cobra Plains Graphite Projects in Mozambique.

Some bullies for you:

• SDS is a highly skilled firm with deep experience in assisting resource and infrastructure companies progress projects across their entire life cycle.

• Based in Mozambique, SDS is well positioned to assist Triton with its development activities in Mozambique at its portfolio of graphite projects.

• SDS will assist Triton with stakeholder engagement, strategic advice and management, regulatory compliance, project development management services and commercial services.

Triton’s Exec Director, Mr Andrew Frazer:

“We have been extremely impressed with SDS’s experience and strong networks within Mozambique. SDS have experience with various resource and infrastructure projects which we believe will greatly assist Triton as we continue to progress development of our world class graphite projects.

The next 18 months are expected to be pivotal in Triton’s journey to becoming a graphite producer and we are excited to have SDS assist us as we work tirelessly to create value for our shareholders.”

Wildcat Resources (ASX:WC8) is back in the headlines as well, this time with even more lithium at its Tabba Tabba after the third batch of assays from the company’s maiden drill program came back from the lab.

The intercepts:

“Highlight the significant scale of the Tabba Tabba Lithium Project and the potential for a Tier-1 lithium deposit at the Leia Pegmatite,” which Wildcat says is now:

>1.5km long, 50m wide and >400m down plunge (250m vertical from surface), thickening at depth, and open laterally and at depth.

Immutep (ASX:IMM) jumped 20 per cent to 33¢ after the biotech company published positive clinical trial results for its lung cancer treatment.

Meanwhile, Odyssey Gold (ASX:ODY), Syrah Resources (ASX:SYR) and Renascor Resources (ASX:RNU) are all higher. We can tell you those last two at least are potentially up on the news China is about to curtail its graphite exports, sending our local graphite stocks higher today.

Blackstone Minerals (ASX:BSX), the Tanzanian graphite developer is up 35%, also partly on the Chinese graphite narrative mentioned above, but also… Feet on the ground at the AGM confirmed today (below) might secure more useful data, but for now, it looks like a vote of confidence in both graphite and management.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Today | Volume | Market Cap |

|---|---|---|---|---|---|

| NMR | Native Mineral Res | 0.031 | -39% | 1,208,808 | $10,278,317 |

| MAP | Microbalifesciences | 0.215 | -29% | 1,900,723 | $90,525,320 |

| RGS | Regeneus Ltd | 0.005 | -29% | 210,843 | $2,145,058 |

| HOR | Horseshoe Metals Ltd | 0.008 | -27% | 2,226,649 | $7,078,265 |

| EMU | EMU NL | 0.0015 | -25% | 4,721,097 | $2,900,043 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | 1,000,000 | $24,408,512 |

| RGL | Riversgold | 0.009 | -25% | 10,296,817 | $11,415,137 |

| NXS | Next Science Limited | 0.29 | -25% | 821,973 | $102,349,970 |

| HTG | Harvest Tech Grp Ltd | 0.029 | -22% | 486,545 | $26,139,144 |

| CNJ | Conico Ltd | 0.004 | -20% | 225,673 | $7,850,475 |

| GTG | Genetic Technologies | 0.002 | -20% | 1,790,999 | $28,854,145 |

| KNM | Kneomedia Limited | 0.002 | -20% | 155,243 | $3,761,963 |

| NZS | New Zealand Coastal | 0.002 | -20% | 20,170 | $4,167,525 |

| RAD | Radiopharm | 0.095 | -19% | 371,806 | $28,119,282 |

| BMG | BMG Resources Ltd | 0.009 | -18% | 486,468 | $6,971,769 |

| RLG | Roolife Group Ltd | 0.009 | -18% | 1,613,759 | $7,948,139 |

| FRS | Forrestaniaresources | 0.029 | -17% | 435,728 | $3,580,556 |

| M2M | Mtmalcolmminesnl | 0.025 | -17% | 387,117 | $3,070,305 |

| TSO | Tesoro Gold Ltd | 0.015 | -17% | 961,843 | $18,965,026 |

| BCT | Bluechiip Limited | 0.02 | -17% | 1,372,960 | $17,128,091 |

| DTR | Dateline Resources | 0.01 | -17% | 148,039 | $10,625,314 |

| MTL | Mantle Minerals Ltd | 0.0025 | -17% | 13,860,422 | $18,442,338 |

| ROG | Red Sky Energy. | 0.005 | -17% | 9,845,977 | $31,813,363 |

| ROO | Roots Sustainable | 0.005 | -17% | 12,414 | $919,875 |

| LYN | Lycaonresources | 0.18 | -16% | 222,956 | $8,614,781 |

TRADING HALTS

European Lithium (ASX:EUR) – Pending an announcement in connection with the NASDAQ merger transaction

Western Mines Group (ASX:WMG) – Pending announcement of a capital raising

Matador Mining (ASX:MZZ) – Pending an announcement regarding a capital raising

Anteris Technologies (ASX:AVR) – Pending an announcement in relation to a proposed capital raising

Azure Minerals (ASX:AZS) – Pending the release of an announcement by the Company regarding a potential change of control transaction

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.