Closing Bell: Hawkish RBA helps extend ASX losses; Indiana Resources surges as Ansell tanks

Philip Lowe, earlier. (pic: Getty Images)

- The ASX extended its losses for a second day running, ending 0.20% in the red

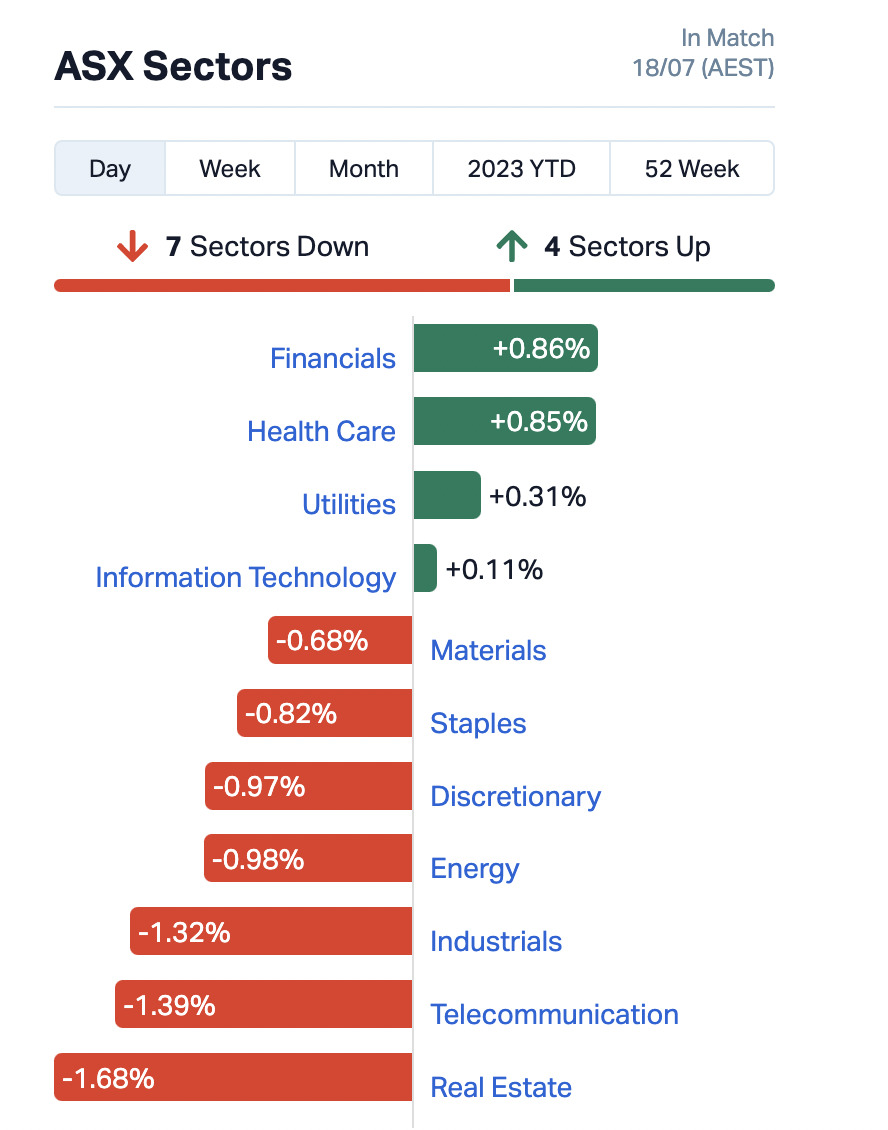

- Real Estate, Telcos, Industrials and Energy stonks led the losers, while Financials and Health Care get the teacher’s smiley stamps today

- The day’s clear winner was Indiana Resources, up 76% courtesy of a useful potential Tanzanian payday

Let’s get straight down to brass tacks. Or maybe some cheaper aluminium ones, given the current macro climate. The All Ordinaries partly lived up to its name today , delivering generally a pretty ordinary performance on the whole. (At time of writing, near closing time, we’re talking -0.20%.)

And for that, we can thank the Reserve Bank of Australia for its hawkishness, and the rest of the world, really (mainly looking at you, China, US and Europe. And New Zealand*), for its part in putting our central bank, and us, in this persistently highly inflated position.

(*Not really.)

The headline-dominating news of the day, then, is that the minutes of the RBA’s July meeting were released into the wild and the upshot is, the central bank has signalled more tightening to come, more interest rates-hiking.

As Gregor noted while wiping the mayo from his chin before it splattered onto his keyboard during his Lunch Wrap, “the main reason the RBA left rates on hold last month was over fears of an unemployment spike at the end of the year.

“The market – already burdened by weakening energy sector issues – got super-grumpy and refused to play ball,” Gregor added.

ALSO IN THE NEWS

• The ASX 200 is having a red day, but hey, at least EY’s Aussie boss is looking flush, eh? Amid the continued consulting firm grill-a-thon in the Senate, EY was under the microscope today with EY Oceania chief exec David Larocca revealing that he was paid a whopping $2.8 million in 2022.

Earlier, he told the Senate panel that PwC’s actions were “deeply disturbing and disappointing conduct”, before being grilled about his pay by Labor senator Deborah O’Neill, who asked him:

“So you’re earning five times the value of the prime minister, does that seem like a fair recompense?”

“Firstly, I don’t set my partner income. And I’m not here to compare my income with the prime minister’s, with a premier, with a government secretary, with any of our clients.

“There’s not a day when I don’t think how privileged I am,” added Larocca.

As the ABC reports: The Senate “committee heard yesterday that Deloitte boss Adam Powick was paid $3.5 million, while sacked former PwC boss Tom Seymour was paid $4.6 million”.

TO MARKETS

The ASX 200, then has squiggled about, with a low point at lunch and a mild recovery since, to arrive underwhelmingly a bit below where it walked through the door this morning. In other words, it’s closed in the red, down -0.20%.

Drilling a little deeper, sector wise, the state of play there is also a bit bloody, with only Financials, Health Care, Utilities and IT (just) notching scores in the green.

Real Estate, Telcos and Industrials are letting the side down the mostest today. Here’s a closer bead on that, too, courtesy of Market Index.

Some slightly larger cap standouts for you before we head further down the nether regions of the ASX 200, where the best action lies.

• Clinuvel Pharmaceuticals (ASX:CUV): +6.31% on no fresh news to speak of.

• Kogan (ASX:KGN): +7.69% on not much that’s news, although Morningstar did tell you back in March that the ecommerce retailer was significantly undervalued.

Annnd tanking today, we have:

• Ansell (ASX:ANN): -13.79% > Bent over and ready for the insertion of a rubber-gloved finger or three, presumably… on news of the company’s “FY24 guidance” that reportedly includes a newly announced “major and costly” productivity program, encompassing slowing production, lowering headcount and spending on IT.

“Excluding IT costs which will be largely post FY24, spend on these initiatives is estimated at US$40-50m, which together with normalisation of incentives and higher interest looks like an extra USD100m of costs, pre tax,” noted UBS analyst, Laura Sutcliffe – as reported by David Rogers in The Australian today.

“As a rough guide, leaving our other major estimates, including sales, unchanged, would bring our FY24 forecast for adjusted EPS in towards the top end of the FY24 guided US$0.57-0.77 range, 36 per cent below Visible Alpha consensus,” continued Sutcliffe.

And being “below Visible Alpha consensus” sounds a bit, well, beta, really. Moving on…

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| IDA | Indiana Resources | 0.072 | 76% | 55,688,657 | $21,962,719 |

| HFY | Hubify Ltd | 0.03 | 58% | 1,778,477 | $9,426,590 |

| SOV | Sovereign Cloud Hldg | 0.15 | 53% | 882,700 | $33,261,266 |

| AUK | Aumake Limited | 0.0055 | 38% | 6,363,642 | $5,949,038 |

| AJX | Alexium Int Group | 0.018 | 29% | 1,170,104 | $9,119,457 |

| FGL | Frugl Group Limited | 0.014 | 27% | 6,211,000 | $10,516,682 |

| KAT | Katana Capital | 1.15 | 27% | 18,804 | $30,281,677 |

| BCA | Black Canyon Limited | 0.2 | 25% | 25,758 | $8,274,529 |

| IAM | Income Asset | 0.125 | 25% | 11,927 | $28,002,082 |

| AOA | Ausmon Resorces | 0.005 | 25% | 3,274,238 | $3,877,157 |

| VAL | Valor Resources Ltd | 0.005 | 25% | 148,000 | $15,212,139 |

| VTI | Vision Tech Inc | 0.28 | 24% | 38,249 | $7,136,374 |

| CMD | Cassius Mining Ltd | 0.043 | 23% | 2,925,231 | $17,385,487 |

| SKF | Skyfii Ltd | 0.061 | 22% | 294,019 | $20,984,408 |

| HMI | Hiremii | 0.054 | 20% | 51,875 | $5,276,505 |

| 1ST | 1St Group Ltd | 0.006 | 20% | 2,500,000 | $7,084,956 |

| LSR | Lodestar Minerals | 0.006 | 20% | 15,451,263 | $9,216,987 |

| NES | Nelson Resources. | 0.006 | 20% | 250,000 | $3,067,972 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 533,578 | $24,182,996 |

| AKN | Auking Mining Ltd | 0.064 | 19% | 573,331 | $11,021,600 |

| MDI | Middle Island Res | 0.033 | 18% | 1,787,862 | $3,427,710 |

| AKO | Akora Resources | 0.17 | 17% | 79,970 | $13,772,508 |

| ADS | Adslot Ltd. | 0.0035 | 17% | 4,287 | $9,799,851 |

| EDE | Eden Inv Ltd | 0.0035 | 17% | 1,325,654 | $8,990,833 |

| FFT | Future First Tech | 0.007 | 17% | 646,973 | $4,289,019 |

Standouts:

Indiana Resources (ASX:IDA): +76% > see Last Orders below. Along with Reubs’ Resources Top 4.

Hubify (ASX:HFY): +58% > For this, we refer you back, again, to Gregor’s Lunch Wrap. If you can’t be bothered clicking the link, and leaving this page, however, here’s the lovingly cut-and-pasted recap:

“ICT and cybersec player Hubify (ASX:HFY) is up 74% after issuing a very positive trading update.

“Hubify says the company is set to deliver consolidated FY23 revenue (unaudited) of $25.72m, an 8% increase YoY, with an underlying EBITDA of $4.42m (unaudited), up $3.42m on the prior year and after removing restructuring and acquisition costs ($0.96m).

“That leaves Hubify with a well-strengthened balance sheet, boasting closing cash of $5.61m with no bank debt.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Today | Volume | Market Cap |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.001 | -33% | 250,000 | $2,581,972 |

| RBR | RBR Group Ltd | 0.002 | -33% | 1,000,665 | $4,855,214 |

| MRI | Myrewardsinternation | 0.015 | -29% | 5,083,589 | $7,514,052 |

| BXN | Bioxyne Ltd | 0.016 | -20% | 325,000 | $38,032,908 |

| AHK | Ark Mines Limited | 0.29 | -19% | 281,172 | $12,459,637 |

| ASP | Aspermont Limited | 0.013 | -19% | 64,078 | $39,020,219 |

| ELE | Elmore Ltd | 0.0075 | -17% | 1,571,900 | $12,594,454 |

| CCO | The Calmer Co Int | 0.0025 | -17% | 4,142,385 | $1,692,233 |

| RML | Resolution Minerals | 0.005 | -17% | 397,800 | $7,543,751 |

| SYR | Syrah Resources | 0.75 | -16% | 20,185,677 | $601,548,980 |

| POL | Polymetals Resources | 0.27 | -16% | 87,812 | $47,573,831 |

| CWX | Carawine Resources | 0.11 | -15% | 249,089 | $25,586,271 |

| ATH | Alterity Therap Ltd | 0.006 | -14% | 87,507 | $17,079,283 |

| BEX | Bikeexchange Ltd | 0.006 | -14% | 324,365 | $7,846,884 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 322,131 | $12,257,755 |

| ANP | Antisense Therapeut. | 0.056 | -14% | 4,288,812 | $43,505,445 |

| CPM | Coopermetalslimited | 0.125 | -14% | 222,905 | $5,983,519 |

| ANN | Ansell Limited | 24 | -14% | 2,290,511 | $3,521,713,116 |

| NGY | Nuenergy Gas Ltd | 0.026 | -13% | 742,137 | $44,428,665 |

| RGL | Riversgold | 0.013 | -13% | 8,448,681 | $14,268,922 |

| RDN | Raiden Resources Ltd | 0.007 | -13% | 1,454,999 | $16,442,151 |

| TTT | Titomic Limited | 0.014 | -13% | 2,751,772 | $5,023,839 |

| PFT | Pure Foods Tas Ltd | 0.105 | -13% | 265,138 | $13,168,790 |

| OZM | Ozaurum Resources | 0.043 | -12% | 225,000 | $6,223,000 |

| EME | Energy Metals Ltd | 0.11 | -12% | 6,868 | $26,210,414 |

LAST ORDERS

A couple of meaty ones to discuss today. Firstly:

92 Energy (ASX:92E), which, as noted below, is halted for trading today due to some capital raising by the uranium explorer.

From some info sent our way, Stockhead understands that the near $32m market cap Aussie exploration company is looking to raise some $5.5 million (before costs) to keep drilling its Canadian (Athabasca Basin, Saskatchewan) uranium discovery.

The raise will reportedly use Canada’s flow-throw share (FTSs) scheme. Basically, that’s an option that offers mining sector operators a tax-based cap raise incentive that’s not otherwise available in Australia. The company effectively renounces its Canadian exploration expenditures to Canadian taxpayers. Lucky them, eh? (They can use the tax deductions for their own income tax purposes apparently.)

The upshot is, it essentially means participating Aussie companies such as 92 Energy can raise capital at a premium to the market price for their securities.

Per term sheet details given to Stockhead, the 92E plan will include:

• a circa C$4.5m (A$5.0m) flow through of approximately 12.3 million (“Flow Through”); and

• a share placement of up to approximately A$0.5 million through the issue of up to 1.67 million new fully paid ordinary shares in the Company offered to select institutional, sophisticated and professional investors (“Placement”).

Additionally, directors of the company intend to subscribe for circa A$100k worth of Placement shares while lead manager Canaccord Genuity will also facilitate the sell-down of 0.34 million ordinary shares, totalling approximately A$100k, from non-executive director Matt Gauci to fund the exercise of 92E options and to meet tax obligations.

In other Last Orderly news, let’s talk about an A220-300 Air Tanzania aircraft recently grounded in the Netherlands, over a land rights dispute between Tanzania and some wealthy Swedish investors… and how that relates to today’s Indiana Resources (ASX:IDA) price spike.

Both eagle-eyed Gregor and Reubs saw the connection, and it’s essentially this…

As reported by Reubs earlier today, the exploration minnow IDA “could be ~US$70m richer after the International Centre for Settlement of Investment Disputes, part of the World Bank, ordered Tanzania to pay US$109.5m ($160m) for the unlawful expropriation of the Ntaka Hill nickel project (IDA ~62% ownership) in 2018.

“Once considered investment-friendly, the east African nation of Tanzania stunned ASX resource plays in July 2017 with sweeping changes to its Mining Act.”

Upshot on that: IDA awarded a great big wad of cash (yet to be settled, mind) due to the Tanzanian government playing the role you might expect the Tanzanian government to play in a James Bond film.

As for the tug-of-war plane business, the aircraft has now been returned to Tanzania but at one stage, Indiana Resources had even threatened to attempt to seize it in order to force the African country to pay out the US$109.5m in nickel-project-loss compensation.

“Tanzania took my asset. I’m quite happy to do the same,” Indiana Resources Executive Chairwoman Bronwyn Barnes told The Africa Report in April.

Hang on, is an airliner, admittedly quite a big one, worth that much money? Nope, it wouldn’t have covered the claim. Barnes had apparently been counting on the shock value of claiming a high-profile asset into shaming the Tanzanian government into coughing up.

All’s well that ends well for Indiana Resources, which washes its hands of that particular part of East Africa for the moment and instead puts its focus on South Australia.

Right, what else is going on? For more, we suggest you check out Em’s arvo column: In Case You Missed It.

Oh, and then there’s this, too…

TRADING HALTS

Metro Performance Glass (ASX:MPP) – Pending a company announcement to clarify the cooperation agreement of two exisiting shareholders (Takutai Limited and Masfen Securities Limited). The agreement revolves around a potential transaction involving MPP.

92 Energy (ASX:92E) – Capital raising.

DUG Technology (ASX:DUG) – Pending an announcement by the firm in relation to funding arrangements for the construction of a new data centre in Geraldton.

Vital Metals (ASX:VML) – Pending the release of an announcement concerning the Saskatoon Processing Facility Review.

Leo Lithium (ASX:LLL) – Pending an announcement in relation to correspondence from the government of Mali relating to plans to produce Direct Shipped Ore.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.