Closing Bell: Health sector takes the ASX’s breath away, down 0.29pc

The prognosis wasn’t great for the ASX today, shedding 0.29pc as healthcare led losses. Pic: Getty Images.

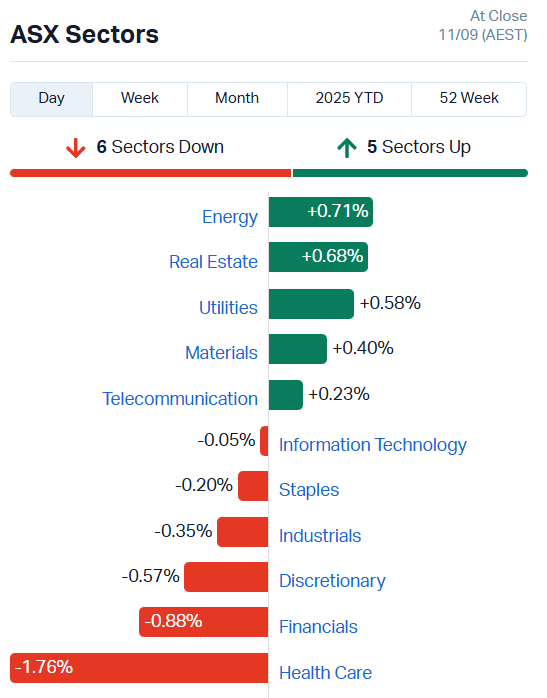

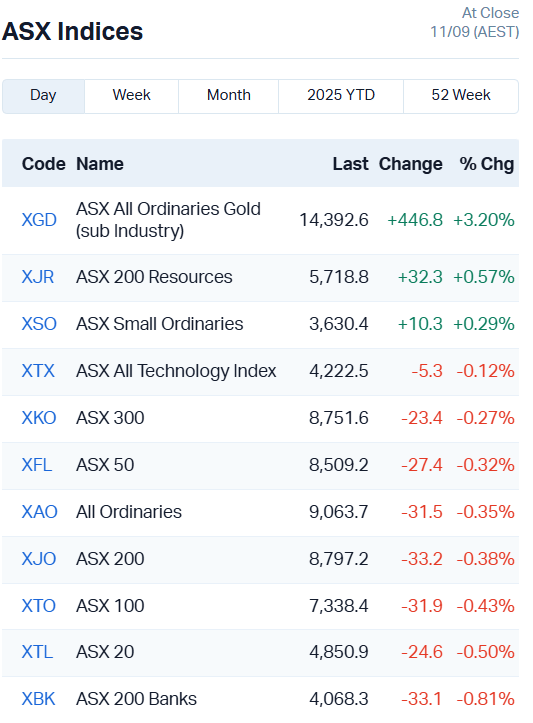

- ASX slides 0.29pc with 6 sectors flashing red

- Healthcare, major banks major drivers of losses

- Record gold prices bump All Ords Gold index up 3pc

Healthcare sector smothers ASX

Losses in health led the broader ASX lower, shedding 0.29% or 25.4 points by the end of trade.

Our brief major banking stock rally from yesterday also fizzled out, switching into profit taking and sticking the finance sector in second-from-last place on today’s boards.

A new all-time high spot gold price overnight gave our materials sector some breathing room, adding more than 3% to the All Gold Index, but it wasn’t enough to pull us out of a bearish tailspin.

A cooling US inflation print all but locked-in a September interest rate cut for the US Fed, giving rate-sensitive stocks in real estate a little breathing room.

Approaching the midpoint of September, today’s losses have drawn us back to neutral for the last five trading days, and we’re now 2.76% off our most recent high.

Banks continue to swing the axe

Bendigo Bank has joined Bank of Queensland, ANZ and NAB in slashing its workforce and restructuring its business, preparing to axe 145 jobs.

The BoQ is cutting 200 jobs from its payrolls, ANZ 3,500 and NAB more than 400.

Rumours of the impending cuts had been circulating on social media for some weeks before the announcements were made public.

The Financial Sector Union has criticised the job eliminations, with FSU national president Wendy Streets describing the restructuring as a “betrayal of workers and their families”.

“This isn’t one rogue bank, it’s the whole sector driving the same agenda at the expense of workers and communities,” she said.

“Cuts this deep don’t just hurt staff they hollow out services for customers and communities who rely on NAB.

“One after the other, banks are swinging the axe. These cuts are destructive to the people who make the banks’ success possible.”

Spokespeople for the major banks emphasised that the decision was a hard one, but that it was a necessary change.

“We are operating in a rapidly evolving and highly competitive banking environment,” ANZ CEO Matos said.

NAB’s comment followed similar lines.

“The environment we operate in is constantly changing and we need to have the right structures alongside the right skills and capabilities in the right locations to help us deliver for our customers,” a spokesperson said.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ZNC | Zenith Minerals Ltd | 0.11 | 83% | 27668151 | $31,767,330 |

| FUN | Fortuna Metals Ltd | 0.105 | 50% | 9173497 | $13,114,086 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 110000 | $1,874,666 |

| ATV | Activeportgroupltd | 0.031 | 48% | 47394674 | $19,672,526 |

| CXU | Cauldron Energy Ltd | 0.0115 | 44% | 44212584 | $14,313,288 |

| AZI | Altamin Limited | 0.029 | 38% | 534980 | $12,064,561 |

| LKO | Lakes Blue Energy | 1.7 | 36% | 332616 | $85,353,005 |

| CT1 | Constellation Tech | 0.002 | 33% | 50000 | $2,212,101 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 1618708 | $7,254,899 |

| EPX | EPX Limited | 0.037 | 32% | 3645265 | $21,016,413 |

| RMX | Red Mount Min Ltd | 0.013 | 30% | 91508594 | $5,952,171 |

| IPB | IPB Petroleum Ltd | 0.009 | 29% | 11707 | $4,944,821 |

| NPM | Newpeak Metals | 0.023 | 28% | 1366224 | $5,924,580 |

| AN1 | Anagenics Limited | 0.005 | 25% | 19000 | $1,985,281 |

| CTN | Catalina Resources | 0.005 | 25% | 12752614 | $9,704,076 |

| NTM | Nt Minerals Limited | 0.0025 | 25% | 200000 | $2,421,806 |

| SIS | Simble Solutions | 0.005 | 25% | 16734793 | $4,329,321 |

| 4DS | 4Ds Memory Limited | 0.011 | 22% | 43193117 | $18,548,088 |

| PAT | Patriot Resourcesltd | 0.044 | 22% | 335425 | $5,940,808 |

| LKY | Locksleyresources | 0.36 | 22% | 35304120 | $74,313,636 |

| OD6 | Od6Metalsltd | 0.062 | 22% | 8824250 | $10,145,404 |

| 4DX | 4Dmedical Limited | 1.92 | 21% | 19968602 | $766,667,132 |

| BNZ | Benzmining | 1.435 | 21% | 2976142 | $241,262,104 |

| LPM | Lithium Plus | 0.089 | 20% | 528488 | $9,830,160 |

| MAT | Matsa Resources | 0.12 | 20% | 7702782 | $77,722,428 |

In the news…

Cauldron Energy (ASX:CXU) has inked a deal with the fifth largest uranium producer globally, Uzbekistan’s national uranium company Navoiyuran.

The non-binding MoU covers a good faith collaboration to advance the Yanrey uranium project in WA with in-situ recovery methods, leveraging Navoiyuran’s expertise as the second largest ISR uranium producer in the world.

CXU says Navoiyuran isn’t the only major uranium player interested in WA’s uranium, suggesting the pressure is building for the WA government to review its mining ban.

Fortuna Metals (ASX:FUN) is looking to repeat Sovereign Metals’ (ASX:SVM) success at the Tier 1 Kasiya rutile and graphite project in Malawi, acquiring two projects right next door.

The Mkanda and Kampini projects cover 658km2 in a stable jurisdiction with established infrastructure and rail to a deepwater port. FUN intends to target rutile, a natural form of titanium, in an effort to mirror SVM’s 1809Mt resource.

Zenith Minerals (ASX:ZNC) has hit very broad gold at the Red Mountain project, with the drill bit striking 139.4m at 1.05 g/t gold from 214.9m. Within that broad intersection, gold grades peaked at 0.8m at 37.10 g/t gold.

Management says the results point to strong similarities with the Mount Wright deposit (1.1Moz gold).

Altamin (ASX:AZI) has gained access to a $3.62 million R&D research grant through the Italian Ministry of Environment and Energy, partnering with RINA SpA.

The funding relates to AZI’s Lazio project at Cesano, just north of Rome, where it will be used to develop a geothermal energy-powered process pathway to produce commercial-grade Sulphate of Potash (SOP), lithium and boron.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RKB | Rokeby Resources Ltd | 0.005 | -44% | 37096489 | $16,432,936 |

| OLH | Oldfields Holdings | 0.015 | -35% | 4788360 | $4,900,360 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 1699964 | $4,880,668 |

| T3D | 333D Limited | 0.078 | -29% | 3005607 | $20,773,919 |

| 1AD | Adalta Limited | 0.003 | -25% | 2328474 | $5,285,266 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | 370177 | $12,894,892 |

| PAB | Patrys Limited | 0.0015 | -25% | 150436 | $9,167,513 |

| SRN | Surefire Rescs NL | 0.0015 | -25% | 1618990 | $7,813,719 |

| E79 | E79Goldmineslimited | 0.02 | -20% | 4846235 | $3,960,316 |

| AOK | Australian Oil. | 0.002 | -20% | 21427301 | $2,653,207 |

| DTM | Dart Mining NL | 0.002 | -20% | 3060000 | $3,436,315 |

| FBR | FBR Ltd | 0.004 | -20% | 1996604 | $32,375,888 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 644998 | $16,854,657 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 5876571 | $9,392,478 |

| GLL | Galilee Energy Ltd | 0.009 | -18% | 340531 | $7,779,122 |

| OLL | Openlearning | 0.018 | -18% | 2612998 | $10,621,775 |

| HFR | Highfield Res Ltd | 0.09 | -18% | 2426317 | $52,148,475 |

| AOA | Ausmon Resorces | 0.0025 | -17% | 1271973 | $3,933,640 |

| ARV | Artemis Resources | 0.005 | -17% | 5498518 | $22,588,033 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 12824360 | $18,756,675 |

| RAN | Range International | 0.0025 | -17% | 14000 | $2,817,871 |

| SPX | Spenda Limited | 0.005 | -17% | 25711554 | $27,691,293 |

| AKO | Akora Resources | 0.092 | -16% | 94118 | $16,213,190 |

| CAE | Cannindah Resources | 0.027 | -16% | 1378031 | $23,298,558 |

| AGD | Austral Gold | 0.04 | -15% | 276118 | $28,778,634 |

In Case You Missed It

Astral Resources’ (ASX:AAR) infill grade control drilling highlights consistency of gold mineralisation at the Theia deposit within its Mandilla project.

Hillgrove Resources (ASX:HGO) has been buoyed by early completion of the Nugent Acceleration project and strong copper processing results.

Airtasker (ASX:ART) has gone full throttle with Visa Cash App Racing Bulls Formula One team, giving its community the chance to design pit crew helmets for VCARB drivers.

Trading halts

Belararox (ASX:BRX) – cap raise

Critical Resources (ASX:CRR) – cap raise

Intelicare Holdings (ASX:ICR) – cap raise

Spacetalk (ASX:SPA) – cap raise

TMK Energy (ASX:TMK) – cap raise

West Wits Mining (ASX:WWI) – cap raise

Yari Minerals (ASX:YAR) – cap raise

At Stockhead, we tell it like it is. While Sovereign Metals and Zenith Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.