CLOSING BELL: Investors respond to the government’s Critical Minerals Strategy by selling everything in sight

Investors have greeted the government's vision for our Critical Minerals future with an enormous fire sale in mining and resources today. Pic via Getty Images.

- Aussie markets are down 0.6% after the gubbermint dropped an unpopular look at the future.

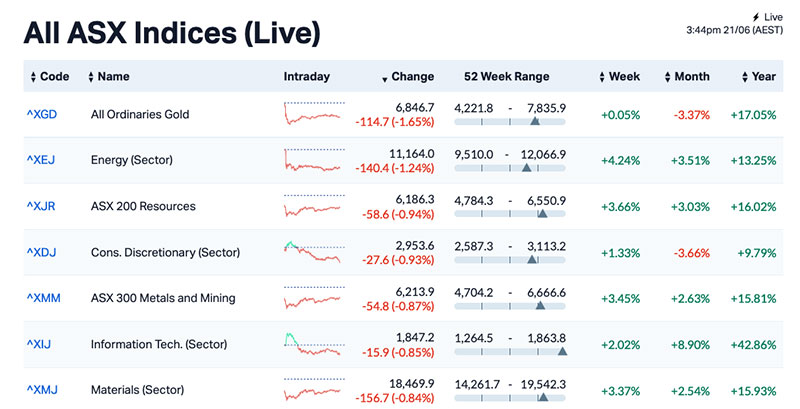

- Gold stocks, Energy, Materials, Resources, Metals and miners are all well below the broader market.

- Iris Metals bucked the trend, out of the ASX doghouse and up 33.6% after relisting today.

The banner headline for the day has been a steep sell-off for (nearly) anything that even remotely smells like mining which, coming the morning after the Federal Resources Minister dropped her long-awaited Critical Minerals Strategy 2023–2030 roadmap, might be a coincidence, but probably definitely is not.

The Hon Madeleine West and the team in her Resource portfolio’s offices have undoubtedly worked super hard to put it together, which – speaking as someone who’s spent their fair share of working hours on government publications just like this one – is a horrifying task involving late-night, ego-driven rewrites after every stakeholder in the building gets their chance to put their fingerprints on it.

The issue is that, as far as I can tell from the admittedly limited time I’ve had to chew my way through it, it’s big on PR buzzwords and promises, and disappointingly light in the other parts that it seems investors were looking for, to back up their trust in the country’s place in a decarbonised, zero-emissions, battery-powered future.

So today, all the miners and diggers and metal merchants copped a thorough kicking right throughout the session, as this handy table of the day’s biggest losers by market sectors shows:

As you can see, that was taken about 15 minutes before the sweet release of the Closing Bell for the ASX this arvo, and six of the seven worst performers are all mining related.

If the Federal Government was hoping that its feel-good “we’re all in this together” approach to the future of Critical Minerals in Australia was going to get a ringing endorsement from the market, it’s pretty clear that it has failed.

The best performing sector for the day was Consumer Staples, which added 0.78% led by Bubs Australia’s (ASX:BUB) 27.5% jump, after the recently-revamped board revealing the company’s banked its first $1 million month on Amazon, and its Direct-to-Consumer (DTC) business is growing nicely, with YTD Net Revenue of $1.8 million.

The rest of the sectors were all being a bit boring, so they’re off the invite list for the rest of the day.

In other big mining news – clearly more Large Cap related, but still worth mentioning here – is that mining giants Rio Tinto (ASX:RIO) and Alcoa have been chased off the trail of 10 exploration tenements in South West WA.

“Rio Tinto is in the process of withdrawing its applications for exploration licences in the South-West of Western Australia,” a company spokesperson said earlier today. “This decision has been made for a number of reasons including in response to concerns raised by local communities.”

Rio had submitted the 10 applications to go hunting for lithium and nickel near the town of Dwellingup, south of Perth, but a gigantic gaggle of locals have managed to shoo the big miner out of town, because it’s very pretty there and they don’t see a need for it to be turned into a massive pit full of trucks and sweaty men.

I’m with them on the sweaty men part of the protest, but I rather fancy a drive of one of those massive mine hauler trucks, so if Rio wants to dig an enormous pit (and take out the dickhead who lives across the road in number 40 in the process), they can swing by my place now they’ve got some spare time on their hands.

Once they’re done dealing with their self-driving train disaster, of course. For those that missed the memo, one of Rio’s driverless trains fell over on Saturday night, about 20km from Dampier in the Pilbara WA.

No word yet on whether the non-existent driver was under the influence when the accident occurred, but WA Police have reported that they’re having a lot of trouble finding him, even though they “just want to talk”.

Rio says exports won’t be affected too badly, as there’s bags of ore on hand to fill requirements while the 30-carriage spill gets cleaned up.

And, because you’re probably completely bored of hearing about mining stuff, here’s the day’s Small Caps winners.

(Spoiler alert: there’s miners in this next bit, too.)

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OPN | Oppenneg | 0.016 | 167% | 1,060,555 | $1,455,180 |

| WFL | Wellfully Limited | 0.0045 | 50% | 3,768,849 | $1,478,832 |

| AYM | Australia United Min | 0.003 | 50% | 818,626 | $3,685,155 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 116,665 | $2,569,460 |

| MTH | Mithril Resources | 0.0015 | 50% | 4,317,388 | $3,368,804 |

| IR1 | Irismetals | 1.53 | 32% | 1,230,962 | $92,486,800 |

| BUB | Bubs Aust Ltd | 0.1875 | 29% | 9,817,627 | $108,946,824 |

| IGN | Ignite Ltd | 0.054 | 29% | 146,710 | $3,762,451 |

| AW1 | Americanwestmetals | 0.115 | 26% | 12,299,183 | $24,220,707 |

| IBX | Imagion Biosys Ltd | 0.015 | 25% | 24,171,712 | $14,011,989 |

| DES | Desoto Resources | 0.125 | 25% | 100,000 | $5,992,650 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 350,000 | $6,605,136 |

| PUA | Peak Minerals Ltd | 0.0025 | 25% | 890,000 | $2,082,753 |

| BLZ | Blaze Minerals Ltd | 0.026 | 24% | 9,712,532 | $9,607,673 |

| FTC | Fintech Chain Ltd | 0.016 | 23% | 26,418 | $8,460,005 |

| AZS | Azure Minerals | 1.265 | 23% | 10,470,163 | $401,943,154 |

| KGL | KGL Resources Ltd | 0.14 | 22% | 442,069 | $65,238,564 |

| RCW | Rightcrowd | 0.018 | 20% | 230,366 | $3,947,877 |

| GTG | Genetic Technologies | 0.003 | 20% | 44,328 | $28,854,145 |

| LVT | Livetiles Limited | 0.012 | 20% | 1,156,435 | $10,471,657 |

| RDN | Raiden Resources Ltd | 0.006 | 20% | 621,304 | $10,276,345 |

| RGS | Regeneus Ltd | 0.006 | 20% | 1,571,666 | $1,532,185 |

| SI6 | SI6 Metals Limited | 0.006 | 20% | 2,263,644 | $7,476,973 |

| PFE | Panteraminerals | 0.095 | 19% | 193,219 | $4,120,090 |

| W2V | Way2Vatltd | 0.013 | 18% | 10,000 | $5,015,295 |

Nominally at the top of the list of winners today is Openn Negotiation (ASX:OPN), which is showing a 166.66% gain for no apparent reason, on little to no volume.

The company has been struggling on market of late, and was held in suspension while Axiom Properties (ASX:AXI) came in to sift through the business and have a crack at recapitalising it at the end of May.

By the looks of things, OPN came back online a few days ago, and sank like a stone, but it’s showing a huge jump today so I thought I’d better let you know.

Also enjoying a Welcome Back party today was our lunchtime leader Iris Metals (ASX:IR1), which has been MIA from the ASX since December, but suddenly emerged from the murk and relisted today.

After falling foul of a few bits of Chapters 1 and 2 of the ASX Listing Rules, and as part of its re-compliance requirements, the company says it has successfully completed the $15 million cap raise required to get back in the good books and start being traded again.

Investors were well on board with Iris returning to the fold, pushing it 45% higher by lunchtime, which has settled back to a +33.6% gain for the day.

Some great news for Imagion Biosystems Limited (ASX:IBX) with brand new CEO Isaac Bright at the helm, and an announcement that the company’s MagSense HER2 imaging agent Phase 1 study (IBI10103) has achieved its enrolment target, and is set to get rolling.

IBX says the new agent works through showing a change in image contrast in nodes highly suspicious for breast cancer tumours. It shows up as “distinctly different from the contrast seen in non-involved nodes” when used with Magnetic Resonance Imaging (MRI) and Magnetic Relaxometry (MRX), for women who have HER2-positive (HER2+) primary breast cancer.

IBX is up 29.17% for the day, just edging out American West Metals (ASX:AW1), on 29.12% with the latter riding high on last week’s news that a high-resolution ground gravity survey at the company’s Storm prospect has identified significant new anomalies that support the potential for a large-scale sediment-hosted copper system.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Today | Volume | Market Cap |

|---|---|---|---|---|---|

| NRX | Noronex Limited | 0.017 | -26% | 347,561 | $5,806,154 |

| ILA | Island Pharma | 0.097 | -25% | 20,013 | $10,564,901 |

| AFW | Applyflow Limited | 0.012 | -25% | 506,721 | $2,366,090 |

| TYM | Tymlez Group | 0.003 | -25% | 950,000 | $4,368,781 |

| OLI | Oliver'S Real Food | 0.015 | -25% | 1,028,000 | $8,814,638 |

| M2R | Miramar | 0.038 | -24% | 855,006 | $4,019,087 |

| OLH | Oldfields Holdings | 0.055 | -21% | 186,000 | $13,982,916 |

| LSR | Lodestar Minerals | 0.004 | -20% | 520,164 | $9,216,987 |

| RBR | RBR Group Ltd | 0.002 | -20% | 4,275,000 | $4,046,012 |

| ROO | Roots Sustainable | 0.004 | -20% | 254,712 | $693,611 |

| THR | Thor Energy PLC | 0.004 | -20% | 2,025,000 | $7,300,064 |

| ENV | Enova Mining Limited | 0.009 | -18% | 588,000 | $4,300,223 |

| TZL | TZ Limited | 0.023 | -18% | 621,650 | $7,075,827 |

| LRL | Labyrinth Resources | 0.01 | -17% | 1,870,182 | $11,513,848 |

| MXC | Mgc Pharmaceuticals | 0.005 | -17% | 320,293 | $20,098,158 |

| TIG | Tigers Realm Coal | 0.005 | -17% | 2,129,320 | $78,400,214 |

| MDI | Middle Island Res | 0.021 | -16% | 2,918,578 | $3,060,456 |

| XAM | Xanadu Mines Ltd | 0.097 | -16% | 19,736,280 | $188,349,782 |

| CAZ | Cazaly Resources | 0.039 | -15% | 2,118,668 | $17,103,802 |

| AJL | AJ Lucas Group | 0.012 | -14% | 529,885 | $19,260,215 |

| AJQ | Armour Energy Ltd | 0.003 | -14% | 213,000 | $17,224,697 |

| AVM | Advance Metals Ltd | 0.006 | -14% | 897,448 | $4,119,911 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 401,984 | $12,257,755 |

| YPB | YPB Group Ltd | 0.003 | -14% | 10,757,962 | $2,167,371 |

| TTT | Titomic Limited | 0.043 | -14% | 942,121 | $11,949,498 |

LAST ORDERS

Today has been a day of weird news gifts that just keeps on giving, after this nugget from New Talisman Gold (ASX:NTL) landed on my desk this afternoon.

The story goes like this: New Talisman announced a cap raise back in February, through a rights offer for existing shareholders with an oversubscription facility on the basis that it would be “the fairest [option] to all shareholders”.

It’s something we’ve all seen a billion times before, so it flew under the radar for most folks… but not those eagle-eyed drones in the ASX Dept of Sticking to the Rules.

Fully five months after the offer was completed, and everything signed, sealed and delivered, the ASX flagged down NTL to say that the issuing of 2.7 million shares to Independent Non-executive Director and Chair. Samantha Sharif had actually occurred in breach of ASX listing rule 10.11 for the allotment of shares under oversubscription.

According to the ASX, that particular portion of the deal required shareholder approval – and without that in place, the ASX was gonna have a beef with NTL and wanted the problem resolved.

So, NTL and the ASX had a sit-down, where it was determined that since Ms Sharif hadn’t knowingly broken the rules, there would be some wiggle room in deciding how it’s all going to play out.

The end result: Ms Sharif has been given 6-8 weeks to dispose of those 2.7 million shares on-market, and any winnings will be donated to an as-yet unnamed charity in New Zealand.

Elsewhere, Scorpion Minerals (ASX:SCN) has been tapped on the shoulder and handed a volume and price query from the ASX, after heading skyward by more than 40% over the past five days, despite no fresh announcements since 08 June.

Scorpion’s responded by calling a trading halt to prepare a response to the speeding ticket – and to announce that it’s got assay results ready to drop from its Youanmi lithium play in Western Australia… So no doubt the watch dogs are gonna want to know if there’s anything that some people might know that the rest of the market doesn’t.

And in even more speeding ticket news, Olympio Metals (ASX:OLY) has responded to the postcard it got from the ASX about price and volume spikes with a hearty shrug of the shoulders, and a well-worded “We have NFI why it’s happened as well”.

Olympio has told the ASX that it’s been out on the hustings doing all the usual investor relations stuff that resources explorers need to do in order to drive engagement and get people on board, and has only been presenting facts and figures that been previously announced to the ASX back in May in whatever PowerPoints they’ve been screening.

So that one’s set to remain a bit of a mystery for now, and OLY which was up 27% yesterday on no news, is live on the market again, and down around 17% for the day.

TRADING HALTS:

Kingsland Minerals (ASX:KNG) – Capital raising.

Lithium Energy (ASX:LEL) – Capital raising.

Ragnar Metals (ASX:RAG) – Significant divestment annnnnd… capital raising.

Strike Resources (ASX:SRK) – On hold ahead of a potential sell-down of a minor portion of its 34.41 million shareholding in Lithium Energy (ASX:LEL).

Scorpion Minerals (ASX:SCN) – Speeding ticket, and on hold ahead of assay results from its Youanmi lithium project in WA.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.