Closing Bell: Healthcare, banking and gold stocks give ASX an 0.86pc boost

The healthcare sector has staged a swift recovery after Friday’s pharmaceutical tariff blow, pumping the ASX higher in the process. Pic: Getty Images

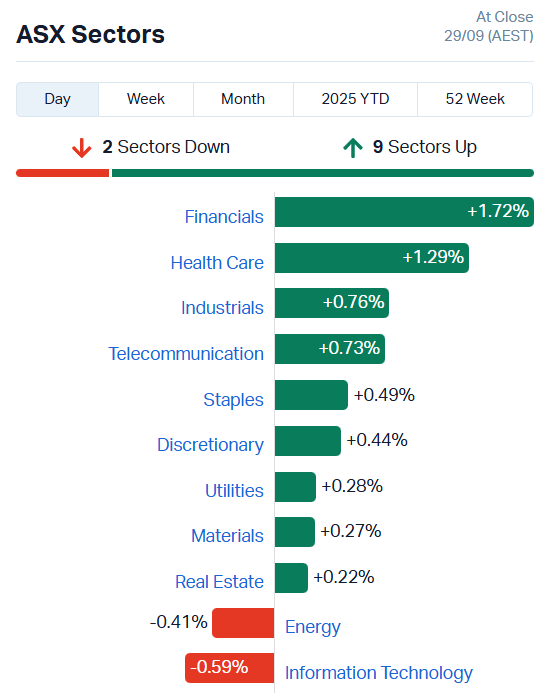

- ASX up 75 points to 8862.8 with 9 sectors higher

- Healthcare, banks and gold stocks drive gains

- Energy, info tech languish in the red

ASX pushes higher alongside spot gold

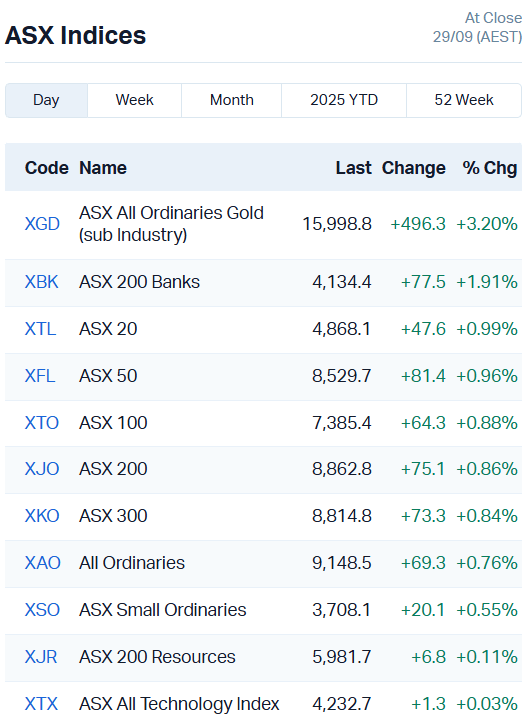

The ASX 200 hummed higher throughout the day, closing out up 0.86% or 75.1 points.

In a change from recent gains, the sectors showed broad strength, with only two falling into the red.

Still, much of today’s momentum came from the usual suspects – major banks and gold stocks.

All seven major banks lifted at least 1.29%. Westpac (ASX:WBC) and Commonwealth (ASX:CBA) added just over 2% each.

Healthcare managed a rally after Friday’s bruising as markets recovered from the shock of 100% US tariffs on pharmaceuticals.

CSL (ASX:CSL) added 2.46% by the end of the day, ResMed (ASX:RMD) 1.2% and Telix Pharma (ASX:TLX) 1.4%.

Spot gold prices rising to new highs at US$3814 an ounce kicked the XGD All Ord Gold index up more than 3%.

With the gold price riding high, precious metal miners are following suit.

Amongst the smaller goldies, Magnetic Resources (ASX:MAU) surged 19%, Minerals 260 (ASX:MI6) 14% and Focus Minerals (ASX:FML) 13%.

Further up the pecking order, Newmont (ASX:NEM) climbed 4%, Evolution Mining (ASX:EVN) 4.4%, and Northern Star Resources (ASX:NST) 3%.

There was also movement in our (admittedly small selection of) defence-related stocks.

DroneShield (ASX:DRO) surged 18% and Electro Optic (ASX:EOS) 12.8%.

Elsight (ASX:ELS) lifted 3.9% and Austal (ASX:ASB) a touch under 5%.

Drone technology in particular is in the spotlight at present, after Russia invaded Danish, Romanian, Estonian and Polish airspace with several drones and launched a renewed barrage of airstrikes against Kyiv.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.002 | 100% | 302945 | $6,589,514 |

| NES | Nelson Resources. | 0.0045 | 50% | 19921107 | $6,515,783 |

| AUH | Austchina Holdings | 0.0015 | 50% | 500000 | $3,025,384 |

| HLX | Helix Resources | 0.0015 | 50% | 9066616 | $5,346,291 |

| SKN | Skin Elements Ltd | 0.003 | 50% | 168821 | $2,150,428 |

| WIN | WIN Metals | 0.053 | 36% | 18424400 | $26,815,388 |

| RAN | Range International | 0.004 | 33% | 1967301 | $3,237,871 |

| LEG | Legend Mining | 0.01 | 33% | 6592317 | $21,858,579 |

| MBK | Metal Bank Ltd | 0.02 | 33% | 13079355 | $7,461,885 |

| IS3 | I Synergy Group Ltd | 0.027 | 32% | 4178694 | $35,581,134 |

| ALY | Alchemy Resource Ltd | 0.009 | 29% | 5546028 | $8,246,534 |

| RMX | Red Mount Min Ltd | 0.036 | 29% | 96444859 | $17,579,454 |

| DRE | Dreadnought Resources | 0.041 | 28% | 67846211 | $162,544,000 |

| JNS | Januselectricholding | 0.185 | 28% | 1778567 | $13,534,161 |

| SPD | Southernpalladium | 1.17 | 27% | 459714 | $98,394,000 |

| EFE | Eastern Resources | 0.047 | 27% | 17850917 | $4,665,328 |

| PIM | Pinnacleminerals | 0.1 | 27% | 422781 | $4,489,501 |

| RNX | Renegade Exploration | 0.0075 | 25% | 1.41E+08 | $12,312,181 |

| NVA | Nova Minerals Ltd | 0.5 | 25% | 2680985 | $160,600,567 |

| BHM | Brokenhillminesltd | 0.85 | 25% | 3475480 | $77,971,757 |

| CML | Connected Minerals | 0.175 | 25% | 194400 | $5,790,150 |

| AN1 | Anagenics Limited | 0.005 | 25% | 4518403 | $1,985,281 |

| RCM | Rapid Critical | 0.087 | 24% | 29727791 | $55,896,315 |

| HVY | Heavymineralslimited | 0.43 | 23% | 347756 | $23,789,007 |

| M79 | Mammothmineralsltd | 0.165 | 22% | 1831837 | $66,761,277 |

In the news…

Metal Bank (ASX:MBK) is taking ownership of three new gold projects from Hastings Technology Metals (ASX:HAS).

MBK will acquire a 75% interest in the Whiteheads gold project JV, the Ark gold project, and the Darcy gold project in return for $2.3m in MBK shares. Hastings is currently drilling toward an initial resource for the Seven Leaders prospect at Whiteheads.

Dreadnought Resources (ASX:DRE) has hit a surprise rare earth intersection in drilling at the Gifford Creek project’s Stinger niobium deposit, grading up 140m at 0.9% total rare earth oxides.

The hit comes from a completely new rare earth carbonatite zone, which management is very interested in because of the highly weathered nature of the mineralisation.

Eastern Resources (ASX:EFE) is also adding a new gold project to its portfolio, acquiring the Marengo gold project in Queensland. EFE can earn up to 80% in Marengo in return for a minimum $1.5 million spend over three years with no upfront consideration.

The area is a prolific gold belt with known endowments of more than 20 million ounces, and the project itself has historically produced samples of up to 149.8g/t gold. Historical drilling hit 1m at 7.8g/t gold from 13m within 4m at 2.05g/t gold.

Renegade Resources (ASX:RNX) has staked its own ground in California’s highly sought after Mountain Pass gold and rare earth district, acquiring the Mustang project.

Mustang includes 39 claims just 3km east of the Colosseum gold mine and 10km north-east of the Mountain Pass rare earths mine.

RNX is hitting the ground running with field programs to begin next week, starting with surface sampling, mapping and geophysical surveys.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PAB | Patrys Limited | 0.001 | -50% | 3100914 | $9,167,513 |

| EEL | Enrg Elements Ltd | 0.001 | -40% | 1300001 | $5,422,748 |

| BMO | Bastion Minerals | 0.001 | -33% | 6300036 | $3,307,430 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 125170 | $7,415,472 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 220000 | $7,254,899 |

| CR9 | Corellares | 0.003 | -25% | 324745 | $4,030,279 |

| CT1 | Constellation Tech | 0.0015 | -25% | 350000 | $2,949,467 |

| VIG | Victor Group Hldgs | 0.047 | -24% | 145390 | $40,438,054 |

| DM1 | Desert Metals | 0.011 | -21% | 7465044 | $6,418,246 |

| BLZ | Blaze Minerals Ltd | 0.002 | -20% | 5000000 | $7,187,500 |

| ERA | Energy Resources | 0.002 | -20% | 1529218 | $1,013,490,602 |

| MEM | Memphasys Ltd | 0.004 | -20% | 2311222 | $9,917,991 |

| NTM | Nt Minerals Limited | 0.002 | -20% | 902141 | $3,027,257 |

| RLC | Reedy Lagoon Corp. | 0.002 | -20% | 200000 | $1,941,767 |

| JNO | Juno | 0.025 | -17% | 78069 | $6,277,111 |

| MRD | Mount Ridley Mines | 0.0025 | -17% | 49022 | $2,972,151 |

| PRX | Prodigy Gold NL | 0.0025 | -17% | 5624299 | $20,225,588 |

| CAN | Cann Group Ltd | 0.016 | -16% | 5371546 | $12,828,047 |

| CVB | Curvebeam Ai Limited | 0.094 | -15% | 1373621 | $43,519,908 |

| EME | Energy Metals Ltd | 0.09 | -14% | 227213 | $22,016,748 |

| BLU | Blue Energy Limited | 0.006 | -14% | 4619046 | $14,900,337 |

| HHR | Hartshead Resources | 0.006 | -14% | 3626121 | $19,660,775 |

| IPT | Impact Minerals | 0.006 | -14% | 4277652 | $28,793,310 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 24710840 | $26,495,787 |

| VMM | Viridismining | 1.465 | -13% | 1719559 | $168,419,394 |

In Case You Missed It

Redcastle Resources (ASX:RC1) and BML Ventures are proceeding with a comprehensive mining proposal for the Queen Alexandra deposit in WA.

Mt Malcolm Mines (ASX:M2M) has started a review of data from the Golden Crown, Dumbarton and Sunday Picnic prospects as it prepares an MRE.

Investors have thrown their weight behind Caspin Resources (ASX:CPN), backing the company’s next drilling campaigns at Weethalle and Bygoo.

Nimy Resources (ASX:NIM) intends to secure a foothold in the US through a non-binding MoU with leading US critical minerals provider M2i Global for gallium supply from Block 3 in WA.

Last Orders

Locksley Resources (ASX:LKY) has closed out the second tranche of its placement with Tribeca Investment, bringing its cash position to more than $7 million as the company pursues its US mine-to-market strategy.

Trading halts

Anatara Lifesciences (ASX:ANR) – cap raise

Australian Mines (ASX:AUZ) – cap raise

Diablo Resources (ASX:DBO) – cap raise and project acquisition

Gold Mountain (ASX:GMN) – outcome of entitlement offer

Kingsland Minerals (ASX:KNG) – cap raise

Matsa Resources (ASX:MAT) – funding package and cap raise

Podium Minerals (ASX:POD) – metallurgical test results

Pursuit Minerals (ASX:PUR) – acquisition and cap raise

Sprintex (ASX:SIX) – cap raise

Yandal Resources (ASX:YRL) – cap raise

At Stockhead, we tell it like it is. While Locksley Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.