Closing Bell: Hawkish Fed comments press ASX lower despite resources gains

The ASX 200 is caught between a rock and a hard place, with hot inflation numbers at home and uncertainty over future US interest rate cuts. Pic: Getty Images

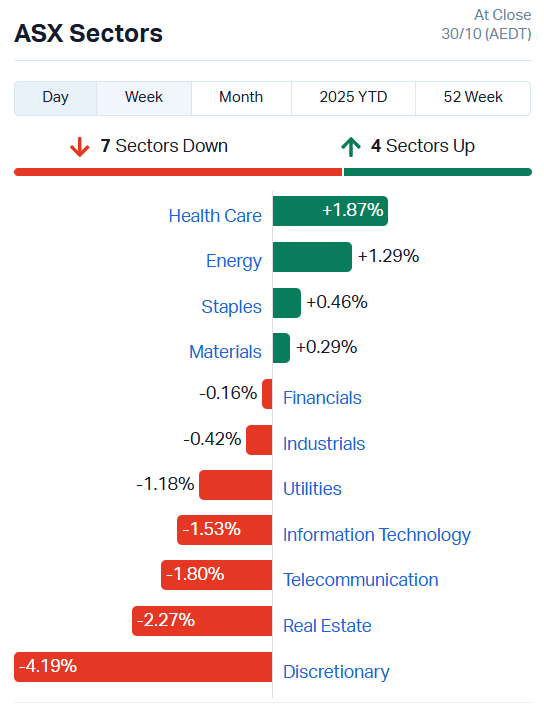

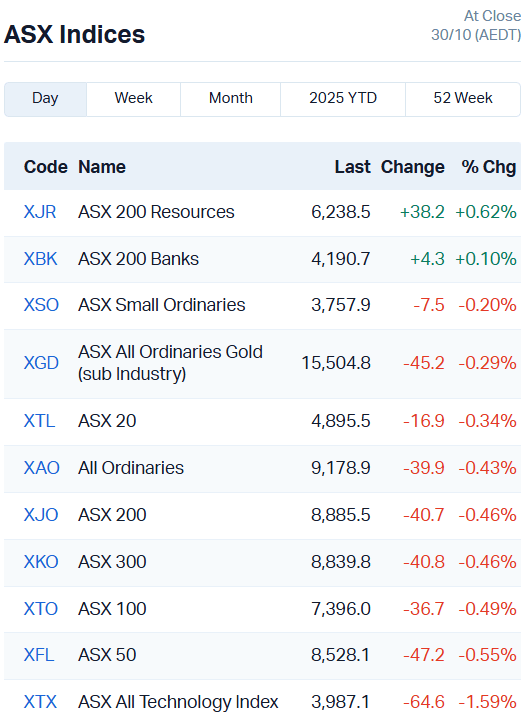

- ASX down 0.41pc as hawkish Fed comments apply pressure

- Healthcare, energy, resources and banks make gains

- Rate-sensitive stocks like consumer dictionary and real estate firmly in the red

Banks and resources stage recovery

Another day of losses on the ASX today, after Powell cautioned against hopes of another interest rate cut in the US for December.

The usual suspects took the news hard. Consumer discretionary, real estate and tech all got pummelled.

Sky-high copper prices combined with a recovery in iron ore and lithium stocks gave the resources sector a bump, and some of the major banks resisted the interest rate malaise to stage a small resurgence, too.

Commonwealth (ASX:CBA), National Australia Bank (ASX:NAB) and Westpac (ASX:WBC) all ticked up between 0.08% and 0.48%.

Overall, the market fell 40.7 points or 0.46% with seven of 11 sectors lower.

Over in resources, copper stocks are flying as supply crunches continue globally.

Bougainville Copper (ASX:BOC) shot up 13.4%, True North Copper (ASX:TNC) 12.5% and 29 Metals (ASX:29M) climbed 4.6%.

Some of the larger stocks have made less dramatic gains, too. Capstone Copper (ASX:CSC) added 3.41% and Sandfire Resources (ASX:SFR) 3.08%.

Over in lithium, Mineral Resources (ASX:MIN) led the way, up 13.76%.

MIN is also benefiting from a record run of iron ore production at its Onslow iron project, shipping a total of 11.4 million WMT from its iron assets.

Liontown (ASX:LTR) was right behind, gaining 11.17%, while Pilbara Minerals (ASX:PLS) climbed 5.91%.

As for the other iron ore stocks – Champion Iron (ASX:CIA) jumped 9.9% and Fortescue (ASX:FMG) added 2.53%.

Powell says nothing is decided for December

US Fed chair Jerome Powell put the fox amongst the chickens when he insisted another rate cut was not set in stone for December, despite lowering the cash rate by 25 basis points last night.

“Although some important federal government data have been delayed due to the shutdown, the public and private sector data that have remained available suggest that the outlook for employment and inflation has not changed much since our meeting in September,” he said.

According to Powell, the Fed itself is divided on December’s decision. The central bank will be keeping a close eye on layoffs and similar shocks to the labour market, as it gauges which way the economy is tilting.

“But in terms of our policy, we have upside risks to inflation, downside risks to employment, and this is a very difficult thing for a central bank,” he cautioned.

The S&P500 had a bit of a fit at the news, diving from +0.25% to -0.55% before recovering to about even.

That’s only with the support of tech heavyweights, though – the equal-weighted S&P500 fell 1.12% last night.

The added uncertainty isn’t doing our real estate sector any favours. It’s approaching a three-month low, down 2.66% for the week.

Dexus (ASX:DXS), Mirvac (ASX:MGR), Stockland (ASX:SGP) and Vicinity Centres (ASX:VCX) all fell between 4.3% and 3%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 8IH | 8I Holdings Ltd | 0.049 | 308% | 717905 | $4,177,930 |

| AUR | Auris Minerals Ltd | 0.036 | 80% | 6850190 | $10,962,397 |

| SNM | Sentinel Metals | 0.31 | 55% | 6814616 | $10,877,666 |

| BMO | Bastion Minerals | 0.0015 | 50% | 1000000 | $2,236,450 |

| MRD | Mount Ridley Mines | 0.024 | 41% | 65479167 | $20,292,588 |

| RDN | Raiden Resources Ltd | 0.007 | 40% | 5984246 | $17,254,457 |

| CHM | Chimeric Therapeutic | 0.004 | 33% | 426750 | $10,926,409 |

| LKO | Lakes Blue Energy | 1.54 | 32% | 542864 | $85,282,587 |

| BEL | Bentley Capital Ltd | 0.026 | 30% | 1506691 | $1,522,558 |

| CAV | Carnavale Resources | 0.005 | 25% | 132000 | $19,789,445 |

| ERA | Energy Resources | 0.0025 | 25% | 3550237 | $810,792,482 |

| MOM | Moab Minerals Ltd | 0.0025 | 25% | 13715666 | $3,749,332 |

| SRN | Surefire Rescs NL | 0.0025 | 25% | 3679203 | $8,051,219 |

| BOC | Bougainville Copper | 1.2 | 24% | 125549 | $389,030,625 |

| AR9 | Archtis Limited | 0.1 | 23% | 2543070 | $38,529,649 |

| SCN | Scorpion Minerals | 0.037 | 23% | 1050202 | $15,729,186 |

| PVT | Pivotal Metals Ltd | 0.027 | 23% | 20836355 | $19,958,969 |

| ENL | Enlitic Inc. | 0.029 | 21% | 114555 | $19,814,789 |

| CRN | Coronado Global Res | 0.35 | 21% | 15249010 | $486,171,582 |

| WCN | White Cliff Min Ltd | 0.02 | 18% | 19577917 | $41,622,718 |

| TNC | True North Copper | 0.28 | 17% | 91372 | $30,571,869 |

| CRB | Carbine Resources | 0.007 | 17% | 100000 | $7,151,194 |

| ERL | Empire Resources | 0.007 | 17% | 89255 | $8,903,479 |

| SPX | Spenda Limited | 0.0035 | 17% | 1358334 | $14,183,146 |

| CVB | Curvebeam Ai Limited | 0.095 | 16% | 31595701 | $38,364,336 |

In the news…

8I Holdings (ASX:8IH) has gone into a trading halt after rocketing up 300% for no discernible reason. The management consulting services firm is preparing a response to an ASX price query, but in the meantime there’s little indication of why the stock is surging.

Sentinel Metals (ASX:SNM) listed to the ASX today, bouncing more than 50% immediately on open after raising $10 million in its IPO.

SNM is led by a star-studded team of former Red 5 and Rio Tinto executives. The company’s flagship is the Columbia gold project in Montana, which already holds a mineral resource estimate of 920k ounces of gold.

Raiden Resources (ASX:RDN) is climbing on some quarterly exploration progress, which saw the company hit a fresh high-grade feeder structure grading at 1.6m at 7.69g/t gold at the Vuzel gold project.

RDN also has a permit in the works for a drilling program over the Skarn Silver anomaly, expanded the Vuzel project’s exploration footprint, and completed a total of 3450m of drilling.

It’s a similar story for Lakes Blue Energy (ASX:LKO), which was reinstated to the ASX in July after ticking off some compliance milestones.

LKO raised $5.8m, drilled the Wombat-5 well to a total depth of over 3000m and reported strong gas shows with concentrations up to 67.5% C₁–C₅ in the best-developed sand packages correlating with Wombat-3.

The company expects to begin production testing in mid-November this year, targeting near-term gas supply for the east coast and Victoria in a tightening market.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CNJ | Conico Ltd | 0.008 | -27% | 1909276 | $2,993,603 |

| C7A | Clara Resources | 0.003 | -25% | 500000 | $3,393,180 |

| UNT | Unith Ltd | 0.009 | -25% | 8190731 | $18,229,305 |

| LRM | Lion Rock Minerals | 0.03 | -21% | 23192187 | $116,428,852 |

| ANX | Anax Metals Ltd | 0.008 | -20% | 1510064 | $8,828,076 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 30000 | $7,051,062 |

| WBE | Whitebark Energy | 0.008 | -20% | 22448756 | $7,035,127 |

| NOR | Norwood Systems Ltd. | 0.018 | -18% | 1553564 | $11,350,408 |

| KSN | Kingston Resources | 0.115 | -18% | 6360290 | $117,605,654 |

| PBL | Parabellumresources | 0.095 | -17% | 35400 | $7,164,500 |

| COS | Cosol Limited | 0.495 | -17% | 717628 | $108,283,334 |

| BLU | Blue Energy Limited | 0.005 | -17% | 3968297 | $18,071,842 |

| IPD | Impedimed Limited | 0.039 | -15% | 4754562 | $93,662,784 |

| EUR | European Lithium Ltd | 0.2 | -15% | 27996605 | $364,080,556 |

| BHM | Brokenhillminesltd | 0.765 | -13% | 2273073 | $100,951,770 |

| BTM | Breakthrough Minsltd | 0.205 | -13% | 352817 | $16,161,113 |

| TAT | Tartana Minerals Ltd | 0.042 | -13% | 81357 | $10,279,003 |

| MDX | Mindax Limited | 0.0465 | -12% | 61307 | $124,479,662 |

| BEO | Beonic Ltd | 0.185 | -12% | 47952 | $14,195,066 |

| DTR | Dateline Resources | 0.2775 | -12% | 16748769 | $1,089,857,032 |

| BM8 | Battery Age Minerals | 0.15 | -12% | 411091 | $30,964,110 |

| SNX | Sierra Nevada Gold | 0.038 | -12% | 906341 | $8,869,239 |

| IXC | Invex Ther | 0.115 | -12% | 5656 | $9,770,000 |

| I88 | Infini Resources Ltd | 0.385 | -11% | 353475 | $29,873,407 |

| IMA | Image Resources NL | 0.055 | -11% | 3049528 | $69,197,303 |

In Case You Missed It

Flynn Gold (ASX:FG1) has uncovered more high-grade gold and tungsten near surface at its Firetower project in northwest Tasmania, after revealing wide zones of mineralisation in historical drill core.

In the September quarter, Adisyn Ltd (ASX: AI1) installed its state-of-the-art Atomic Layer Deposition system in Israel, began testing its low-temperature graphene process, and ended with $6 million in cash.

Tylah Tully looks at Trigg Minerals (ASX:TMG) and the beginning of its dual-listing on the world’s biggest capital market.

Kraken’s 2025 Wallet analysis reveals Australians are diverging from global trends, and showing a risk-on taste for memecoins.

Ark Mines (ASX:AHK) is close to completing groundwork at the Sandy Mitchell project as environmental baseline studies continue.

Last Orders

Generative AI developer Hiremii (ASX:HMI) has flexed success this past quarter, driving its revenue up by 6% to $7.9m, and gross profit up an even more impressive 18.1% to achieve $0.78m – as revealed in its latest quarterly report.

“This result reflects the continued strength and operational discipline of our recruitment business, which remains a key driver of the Group’s financial performance,” HMI managing director Andrew Hornby said.

Trading halts

8IH Holdings (ASX:8IH) – price and volume query

Black Dragon Gold (ASX:BDG) – awaiting update from Asturias’ SEKUENS Agency

Elevate Uranium (ASX:EL8) – cap raise

Loyal Metals (ASX:LLM) – cap raise

Piche Resources (ASX:PR2) – cap raise

Red Sky Energy (ASX:ROG) – pending Killanoola-2 drilling results

RocketDNA (ASX:RKT) – cap raise

Steadfast Group (ASX:SDF) – workplace complaint investigation

West Cobar Metals (ASX:WC1) – cap raise

At Stockhead, we tell it like it is. While Hiremii is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.