Closing Bell: Haemorrhaging 11% for the month-to-date, is our small cap index an emerging disaster?

Via Getty

The preferred, often heroic index of the Australian small cap, The Emerging Companies XEC has shed 2.4% today, to add to the haemorrhaging of the last four weeks.

The ASX200 (XJO) has closed just 0.2% lower. If this is a cash rate thing, what’s in the post for equity markets?

Dr Shane Oliver says AMP Capital now expects the cash rate to rise to 1.5% by year-end and to 2% by mid next year.

“But the RBA will only raise rates as far as necessary to cool inflation and high household debt has likely made rate hikes more potent.”

For now, the good doc says rate hikes are unlikely to de-rail the economic recovery with ultra-easy monetary policy still in the ascent.

“But they will add to the slowdown in home prices, where we see dwelling prices falling 10 to 15% into early 2024.”

Nevermind that. One can always sell the house, farm out the kids and sell the husband into slavery if cash is needed to keep the investment in small caps liquid – so dammit all, where are equities off to then?

The Mulder and Scully scale: what will higher rates do to the stock market?

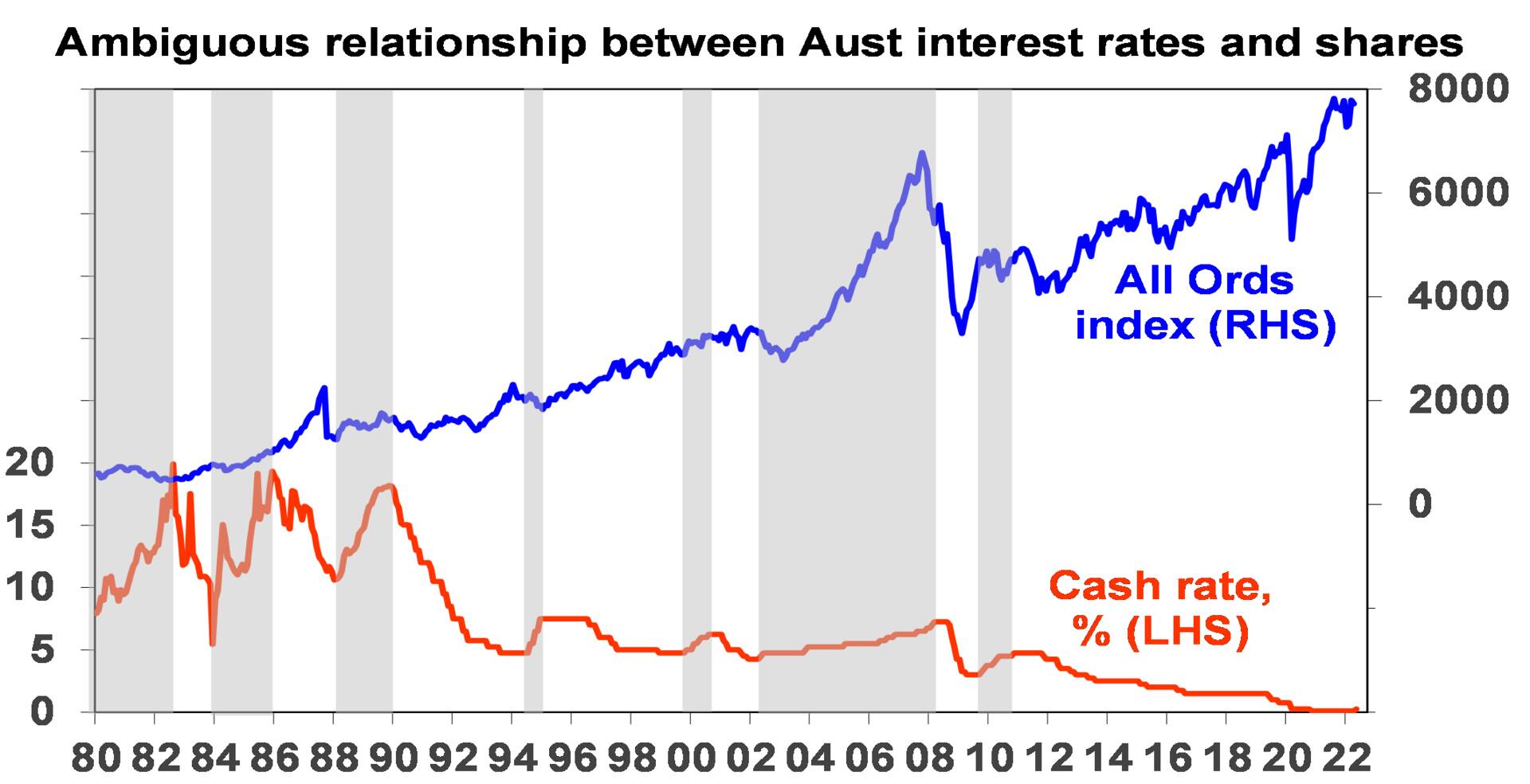

Dr Oliver says there’s an ambiguous relationship between rising interest rates and the Australian share market.

“While higher rates place pressure on share market valuations by making shares appear less attractive, early in the economic recovery cycle this impact is offset by still improving earnings growth,” he said.

The Mulder and Scully chart above clearly shows the official cash rate and share prices in Australia since 1980, with cash rate tightening cycles shaded.

“Sometimes rising interest rates have been bad for shares, as in 1994 for example, but at other times this has not been the case. For example, between 2003 and 2007 shares went up as interest rates rose with shares only succumbing in 2008, after multiple rate hikes over several years and with the GFC,” Dr Oliver observes.

Break it down for me, Doc:

- Rising rates from a low base are normally not (initially) bad for shares, as they go with improving economic conditions

- Rising interest rates are only really a major problem for shares when rates reach onerous levels (ie, above “normal”), contributing to an economic downturn, (see Crisis, Global Financial: 1981/82, late 1989, late 2007 /2008) They’re also a problem when rate hikes are too aggressive, as in 1994 when the cash rate was increased from 4.75% to 7.5% in four months

- If the RBA cash rate rises to 1.5% by year end, deposit rates would still be less than 2%, so they will still be low relative to the grossed-up dividend yield on shares of around 5.5% leaving shares relatively attractive (maths is right)

- Given the high short-term correlation between Australian shares and US shares, what the Fed does is arguably far more important than local interest rates, and this is perhaps a bigger risk given higher inflation in the US (the Fed can still F’us)

“So, the rise in Australian interest rates to 1.5% by year-end is unlikely on its own to derail the cyclical bull market in shares, Dr Oliver concludes. “But an environment of rate hikes will likely result in a continued period of volatility for shares.”

The Fed delivers its take on the cash rate tonight.

I’m sure everything will go totally smoothly, as planned. It’s a shoe-in.

No probs. It’ll be fine.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Last | % | Volume |

|---|---|---|---|---|

| PBX | Pacific Bauxite Ltd | 0.25 | 67% | 1,000,770 |

| SIH | Sihayo Gold Limited | 0.003 | 50% | 43,610,004 |

| VMG | VDM Group Limited | 0.0015 | 50% | 3,000,000 |

| AZI | Altamin Limited | 0.1 | 39% | 10,054,044 |

| HCD | Hydrocarbon Dynamic | 0.034 | 31% | 26,910,575 |

| T3D | 333D Limited | 0.0025 | 25% | 100,000 |

| OVN | Oventus Medical Ltd | 0.022 | 22% | 869,470 |

| 1VG | Victory Goldfields | 0.18 | 20% | 97,802 |

| LNU | Linius Tech Limited | 0.012 | 20% | 2,684,139 |

| NCR | Nucoal Resources Ltd | 0.012 | 20% | 1,220,393 |

| IVO | Invigor Group Ltd | 0.047 | 18% | 193,444 |

| KOB | Kobaresourceslimited | 0.235 | 18% | 2,607,697 |

| KFE | Kogi Iron Ltd | 0.007 | 17% | 7,598,312 |

| AMD | Arrow Minerals | 0.004 | 14% | 100,000 |

| CXU | Cauldron Energy Ltd | 0.016 | 14% | 578,669 |

| ESH | Esports Mogul Ltd | 0.004 | 14% | 975,747 |

| MTH | Mithril Resources | 0.008 | 14% | 2,743,437 |

| OZM | Ozaurum Resources | 0.16 | 14% | 199,794 |

| XTE | Xtek Limited | 0.33 | 14% | 318,151 |

| LAW | Lawfinance Ltd | 0.25 | 14% | 12,742 |

| AJQ | Armour Energy Ltd | 0.009 | 13% | 1,010,462 |

| DXN | DXN Limited | 0.009 | 13% | 888,333 |

| PIL | Peppermint Inv Ltd | 0.019 | 12% | 59,388,236 |

| HVM | Happy Valley | 0.059 | 11% | 17,000 |

| CCG | Comms Group Ltd | 0.099 | 11% | 180,000 |

Altamin (ASX:AZI) has delivered on the biggest stage (that’s the XEC, btfw ). The advanced zinc play is telling twitchy shareholders to take no action on an unsolicited takeover offer from its largest shareholder – a $37 million and change unsolicited bid from VBS Exchange.

The 9.5c per share offer is an 8.7% discount to AZI’s 52-week high of 10.4c per share. VBS wants to snap up all the rest of Altamin’s stock which it doesn’t already own via an off-market takeover deal.

Altamin, up about 37% and obviously enjoying the attention, says it will need time to bask – I mean, to consider – the offer before it makes a formal call to its shareholders.

Reuben says, AZI’s main game is the Gorno zinc project in Italy, where a Scoping Study ascribed a net present value (NPV) of US$211 million ($297 million) in late-2021.

And what is also worth puling up from my spread sheet shaped brain – the US$2,850/t zinc price used in the study compares with the look-out it’s coming right at us – current price of well over US$4,000/t.

AZI also has exposure to battery metals projects in Italy, including the ‘Punta Corna’ cobalt project and lithium projects neighbouring ground held by Vulcan Energy Resources (ASX:VUL).

The $40m market cap stock is up 42% year-to-date. It had $6.1m in the bank at the end of March.

Up over 20% is Victory Goldfields (ASX:1VG) after fire assay sampling on drilling done late last year returned thick, shallow, and high-grade gold hits up to 54.3g/t gold at the ‘Coodardy’ project, part of 1VG’s tenement portfolio in the Cue region of WA.

I remember when being thick and shallow was a definite negative, but the highlight result here was a very shallow, very thick 5m @ 15.2g/t gold from 37m (including 1m @ 54.3g/t from 38m).

Anything above 5g/t is generally considered high grade.

‘Fire assay’ — which melts samples in a furnace heated to about 1000 degrees — is the industry standard process for obtaining definitive gold concentrations from high-grade ores.

1VG says a mineral resource for Coodardy, which remains open, will be finalised by the end of the month.

And we’re on East 33 (ASX:E33) watch here at Stockhead, where everyone agrees the people must have their oysters.

Today, the home of Sydney Rock Oysters jumped a mild 18%.

For a little background – as little as possible really – the oyster-catcher’s last few sessions has been nought but teeth-bleeding highs and toe-exploding lows.

The share price peaked at over 120% on Monday, it lost about 40% yesterday and, well, here we are. And the best part is it’s only Wednesday!

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| MGTRE | Magnetite Mines - Rights 06-May-22 | 0.003 | -40% | 11,096,107 |

| WRM | White Rock Min Ltd | 0.14 | -30% | 4,203,965 |

| PNN | PepinNini Minerals | 0.665 | -24% | 2,004,958 |

| MLS | Metals Australia | 0.1 | -23% | 42,553,120 |

| BMO | Bastion Minerals | 0.15 | -21% | 181,970 |

| NC1 | Nicoresourceslimited | 1.09 | -21% | 2,009,097 |

| CZR | CZR Resources Ltd | 0.012 | -20% | 19,615,333 |

| AVZ | AVZ Minerals Ltd | 0.7925 | -20% | 123,214,932 |

| IOU | Ioupay Limited | 0.089 | -19% | 13,475,958 |

| EGY | Energy Tech Ltd | 0.056 | -19% | 214,449 |

| HAW | Hawthorn Resources | 0.155 | -18% | 1,125,820 |

| BASDA | Bass Oil Ltd | 0.049 | -18% | 1,345,315 |

| AQC | Auspaccoal Ltd | 0.18 | -18% | 38,050 |

| BMM | Balkanminingandmin | 0.3 | -18% | 38,221 |

| MMG | Monger Gold Ltd | 0.37 | -18% | 1,232,424 |

| OAU | Ora Gold Limited | 0.014 | -18% | 3,219,852 |

| TSL | Titanium Sands Ltd | 0.014 | -18% | 517,213 |

| PXX | Polarx Limited | 0.0175 | -17% | 4,718,745 |

| GNM | Great Northern | 0.005 | -17% | 2,180,000 |

| SBR | Sabre Resources | 0.005 | -17% | 32,493,679 |

| BGT | Bio-Gene Technology | 0.205 | -16% | 535,963 |

| SMI | Santana Minerals Ltd | 0.805 | -16% | 372,965 |

| AX8 | Accelerate Resources | 0.038 | -16% | 8,892,000 |

| GBE | Globe Metals &Mining | 0.085 | -15% | 513,360 |

| IMI | Infinitymining | 0.17 | -15% | 769,444 |

White Rock Minerals (ASX:WRM), some might say already a bit of a loser with that unfortunately dated name, has come out of a trading halt to announce a placement of some $2.4M.

White Rock acquired the Woods Point Gold Project in Victoria in August 2021, and by October diamond drilling had started at the high-grade Morning Star gold mine, with two diamond rigs testing multiple mineralised quartz reefs.

White Rock MD & CEO Matt Gill said: “The team on site has done a sterling job, with at least three possible production areas subsequently identified for potential mining. This capital raising will now allow us to take the next big step for the Company and its shareholders – become Victoria’s next gold producer.”

“This capital raise will allow for certain works to be undertaken and propel White Rock into the league of gold producers – a step many junior exploration companies aspire to make. White Rock intends to continue with this aggressive exploration focus on the significant in-mine and regional exploration potential of the project with the driving objective of making a new discovery that adds to the re-emergence of Victoria’s gold mining industry.”

In addition, White Rock has entered into a non-binding term sheet with Obsidian Global Partners in connection with a proposed convertible note and equity facility under which Obsidian may invest up to A$30 million in White Rock over a 24 month period, and which contemplates an initial A$3.5 million investment by way of convertible notes – subject to Shareholder approval and to a floor price of 15 cents.

“The funds raised will be used to propel White Rock into the league of gold producers,” the company adds, for second time in just a few sentences. In fact they said the same thing in an August 2021 release. What the hell is the league of gold producers?

I’m going to assume here that they wanted to say “propel White Rock into the – something really good – league of gold producers. And just for clarity’s sake, I’m going to go with ‘really good’ or ‘great.’

Shares down 27%.

Now for some excellent white rock from ’84:

ANNOUNCEMENTS YOU MAY HAVE MISSED

A day after the RBA’s rate hike Tamawood (ASX:TWD) has announced sales remain strong and are above expectations for the current election period which is traditionally a difficult period for new home sales.

Tamawood said new contracts are being signed at a rate and prices that the board believes are sufficient to indicate a positive outlook for FY23 and that the business is well positioned to take advantage of the changing environment.

Aldoro Resources (ASX:ARN) has announced its engaged Three Rivers Drilling to start its maiden drilling campaign at their Wyemandoo critical metal pegmatite project.

Weather permitting, drilling is expected to start in the next five days and will include an initial 48 holes ranging from 80m to 150m depth on azimuths of 145 degrees and dips of ~60 degrees based on mapping, however pegmatite intercepts may dictate changes.

VDM Group (ASX:VMG) has appointed Ming Guo as a non-executive director as it works to advance its copper project in Angola. Guo is a chairman and principal shareholder in a marble mine operating in Angola.

VDM Group said his knowledge and experience will help the company as it seeks to advance its Cachoeiras Do Binga Copper Project and Cage Bengo Gold and Base Metals Project in the African country.

TRADING HALTS

Air New Zealand (ASX:AIZ) trading halt – undertaking bookbuild for shares not taken up in the $1.09bn rights issue.

Airtasker (ASX:ART) trading halt – capital raising in connection with an acquisition

Black Rock Mining (ASX: BKT) trading halt – capital raising

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.