Closing Bell: Investors left high and dry after China disappoints; Iron ore, oil stocks swing to losses

Investors left high and dry after China announcement. Pic: Getty Images

- ASX fell as mining stocks dropped on China’s lack of stimulus

- Brent oil dipped below US$80

- Big lithium stocks fall, but Piedmont and Atlantic gain as Ghanaian mine permit arrives

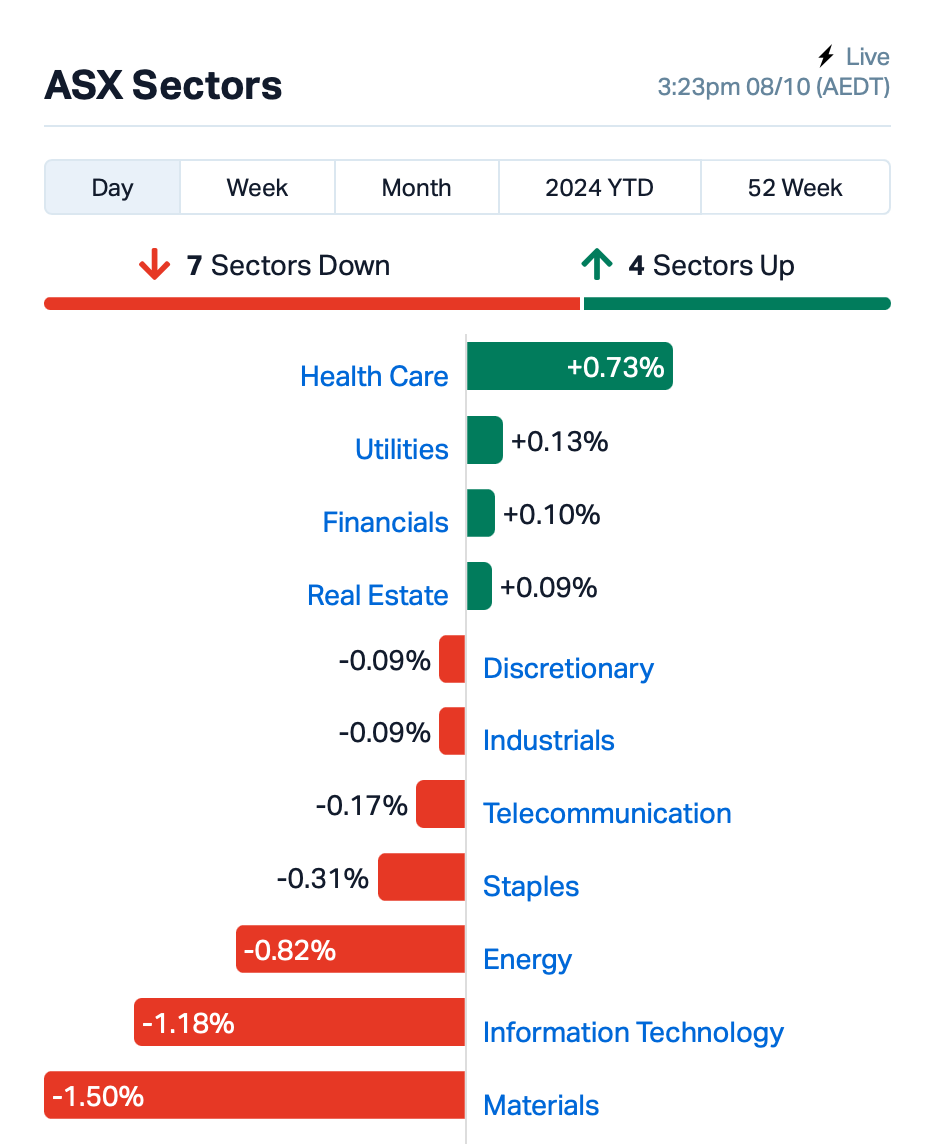

The ASX closed lower by 0.35% in a volatile session, with traders feeling sidelined as mining and energy stocks swung to losses after hopes for more China stimulus fizzled out.

Markets were earlier brimming with anticipation for a substantial “bazooka” stimulus from China, but expectations were dashed following a press conference from China’s National Development and Reform Commission, leaving many disappointed.

The briefing by the top economic planner didn’t announce new stimulus, as the market had expected.

“And…the briefing came to an end without ambitious stimulus revealed. That leaves the market (and myself) unimpressed, with CSI 300 paring gains,” said Olivia Tam at Bloomberg.

The Chinese market benchmark, the CSI 300 index, lost most of its earlier 11% gains soon after the press conference.

Iron ore futures in Singapore also dropped from $US114 to below $US110, scuttling stocks like BHP (ASX:BHP) and Fortescue (ASX:FMG), which fell over 5%.

Elsewhere, Brent oil dropped below US$80 a barrel during the conference, sending ASX oil stocks lower.

On a brighter note, lithium investors were buzzing today after Rio Tinto (ASX:RIO) announcement yesterday that it was making a play for Arcadium Lithium (ASX:LTM) .

While big players were caught up in the China economy storm, shares in Piedmont Lithium (ASX:PLL) surged by 6%, while Atlantic Lithium (ASX:A11) was up almost 6%, with Atlantic announcing late in the day that the Ghanaian Government had issued an operating permit for A11’s Ewoyaa mine, in which PLL has an interest.

In single stock news, fertiliser and explosives maker Incitec Pivot (ASX:IPL) said its chief financial officer, Paul Victor, will be leaving the company. He’ll stay on as CFO until February 15. IPL’s share price fell 0.7%.

NRW Holdings (ASX:NWH) has landed a $360 million deal with Evolution Mining (ASX:EVN) for surface mining at Castle Hill in WA. Work is set to start in November and should wrap up by mid-2030. NRW’s shares climbed by 0.85%.

And, the RBA’s minutes from its September meeting have left investors feeling nervous.

While the cash rate remained steady at 4.35%, the minutes suggested that interest rates might need to stay high or increase further if consumer spending rises.

What else happened today?

The regional Asian equity gauge, the MSCI’s Asia-Pacific index, dropped the most in a month after China disappointed markets.

Hong Kong stocks tumbled, joining Japan and South Korea as concerns over economic conditions in China continue to weigh heavily.

Over in Seoul, Samsung has apologised to investors for disappointing results, acknowledging that the memory chip leader is facing a potential crisis after losing its competitive edge.

Jun Young-hyun, the new head of the semiconductor division, promised a major overhaul in a candid statement following Samsung’s announcement of lower-than-expected revenue and profit.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RIM | Rimfire Pacific | 0.059 | 48% | 14,163,797 | $91,809,376 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 19,033,558 | $5,567,228 |

| RNE | Renu Energy Ltd | 0.002 | 33% | 1,001,664 | $1,206,201 |

| PNT | Panthermetalsltd | 0.026 | 30% | 24,582,307 | $4,706,973 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 19,383,146 | $57,867,624 |

| NTM | Nt Minerals Limited | 0.005 | 25% | 250,000 | $4,069,612 |

| PUR | Pursuit Minerals | 0.003 | 25% | 1,152,630 | $7,270,800 |

| PIQ | Proteomics Int Lab | 0.800 | 21% | 2,257,887 | $86,461,794 |

| AHK | Ark Mines Limited | 0.230 | 21% | 40,427 | $10,534,818 |

| MKR | Manuka Resources. | 0.054 | 20% | 3,733,035 | $35,089,545 |

| BMR | Ballymore Resources | 0.150 | 20% | 82,442 | $22,091,323 |

| CUL | Cullen Resources | 0.006 | 20% | 30,492 | $3,467,009 |

| MEL | Metgasco Ltd | 0.006 | 20% | 588,652 | $7,287,934 |

| AU1 | The Agency Group Aus | 0.021 | 17% | 72,015 | $7,714,379 |

| LNR | Lanthanein Resources | 0.004 | 17% | 259,999 | $7,330,908 |

| OVT | Ovanti Limited | 0.004 | 17% | 865,587 | $4,669,045 |

| PAB | Patrys Limited | 0.004 | 17% | 422,740 | $6,172,342 |

| PTR | Petratherm Ltd | 0.053 | 15% | 1,041,160 | $12,250,713 |

| AQX | Alice Queen Ltd | 0.008 | 14% | 397,000 | $8,028,230 |

| NSX | NSX Limited | 0.032 | 14% | 152,886 | $12,817,867 |

| HPR | High Peak Royalties | 0.072 | 14% | 57,726 | $13,107,762 |

| EME | Energy Metals Ltd | 0.105 | 14% | 125,571 | $19,290,865 |

| BCA | Black Canyon Limited | 0.065 | 14% | 68,503 | $4,660,061 |

Panther Metals (ASX:PNT) jumped after announcing that numerous gold nuggets were discovered at the Comet Well and Comet Well South project areas, including a striking gold in quartz specimen. These initial finds occurred during drill preparations, and subsequent detecting activities near the upcoming drill sites revealed even more nuggets. Additional detecting is currently ongoing across both project areas.

Also, assays have now been submitted for Burtville East, following up on a previous 600m RC programme conducted in 2022, which yielded impressive results. One drill hole, BVE006, showed 15m at 53.94g/t Au from 27m, with a standout intercept of 1m at 478g/t from 28m.

Ark Mines (ASX:AHK) has submitted a mining lease application for its Sandy Mitchell rare earths and heavy minerals project in northern Queensland. The application covers the acreage that forms the basis of the recently reported high certainty measured resource of 71.8Mt grading 1732.7 parts per million monazite equivalent. This resource underpins the completion of a scoping study, supports the application for this Mining Licence, and accelerates ongoing strategic partnership and offtake discussion

Ballymore Resources (ASX:BMR) announced a promising new gold-copper target at its Dittmer Project, near Proserpine in north Queensland. A recent high-resolution magnetic and radiometric survey revealed significant anomalies, including a large 1200m x 800m magnetic body beneath the historic Dittmer mine. 3D magnetic modelling suggests that this area sits above a copper-gold system, supporting earlier findings of elevated copper in the soil. Preparations are now underway to drill and test this exciting new target.

Uranium play, Energy Metals (ASX:EME) , has reported impressive results from its drilling campaign at the Bigrlyi Project, with multiple drillholes hitting high-grade uranium in the A2, A4, and A15 sub-deposits. Notable findings include 5.1 metres at 4,500 ppm eU3O8 from the A2 sub-deposit, and 1.1 metres at 8,600 ppm eU3O8 from the A15 sub-deposit.

The 2024 drilling program has now wrapped up, with all samples sent to the lab for chemical assays. The Bigrlyi Project, located about 350 km northwest of Alice Springs, is a joint venture project that aims to expand its current resource of 6.32 million tonnes at an average grade of 1,530 ppm for a total of 9.66 kilotonnes of U3O8.

Black Canyon (ASX:BCA) has announced promising results from its W2 prospect in Wandanya, located 80 km south of the Woodie Woodie Manganese Mine. Significant assays include 5m at 33.2% Mn and notable higher-grade intervals of up to 48.7% Mn. The mineralisation shows impressive thickness and grade consistency over 240m and remains open for further exploration. The W2 area is thought to represent a new model for hydrothermal manganese enrichment in the Oakover Basin. Plans for metallurgical testing aim to produce a high-grade manganese concentrate.

Rimefire Pacific Mining (ASX:RIM), FY24’s top small cap gainer, surged as investors exercised over 60 million options at a cut-price 2c, dropping ~$1.2m of fresh funds in the scandium explorer’s coffers.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EXR | Elixir Energy Ltd | 0.072 | -56% | 38,916,089 | $197,473,782 |

| HCD | Hydrocarbon Dynamic | 0.002 | -33% | 119,602 | $2,425,747 |

| VPR | Voltgroupltd | 0.001 | -33% | 9,951 | $16,074,312 |

| IVX | Invion Ltd | 0.003 | -25% | 1,057,882 | $27,066,367 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 816,630 | $1,929,431 |

| RIL | Redivium Limited | 0.004 | -20% | 4,769,052 | $13,734,274 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 1,050,000 | $16,439,627 |

| IMI | Infinitymining | 0.035 | -19% | 344,182 | $5,836,998 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 1,000,000 | $2,115,421 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 15,409 | $1,189,924 |

| FHS | Freehill Mining Ltd. | 0.005 | -17% | 7,088,416 | $18,471,167 |

| OMA | Omegaoilgaslimited | 0.250 | -15% | 1,444,491 | $84,501,852 |

| KOB | Kobaresourceslimited | 0.115 | -15% | 21,222 | $21,405,818 |

| HTM | High-Tech Metals Ltd | 0.125 | -14% | 20,000 | $3,588,966 |

| SBR | Sabre Resources | 0.013 | -13% | 1,174,967 | $5,894,429 |

| IR1 | Irismetals | 0.200 | -13% | 708,814 | $31,995,296 |

| PV1 | Provaris Energy Ltd | 0.020 | -13% | 314,786 | $14,512,249 |

| ATH | Alterity Therap Ltd | 0.004 | -13% | 225,000 | $21,281,344 |

| CRR | Critical Resources | 0.007 | -13% | 6,143,992 | $15,709,469 |

| NAG | Nagambie Resources | 0.014 | -13% | 834,962 | $12,746,171 |

| 8CO | 8Common Limited | 0.035 | -13% | 67,980 | $8,963,796 |

Elixir Energy (ASX:EXR) dropped over 50% following the conclusion of operations at the Daydream-2 well, where the stabilised gas flow rate was lower than expected.

Although five out of six stimulated zones flowed gas, the final stabilised rate was only 1.0 MMCFPD, down from a maximum of 2.6 MMSCFD. This reduction was due to issues like condensate or water banking around the wellbore, which are common in early-stage gas plays and could be resolved with improved operational management.

Elixir, however, reported that all licence commitments for ATP 2044 have been met and the well will be retained for future production.

IN CASE YOU MISSED IT

Elevate Uranium (ASX:EL8) and its operating partner Energy Metals (ASX:EME) have struck more high-grade uranium at their Bigrlyi project about 350km northwest of Alice Springs in the Northern Territory.

The drilling to grow the current resource of 6.32Mt grading 1530ppm U3O8 – 21.3Mlbs contained U3O8 – returned outstanding results more than 1% eU3O8 from the A2, A4 and A15 sub-deposits.

BRC2430 returned 5.1m at 4500ppm eU3O from 129m at A2, BRD2415 returned 5m at 3,400ppm eU3O8 at A4 and BRC2428 returned 1.1m at 8600ppm eU3O8 from 129m at A15.

All samples from the now completed drill program have been submitted to the laboratory for assaying.

Lumos Diagnostics (ASX:LDX) has completed the retail component of its 1 for 1.82 pro rata entitlement offer, adding about $6.9m to its coffers. Along with the institutional component of the offer, which raised ~$3.1m, the company now has an additional $10m to drive growth of its business. The company was recently awarded US$3m in non-dilutive funding via a US Government grant to support a CLIA waiver study and US FDA regulatory submission for its test to differentiate a bacterial versus non-bacterial etiology (cause of) respiratory infection.

Peel Mining (ASX:PEX) has a pep in its step following the encounter of oxide and supergene copper, gold, and silver mineralisation during recent drilling at the Wagga Tank-Southern Nights deposit in the south-central part of Cobar, NSW.

Stand out oxide results include 24m at 5.09g/t gold, 89g/t silver from 15m while sulphide assays include 66m at 6.01% lead, 3.73% zinc, 0.26% copper, 32g/t silver and 0.47g/t gold from 100m. Nearly all mineralised intercepts sit outside the existing 6.83Mt indicated-inferred resource, which remains open along strike. PEX reckons the results pave the way for further drilling which is set to take place later this quarter.

Trigg Minerals (ASX:TMG) is moving to re-state and expand the Wild Cattle Creek antimony resource at the Achilles project as antimony prices surge 150% higher since the resource was announced in 2013.

Norwest Minerals (ASX:NWM) has started drilling its Tamba prospect at Arunta West, which boasts a 3km x 1.5km copper-in-soil footprint. Other critical mineral targets including ‘Malibu’ and ‘Duck’ will be drill tested thereafter.

Koba Resources (ASX:KOB) has intersected more high-grade uranium including a 1.39m hit grading 617ppm eU3O8 at its Yarramba project in South Australia. More drilling will be carried out at the Oban deposit before the rig moves to the Mt John prospect.

TRADING HALTS

Imagion Biosystems (ASX: IBX) – Cap raise

GreenX Metals (ASX: GRX) – pending arbitration claims against Poland and the Tribunals Award decision

Brazilian Critical Minerals (ASX: BCM) – Cap raise

At Stockhead, we tell it like it is. While Ark Mines, Elevate Uranium, Trigg Miing, Norwest Minerals, Koba Resources, and Lumos Diagnostics are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.